Cryptocurrency trading, crypto coin trade.

Crypto coin trade

Market and stop-limit are the basic order types you’ll find on almost all exchanges, while OCO is a bit less common.

Top forex bonus list

Different exchanges will sometimes have different order types, and slightly different rules about how they can be placed. Warning: your capital is at risk. The value of investments can fall as well as rise, and you may get back less than you invested. Past performance is no guarantee of future results. This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering. It is not a recommendation to trade

Cryptocurrency trading

Find out how to get started trading cryptocurrency in this step-by-step guide.

Etoro cryptocurrency trading

- Buy bitcoin and 15 other cryptocurrencies

- Copy top-performing traders

- Disclaimer: virtual currencies are highly volatile. Your capital is at risk

- BC bitcoin

- CEX.IO

- Coinjar

- Etoro

- EXMO

- Gemini

- Kraken

- Paybis

- Revolut

- A-Z list of exchanges

- Trezor

- Ledger nano S

- Keepkey

- Jaxx

- Mycelium

- Electrum

- Exodus

- Copay

- Edge

- A-Z list of wallets

- Bitcoin (BTC)

- Ethereum (ETH)

- Ripple (XRP)

- Bitcoin cash (BCH)

- EOS (EOS)

- Litecoin (LTC)

- Cardano (ADA)

- IOTA (MIOTA)

- Stellar (XLM)

- TRON (TRX)

- NEO (NEO)

- A-Z list of altcoins

There are lots of different ways of making a profit (or losing money) from cryptocurrency. Trading is one of the most popular.

This guide explains where to begin, including how to choose a trading style, how to devise a trading plan, what to look for in a trading platform and things to consider.

What's in this guide?

How to trade cryptocurrency

There are five steps to getting started:

- Do your research and work out whether cryptocurrency trading is right for you.

- Decide whether you want to do long term or short term trading.

- Choose the trading method that’s right for you.

- Learn how to place trades and read charts.

- Choose an exchange and start trading.

This guide walks you through each of these steps.

The different types of cryptocurrency trading

The first step is to decide between long term or short term cryptocurrency trading. Both are very different.

Long-term trading

Long-term traders buy and hold cryptocurrencies over a long period of weeks, months or even years, with the intention of selling at a profit or using it later.

If you believe the value of a cryptocurrency will grow in the long run, and don’t want the stress of actively trading, then this might be your style, and a good first step may be learning how to safely buy and hold cryptocurrency.

Short-term trading

Short-term trading is about taking advantage of short term cryptocurrency price swings by creating and executing a trading strategy.

It’s more active, stressful and risky than long-term trading, but it also offers faster and larger potential returns for those who do it right, and lets you profit from cryptocurrency prices dropping as well as rising.

If this is what you’re looking for, you can either read on for a beginner’s guide or compare cryptocurrency trading platforms to get started.

Trading means accumulating more crypto or fiat currency through repeatedly buying low and selling high.

If you do it right, your funds grow. If you do it wrong, your funds shrink over time, as bad trades and changing markets eat away at your holdings.

The value of your cryptocurrency will rise and fall, but there’s no risk of immediately losing all your money to a bad trade.

- Good for: beginners, accumulating cryptocurrency, avoiding excessive risks, keeping things simple.

- Not so good for: high-risk high-reward strategies, profiting from markets dropping.

Cryptocurrency trading for beginners

Before you can start trading, you need to be sure cryptocurrency trading is right for your circumstances, and that you understand the risks associated with it. You’ll also need to know what all the buttons do.

Fortunately, most cryptocurrency exchanges have similar-looking market pages, and you can safely ignore a lot of the information on the page.

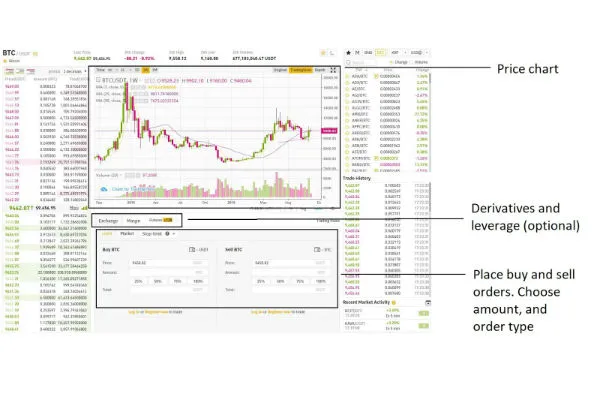

Here’s an example from the binance cryptocurrency trading platform, showing the bitcoin/USDT market with the important parts annotated.

Warning: binance offers cryptocurrency derivatives which the regulator banned from sale to UK consumers in january 2021.

The red and green box at the top is the price chart. At the bottom is where you place your buy and sell orders. There are two things to pay attention to here: your order type and the amount you want to buy or sell.

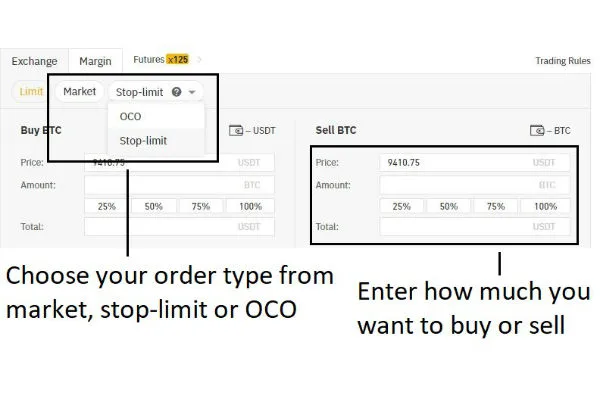

In this case, binance offers three basic order types: market, stop-limit and OCO.

- Market: place a buy or sell order at the current market price, to execute immediately.

- Stop-limit: once you select this, you will be prompted to choose a separate stop price, and limit price. Once the asset (bitcoin in this case) reaches the stop price, it will sell for at least the limit price, if possible.

- OCO: “one cancels the other.” this is two stop-limit orders combined, where one cancels the other if it’s triggered.

Market and stop-limit are the basic order types you’ll find on almost all exchanges, while OCO is a bit less common. Different exchanges will sometimes have different order types, and slightly different rules about how they can be placed.

How to make a trading plan

The difference between gambling and trading is having a plan. Creating a plan is a three step process:

1. Look for patterns

The basic principle of reading charts and creating trading plans is to look for patterns in previous price movements, and then using those to try to predict future movements.

Some patterns emerge frequently enough across multiple markets that they’re given their own names, such as resistance and support. But others are much more obscure, and are never given names of their own.

For example, if you think bitcoin goes up when ethereum goes down, or that bitcoin rises when the US dollar falls relative to the chinese renmibi, or anything else you can think of, that could be a pattern you can trade on.

2. Make a plan and stick to it

The two basic components of a trading plan are:

- A place where you take profits

- A place where you cut your losses

For example, someone’s basic plan might be to sell 33% of their bitcoin for every $1,000 the price goes up (taking profits), or to immediately sell all their bitcoin if prices drop below the current support line (cutting losses). To lay out this plan, they could set up a series of stop-limit orders.

This is not necessarily a good plan, but it would ensure that the amount they gain or lose is within sensible boundaries no matter what the market does.

As traders get more experienced, they can create increasingly sophisticated trading plans that tie together more market indicators, and allow for much more nuanced trading strategies.

Experienced traders typically use cryptocurrency trading bots to execute their strategies, because they tirelessly follow complex trading plans faster and more reliably than a human ever could.

3. Experiment

It’s good to test trading theories before throwing real money at them. Paper trading or backtesting can be useful here. Both features are often found on trading platforms.

Paper trading is a way of using fake money on the real markets, so you can test a trading strategy in real, current conditions. Backtesting is when you put a trading strategy through historical market movements to see how it would have performed.

If you’re a beginner trying to get your head around the basics of reading charts and spotting patterns, you may want to read the step-by-step guide to cryptocurrency technical analysis for a sense of how to start spotting patterns.

What to watch out for

Cryptocurrency trading incurs many of the risks of trading on any other market, as well as some unique challenges.

- Volatility. Cryptocurrency is volatile. This is one of the things that makes it attractive to traders, but it also makes it very risky. Double-digit intra-day price swings are common, and drastic shifts can happen in just minutes.

- Unregulated, manipulated markets. The cryptocurrency markets are largely unregulated compared to more traditional markets. It’s an open secret that wash trading and market manipulation are common. They’re also a lot less liquid than many other markets, which can contribute to the volatility and make it easier for well-moneyed “whales” to manipulate prices, force liquidations and similar. Exchanges themselves are sometimes accused of manipulating their own markets against their own customers.

- Inaccurate patterns. Markets will often follow patterns, but often they won’t. This is a risk when trading anything, but the unique characteristics of the cryptocurrency market means it’s a particular challenge there.

- Being over-exposed. Don’t bet more than you can afford to lose. Limit your exposure and consider setting up “take profit” and “stop loss” orders to limit your exposure in the event of drastic swings.

- Using excessive leverage. Many cryptocurrency exchanges will offer up to 100x leverage, dramatically magnifying the potential risks. The volatility of cryptocurrency, combined with high leverage trading, can see positions be liquidated extremely quickly.

- Not knowing when to fold. Whether you’re up or down, it’s important to know when to close a position and either take profits, or cut your losses.

Compare cryptocurrency trading platforms

When choosing a cryptocurrency trading platform, consider factors such as whether it offers derivatives or leverage, what kind of order types it allows, and how easily it can integrate with cryptocurrency trading bots.

Where to trade cryptocurrency in the UK

Warning: your capital is at risk. The value of investments can fall as well as rise, and you may get back less than you invested. Past performance is no guarantee of future results. This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering. It is not a recommendation to trade

All of the following platforms are available in the UK and offer cryptocurrency trading.

Cryptocurrency stocks trade in all directions today, even as bitcoin climbs above $34,000

These stocks reminded investors that day trading stocks based on the price of bitcoin can be an unpredictable game to play.

What happened

Bitcoin was rising again on tuesday. As of 4:15 p.M. EST, bitcoin was up 8% over the previous 24 hours and had briefly surpassed $34,000 per token earlier in the afternoon, according to coindesk. Its daily high of $34,221 was within 1% of its all-time high, which was hit over this past weekend.

Most days when bitcoin is up, cryptocurrency stocks track higher, as well. There's some fundamental basis for this (as we'll see in a moment). But other factors impact stock prices, as well. Indeed, crypto stocks showed no real correlation to the price of bitcoin today. Some were up, some were down, and some traded sideways.

- Going up today were shares of bitcoin mining companies like marathon patent group (NASDAQ:MARA) and riot blockchain (NASDAQ:RIOT) , up 23% and 12%, respectively.

- Down a little were shares of bitcoin mining company bit digital (NASDAQ:BTBT) , along with shares of canaan (NASDAQ:CAN) , a company that manufactures equipment for mining bitcoin. These both fell a mere 5%.

- Finally, ebang international holdings (NASDAQ:EBON) is another company manufacturing bitcoin mining hardware, and its stock was down a painful 13%.

Image source: getty images.

So what

Bitcoin miners run the bitcoin blockchain network and are paid in bitcoin. These companies pay for workers, computers, real estate, and electricity in fiat money. Therefore, they have to sell their bitcoin tokens to non-miners who want to own bitcoin. Therefore, revenue potential for marathon, bit digital, and riot blockchain is subject to the market price of bitcoin. As it rises, so does the revenue potential for these companies.

This explains why investors get excited about bitcoin mining when the price of the cryptocurrency goes up. But what about hardware companies like ebang and canaan? Sales for these two companies were largely down in 2020. But as bitcoin mining becomes more profitable, there's greater potential for a new bitcoin mining craze, which could cause sales to rise again for ebang and canaan.

When bitcoin goes up, it's good for these stocks. But this is only generally speaking. Investors should not just trade in and out of these stocks based solely on the price of bitcoin.

Image source: getty images.

Now what

Trading solely based on the price of bitcoin is a bad idea because in the short term, anything can happen with stocks. Consider that these are all small-cap stocks and are easily manipulated.

Sure, you could get lucky on a day trade. For example, anyone trading in and out of bit digital recently is clearly happy, considering it's nearly tripled over the past five trading days alone. However, these stocks could easily become the target of a famous short-seller. Given how easily these can be manipulated, these stocks would likely plummet on a development like that -- at least in the short term.

More importantly, these are all real-life businesses that could, at any time, report things unique to their companies. Sometimes it's good news; sometimes it's bad news.

For example, yesterday the price of bitcoin was mostly rising, whereas marathon stock was mostly falling. It spiked at the open and finished up for the day. But it steadily declined from early session highs. This is likely because of its announced capital raise of $200 million to help purchase additional equipment from bitmain, increasing its mining capability. That's good.

However, because of this, the company's share count is rising at an alarming pace, eroding shareholder value. Currently, marathon has almost 75 million shares outstanding. For perspective, it had less than 8.7 million on march 31, 2020.

Considering how overvalued these stocks appear to be, you can't blame marathon for taking advantage of its high stock price. Indeed, $200 million from selling its stock is lightyears beyond what its business is capable of generating in revenue right now. In fact, I wouldn't be surprised if all of these companies announce more dilutive moves in the near future. If any do make such an announcement, their stock will likely fall, regardless of what the price of bitcoin happens to be doing that day.

These are just a couple of reasons why eyeing short-term gains can be a dangerous game when it comes to stocks. It's hard to predict. However, in the long term, stocks strongly correlate with business fundamentals like revenue and profits, which is much easier for average investors like you and me to envision.

Best cryptocurrency brokers for 2021

Daniel ‘harris’ major

I have tested 40+ crypto brokers. You can find the best cryptocurrency brokers below. This is by far the easiest way to get started with cryptocurrencies.

Cryptocurrency trading has become really popular in the past years. It’s growing more ever year.

Many big trading brokers have already added some of these cryptocurrencies. Everybody can sign up and start trading bitcoin or other crypto coins. This is the easiest and probably the simplest way to invest in cryptocurrency.

After trying out most brokers, here are the best cryptocurrency brokers:

Best cryptocurrency brokers (non-US traders only)

Plus500 – top rated trading platform

Plus500 is a big name in the trading industry. They have a really low minimum deposit requirement and a great trading site.

Buy/sell cfds on bitcoin in addition to buying stocks, commodities, forex etc (traded only through cfds). Plus500 is the most complete trading platform.

- Trade cfds on bitcoin & many other cryptos

- Minimum deposit is only $100

- Regulated and trusted platform

- Very fast signup process

- Live chat

- Many payment methods (even paypal)

- You cannot withdraw any cryptocurrency

- You have to complete a questionnaire, upon sign up

Plus500 disclaimer: 76.4% of retail CFD accounts lose money.

IQ option – lowest minimum deposit ($10)

If you don’t want to make a huge initial investment, then IQ option is the best broker for you. The minimum deposit requirement is only $10. This is by far the lowest in the industry.

- You can trade many cryptocurrencies

- Minimum deposit is only $10

- Best trading platform

- Multiple account currencies

- Free demo account

- Regulated by CYSEC (#247/14)

Etoro – top crypto broker

Etoro is a really popular trading site. They have been around since 2006. Etoro is regulated by CYSEC, FCA and ASIC.

Buy/sell bitcoin on etoro in addition to buying stocks, commodities, forex etc. Etoro is the most complete trading platform.

- Trade bitcoin & many other cryptos

- Minimum deposit is $200

- Regulated and trusted platform

- Australian traders are also accepted

- Great support team

- Many payment methods (even paypal)

- You cannot withdraw any cryptocurrency

- You have to complete a questionnaire, upon sign up

Etoro disclaimer: 71% of retail CFD accounts lose money.

Highlow – best all-round crypto broker

Due to regulation highlow stopped accepting traders from the EU and UK.

Highlow is an australian trading broker (AFSL no.364264). What I like most about this broker is the intuitive platform. It is so easy to use. Especially new traders will like the clean layout.

I’ve been using highlow for a few years now and I never had a problem. Highlow publishes their number of trades on the homepage. There are millions of trades on this broker each month.

I use the main platform which is web based. This means, that you don’t have to download any software. This platform is stable and safe (they use SSL).

I have also tried the ios app and the android app. They are great, but I just don’t like trading on smartphones in general.

The payouts on highlow are amazing (up to 200%, which is more than on other brokers).

Highlow is a great broker for cryptocurrencies (but only if you are not from EU,UK, US). They have a good reputation, great support team and awesome promotions for new traders.

- Trade bitcoin & other cryptos

- Minimum deposit is only $50

- Regulated and trusted platform

- Fastest signup process (no questionnaires)

- Multiple account currencies

- Free demo account (no registration needed)

Nadex – US traders welcome

Nadex is a CFTC regulated broker. In fact, this is probably the only US broker that has this regulation.

Only US traders are allowed on nadex. Non-US traders check out the next broker.

Update OCTOBER 2019: looks like nadex removed crypto trading. After contacting them I found out that they will add it back soon. Register on nadex now and get updated when they add it.

Recently, nadex started offering bitcoin trading.

- Trade bitcoin, forex or binary options

- Minimum deposit is $250

- CFTC regulated broker

- Great support team

- Many payment methods (even paypal)

Crypto brokers with most cryptocurrencies

Here are the most popular cryptocurrencies offered by cryptocurrency brokers:

- Etoro – bitcoin, ethereum, litecoin, dash, ethereum classic, NEO and ripple.

- Plus500 – bitcoin, ethereum, litecoin, bitcoin cash, ripple, IOTA.

- Avatrade – bitcoin, ethereum, ethereum classic, ripple, dash, bitcoin cash litecoin, monero and NEO.

Lowest minimum deposit brokers

These are the best brokers with low minimum deposit requirements:

- Etoro – $200

- Plus500 – $100

- Avatrade – $100

This is really important because the crypto market itself is unregulated. Depositing on a regulated broker means that your money is safe.

We’ve also looked at the support team and the payment methods. You can deposit easily using multiple payment methods on the brokers below.

Top rated brokers that have cryptocurrencies

While we are all familiar with the broad definition of a broker, is there something more to it when it comes to cryptocurrencies?

Simply put, a cryptocurrency broker refers to a website that traders will visit to trade cryptocurrencies at a set price. In many ways, they are similar to forex brokers whose services are a lot more familiar to the general public.

Etoro disclaimer: 71% of retail CFD accounts lose money.

You still can’t decide which broker is best for you?

How to choose your cryptocurrency broker

Is leverage really necessary? Cryptocurrency markets are volatile in nature with prices fluctuating immensely thereby generating high profits even in the absence of leverage. But for some traders, the desire for more earnings justifies the use of leverage.

Before choosing your broker, settle yourself on whether the already immense profits that come from a cryptocurrency market are enough for you or you would like to use leverage to enhance them even further, bearing in mind, of course, that will also significantly increase the risk factor to your funds.

Negative balance protection: it is always advisable to trade with a broker that affords the negative balance protection facility. That way, you will never be at risk of losing more than what you invested in case you sustain very heavy losses.

How suitable is the required capital for you? This is another subjective part to your decision. Do you prefer trading with a small capital or bigger one to help you zero in on bigger returns? Find out what size trades your broker is offering before you open an account.

Narrow spreads for the win: let us be honest, it is only fair that your broker gets a cut from the money you generated having provided you with the essential facilities for it and all. But let us be honest, you definitely want every last dime for yourself.

A spread refers to the difference between the buying price and selling price of a trade and it varies with each broker. The spread is what counts as fees for your broker so the smaller it is, the lower the cost will be on your part.

Lets go into what aspects you as a trader must consider when choosing a broker to trade cryptocurrencies.

Which cryptocurrencies are you interested in trading?

Make sure you have decided on which cryptocurrencies you want to trade in before signing up with your broker.

If your choice is a prominent cryptocurrency like bitcoin (official site), litecoin (official site), or ethereum(official site), there will be a relatively broad availability of brokers that have trading options for those. However, less prevalent examples like monero, IOTA, or zcash may be a little harder to come by.

So study the cryptocurrencies being offered by a broker before you sign up for an account.

Pros and cons of cryptocurrency brokers

Here are some features that these broker have or don’t:

pros

- Signup up with a crypto broker is probably the fastest way to get started with cryptocurrency trading

- If you are less tech-savvy then a broker is safer for you

- You can start buying cryptocurrency while traditional exchanges don’t always accept this payment method

- Most of the time you can’t withdraw cryptocurrencies from a broker. You have to exchange it back to fiat money (USD/EUR etc.)

Cryptocurrency brokers – what to look for

Here are some of the more understated details about your cryptocurrency broker that could make your trading experiences so much more efficient and successful.

1. What are the weekend hours like?

This is a key detail that distinguishes cryptocurrencies from other prominent trading markets like forex, futures, and equity. Cryptocurrency brokers operate during the weekends as well.

There is virtually no difference in purchasing bitcoin at the end of the week as opposed to the middle of the week during peak hours.

But there is a catch. While digital currency exchanges are available during the weekend, your broker may not (why is the stock market closed on the weekend?). So in effect, if there is considerable movement within your relevant cryptocurrency market during a weekend when your broker is not operating, you may not have the ability to respond in any way.

2. How is it hedging?

Your broker is probably not keen on revealing if it is hedging cryptocurrency traders but it is important information for you to know.

Why is it so important for you to know?

Because, as a trader, you want to be absolutely in the clear regarding the policies for risk management being followed by your broker. Let us not forget that cryptocurrency markets are extremely volatile and an unhedged broker is more easily prone to major losses incurred by its clients. Naturally, those costs will warrant compensation via fatter spreads and additional costs for traders. It will be best to sign up with a broker that will not withhold the relevant information from you.

More great features you could be interested in

Commissions and trading on margin – an important thing to note while trading cryptocurrencies is that their prices tend to be more similar to equities than they are to real currencies. So your broker could be charging you commissions in addition to a wide spread on each trade. That, of course, raises the cost probably a bit much for your liking.

Another similarity with equities is that the margin conditions with cryptocurrencies are significantly more than they are with forex or cfds. Consequently, leverage is usually up to 10x. How considerable the margin rate will be for traders is down to what trading strategies and risk management they subscribe to.

Authenticity of market data – aside from merely evaluating how it influences spreads, market data for cryptocurrency CFD prices can be a good indicator of how the quality of the product will be in the future.

One of the more recent examples of this is BTC-e which was an immensely popular platform for trading bitcoin before it was shut down by feds. BTC-e was the first bitcoin exchange to incorporate forex trades and so made their exchange accessible via MT4 and supplied cryptocurrency liquidity for brokers.

But once it was shut down, every broker that depended squarely upon BTC-e was left with no hedging options or market data to put a price on its crypto cfds.

Are short sales available? For many traders, shorting is a crucial strategy option, the lack of which can be a deal breaker with a potential broker. Many brokers tend to offer ‘long’ only since there are only a few hedging solutions when opening short trades.

As you see, investing in cryptocurrencies can be a truly lucrative venture for you but only if you get it right.

And a lot of that is down to which broker you decide to trade with.

Ready to start trading?

Trade with the cryptocurrency brokers listed above to make sure that your money is safe, you pick a broker with a stellar reputation and you keep the fees low. Excel at trading bitcoin by creating your own trading strategy.

These cryptocurrency brokers make it really easy to trade bitcoin and other coins. You don’t have to be a trading expert. It helps if you know what a blockchain is or how the ledger and transactions work, but this is all optional.

Sign up now and see for yourself how easy it is to get started.

Crypto coin trade

Your guide to the world of an open financial system. Get started with the easiest and most secure platform to buy and trade cryptocurrency.

Cheaper GBP deposits HOT

50% off for GBP deposits with the UK-issued cards

Deposit now

Margin trading

Trade with leverage as high as 100x

Trade now

CEX.IO staking

Earn by simply holding coins on CEX.IO

Learn more

Buy crypto with a card

Own crypto in minutes using your card

Buy now

Among the numerous websites providing bitcoin exchange services, the positive reputation of CEX.IO makes it worth the trust of the users all over the world. With the customer base of over 3,000,000, the platform can be recognized as the one that can be relied on. Starting your bitcoin trading on a platform with substantial history, you will benefit from a deep understanding of the market and customersвђ™ needs. We are constantly working on enhancing the security, ensuring the high level of customer support, and providing our users with new opportunities for trading on the bitcoin market. CEX.IO is regularly considering the addition of new coins, which was not so long the case with dash, zcash, and bitcoin cash. Still, every cryptocurrency has to pass a thorough check to be listed. Our due diligence and concerns about the quality of the service yield results. Now, we are moving forward to achieve the status of the best cryptocurrency exchange.

Best cryptocurrency exchange: what does it mean for us?

For you to be able to recognize a reliable online exchange and sort out those that appear to be too weak, we list several features, paying attention to which would help you to make the right choice. 1. Service safety and security. It is critical to ensure that your data will not be leaked to any other parties. Thus, the availability of certificates, like the PCI DSS, serves as the proof of serviceвђ™s safety. Besides, the regulation of exchanges is also important. For example, CEX.IO.

- Is officially registered in the UK;

- Has a money services business status in fincen;

- Complies with the legal requirements of the countries where it functions.

Cryptocurrency stocks trade in all directions today, even as bitcoin climbs above $34,000

These stocks reminded investors that day trading stocks based on the price of bitcoin can be an unpredictable game to play.

What happened

Bitcoin was rising again on tuesday. As of 4:15 p.M. EST, bitcoin was up 8% over the previous 24 hours and had briefly surpassed $34,000 per token earlier in the afternoon, according to coindesk. Its daily high of $34,221 was within 1% of its all-time high, which was hit over this past weekend.

Most days when bitcoin is up, cryptocurrency stocks track higher, as well. There's some fundamental basis for this (as we'll see in a moment). But other factors impact stock prices, as well. Indeed, crypto stocks showed no real correlation to the price of bitcoin today. Some were up, some were down, and some traded sideways.

- Going up today were shares of bitcoin mining companies like marathon patent group (NASDAQ:MARA) and riot blockchain (NASDAQ:RIOT) , up 23% and 12%, respectively.

- Down a little were shares of bitcoin mining company bit digital (NASDAQ:BTBT) , along with shares of canaan (NASDAQ:CAN) , a company that manufactures equipment for mining bitcoin. These both fell a mere 5%.

- Finally, ebang international holdings (NASDAQ:EBON) is another company manufacturing bitcoin mining hardware, and its stock was down a painful 13%.

Image source: getty images.

So what

Bitcoin miners run the bitcoin blockchain network and are paid in bitcoin. These companies pay for workers, computers, real estate, and electricity in fiat money. Therefore, they have to sell their bitcoin tokens to non-miners who want to own bitcoin. Therefore, revenue potential for marathon, bit digital, and riot blockchain is subject to the market price of bitcoin. As it rises, so does the revenue potential for these companies.

This explains why investors get excited about bitcoin mining when the price of the cryptocurrency goes up. But what about hardware companies like ebang and canaan? Sales for these two companies were largely down in 2020. But as bitcoin mining becomes more profitable, there's greater potential for a new bitcoin mining craze, which could cause sales to rise again for ebang and canaan.

When bitcoin goes up, it's good for these stocks. But this is only generally speaking. Investors should not just trade in and out of these stocks based solely on the price of bitcoin.

Image source: getty images.

Now what

Trading solely based on the price of bitcoin is a bad idea because in the short term, anything can happen with stocks. Consider that these are all small-cap stocks and are easily manipulated.

Sure, you could get lucky on a day trade. For example, anyone trading in and out of bit digital recently is clearly happy, considering it's nearly tripled over the past five trading days alone. However, these stocks could easily become the target of a famous short-seller. Given how easily these can be manipulated, these stocks would likely plummet on a development like that -- at least in the short term.

More importantly, these are all real-life businesses that could, at any time, report things unique to their companies. Sometimes it's good news; sometimes it's bad news.

For example, yesterday the price of bitcoin was mostly rising, whereas marathon stock was mostly falling. It spiked at the open and finished up for the day. But it steadily declined from early session highs. This is likely because of its announced capital raise of $200 million to help purchase additional equipment from bitmain, increasing its mining capability. That's good.

However, because of this, the company's share count is rising at an alarming pace, eroding shareholder value. Currently, marathon has almost 75 million shares outstanding. For perspective, it had less than 8.7 million on march 31, 2020.

Considering how overvalued these stocks appear to be, you can't blame marathon for taking advantage of its high stock price. Indeed, $200 million from selling its stock is lightyears beyond what its business is capable of generating in revenue right now. In fact, I wouldn't be surprised if all of these companies announce more dilutive moves in the near future. If any do make such an announcement, their stock will likely fall, regardless of what the price of bitcoin happens to be doing that day.

These are just a couple of reasons why eyeing short-term gains can be a dangerous game when it comes to stocks. It's hard to predict. However, in the long term, stocks strongly correlate with business fundamentals like revenue and profits, which is much easier for average investors like you and me to envision.

Crypto-currency firm ripple charged by US watchdog

Crypto-currency firm ripple has been charged with conducting investments without proper licences by the US securities and exchange commission.

The SEC asserted that ripple's XRP token is a tradable asset, known as a security, and thus subject to its regulations.

The firm argues that XRP is a currency and therefore does not have to be registered as an investment contract.

The value of XRP fell by more than 30% on the news.

Digital currencies are governed by another US regulator - the commodity futures trading commission (CFTC) - which has different rules.

Ripple's chief executive brad garlinghouse, and former chief executive chris larsen, have both been charged with violating the securities act.

"we allege that ripple and its executives failed over a period of years to satisfy [the SEC's] core investor protection provisions, and as a result, investors lacked information to which they were entitled," said marc berger, deputy director of the watchdog's enforcement division.

Mr garlinghouse subsequently blogged reaction from one of the firm's lawyers, who said: "the SEC is completely wrong on the facts and the law and we are confident we will ultimately prevail before a neutral fact-finder."

Billions of dollars' worth of XRP are traded every day, the lawyer continued, adding that it should be treated as being a virtual currency like bitcoin.

Mr garlinghouse also stressed that the crypto-currency was separate from ripple, the company that provides a payment system for banks around the world.

"ripple our company has shareholders: if you want to invest in ripple, you do not buy XRP but rather shares in ripple."

Later he tweeted: "the SEC should not be able to cherry-pick what innovation looks like. This battle is just the beginning."

XRP, the world's third largest crypto-currency has fared differently to others such as bitcoin and ether in part because it works differently.

It was set up by ripple which developed a payment system used by banks to speed up and modernise how they pay each other. And while bitcoin is decentralised and "mined" using a sophisticated computer network, spread around the world, XRP is controlled by ripple, with the firm releasing coins each month.

Bitcoin and ether have been ruled out of trading exchanges that offer the buying and selling of stocks and bonds.

In 2018, the US commodity futures trading commission said both could be traded as commodities, like currencies, oil or cotton.

The case will add to the debate over whether crypto-currencies should be treated like stock and governed by a regulator like the SEC.

Allowing crypto-currency XRP to trade like a stock or a bond would serve as a stamp of approval from a securities regulator and attract higher trading volumes and investment.

But it may also mean that it would have to be delisted from currency exchanges unless they registered as security exchanges.

Cryptocurrency trading

Trade eight cryptocurrencies including bitcoin, ether, ripple and litecoin – no wallet needed. Or get broad exposure in a single trade with our crypto 10 index.

Cryptocurrency trading is only available to professional traders.

Find out more about our professional account

Our helpdesk is available 24 hours a day, from 8am saturday to 10pm friday. Call 0800 195 3100 or email newaccounts.Uk@ig.Com .

Contact us: 0800 195 3100

Our helpdesk is available 24 hours a day, from 8am saturday to 10pm friday. Call 0800 195 3100 or email newaccounts.Uk@ig.Com .

Contact us: 0800 195 3100

Why trade cryptocurrencies with us?

If you’re a professional trader looking to trade cryptocurrencies with spread bets or cfds, you’ll be able to:

Trade rising and falling prices on leverage to make the most of volatility 1

Our deep internal liquidity means there’s more chance of executing a trade at your chosen price

Protect your capital with guaranteed stops 2

Safely and easily deposit and withdraw funds. We’re a regulated FTSE 250 company

Speculate on ten cryptos, or get wider exposure to the market with our crypto 10 index

Tax-free profits when you place a spread bet on cryptos 3

Cryptocurrencies you can trade with us

Professional traders can also trade our crypto 10 index, getting simultaneous exposure to the ten largest coins with a single trade.

Live prices on popular cryptos

Prices above are subject to our website terms and conditions. Prices are indicative only.

Ways to trade cryptocurrencies with us in the UK

| crypto spread betting | crypto CFD trading | |

| main benefits | profits are tax-free in the UK 3 | tax-deductible losses are useful for hedging 3 |

| available to | professional clients only | professional clients only |

| traded in | £ (or other base currency) per point | contracts |

| tax status | no capital gains tax (CGT) or stamp duty 3 | no stamp duty, but you do pay CGT. Losses can be offset as a tax deduction 3 |

| commission | commission-free (just pay our spread) | commission-free (just pay our spread) |

| platforms | web, mobile app and advanced crypto trading platforms | web, mobile app and advanced crypto trading platforms |

| learn more | learn more |

What is cryptocurrency trading?

Cryptocurrency trading is a way for professional traders to speculate on the market price of cryptocurrency with financial derivatives like spread bets and cfds.

What are the benefits of cryptocurrency trading?

The main benefits of crypto trading include tax-efficiency, 4 the ability to open a position with leverage, and the option to speculate on prices rising or falling.

Plus, you’ll never need an exchange account or digital wallet.

Who can trade cryptocurrencies?

To trade cryptocurrencies, you’ll need to have a professional trading account.

If you do, then you’ll be able to reap the benefits of trading cryptos with financial derivatives like spread bets or cfds.

How much will I have to pay?

Margins

Spread bets and cfds are traded with leverage. This means you can gain or lose a significant amount more than you deposit. Though not actually a cost to you, the margin you pay makes a big difference to the affordability of your trade.

Spreads

Your key payment for trading cryptocurrencies is the spread – the difference between the buy and the sell price. Essentially, this is our commission for executing your trade – and we work to keep our spreads among the lowest in the business.

| Spot FX | professional margin what is this? | Leverage equivalent |

| bitcoin | 4.5% | 1:22 |

| ether | 4.5% | 1:22 |

| ripple | 4.5% | 1:22 |

| bitcoin cash | 9% | 1:11 |

| litecoin | 9% | 1:11 |

| EOS | 9% | 1:11 |

| stellar | 9% | 1:11 |

| NEO | 9% | 1:11 |

| crypto 10 index | 9% | 1:11 |

| spread betting | cfds | MT4 | |

| bitcoin | 36 | 36 | 36 |

| ether | 1.2 | 1.2 | 1.2 |

| ripple | 0.36 | 0.36 | 0.36 |

| bitcoin cash | 2 | 2 | 2 |

| litecoin | 0.4 | 0.4 | 0.4 |

| EOS | 4 | 4 | 4 |

| stellar | 0.2 | 0.2 | 0.2 |

| crypto 10 index | 38 | 38 | n/a |

How much will I have to pay?

Margins

Spread bets and cfds are traded with leverage. This means you can gain or lose a significant amount more than you deposit. Though not actually a cost to you, the margin you pay makes a big difference to the affordability of your trade.

Spreads

Your key payment for trading cryptocurrencies is the spread – the difference between the buy and the sell price. Essentially, this is our commission for executing your trade – and we work to keep our spreads among the lowest in the business.

| Spot FX | professional margin | leverage equivalent |

| bitcoin | 4.5% | 1:22 |

| ether | 4.5% | 1:22 |

| ripple | 4.5% | 1:22 |

| bitcoin cash | 9% | 1:11 |

| litecoin | 9% | 1:11 |

| EOS | 9% | 1:11 |

| stellar | 9% | 1:11 |

| NEO | 9% | 1:11 |

| crypto 10 index | 9% | 1:11 |

| spread betting | cfds | MT4 | |

| bitcoin | 36 | 36 | 36 |

| ether | 1.2 | 1.2 | 1.2 |

| ripple | 0.36 | 0.36 | 0.36 |

| bitcoin cash | 2 | 2 | 2 |

| litecoin | 0.4 | 0.4 | 0.4 |

| EOS4 | 4 | 4 | 4 |

| stellar | 0.2 | 0.2 | 0.2 |

| crypto 10 index | 38 | 38 | n/a |

The UK’s best crypto trading platform

Discover crypto opportunity on the UK’s best web-based platform and mobile trading app, 4 as well as popular third-party platforms including metatrader 4.

The latest crypto news

Coinbase IPO: what you need to know on coinbase shares

Ethereum approaches all-time high as whales buy and bitcoin thrives

Bitcoin: is tighter scrutiny likely?

Bitcoin: is a price correction looming in 2021?

Under FCA rules, only professional traders can trade cryptocurrency with derivatives like spread bets and cfds. Learn more about professional trading and check your eligibility on our professional account page.

Our crypto 10 index tracks the price of the top ten cryptocurrencies, changed every quarter:

- Bitcoin

- Ether

- Ripple

- Litecoin

- Bitcoin cash

- EOS

- Bitcoin SV

- Cardano

- Monero

- Stellar

Try these next

Trading bitcoin

Trading litecoin

Bitcoin halving

No exchange account? No problem. Go long or short on bitcoin with spread betting or cfds.

Trade ‘the silver to bitcoin’s gold’ – whether it’s headed up or down, with no need to own coins.

Discover everything you need to know about trading the next bitcoin halving.

1 while leverage magnifies profits, it will also magnify losses.

2 guaranteed stops incur a small premium if triggered.

3 tax laws are subject to change and depend on individual circumstances. Tax law may differ in a jurisdiction other than the UK.

4 best trading platform as awarded at the ADVFN international financial awards and professional trader awards 2019. Best trading app as awarded at the ADVFN international financial awards 2020.

Markets

IG services

Trading platforms

Learn to trade

Contact us

Spread bets and cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading spread bets and cfds with this provider. You should consider whether you understand how spread bets and cfds work, and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. All trading involves risk.

The value of shares, etfs and etcs bought through a share dealing account, a stocks and shares ISA or a SIPP can fall as well as rise, which could mean getting back less than you originally put in. Past performance is no guarantee of future results.

CFD, share dealing and stocks and shares ISA accounts provided by IG markets ltd, spread betting provided by IG index ltd. IG is a trading name of IG markets ltd (a company registered in england and wales under number 04008957) and IG index ltd (a company registered in england and wales under number 01190902). Registered address at cannon bridge house, 25 dowgate hill, london EC4R 2YA. Both IG markets ltd (register number 195355) and IG index ltd (register number 114059) are authorised and regulated by the financial conduct authority.

The information on this site is not directed at residents of the united states, belgium or any particular country outside the UK and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

8 best exchanges to trade crypto with no fees (zero commission)

Best no-fee exchange for

Best no-fee exchange for

Best no-fee exchange for

Did you know the most popular cryptocurrency trading platforms in the world such as coinbase, binance and etoro take a small amount of your account balance each time you make a trade?

This is where zero-fee fee crypto exchanges can allow traders to buy, trade and sell bitcoin and cryptocurrencies assets without paying any fees. For active investors, it could be the difference between a profitable and losing trader in the long run. In this article, we will share the best places to trade cryptocurrency without fees.

How to trade cryptocurrency without fees

To trade cryptocurrency without fees or commissions, follow these simple steps:

- Register a new account with phemex that offers no-fee crypto trading

- Click the 'products' link and select 'spot trading (zero fees)'

- Search for bitcoin or another cryptocurrency you want to buy, trade or sell

- Enter the amount of crypto to buy or sell against another coin

- Click on the 'buy' or 'sell' button to complete the trade without fees

Before getting started, some exchanges require you to own a bitcoin hardware wallet such as the ledger nano X. If you don't have a wallet, read our guide on the best cryptocurrency hardware wallets.

Platforms to trade bitcoin with no fees

Here is our list of the best crypto exchanges to trade bitcoin without fees (with our commentary):

- Phemex (lightning-fast trade execution speed and features a demo trading account)

- Crypto.Com (global digital asset service that offers a wide range of products)

- Kucoin (trusted by 1 out of every 4 crypto holders in the world)

- Digitex (suitable for crypto day traders, uses native exchange token as collateral)

- Amplify (trade over 14 crypto pairs against fiat, BTC, ETH or native token)

- Shapeshift (instantly swap crypto with zero fees and commissions)

- BLADE (exchange is backed by coinbase and other world-class and trusted investors)

- Lykke (an innovative digital exchange that offers forex, crypto and crypto index trading)

Overall rating

Our review

Website

Phemex

Phemex is a cryptocurrency trading exchange that offers spot, derivatives and simulated trading all on a single unified platform. The trading platform offers it's premium users the ability to trade crypto with zero-fees on its spot exchange for the major cryptocurrency assets such as bitcoin, ethereum, XRP and link.

Founded in 2019 by a group of 8 former morgan stanley executives, the team is focused on creating a trustworthy digital platform and become a leading financial services provider in the cryptocurrency industry. Phemex supports traders all over the world such as the united states, australia and the UK.

Phemex exchange is packed with features such as:

- Trade crypto without fees on its spot-trading exchange (for premium users)

- Derivatives trading up to 100x leverage with BTC & USD contract settlement

- Competitive trading fees on margin trading platform

- Advanced order types to manage risk

- Cryptocurrency demo account for beginners to practise

- 300k transactions per second (TPS)

- Cold wallet storage to keep funds safe on the exchange

- Fast and responsive mobile trading app

- Traditional financial assets (coming soon)

Users that create an account with phemex receive free access to the premium membership for 7 days. This can be extended to 30 days by referring a friend to the exchange. Once the trial ends, users on the exchange will need to purchase the premium membership which starts at $0.19USD per day to continue to trade bitcoin with zero fees.

While it might seem add to pay a subscription for no fee crypto trading, for high volume investors and crypto day traders, this is a very small price to pay to buy, trade and sell crypto without paying fees or commissions.

Crypto.Com

Crypto.Com is a digital asset platform that offers several cryptocurrency products and services. The exchange has seen massive growth in recent years and has over 1 million users on its platform and is a supported cryptocurrency exchange in the US. Crypto.Com is a popular platform that offers a powerful alternative to traditional financial services, making it easier for everyone to buy, trade and sell cryptocurrencies.

Get $50 FREE when you download the app and stake CRO for a MCO visa card using our referral code 45h3ct59tv. Get your debit card now!

With its growing list of features and crypto services, we expect crypto.Com to be one of the best cryptocurrency companies in the world within the next few years to rival the likes of binance and coinbase.

Crypto.Com is continually innovating and developing new crypto services and products for its users to accelerate the adoption of blockchain technology and improving the user experience of using cryptocurrencies. The exchange offers the following limited-time promotional offers:

- 0% trading fee for the first 90 days for new users

- Up to 50% trading fee reduction on all trades for existing users of the exchange

- 2% bonus deposit interest rate for all deposits made by new users in the first 30 days

- Send crypto to crypto.Com app users instantly without fees

- Buy bitcoin with 0% credit card fees

The digital currency provider offers a suite of crypto services and features at your fingertips which let's you buy, sell, trade, spend, store, earn interest on crypto, loan cash and even pay bills with cryptocurrency. Crypto.Com have also announced the future launch of margin and derivatives trading to compete with bybit and FTX.

Kucoin

Kucoin is a cryptocurrency exchange that was built to cater to individuals around the globe by providing an easy to use platform for investors to exchange digital assets and cryptocurrencies. Established in late 2017, kucoin is one of the most popular crypto trading exchanges in the world with over 5 million users globally.

PROMOTION: we have partnered with kucoin to offer a special promotion of zero-trading fees for 7 days when you create a new account using our link below.

Kucoin offers innovative crypto services and products including a spot exchange, futures markets, margin trading, staking rewards, lending service to earn interest on crypto assets and even the ability to purchase cryptocurrencies using a credit/debit card.

The well-known trading platform has recently launched an 'instant exchange' to provide access to the best available crypto exchange rate in the global market. Users can purchase cryptocurrencies such as bitcoin, ethereum, litecoin and XRP with zero-trading fees or commissions.

Kucoin instant exchange is a one-click crypto exchange service that was co-developed by kucoin and a top high frequency trading firm in wall street. The integration through the instant exchange allows a quick purchase of the supported cryptocurrencies, with zero-trading fees and the best available prices.

Digitex

Digitex futures exchange (DFE) is a zero-fee, peer-to-peer crypto futures exchange that allows users to trade bitcoin perpetual swap futures contract with leverage up to 100x. The trading exchange is built on ethereum’s blockchain technology to provide a cutting-edge crypto futures exchange with zero trading fees.

The exchange model is based on users having a balance of its own native coin, the DGTX token to be eligible for zero-commission trading. Each user that places a trade increases the demand for the DGTX token.

The platform is able to offer zero-fee bitcoin trading by selling DGTX tokens to earn money. This means, you can trade crypto with high frequency without having to worry about exchange commissions and taker fees eroding your profits.

Overall, we were quite impressive with digitex and the direction the exchange is headed. However, we would like to see improvements to the user interface, which appears dated in terms of functionality and lacks advanced trade order types. This is an important aspect to trading as this is where most of your time will be spent analyzing the charts.

Amplify

Amplify exchange was launched in 2019 to solve issues in the crypto world that inhibit the broader crypto adoption and common frustrations experienced by crypto traders.

The crypto exchange offers customers all over the globe (apart from US and canada) to buy and sell cryptocurrency without paying trading fees. This means there are no additional fees above spot crypto pricing.

Furthermore, there are no prerequisites to be eligible for zero-trading fees such as financial status, degree of trading expertise and/or amount of investment making it suitable for everyone.

Amplify exchange has over 14 crypto pairs such as:

- Bitcoin

- Ethereum

- Litecoin

- Ripple

- Bitcoin cash

- Stellar lumens

- Dash

- Cardano

- NEO

- Ethereum classic

- Basic attention token

- ZRX

- EOS

- Amplify loyalty token (AMPX)

Each crypto pair can be traded against fiat currency, BTC, ETH and the platform's native coin, AMPX token with zero-fees and commissions. When you log in for the first time, you might be a little surprised at the interface. It's not like other margin crypto exchanges. While it is very simplistic and suited to beginners.

Shapeshift

Shapeshift is a digital marketplace that was established in 2014 by erik voorhees that provides a crypto services to users all around the world. The online exchange offers the ability to quickly swap between assets in a seamless, safe, and secure environment.

In a matter of minutes, you can instantly exchange bitcoin to another altcoin and vice versa without any hassle. The team behind shapeshift have recently launched a new platform to buy bitcoin with no fees in an effort to compete with other cryptocurrency exchanges.

To be eligible for commission free, zero spread and zero trading fees on shapeshift, users need to hold their native FOX tokens. When you create an account, shapeshift deposit 100 FOX tokens for free in your account.

The new shapeshift platform allows you to:

- Create a new wallet or connect your keepkey, trezor or portis wallet

- Visualize your portfolio performance through a powerful dashboard

- Trade crypto instantly and for free with over a thousand asset pairs by holding FOX tokens

- Buy crypto with your bank account

- Send, receive, and HODL your digital assets on your hardware wallet

Day trading cryptocurrency – how to make $500/day with consistency

Would you like to learn day trading cryptocurrency and make a consistent $500 per day? We often hear about all the money you can make by day trading stocks. But what about crypto day trading? In today’s lesson, you’ll learn how to day trade cryptocurrency using our favorite crypto analysis tools.

Our team at trading strategy guides is lucky to have over 50 years of combined day trading experience. We’re going to share with you what it takes to day trade for a living, and hopefully, by the end of this trading guide, you’ll know if you have what it takes to succeed in this business.

First and foremost, when day trading, it’s essential to have a structured approach and a rule-based strategy. The same as swing trading or positional trading you are not going to trade every day, and you’re not going to make money every day. So, you need a day trading cryptocurrency strategy to protect your balance.

The high volatility nature of bitcoin and other cryptocurrencies has made the crypto market like a roller-coaster. This is the perfect environment for day trading because during the day you’ll have enough up and down swings to make a decent profit.

Moving forward, we’re going to teach you what you need to learn how to day trade cryptocurrency and we’re going to share some out-of-the-box rule-based day trading strategies.

How to day trade cryptocurrency

The crypto market’s unique characteristics require you to have a firm understanding of how it works. Otherwise, your experience can be like skydiving without a parachute.

The good news is that we’re going to provide you with everything you need to survive crypto day trading.

Day trading the cryptocurrency market can be a very lucrative business because of the high volatility. Since the crypto market is a relatively new asset class, it has led to significant price swings.

Before day trading bitcoin or any other altcoins, it’s prudent to wait until we have a high reading of volatility. The good news is that even when we have a low reading of volatility relative to other asset classes, this volatility is still high enough that you can generate a modest profit on your trades.

Crypto day trading also requires the right timing and good liquidity to make precise entries.

A lot of the cryptocurrencies and crypto exchanges are very illiquid and don’t have the liquidity to offer instant execution that you might find when trading forex currencies.

Before day trading bitcoin or any other alt coins, it’s also important to check how liquid the cryptocurrency you wish to trade is. You can do so by simply verifying the 24-hour volume of the crypto trade.

Coinmarketcap is a good free resource to read and gauge the market volume of any particular coin.

Note* always remember that not having enough liquidity could lead to substantial slippage and subsequent to bigger losses.

As previously stated, crypto day trading doesn’t require trading every single day. We only like day trading cryptocurrencies when all the conditions align in our favor. In this case, avoid trading on weekends and limit trading only on the highest-volume days.

Put your seatbelt on because next, we’re going to reveal how professional traders are day trading cryptocurrencies.

Crypto day trading strategy

The idea behind crypto day trading is to look for trading opportunities that offer you the potential to make a quick profit. If day trading suits your own personality, let’s dive in and get through a step-by-step guide on how to day trade cryptocurrency.

Now, before we go any further, we always recommend taking a piece of paper and a pen and note down the rules of this scalping strategy.

In this article, we’re going to look at the 'buy' side.

Step #1: pick up coins with high volatility and high liquidity

As previously discussed, the number one choice you need to make is to pick coins that have high volatility and high liquidity. If you’re not day trading bitcoin, which is the most liquid coin out there, and you like the altcoins, try to pick those coins that have good liquidity and volatility.

There are more than 1600 coins on the market and growing. By following only the top cryptocurrencies, you’ll reduce your area of selection.

Day trading smaller cryptocurrencies can also be a very lucrative business, but there are higher risks. Remember, crypto prices can crash just as fast as they have risen.

Moving forward, you’re going to learn how you can make money crypto day trading.

Step #2: apply the money flow index indicator on the 5-minute chart

This specific day trading strategy uses one simple technical indicator, namely the money flow index. We use this indicator to track the activity of the smart money and to gauge when the institutions are buying and selling cryptocurrencies.

The preferred settings for the MFI indicator are 3 periods.

We’re also going to alter the default buying and selling levels from 80 to 100 and respectively from 20 to 0.

How to use the IMF indicator will be outlined during the next step.

Step #3: wait for the money flow index to reach the 100 level

An MFI reading of 100 shows the presence of the big sharks stepping into the markets. When buying, smart money can’t hide their footsteps. They inevitably leave tracks of their activity in the market and we can read that activity through the MFI indicator.

Technical indicators aren’t always right, so in order to fine-tune our day trading strategy, we’ve added a few more conditions. Namely, during the current day, we need to skip the first two MFI readings of 100 and study the crypto price reaction.

The price needs to hold up during the first and second 100 MFI reading.

If the price drops after the first two MFI 100 readings, then this suggests that most likely we’re going to have a down day.

Let’s now determine the appropriate place to go buy bitcoin and what are the technical conditions that need to be satisfied.

Step #4: buy if MFI = 100 and if the subsequent candle is bullish

We can now wait for the third MFI reading above 100. It doesn’t necessarily have to be the third MFI = 100 reading, you can take every other MFI = 100 readings. If your time doesn’t allow you to catch the third 100 reading on the MFI indicator, you can simply pick the next one as long as all the other technical conditions are satisfied.

Next, we also need the candlestick when we got the MFI = 100 reading to be a bullish candle. The close of this candle needs to be near the upper end, giving us a candle with very small wicks.

This brings us to the next important thing that we need to establish when day trading cryptocurrency, which is where to place our protective stop loss and where to take profits.

Step #5: hide your protective stop loss below the low of the day. Take profit during the first 60 minutes after you opened the trade.

The obvious place to hide your protective stop loss is below the low of the day. A break below it will signal a shift in the market sentiment, and it’s best to get out of the trade. This can also signal a reversal day.

We’re more flexible when it comes to our exit strategy. However, the only rule you need to abide by is to take profits during the first 60 minutes or the first hour after your trade got triggered. Holding the trade longer than one hour will result in a lower success rate. At least that’s what our backtested results showed us.

Conclusion – crypto day trading

If you took the time to read the whole day trading crypto guide, then you should be able to buy and sell bitcoin and alts and make some daily profits. If you are interested in learning how to day trade cryptocurrency, be sure to equip yourself with enough information before diving into the market.

Crypto day trading can be a great way to grow your crypto portfolio and it’s a very lucrative alternative to the holding mentality that it’s crippling the crypto community.

Making a living day trading cryptocurrency can be a lot easier due to the high volatility nature of the crypto market. High volatility suits day trading very well, so you have the right environment to succeed. You may also be interested in reading our guide on the best cryptocurrencies investments for 2019.

Feel free to leave any comments below, we do read them all and will respond.

Also, please give this strategy a 5 star if you enjoyed it!

Please share this trading strategy below and keep it for your own personal use! Thanks, traders!

So, let's see, what we have: A step-by-step beginner’s guide to cryptocurrency trading, including how to choose a trading style, develop a trading plan and compare platforms. At crypto coin trade

Contents

- Top forex bonus list

- Cryptocurrency trading

- Find out how to get started trading cryptocurrency in this step-by-step guide.

- What's in this guide?

- How to trade cryptocurrency

- The different types of cryptocurrency trading

- Cryptocurrency trading for beginners

- How to make a trading plan

- What to watch out for

- Compare cryptocurrency trading platforms

- Where to trade cryptocurrency in the UK

- Cryptocurrency stocks trade in all directions today, even as bitcoin climbs above $34,000

- These stocks reminded investors that day trading stocks based on the price of bitcoin can be an...

- What happened

- So what

- Now what

- Best cryptocurrency brokers for 2021

- Best cryptocurrency brokers (non-US traders only)

- Plus500 – top rated trading platform

- IQ option – lowest minimum deposit ($10)

- Etoro – top crypto broker

- Highlow – best all-round crypto broker

- Nadex – US traders welcome

- Crypto brokers with most cryptocurrencies

- Lowest minimum deposit brokers

- Top rated brokers that have cryptocurrencies

- How to choose your cryptocurrency broker

- Which cryptocurrencies are you interested in trading?

- Pros and cons of cryptocurrency brokers

- Cryptocurrency brokers – what to look for

- More great features you could be interested in

- Ready to start trading?

- Crypto coin trade

- Cheaper GBP deposits HOT

- Margin trading

- CEX.IO staking

- Buy crypto with a card

- Best cryptocurrency exchange: what does it mean for us?

- Cryptocurrency stocks trade in all directions today, even as bitcoin climbs above $34,000

- These stocks reminded investors that day trading stocks based on the price of bitcoin can be an...

- What happened

- So what

- Now what

- Crypto-currency firm ripple charged by US watchdog

- Cryptocurrency trading

- Why trade cryptocurrencies with us?

- Cryptocurrencies you can trade with us

- Ways to trade cryptocurrencies with us in the UK

- What is cryptocurrency trading?

- What are the benefits of cryptocurrency trading?

- Who can trade cryptocurrencies?

- How much will I have to pay?

- How much will I have to pay?

- The UK’s best crypto trading platform

- The latest crypto news

- Coinbase IPO: what you need to know on coinbase shares

- Ethereum approaches all-time high as whales buy and bitcoin thrives

- Bitcoin: is tighter scrutiny likely?

- Bitcoin: is a price correction looming in 2021?

- Try these next

- Trading bitcoin

- Trading litecoin

- Bitcoin halving

- Markets

- IG services

- Trading platforms

- Learn to trade

- Contact us

- 8 best exchanges to trade crypto with no fees (zero commission)

- How to trade cryptocurrency without fees

- Platforms to trade bitcoin with no fees

- Day trading cryptocurrency – how to make $500/day with consistency

- How to day trade cryptocurrency

- Crypto day trading strategy

- Step #1: pick up coins with high volatility and high liquidity

- Step #2: apply the money flow index indicator on the 5-minute chart

- Step #3: wait for the money flow index to reach the 100 level

- Step #4: buy if MFI = 100 and if the subsequent candle is bullish

- Step #5: hide your protective stop loss below the low of the day. Take profit during the...

- Conclusion – crypto day trading

Comments

Post a Comment