5 Profit Making Cryptocurrency Trading Strategieseval(ez_write_tag( 336,280, forexop_com-box-3, ezslot_11,138, 0, 0 )), crypto coin trading strategy.

Crypto coin trading strategy

Another kind of arbitrage is with stable coins. Stable coins have their value fixed to some underlying asset.

Top forex bonus list

Most are pegged to a fiat currency such as the USD dollar so that there’s a 1:1 ratio between the coin and the underlying fiat currency. You then wait for the price gap to close so that there’s no price differential. If it adjusts to the correct exchange rate, and say BTCUSD stays fixed, BTCGBP should rise to £5416/£5420. Let’s assume this happens 1 hour later. You then unwind the trade.

5 profit making cryptocurrency trading strategies

In this article, we will look at five easy cryptocurrency trading strategies.

1. Bitcoin-altcoin ratios

When looking at a crypto currency chart, remember that half and probably a lot more of the price action has nothing at all to do with that crypto asset, or even crypto currencies in general. It has far more to do with the underlying fiat currency.

Let’s take the pair BTCUSD as an example. If the US dollar rallies against other currencies then all things equal we’ll likely see a big drop in bitcoin versus the US dollar for the simple reason that dollars are a more expensive asset at that point in time.

There may be little change in the number of bitcoin buyers and sellers, but the drop happens anyway because if it didn’t it would open an opportunity for risk free profit.

Precious metals traders have been dealing with that problem for years. One useful chart that they use is the gold-silver ratio chart. This plots the price of gold against the price of silver. When the ratio is high it means that gold is expensive relative to silver. And when it’s low the opposite is true.

You can use any coin ratio but since many people liken bitcoin to digital gold and litecoin to digital silver, let’s stick with that. So think of the litecoin-bitcoin ratio as the digital equivalent of the silver to gold ratio.

With ratio trading, you calculate the mean line then trade towards that line. When the litecoin-bitcoin ratio is high, above the mean line, that might be a time to switch out of litecoin and into bitcoin. When it’s low, that’s a time to start switching out of bitcoin and into litecoin.

Ratio trading can be a very profitable strategy if it’s performed consistently and over the long haul.

The great thing about using such ratio charts is that they eliminate many unrelated variables. You’re comparing like with like.

The slight problem though is that gold and silver have very long trading histories, going back thousands of years. Crypto currencies have only been around a few years. That means these historical ranges have not yet had a time to establish themselves. However ranges and mean lines will always exist, but prepare for them to evolve a little as the technology matures.

Remember that at some point in time you might want to change back into a fiat currency and at that time, the crypto to fiat exchange rate becomes relevant again.

2. Cross crypto arbitrage

Crypto currencies trade relative to their underlying fiat currency in much the same way as fiat currencies trade relative to one another.

Most exchanges and brokers will list a crypto asset against a range of other major fiat currencies. These cross rates can create a trading opportunity known as arbitrage. Arbitrage simply means the chance to make a risk free profit.

BTCUSD is trading at $6500 / $6505

BTCGBP is trading at £5300 / £5305

GBPUSD is trading at 1.2000 / 1.2010

You do the calculation and see that BTCGBP is cheap relative to BTCUSD. From the exchange rate, it should really be trading at £5416/£5420.

The arbitrage trade is then placed to buy the lower priced asset and sell the higher priced asset.

Sell BTCUSD at $6500

buy BTCGBP at £5305

You then wait for the price gap to close so that there’s no price differential. If it adjusts to the correct exchange rate, and say BTCUSD stays fixed, BTCGBP should rise to £5416/£5420. Let’s assume this happens 1 hour later. You then unwind the trade.

Buy BTCUSD at $6505, profit -$5

sell BTCGBP at £5416, profit +£111

Assuming you sell your pounds for dollars your total profit is then $97.4. This is a very simplified example but it demonstrates how arbitrage works.

Remember, when doing arbitrage the profits can be small so trading fees like spreads and swaps are very important.

When markets are working efficiently, arbitrage opportunities are seldom and the gaps are slim. They’re quickly found and traded away. Crypto currency markets are getting much more efficient than they were a few years back, because there are far more people trading them now.

3. Stable coin arbitrage

Another kind of arbitrage is with stable coins. Stable coins have their value fixed to some underlying asset. Most are pegged to a fiat currency such as the USD dollar so that there’s a 1:1 ratio between the coin and the underlying fiat currency.

Some stable coins are specifically designed to be arbitraged. Any deviation away from the peg creates an arbitrage opportunity. This means arbitrage traders can move the price back to the peg and make a profit for their efforts.

DAI is one example. The ratio is 1 dollar to 1 DAI. Unlike tether for example, another stable coin, DAI doesn’t rely on any central backing for its peg to be maintained. The DAI token is backed, or collateralized by ethereum.

DAI can be generated or borrowed by depositing some coins into a vault. On doing this you’ll get back a certain dollar amount of DAI, and at an exchange rate of 1 dollar to 1 DAI. The exact collateral you need to deposit varies from time to time.

As a simple example, suppose DAI is trading at $1.11. This is too high. You have 10 ethereum coins in your crypto wallet and the price of one ETH is $100. You could generate DAI at a cost of $1. You’d then sell your DAI on the exchange at a rate of $1.1.

When enough people do this, the external supply of DAI increases and so the price should adjust downwards. At that time you buy back your DAI tokens at $1 and redeem your ETH from the vault. Of course, if ETH is no longer $100 this could make the actual dollar profit smaller or bigger. But if you planned on holding your ethereum anyway, this wouldn’t matter. You’ve pocketed a bit of income.

Scalping

Daily pips

Essential for anyone serious about making money by scalping. It shows by example how to scalp trends, retracements and candle patterns as well as how to manage risk. It shows how to avoid the mistakes that many new scalp traders fall into.

The other way to arbitrage stable coins is simply to buy or sell the coins directly on an exchange. With tether for example, you could sell when it’s above $1 and buy when it’s below. Then wait for the gap to close before closing the position to take profits.

As with all arbitraging, the profits are meagre and trading costs can be high. This isn’t a strategy you’d want to sit at your desk doing all day long. It works better when automated with software and that’s how most arbitragers do business.

Take note that currency pegs can break down. The breaking of the EURCHF peg is one that took many traders by surprise and even bankrupted a couple of brokers.

4. Trading the bitcoin/altcoin adoption curve

Blockchain and crypto currencies are new technology. Just like the train, the automobile and the internet these technologies historically evolve into what’s known as the s-curve adoption model.

The s-curve is highly typical of new technological breakthroughs so the relationship is a fairly strong one. Pioneers are first in, next early adopters cause the curve to rise. Then there’s a rapid rise as the majority see the potential of the new technology. This flattens as the technology becomes more mainstream, widespread and accepted.

While there is no guarantee that history will repeat, the adoption curve model is one of the strongest long-term buy and sell signals for bitcoin that we currently have. Those who’ve bought at the base of the curve and sold at the top would have made a tidy profit.

Trading the adoption curve is a strategy for the long haul. There certainly can be some ups and down and large deviations from the s-curve. However, over the long-run, history tends to repeat this kind of price progression where innovative technologies merge into mainstream use.

5. Bitcoin and altcoin halving events

Finally, there are the bitcoin halving events. Bitcoin and other crypto assets are unique in that their supply follows a known-in-advance set of rules that are programmed into the protocol.

With bitcoin for example, each halving event, cuts the supply of bitcoin in half.

Bitcoin supply currently comes from miners. Miners are computers that validate new blocks on the blockchain by solving a hard computational hashing problem. By doing this, the miners maintain the network and keep it secure. Miners are rewarded with new bitcoin. This is the block reward and is where the supply of new bitcoin comes from.

The next halving event is 13 th may 2020 and it will cut the issuance of new bitcoins from 12.5 to 6.25 bitcoins for each new block.

Halving events create a speculative fever because many bitcoin hodlers expect the price to skyrocket afterwards. These people have already bought in so that we can expect that some of the halving is already priced into bitcoin. This is our old friend “buy the rumor, sell the fact” at work.

If history is to go by, then the volatility of bitcoin will increase sharply after the halving event. Previous halving events created dramatic price gains in the following months.

On the other hand, there are some complex dynamics at play. Halving may cause some miners to give up because the rewards are less than running costs of the expensive mining rigs that are necessary these days to mine bitcoin. This will cut supply further and fewer miners will arguably make the network less secure, which could hit the demand side.

Bitcoin’s clever protocol anticipates this and adjusts it hashing difficulty to the number of miners. Overall then this may effect may be nullified.

Only time will tell what the next halving event brings. One thing is clear though, it will create some interesting trading opportunities.

Ebook trader's pack

4x popular ebooks

Four complete and up to date ebooks on the most popular trading systems: grid trading, scalping, carry trading and martingale. These ebooks explain how to implement real trading strategies and to manage risk.

Really great information! Thanks for sharing this article!

Crypto currency market : future innovation strategies, growth & profit analysis, forecast by 2020 – 2027

Market research intellect added a title on “ global crypto currency market – 2020 -2027” to its collection of market research reports. The research report study on the global crypto currency market outlines the analysis of all the inclusive segments, along with the market size, Y-O-Y growth analysis & structure of the overall industry. The study also includes the analysis of prominent players and also covers the new market players, including all the information suitable for the clients to make strategic business decisions in the industry.

The market research report on global crypto currency market includes the section of market dynamics which is divided into market growth factors, trends, opportunities, and barriers that defines the current behaviour & future status of the market. Along with this, the research report also covers the facts & figures related to the macroeconomic trends that are expected to impact the growth of the market.

The report covers PESTLE analysis and porter’s five forces analysis which demonstrates the five forces including buyers bargaining power, suppliers bargaining power, the threat of new entrants, the threat of substitutes, and degree of competition in the global crypto currency market. In the study, the framework of porter’s five forces analysis explains the method for analysing the competition of the business covering the industry structure & the level of competition in the market.

Competitive landscape

The report presents a holistic investigation of the crypto currency business mechanism and growth-oriented approaches undertaken by the leading companies operating in this market. The report highlights the numerous strategic initiatives, such as new business deals and collaborations, mergers & acquisitions, joint ventures, product launches, and technological up-gradation, implemented by the leading market contenders to set a firm foot in the market. Hence, this section is inclusive of the company profiles of the key players, total revenue accumulation, product sales, profit margins, product pricing, sales & distribution channels, and industry analysis.

Market segments by top manufacturers:

Bitfinex, bitfury group, bitstamp, coinbase, coinsecure, litecoin, okex fintech company, poloniex, ripple, unocoin technologies private, zeb it service

COVID-19 impact analysis:

The COVID-19 impact assessment included in this report makes it highly distinctive from other market reports of the same category. Researchers have drawn a major focus on the significant impact of the COVID-19 pandemic on the crypto currency market. This section depicts the pandemic’s effects on the global economic scenario, which have further impacted the crypto currency business sphere. The report evaluates the key market influencing factors and considers the COVID-19 pandemic as one of the contributing elements for the market’s potential downturn. The market has been substantially affected by the pandemic, and changes can be seen in the market dynamics and demand trends. Therefore, the report broadly assesses the comprehensive impact of the pandemic on the overall growth of the crypto currency market, besides offering a future COVID-19 impact assessment.

Market split by type can be divided into:

Bitcoin, litecoin, etherium, zcash, other

Market split by application can be divided into:

Private, enterprise, government, other

Geographical analysis:

The latest business intelligence report analyzes the crypto currency market in terms of market reach and consumer bases in the market’s key geographical regions. The crypto currency market can be categorized into north america, asia pacific, europe, latin america, and the middle east & africa based on geography. This section of the report precisely evaluates the presence of the crypto currency market in the major regions. It determines the market share, market size, revenue contribution, sales network, and distribution channels of each regional segment.

Key points of the geographical analysis:

- Data and information related to the consumption rate in each region

- The estimated increase in the consumption rate

- The expected growth rate of the regional markets

- Proposed growth of the market share of each region

- Geographical contribution to market revenue

Key highlights of the crypto currency market report:

- R&D analysis

- Raw material sourcing strategy

- Product mix matrix

- Supply chain optimization analysis

- Vendor management

- Location quotients analysis

- Regional demand estimation and forecast

- Pre-commodity pricing volatility

- Technological advancements

- Carbon footprint analysis

- Competitive analysis

- Patent analysis

- Mergers & acquisitions

- Cost-benefit analysis

Thank you for reading our report. For further information regarding the report or to get a customized copy of it, please connect with us. We will make sure you receive a report perfectly tailored to your needs.

Market research intellect provides syndicated and customized research reports to clients from various industries and organizations with the aim of delivering functional expertise. We provide reports for all industries including energy, technology, manufacturing and construction, chemicals and materials, food and beverage, and more. These reports deliver an in-depth study of the market with industry analysis, the market value for regions and countries, and trends that are pertinent to the industry.

Day trading cryptocurrency: how to day trade cryptocurrency 101

Day trading cryptocurrency: find out how to day trade cryptocurrency and become n expert in no time. Day trading cryptocurrency made easy for you!

Last updated: january 05, 2021

Bitdegree.Org fact-checking standards

To ensure the highest level of accuracy & most up-to-date information, bitdegree.Org is regularly audited & fact-checked by following strict editorial guidelines. Clear linking rules are abided to meet reference reputability standards.

All the content on bitdegree.Org meets these criteria:

1. Only authoritative sources like academic associations or journals are used for research references while creating the content.

2. The real context behind every covered topic must always be revealed to the reader.

3. If there's a disagreement of interest behind a referenced study, the reader must always be informed.

Feel free to contact us if you believe that content is outdated, incomplete, or questionable.

If you’re thinking about leaving your job and becoming a full-time day trading cryptocurrency expert? Well before you do, I think you should read my guide first!

Day trading cryptocurrency isn’t for everyone and there is a lot to consider before you get started. In fact, it is estimated that almost 95% of all day traders eventually fail.

In my “day trading cryptocurrency” guide, I am going to tell you everything you need to know. This will start by explaining exactly what day trading is, followed by the things you need to consider.

After that, if you are still interested, I am then going to show you how to get started!

By the end of reading my guide from start to finish, you will have all the information you need to decide if day trading cryptocurrency is right for you.

So what are you waiting for? Let’s begin by finding out what day trading is!

Table of contents

Day trading cryptocurrency: what is day trading?

When people talk about trading, they are referring to buying and selling an asset with the aim of making a profit. For example, in real-world stock exchanges, people trade all kinds of things. This can include stocks and shares like apple, currencies like U.S. Dollars, and even metals such as gold and silver.

Latest coinbase coupon found:

GET UP TO $132

By learning - coinbase holiday deal

This coinbase holiday deal is special - you can now earn up to $132 by learning about crypto. You can both gain knowledge & earn money with coinbase!

GET UP TO $132

By learning - coinbase holiday deal

This coinbase holiday deal is special - you can now earn up to $132 by learning about crypto. You can both gain knowledge & earn money with coinbase!

Your discount is activated!

Whatever is being traded, the objective is the same. Buy an asset and then sell it for more than you paid for it! This is exactly the same as trading cryptocurrency.

There are different types of trading goals, which are normally split into short-term trading and long-term trading. This is determined by how long you like to hold an asset before you sell it.

Day trading is very short-term trading, and it can mean holding an asset for just a few seconds, to a couple of hours. The idea is that you sell your asset before the end of the day, hoping to make a small, but quick profit.

Let’s take a quick look at an example of two cryptocurrency day trades.

- Peter buys some ripple (XRP) as he thinks the price will increase in the next few minutes as it has just been announced in the news that a big U.S. Bank is going to be using it for their international payments.

- He buys 1000 XRP at a price of $0.80

- As lots of other people are now trying to buy it, the price is going up.

- 10 minutes later, the price of XRP is now $0.816 and peter has decided he wants to sell to make a quick profit.

- Peter makes a 2% profit, which amounts to $16 – not bad for just a few minutes “work”!

- John buys some EOS (EOS) as he has been studying the charts and it looks like the price is going to keep going up.

- He buys 100 EOS at a price of $17.

- The price continues to go up, reaching $24 in just a few hours, however, it then begins to go back down.

- John sells his EOS at a price of $21.

- John makes a profit of just over 23%, which amounts to just over $391!

However, it is important to remember that the above two trades are examples of a successful prediction. On another day, the prices could have easily gone the other way, which would have meant that both peter and john lost money.

The main idea is that when day trading, you look for opportunities to make a quick profit. If you are planning on holding on to a cryptocurrency for longer, this is called long-term trading.

Fun fact: A buzzword you’ll hear a lot in the crypto space is ‘HODL’. This is a misspelling of the word ‘hold’, as someone once made a typo in a forum and it has since stuck around as a crypto-community trend. It literally just means to hold a coin or token for a long time and resist selling it.

There are lots of different methods that people use today trade, but the main two are based on either speculation or chart analysis.

Speculation is when a trader believes a price will go up or down because of a certain event. In the above example of peter, he purchased ripple because he saw a positive news story. There was no guarantee that the price would go up, but he speculated that it would be based on his own opinion.

The other day trading cryptocurrency strategy often used is chart analysis. This is where traders study the price movement of a particular cryptocurrency and try to guess which way it will go, based on historical price movements. When analyzing charts, you can look at how a price moves every few seconds, minutes or even hours.

So now that you know how it works, the next part of my “day trading cryptocurrency” guide is going to look at what you need to know before getting started.

Day trading cryptocurrency: what you need to know first

In the above section, I briefly discussed what day trading cryptocurrency actually is and some of the crypto trading strategies people use. This section is going to talk about the mental side of trading, which is probably the most important thing to consider.

Volatility

Firstly, there are one major difference between day trading cryptocurrency and day trading real-world assets. The reason for this is volatility. Volatility is when the price of an asset moves up or down really quickly, meaning it can either be a great success for the trader or alternatively a great failure.

For example, if you were day trading stocks on the NYSE (new york stock exchange), it is very unlikely that the prices would change that much in a 24 hour period. This is because they are safe companies that have been operating for a long time. Of course, prices still go up or down, but compared to cryptocurrencies, it would generally only be by a small amount.

On the other hand, the prices of cryptocurrencies are very volatile. It is not unusual for the price of a coin to rise or fall by more than 10%-50% in a single day. In some circumstances, even more. For example, in february 2018, a cryptocurrency called E-coin increased in value by more than 4000% in just 24 hours, only to fall straight back down to where it started.

Anyone that bought the coin towards the start of the day would have made a lot of money, however, the people that bought it at its highest price would have lost the majority of their investment.

Cryptocurrency strategy for beginners - #cryptotrading

Intro to crypto strategy for beginners. Lo and behold, there is a strategy even to hodling.

Let’s face the music right away.

Trading is not for everyone

And it’s not just that crypto trading is not for everyone.

Even if you have enough skill or edge to trade, very often there is just not a good opportunity to open a trade.

The market is choppy, there are stop hunts, the volume is too thin.

So then, can you profit from your crypto holdings even if you don’t want to trade?

The answer is you can with a basic crypto strategy, but be warned. For the most part it requires you to be ultra-longterm bullish on crypto.

Let’s take a look at the options you have.

1/ build a “hodl” strategy

This is the simplest method ever.

The “buy and hold” strategy is the staple of retail legacy finance as well. In crypto, the idea is the same, except you apply it on a cryptoasset instead of on a stock.

Oh, and we call it “hodl” in crypto, not “hold”.

Beginner HODL crypto strategy

- Find a crypto with good fundamentals: network effect, resistance to bad news, a use case showing that it’s more than a vaporware.

- Once you find cryptocurrencies you want to keep, decide on how long you are willing to hold them. Ballpark is good enough: A decade? A year?

- Split that period and make a mental note on how often you will re-evaluate your investment. You can go with seasonal cycles, as long as they are relevant. Crypto traders all week all year, but there are seasonal things like the halving cycle of bitcoin.

- Every time your point of re-evaluation comes, you can decide to rebalance and take out some amount from your profits, or to cut your losses, or to just keep holding everything.

If you are wondering about how much to invest and how to pick the best time to buy - that’s already speculation. If you are a beginner, you will do best with DCA, which is dollar cost averaging.

Your toolbox

To execute a beginner HODL strategy, you will probably need some of these:

- Skim through our guide on buying altcoins - with KYC, with no KYC.

- Recommended crypto exchange to buy from is independent reserve, if you go the KYC route.

- Recommended non-KYC place to buy from is localcryptos, the P2P marketplace for crypto.

- Get the basics of dollar cost averaging. For a true beginner strategy you will want to avoid price speculation. Too many people fall into the trap of “I will buy when it drops” and never get started.

- Two places where you can easily automate your regular purchases are independent reserve (real crypto) and the revolut app (investing vehicle only, impossible to withdraw).

- Get a good crypto wallet, that’s where you will hodl your coin. The commercial ones get on sale a few times a year.

2/ crypto lending

If you have more than a tiny amount of bitcoins (or ether, or any other cryptocurrency that is traded on custodial exchanges), you can lend it to traders on most exchanges that run margin trading.

You will earn interest in cryptocurrency directly into your exchange wallet.

Beginner crypto lending strategy

- Sign up at an exchange that does margin lending. This is a link to bitfinex, there you go.

- Decide on the size of your lending stack. All your wallet’s contents? Part of it? It’s up to you.

- Lending itself has next to no risk, but the platform through which you lend may get hacked.

- Decide what is the lowest acceptable rate for you. A good one is a daily rate of 0.03 which gives you 10% return per year.

- Monitor the daily rates. If the rates increase, lend all your stack! If the rates get below your threshold, lend less and take the rest out into your crypto wallet.

Your toolbox

- Margin lending: full template and formulas for your interest rates calculation can be found in ATNET strategy on lending

- Other options: lending platforms like ethlend, where you can lend a range of some 250 ERC-20 tokens.

- Automation: if you don’t want to manually manage the lending rates, a crypto lending bot can take care of it either for free or for a fee. The platform 3commas offers easily configurable crypto trading bots.

3/ run a masternode

With masternode management we are getting into the territory of strategies that are simple to pull of, but they require upfront investment.

Masternode is a cryptocurrency full node with a wallet that keeps the full copy of the blockchain. By that it supports the coin’s network.

A masternode must be always up and running and is required to perform certain tasks for the cryptocurrency network. You as the masternode owner get a payout in your node’s currency as a compensation for this.

As already mentioned, running a masternode also requires an upfront investment.

You will need to buy the node’s currency and hold it in the node wallet as a minimum to start running your node as a masternode.

Obviously you don’t want to be stuck with a shitcoin. Make sure you do your proper due diligence and judge the coin’s value carefully.

4/ staking

Staking might be the easiest way to get extra income on a cryptocurrencies you hold. Clearly, as with masternode management, you need to hold the crypto in question.

Our note about value judgement is just as relevant here.

Once you decided a currency has value for the long run, staking requires no strategy or evaluation - you are primarily collecting more of the coin.

You can stake even OG cryptos

In order to stake a cryptocurrency, it has to follow the proof-of-stake consensus mechanism.

But in 2020, there are variations of “wrapped” cryptocurrencies. That means you can also stake bitcoin in its wrapped form, or even a fiat currency.

Staking is not too profitable

In the past you could earn up to 10% extra coins in a year by just holding and staking them. As the barrier to start staking gradually became lower, the earnings also decreased.

As of 2020, for the more mainstream cryptocurrencies you will earn better by lending them via margin funding.

If you still want to do it…

Your toolbox

- The crypto trading platform kraken is one of the most legit places that lets you do that.

- If you prefer non-KYC platforms, bitfinex lets you stake automatically after depositing a stakeable cryptocurrency.

5/ mining and other early opportunities: bounties, rebates, cashback…

In 2020, mining of the most popular proof-of-work coins (like bitcoin) is a lost case unless you are in special circumstances.

These days, mining is only really profitable if you are a big player, if you have cheap electricity and special equipment.

If you have mining rigs and cooling stuff left over from when small scale bitcoin mining still paid off, you can still make some money with that on the altcoin markets.

There are new proof-of-work cryptocurrencies getting launched all the time. With new coins you can get into mining early when it’s easy and pays well.

Here on ATNET we alert you on these opportunities through our crypto airdrops page.

Posted in crypto trading technique

tagged as #CRYPTO-FUNDAMENTALS #CRYPTO-TRADING-STRATEGY

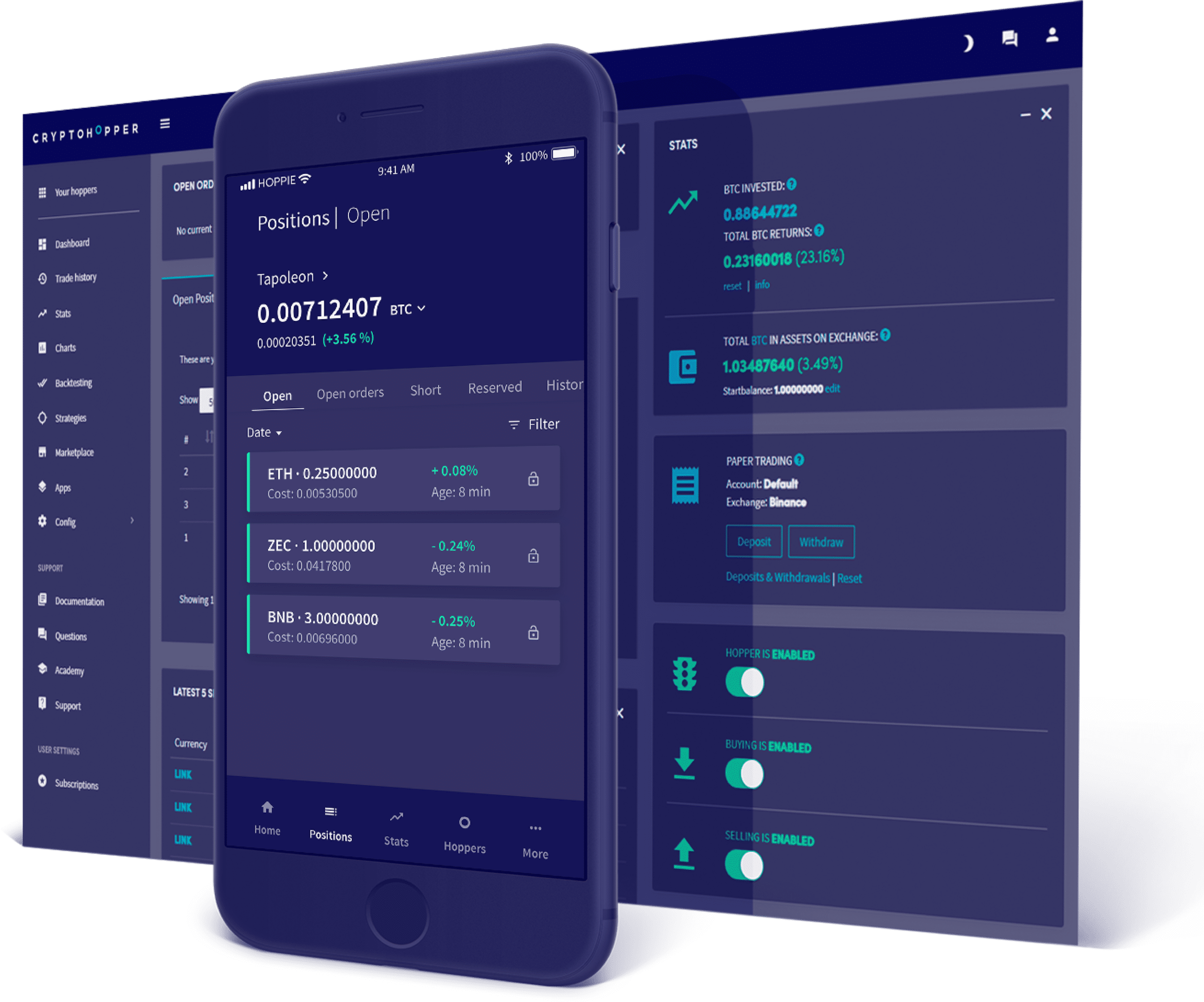

World class automated crypto trading bot

Copy traders, manage all your exchange accounts, use market-making and exchange/market arbitrage and simulate or backtest your trading.

Fast automated trading, and portfolio management for bitcoin, ethereum, litecoin, and 100+ other cryptocurrencies on the world’s top crypto exchanges.

Automate

your trading

And take your emotion out of the equation

Invest in all cryptocurrencies that your exchange offers. At the same time, you’ll also gain access to an expert suite of tools like our trailing features that help you buy/sell better than before.

Trades opened on cryptohopper

Manage all your exchange accounts in one place

Connect your exchange.

Your exchange is where your funds are located. With cryptohopper you can manage all your exchange accounts and trade from one place.

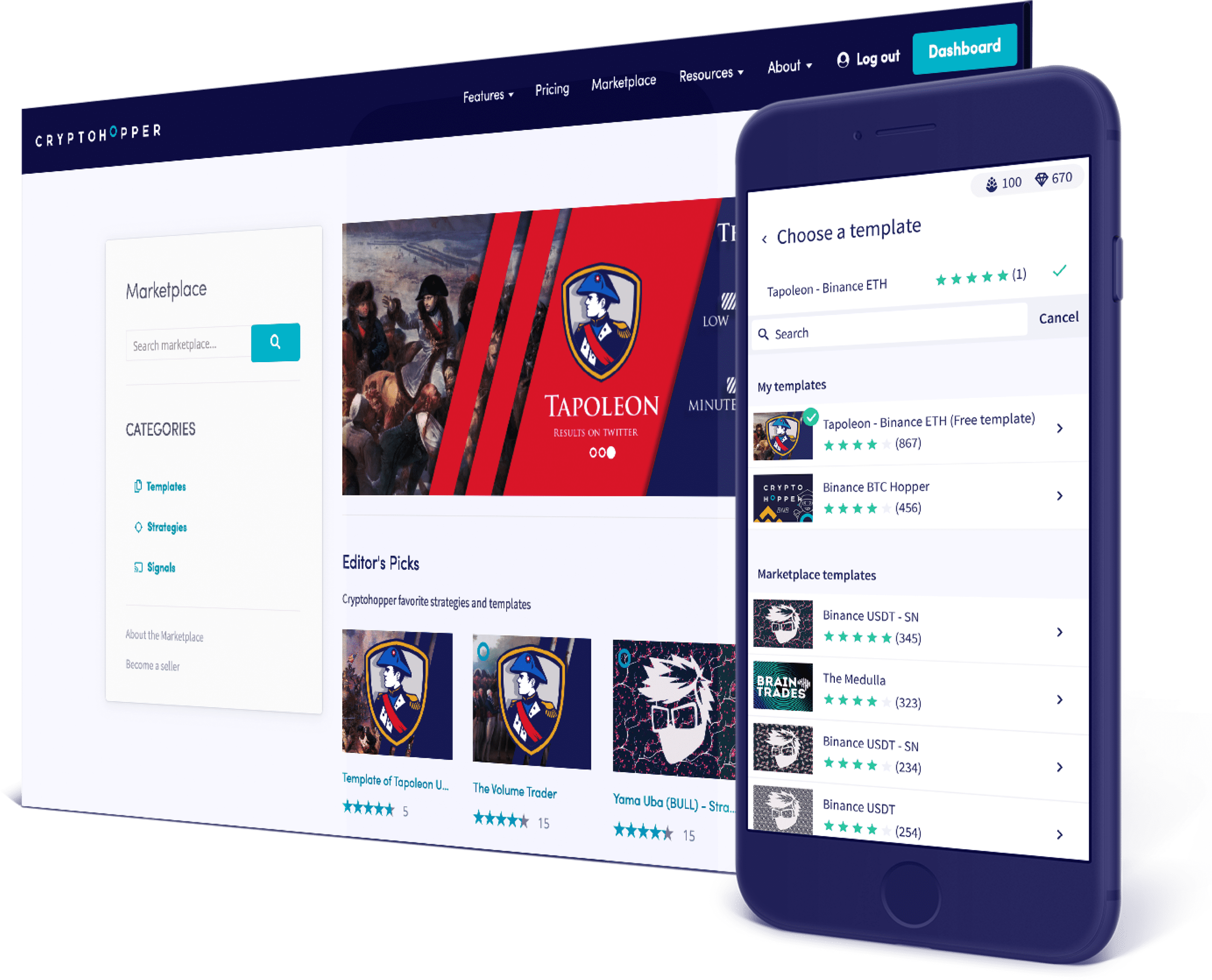

Signals. Templates. Strategies

Social trading platform

(check out the marketplace!)

Join the social trading revolution. Subscribe to trading signals, discuss trading strategies on our internal chat, and buy strategies and bot templates from our marketplace. You don't need to be an expert to trade like one.

Easy. Effective. Worldclass

Use expert tools

without coding skills

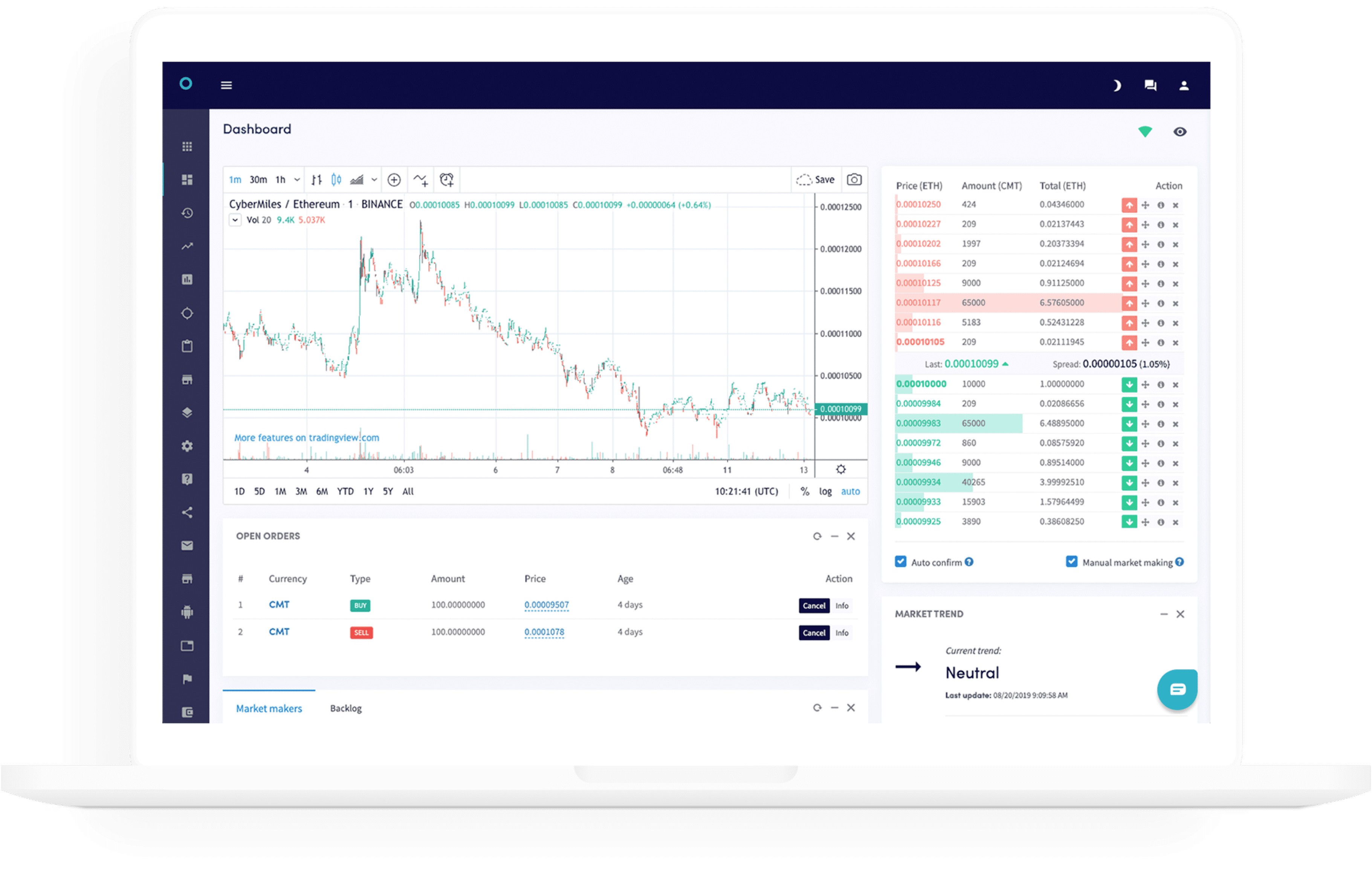

Market-making

Market makers are the best friend of every exchange or crypto project. Now you can trade easily on the spread as well, and make the markets. A win-win for everybody. Read more

Exchange/market arbitrage

Want to benefit from price differences of exchanges and/or between pairs? Our arbitrage tool is your new best friend. Read more

Strategy designer

Create your own technical analysis to get the best buy and sell signals from your strategy. Popular indicators and candle patterns are: RSI, EMA, parabolic sar, CCI, hammer, hanged man, but we have many more. Your hopper will scan the markets 24/7 searching for opportunities for you. Read more

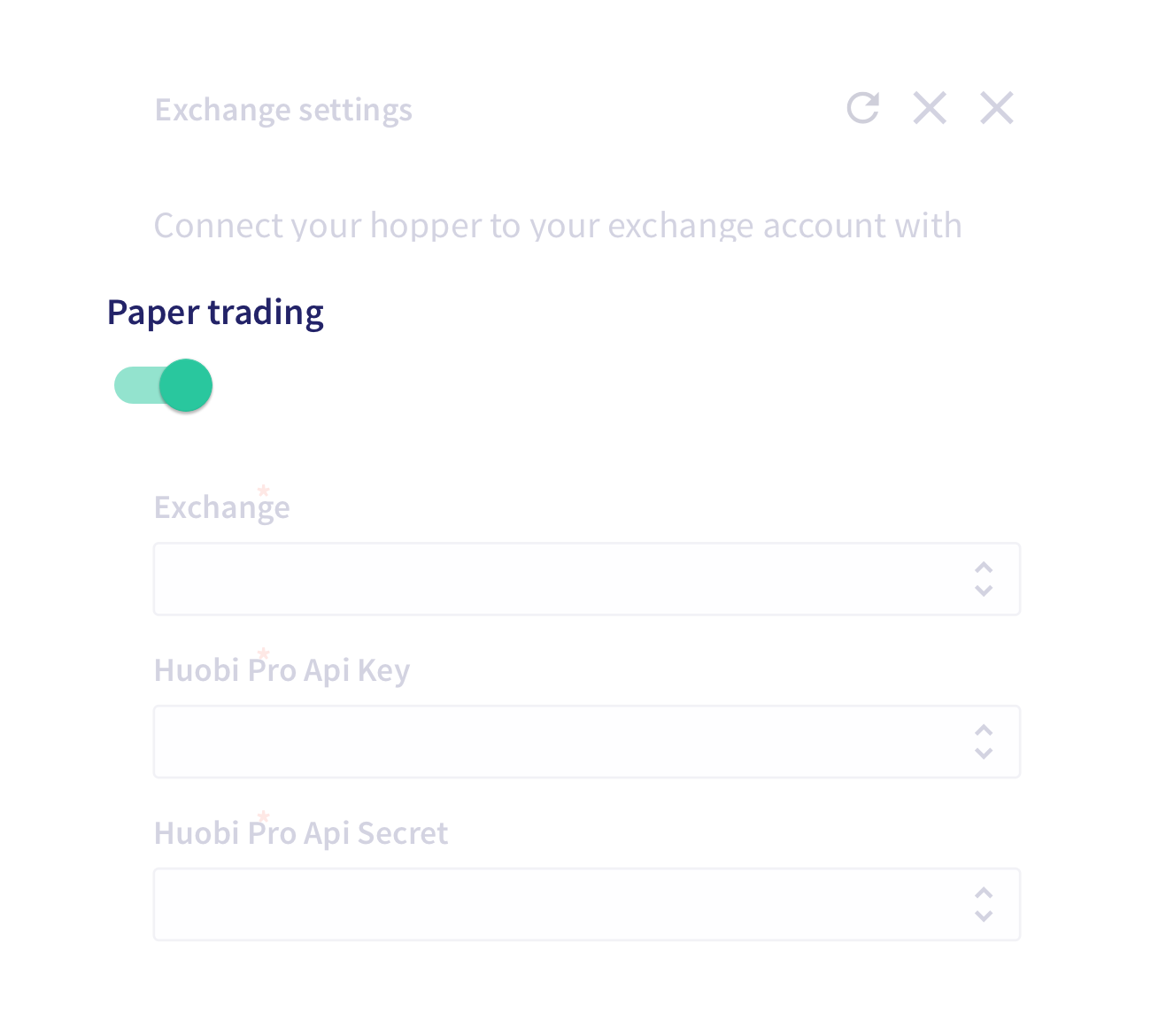

Simulate your trading without fear (or money.)

Practice daring new strategies risk-free while mastering cryptohopper’s tools. Even backtest your bot and your strategies, so you can keep tweaking until it is effective.

What succesful cryptocurrency traders say about cryptohopper

Average score from the google play store (21 nov. 2019)

Meyer family | 11 nov 2019

"I'm very satisfied with cryptohopper and highly recommend it for day trading. It took me a while to get a strategy that worked for me, but it appears to have been well worth it. I recommend paper trading and backtesting extensively before using any real money. Once you master the initial learning curve, you will feel much more secure and confident that you can weather any trend or market. It will also be a valuable asset during the next alt-season and halvening events. Thank you cryptohopper team!"

Roshywall gurgel | 7 nov 2019

"great app. I don't understand cryptocurrencies very well but from what I saw in the demo you can profit. I will definitely buy the basic version to upgrade and profit."

"good service, powerful features, effective, affordable. Highly recommend. ��"

Soflow will | 24 oct 2019

"very easy to use and incredibly affordable. Get the free trail to test it and learn the ropes, then upgrade. I upgraded twice after one week and i still use both subscriptions. Awesome selection of options. Unlimited strategies, lots of free built-ins. Spend time to learn the fundamentals of technical analysis - you'll be glad you did. Crypto hopper will soon become your best friend. And weapon of choice!"

Chika moronu | 23 oct 2019

"took a while to get used to the settings, but once I got the hang of it, the app has been great"

Damion la bagh | 21 sep 2019

"the cryptohopper experience is simply amazing. Great instructions to help you on your way and s great community. The website is beautifully designed with full functionality. The app on the other hand is nice but it's not as full featured. It has the things you need to monitor your hoppers and basically interact but doesn't have the nice graphs, charts or settings to create new strategies like the website does. So one is still dependant on a laptop or computer to get everything set up 1st before"

Mitchell kemp | 3 sep 2019

Galen grassi | 6 sep 2019

"so far for a begginer I'm enjoying this, got a lot to learn but it's a good platform with useful tutorials to assist you along.. I would recommend cryptohopper."

Cryptocurrency investing strategies in 2020

Whether you’re looking for a side gig, a hobby, or even a career, crypto investing can be a lucrative endeavor.

The blockchain industry is young and still ripe for disruption, which provides a major opportunity to profit. Let’s explore three cryptocurrency investing strategies.

Like everybody else, you are here to make money right?

And you see crypto as your one-way ticket for a hefty pot of gold. It is a great wealth creation machine, I’d give you that. But if you want to have better odds than winning the lottery, you need a proper strategy.

Back in early 2017, just about any new cryptocurrency project can spike 20x or 30x in a few weeks or months. So there was no problem making money even for new investors.

Today, the crypto landscape is quite different. But that doesn’t mean there is no pot of gold anymore. And it certainly doesn’t mean the days of 20x and 30x are over.

Crypto is still in its bleeding edge phase. The entire market cap hasn’t even reached a trillion dollars. Upside potential is still enormous.

By the way, I’ve only included the top cryptocurrency investing strategies that have a high probability of earning profit.

Now before we proceed any further I want to stress that HODL is not a crypto trading strategy. It just isn’t. I’ve tried it for two years and can testify that it’s a terrible way to make money in crypto.

For that reason, I didn’t include it in this list.

3 crypto investing strategies

1) dollar cost averaging

Good for: busy people who have no time to spend on the market

Pros: very easy; not time intensive

cons: not as profitable as other strategies; just as likely to backfire

This strategy is fairly easy for new investors to follow. Dollar cost averaging is simply the purchase of cryptocurrencies at regular intervals no matter which direction the price is moving. This scheme can last several months or indefinitely.

While the amount invested in each interval remains the same, the total number of coins you buy will vary depending on the price fluctuations.

Dollar cost averaging allows an investor to average out his purchase price within this set intervals, thereby, managing short-term risk.

The average price will ultimately end up being much lower or higher than if you were to purchase in one payment.

For instance, if you plan to purchase $3000 in EOS but don’t want to do it in one go. Therefore, you decide to invest $750 every first day of each month for the next four months.

For this example, let’s use the real chart history of EOS from june to september 2019, it would look something like this:

Taken from coinmarketcap

June — the price of EOS is $8.24. You buy 91.01 EOS.

July — the price of EOS is $5.90. You buy 127.11 EOS.

August — the price of EOS is $4.42. You buy 169.68 EOS.

September — the price of EOS is $3.04. You buy 246.71 EOS.

If you had followed this strategy, you’d be able to accumulate 634.51 EOS, instead of owning only 364.07 EOS had you purchased it all in one sitting the first month.

Afterwards, it’s your choice whether you want to hold on to your cryptocurrency or sell.

Some investors prefer to continue buying indefinitely until the price goes to the moon. And then they sell.

Among the cryptocurrency investing strategies, this is the most beginner-friendly. With that being said, this is also the least effective money-making technique in this list.

I suggest that if you have more time, try to learn the other strategies as they have better chances and higher profits.

2) trading strategy

Good for: people who have a lot of free time or are planning to make crypto their primary source of income

Pros: very profitable; earnings are consistent

cons: relatively difficult to learn; mentors are costly

Some people might prefer to call this technical analysis, but it’s not. Let me show you the difference.

Technical analysis is a trading discipline employed to identify trading opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume.

But it’s not a strategy by itself. It is only one ingredient of it.

If you want to make money in crypto, you need a detailed systematic plan on where to place entry points, exit points, as well as what tools to use.

A trader needs to know when to trade and when not to trade. You have to have guidelines that objectively let you decide the best course of action.

Indicators

Indicators are one of many trader tools, but note that they are not useful on their own.

Therefore, it is important to know which indicator to use, because there over five thousand of them. How the hell would you know which one to use?

Some self-proclaimed “crypto trading gurus” will teach phony tactics using these tools. As if indicators alone can make you money. Utter nonsense.

I worked for one of the best traders in the world, and he showed me the truth. With evidence! No indicator alone can consistently win profits for you.

Resistance and support levels

Resistance and support levels are barriers that prevent the price of a token from getting pushed in a certain direction.

Support is when a downward price movement (selling) is interrupted because of buyer demand.

Resistance is when an upward price movement (buying) is interrupted due to a sell-off when the price becomes too high.

Trading strategy is more of a short-term profit-making strategy, usually lasting hours if not a day or a week. That said, some trends can last for months.

By that I don’t mean you can only profit short-term. Because you can definitely make money indefinitely in trading. I meant that money is quick with this type of crypto investing strategy.

Learn and get a mentor

But to become competent at trading strategy, you have to be comfortable analyzing charts. It won’t give you a crystal ball, but it allows you to manage risks and maximize profits in order to make better and more informed trading decisions.

I highly recommend you get a proper mentor when learning to trade cryptocurrencies. This isn’t something that you can easily learn on your own.

Maybe you can, but it’s going to take a while and you will make a whole lot more mistakes. Furthermore, you will likely catch bad habits that will be very difficult to unlearn later on.

It’s just not worth it. If I were in your position, knowing what I know, I’d rather spend money on a mentor than blowing out my first few trading accounts.

Learning proper trading strategy is probably the best if not second best cryptocurrency investing strategy you can make. The other one being value investing.

3) value investing

Good for: semi-busy people who have spare time probably on weekends

Pros: extremely profitable (5x-20x); not very time intensive

cons: inconsistent profits; a little difficult to learn

Value investing is less about charts and trend lines and more about finding crypto assets that are priced below their intrinsic value. The best measuring technique for value investing is fundamental analysis.

Fundamental analysis

Fundamental analysis is a method of measuring a security’s intrinsic value by examining related economic and financial factors.

This involves studying anything that could influence an asset’s value such as the founding team, the industry it is servicing, the partnerships it has garnered.

The goal here is to be able to pick out undervalued cryptos from a sea of substandard blockchain startups.

These “gems”, as most crypto enthusiasts call them, are usually altcoins with low market capitalization but have phenomenal capabilities that exceed their competitors, or even outclass them.

Fundamental analysis in the crypto industry works very differently from traditional markets since there are no cut and dried metrics to assess a coin’s value.

Furthermore, the industry is nascent and highly speculative, which tends to have higher risks and rewards.

However, there are several factors that can serve as substitute metrics for a coin’s value such as:

- Proof of concept

- Technology

- Team

- Roadmap

- Liquidity

- Tokenomics

- Real world use case

- Competitors

- Whitepaper quality

- Community support

This type of investing strategy requires a bit of research, which shouldn’t be a problem since most altcoin developers provide most if not all the necessary information online.

Successful execution, however, involves timing as well. To know when to buy and when to sell, you must be updated on major announcements of the digital coin market.

- Partnerships

- Exchange listings

- Forks (when an altcoin splits into two, creating two separate currencies)

When enjin coin announced its partnership with samsung, its value swiftly pumped from $0.09 to $0.18 (100% increase) in less than seven hours, and then peaked at nearly $0.25 after two days.

Value investing is more of a long-term strategy but it is likely the most rewarding. Back in 2013, many people scoffed at bitcoin when it was being traded at $100. But some value investors saw something others couldn’t.

They saw the underlying value of bitcoin and years later became multi-millionaires. Even kids.

Conclusion

These three cryptocurrency trading strategies may seem different, but they work best when implemented together.

Trading and value investing both have weak points, but they complement each other.

Dollar cost averaging still requires studying the coin you’re investing in as well as analyzing trends, therefore, it needs to utilize both fundamentals and technicals a little.

If you want to learn more ways to earn income in the crypto market and blockchain industry, be sure to subscribe to the crypto skillset newsletter.

I am not a financial advisor and this isn’t financial advice.

Three trading strategies for crypto

The most performed activity in the crypto space is trading. There is an increasing number of people buying and selling cryptocurrencies to generate a return. Now, there are numerous ways to approach cryptocurrency trading, and this article will introduce three simple strategies that you can use to trade in the market.

1. Fundamental analysis

The idea of fundamental analysis as a trading strategy comes from its use in traditional markets such as stocks and bonds. The principle behind fundamental analysis is to identify assets that are undervalued by the market. If you can do this, then you will be able to benefit from upside gains as the wider market realizes the value of the asset that you bought long ago. Fundamental analysis is a longer-term strategy, so you will need to be willing to hold the asset for quite some time.

Now, being able to find an undervalued asset is tricky, but in traditional markets, measures such as the price to earnings ratio and earnings per share ratio is often used. However, these metrics are not applicable to cryptocurrencies such as bitcoin, as it is not a company. Instead, different measures must be used, such as the quality of the team developing the cryptocurrency and the value proposition of the crypto.

2. Swing trading

Swing trading is probably one of the most popular strategies that traders use in the market. This is because the swing trading strategy is great for volatile markets. This is especially useful for the crypto market as we will often see wild swings in the price of bitcoin in the span of hours. Being able to properly execute this strategy requires one’s ability to be able to time when the market will swing upwards or downwards. So, being familiar with price action will give you a big edge with this strategy. Also having an automated setup, and using crypto bots and signal groups (e.G. Binance signals) will help you improve entry execution, which is extremely important in maximizing potential profits.

3. Arbitrage

The arbitrage trading strategy is one that is especially suited for the crypto space. This is because cryptocurrencies are often traded on numerous exchanges, and as a result, it is often the case that the price of bitcoin for example will be trading at slightly different prices across various exchanges. For example, bitcoin could be trading at $11,000 on coinbase, but trading slightly higher at $11,100 on binance. The arbitrage trading strategy allows you to exploit this price difference to generate consistent returns.

Conclusion

There are more types of strategies that traders use to gain an edge in the market. What’s important is finding a strategy that works well for your trading style, so make sure to find trading strategies that you are most comfortable with so that you can generate consistent and reliable returns.

Day trading strategies in cryptocurrency

Immersed in the world of finance, one has probably tried to trade cryptocurrency at least once. Cryptocurrency day trading is different from the one provided by a traditional stock market. What does a trader need to start day trading? Does day trading suit crypto beginners? How to day trade? Let’s try to figure it all out.

Before you start your day trade

Before you finally get into day trading, be sure you are familiar with basic trading definitions like order, order book, spread, and so on. It is important to understand what goals you want to achieve while day trading. Is it going to be your additional part-time job? Or, perhaps, a full-time job? Or do you treat day trading as a hobby? How much money are you ready to lose? Once you’ve got answers, we are ready to provide you with the next steps.

The next step is to choose a reliable crypto exchange. The exchange should be secure, fault-tolerance, and have to provide a wide variety of digital assets for trading to be smooth and rich. These characteristics suit such cryptocurrency exchanges as binance, huobi, hitbtc, and many others. Unlike the regular stock market, the crypto industry never sleeps so that crypto exchanges work 24/7.

Instant crypto exchange changelly provides access to over 150 cryptocurrencies. Buy BTC, ETH and hundred of digital assets with USD, EUR, GBP. Credit cards accepted.

To deposit funds, you have to obtain a secure crypto wallet. Besides being safe, the wallet has to support different coins and tokens of various standards (ERC-20, ERC-721, etc.) A good wallet implies high-level security features, intuitive UX/UI, availability, and a lot of other characteristics. A crypto wallet should be chosen as wisely as a crypto exchange. Find the one that suits your needs and let’s get started.

What is day trading?

Day trading is a type of short-term trading aimed to bring quick profit in a short period of time. As the opposite of day trading, there is long-term trading which implies such a strategy as hodling. Pretty much every cryptocurrency can be traded in short and long positions if you know how to ‘read’ the market. However, some coins seem to be created as a long-term investment whereas other cryptocurrencies perfectly work for day trading.

To obtain maximum profit when day trading, a trader has to stay informed on the slightest market movements and cryptocurrency news, know how to use trading instruments and be able to open or close positions in time.

The cryptocurrency market is volatile. It takes lots of effort to predict the rate of certain crypto even for the next 10 minutes. If you can read charts and market signals, there is no guarantee that your prediction is correct. Like any other type of trading, day trading may bring you either considerable profit or loss. And once you start trading, you have to keep this fact in mind.

Day trading tips & tricks

The following tips & tricks perfectly suit crypto day trading beginners. The main goal of any trader is to make a profit and reduce the number of losses. You can’t make an omelet without breaking eggs. The sooner you accept the fact that there will be losses, the better. Losses are part of the game, so just go with it and keep moving forward.

Due to the volatile nature of the crypto market, it is highly recommended to wait once the crypto market meets a relatively stable state (especially if you are a beginner at crypto trading).

To protect yourself from great losses, choose the right order. Decide on the maximum price you expect to lose and set up a stop-loss order.

A stop-loss is a trading order that allows you to set up a price that once reached will execute the trade.

Example: you buy 1 ETH at $140, but the market tends to go down. You decide to set up a stop-loss order at $130. Once ETH reaches the price of $130, the system will automatically sell this asset at this price.

The stop-loss orders also work if you want to sell your asset at the highest price. Decide on which price will be considered the best for you.

Example: you buy 1 ETH at $140 and the market tends to go up. According to your predictions, the price will most likely increase by 10% and you set up a stop-loss order to execute the trade once ETH price hits $154.

When trading, it is also recommended to set up alerts on the maximum and minimum price a cryptocurrency might reach during the day trading.

To become a professional in any field, the most important thing is – practice. Start your trading career with daily practice. Trade a small amount of your funds and don’t put all your money into trading.

The golden rule of trading is – trade an amount of funds you are not afraid to lose.

Day trading strategies

As soon as you start day trading and gain some experience, you’ll probably develop your own trading strategy. Until that moment here are a couple of day trading strategies that might work for crypto beginners.

Wave riding strategy

The wave riding strategy perfectly works for crypto newbies as it is simple and efficient. While in early stages, it is better to trade a cryptocurrency against a stablecoin. In this case, you have to monitor fluctuations of just one coin in a pair.

Day trading cryptocurrency: how to day trade cryptocurrency 101

Day trading cryptocurrency: find out how to day trade cryptocurrency and become n expert in no time. Day trading cryptocurrency made easy for you!

Last updated: january 05, 2021

Bitdegree.Org fact-checking standards

To ensure the highest level of accuracy & most up-to-date information, bitdegree.Org is regularly audited & fact-checked by following strict editorial guidelines. Clear linking rules are abided to meet reference reputability standards.

All the content on bitdegree.Org meets these criteria:

1. Only authoritative sources like academic associations or journals are used for research references while creating the content.

2. The real context behind every covered topic must always be revealed to the reader.

3. If there's a disagreement of interest behind a referenced study, the reader must always be informed.

Feel free to contact us if you believe that content is outdated, incomplete, or questionable.

If you’re thinking about leaving your job and becoming a full-time day trading cryptocurrency expert? Well before you do, I think you should read my guide first!

Day trading cryptocurrency isn’t for everyone and there is a lot to consider before you get started. In fact, it is estimated that almost 95% of all day traders eventually fail.

In my “day trading cryptocurrency” guide, I am going to tell you everything you need to know. This will start by explaining exactly what day trading is, followed by the things you need to consider.

After that, if you are still interested, I am then going to show you how to get started!

By the end of reading my guide from start to finish, you will have all the information you need to decide if day trading cryptocurrency is right for you.

So what are you waiting for? Let’s begin by finding out what day trading is!

Table of contents

Day trading cryptocurrency: what is day trading?

When people talk about trading, they are referring to buying and selling an asset with the aim of making a profit. For example, in real-world stock exchanges, people trade all kinds of things. This can include stocks and shares like apple, currencies like U.S. Dollars, and even metals such as gold and silver.

Latest coinbase coupon found:

GET UP TO $132

By learning - coinbase holiday deal

This coinbase holiday deal is special - you can now earn up to $132 by learning about crypto. You can both gain knowledge & earn money with coinbase!

GET UP TO $132

By learning - coinbase holiday deal

This coinbase holiday deal is special - you can now earn up to $132 by learning about crypto. You can both gain knowledge & earn money with coinbase!

Your discount is activated!

Whatever is being traded, the objective is the same. Buy an asset and then sell it for more than you paid for it! This is exactly the same as trading cryptocurrency.

There are different types of trading goals, which are normally split into short-term trading and long-term trading. This is determined by how long you like to hold an asset before you sell it.

Day trading is very short-term trading, and it can mean holding an asset for just a few seconds, to a couple of hours. The idea is that you sell your asset before the end of the day, hoping to make a small, but quick profit.

Let’s take a quick look at an example of two cryptocurrency day trades.

- Peter buys some ripple (XRP) as he thinks the price will increase in the next few minutes as it has just been announced in the news that a big U.S. Bank is going to be using it for their international payments.

- He buys 1000 XRP at a price of $0.80

- As lots of other people are now trying to buy it, the price is going up.

- 10 minutes later, the price of XRP is now $0.816 and peter has decided he wants to sell to make a quick profit.

- Peter makes a 2% profit, which amounts to $16 – not bad for just a few minutes “work”!

- John buys some EOS (EOS) as he has been studying the charts and it looks like the price is going to keep going up.

- He buys 100 EOS at a price of $17.

- The price continues to go up, reaching $24 in just a few hours, however, it then begins to go back down.

- John sells his EOS at a price of $21.

- John makes a profit of just over 23%, which amounts to just over $391!

However, it is important to remember that the above two trades are examples of a successful prediction. On another day, the prices could have easily gone the other way, which would have meant that both peter and john lost money.

The main idea is that when day trading, you look for opportunities to make a quick profit. If you are planning on holding on to a cryptocurrency for longer, this is called long-term trading.

Fun fact: A buzzword you’ll hear a lot in the crypto space is ‘HODL’. This is a misspelling of the word ‘hold’, as someone once made a typo in a forum and it has since stuck around as a crypto-community trend. It literally just means to hold a coin or token for a long time and resist selling it.

There are lots of different methods that people use today trade, but the main two are based on either speculation or chart analysis.

Speculation is when a trader believes a price will go up or down because of a certain event. In the above example of peter, he purchased ripple because he saw a positive news story. There was no guarantee that the price would go up, but he speculated that it would be based on his own opinion.

The other day trading cryptocurrency strategy often used is chart analysis. This is where traders study the price movement of a particular cryptocurrency and try to guess which way it will go, based on historical price movements. When analyzing charts, you can look at how a price moves every few seconds, minutes or even hours.

So now that you know how it works, the next part of my “day trading cryptocurrency” guide is going to look at what you need to know before getting started.

Day trading cryptocurrency: what you need to know first

In the above section, I briefly discussed what day trading cryptocurrency actually is and some of the crypto trading strategies people use. This section is going to talk about the mental side of trading, which is probably the most important thing to consider.

Volatility

Firstly, there are one major difference between day trading cryptocurrency and day trading real-world assets. The reason for this is volatility. Volatility is when the price of an asset moves up or down really quickly, meaning it can either be a great success for the trader or alternatively a great failure.

For example, if you were day trading stocks on the NYSE (new york stock exchange), it is very unlikely that the prices would change that much in a 24 hour period. This is because they are safe companies that have been operating for a long time. Of course, prices still go up or down, but compared to cryptocurrencies, it would generally only be by a small amount.

On the other hand, the prices of cryptocurrencies are very volatile. It is not unusual for the price of a coin to rise or fall by more than 10%-50% in a single day. In some circumstances, even more. For example, in february 2018, a cryptocurrency called E-coin increased in value by more than 4000% in just 24 hours, only to fall straight back down to where it started.

Anyone that bought the coin towards the start of the day would have made a lot of money, however, the people that bought it at its highest price would have lost the majority of their investment.

So, let's see, what we have: 5 profit making cryptocurrency trading strategies in this article, we will look at five easy cryptocurrency trading strategies. 1. Bitcoin-altcoin ratios when looking at a crypto currency at crypto coin trading strategy

Contents

- Top forex bonus list

- 5 profit making cryptocurrency trading strategies

- 1. Bitcoin-altcoin ratios

- 2. Cross crypto arbitrage

- 3. Stable coin arbitrage

- Scalping

- 4. Trading the bitcoin/altcoin adoption curve

- 5. Bitcoin and altcoin halving events

- Ebook trader's pack

- Crypto currency market : future innovation strategies, growth & profit analysis, forecast by 2020 –...

- Day trading cryptocurrency: how to day trade cryptocurrency 101

- Day trading cryptocurrency: what is day trading?

- GET UP TO $132

- Day trading cryptocurrency: what you need to know first

- Cryptocurrency strategy for beginners - #cryptotrading

- Trading is not for everyone

- 1/ build a “hodl” strategy

- 2/ crypto lending

- 3/ run a masternode

- 4/ staking

- 5/ mining and other early opportunities: bounties, rebates, cashback…

- World class automated crypto trading bot

- Manage all your exchange accounts in one place

- Social trading platform

- Use expert tools without coding skills

- Market-making

- Exchange/market arbitrage

- Strategy designer

- Simulate your trading without fear (or money.)

- What succesful cryptocurrency traders say about cryptohopper

- Cryptocurrency investing strategies in 2020

- 3 crypto investing strategies

- 1) dollar cost averaging

- Good for: busy people who have no time to spend on the market

- Pros: very easy; not time intensivecons: not as profitable as other strategies; just as...

- 2) trading strategy

- Good for: people who have a lot of free time or are planning to make crypto their primary source of...

- Pros: very profitable; earnings are consistent cons: relatively difficult to learn; mentors...

- Indicators

- Resistance and support levels

- Learn and get a mentor

- 3) value investing

- Good for: semi-busy people who have spare time probably on weekends

- Pros: extremely profitable (5x-20x); not very time intensivecons: inconsistent profits; a...

- Fundamental analysis

- 1) dollar cost averaging

- Conclusion

- Three trading strategies for crypto

- 1. Fundamental analysis

- 2. Swing trading

- 3. Arbitrage

- Day trading strategies in cryptocurrency

- Before you start your day trade

- What is day trading?

- Day trading tips & tricks

- Day trading strategies

- Day trading cryptocurrency: how to day trade cryptocurrency 101

- Day trading cryptocurrency: what is day trading?

- GET UP TO $132

- Day trading cryptocurrency: what you need to know first

Comments

Post a Comment