Bitcoin (BTC) 24-Hour Trading Volume Close to $1 trillion, Liquidity Drying Up Fast, bitcoin trading volume.

Bitcoin trading volume

On the other hand, as per the glassnode data, the active BTC addresses have recently hit an all-time high.

Top forex bonus list

Bitcoin has a 200%+ compound annual growth rate over the last 9 years.

Bitcoin (BTC) 24-hour trading volume close to $1 trillion, liquidity drying up fast

As per the information on coinmarketcap, the 24-hour trading volume for bitcoin has surged 25% coming very close to $1 trillion. As of writing this story, the BTC 24-hour trading volume stands at $98 billion. As a result, popular crypto exchanges like bitstamp and binance have reported record user traffic. As bitstamp recently update, the daily bitcoin trading volume on the exchange crossed $2 billion for the very first time.

Daily volume at bitstamp just reached $2B for the first time ever. Thank you all for your support! �� pic.Twitter.Com/95gv8a7mpj

On the other hand, binance CEO changpeng zhao tweets “insane amount of traffic”. The popular crypto handle on twitter “unfolded” notes that “ contrary to previous months, recent 30-day bitcoin (BTC) trading volumes as high on weekends as on weekdays. This change in activity might be due to increased retail investments, as binance reports record user traffic”.

On the other hand, as per the glassnode data, the active BTC addresses have recently hit an all-time high.

Looks like a new ATH for $BTC active addresses is in ladies and gents! Previous cycle benchmark–when aa’s recorded new highs–was around late 2016/early 2017. Pic.Twitter.Com/nlweuuqvlt

Bitcoin (BTC) liquidity crunch intensifies

Another market analyst willy woo has recently shared interesting data that shows hodlers are squeezing-in more BTC at the moment.

Red = coins moving to rick astley, the ultimate hodler.

Never gonna give you up

never gonna let you down

never gonna run around and desert you pic.Twitter.Com/rrcixtamj2

In the following tweet, woo writes: “RED zones mean the net flow of coins are moving to participants that are historically strong hodlers. Via on-chain forensics; clustering wallet addresses into participants, then observing their behaviour. Historically we see GREEN, before rallies start to top out”.

The recent bitcoin bull run of 2021 has flabbergasted every market analyst in the financial world. Analyst neil wilson cautions investors at this stage and says that there could be a massive profit-booking and correction in the coming days.

Sharing another interesting fact, morgan creek digital’s founder notes that bitcoin (BTC) has given over 200%+ compounded annual returns over the last 9 years. Probably bitcoin is the only asset class to give such historic returns in the last decade. Even if it continues to surge at one-fourth of this rate, BTC can easily touch $1 million by 2030.

Bitcoin has a 200%+ compound annual growth rate over the last 9 years.

Even if that slowed by 50% over the next 9 years, bitcoin will still reach $1 million before 2030.

Cryptocurrency trading volumes hit record $68.3 billion following bitcoin rally, research shows

Bitcoin hit a record high $34,800 (roughly rs. 25 lakhs) on sunday.

Bitcoin's record high came less than three weeks after it crossed $20,000 (roughly rs. 14.6 lakhs)

- Ethereum also on monday hit its highest level since january 2018

- World's biggest cryptocurrency more than quadrupled in price last year

- Bitcoin's advance reflects expectations it will become mainstream payment

Trading volumes on major cryptocurrency exchanges hit a daily record on monday of over $68 billion (roughly rs. 4,97,200 crores), research showed, highlighting the trading frenzy that has accompanied bitcoin's charge to an all-time high.

Bitcoin hit a record high $34,800 (roughly rs. 25.4 lakhs) on sunday, building on a 2020 rally that saw it more than quadruple as bigger US investors jumped into the market. It then fell sharply on monday amid volatility in highly leveraged futures markets, before recovering losses.

The second-biggest cryptocurrency, ethereum, which tends to trade in tandem with bitcoin, also on monday hit its highest level since january 2018, touching $1,170 (roughly rs. 85,600).

Overall daily trading volumes in cryptocurrencies hit $68.3 billion (roughly rs. 4,99,600 crores), the data from UK research firm cryptocompare showed on tuesday. Daily volumes had averaged $13.1 billion (roughly rs. 95,800 crores) in 2020, the data showed.

Bitcoin's record high came less than three weeks after it crossed $20,000 (roughly rs. 14.6 lakhs) for the first time on december 16.

Fuelling bitcoin's rally has been the perception it can act as a hedge against the risk of inflation as governments and central banks turn on the stimulus taps to counter the COVID-19 pandemic. Its potential for fast gains also attracted demand.

Crypto trading volumes regularly spike during periods of extreme price swings, highlighting the central role for speculative traders in digital currency trading.

What will be the most exciting tech launch of 2021? We discussed this on orbital, our weekly technology podcast, which you can subscribe to via apple podcasts, google podcasts, or RSS, download the episode, or just hit the play button below.

Edited: bitcoin (BTC) 24-hour trading volume close to $100 billion, liquidity drying up fast

Edited: bitcoin (BTC) 24-hour trading volume close to $100 billion, liquidity drying up fast

Bitcoin (BTC) is smashing past new records every few hours over the last two days. In a fresh rally today, the bitcoin price clocked a new all-time high of $41,500 flipping giant organizations like facebook and tesla. However, with the one price rally, bitcoin has hit multiple milestones.

As per the information on coinmarketcap, the 24-hour trading volume for bitcoin has surged 25% coming very close to $700 billion. As of writing this story, the BTC 24-hour trading volume stands at $98 billion. As a result, popular crypto exchanges like bitstamp and binance have reported record user traffic. As bitstamp recently update, the daily bitcoin trading volume on the exchange crossed $2 billion for the very first time.

Daily volume at bitstamp just reached $2B for the first time ever. Thank you all for your support! �� pic.Twitter.Com/95gv8a7mpj

On the other hand, binance CEO changpeng zhao tweets “insane amount of traffic”. The popular crypto handle on twitter “unfolded” notes that “ contrary to previous months, recent 30-day bitcoin (BTC) trading volumes as high on weekends as on weekdays. This change in activity might be due to increased retail investments, as binance reports record user traffic”.

On the other hand, as per the glassnode data, the active BTC addresses have recently hit an all-time high.

Looks like a new ATH for $BTC active addresses is in ladies and gents! Previous cycle benchmark–when aa's recorded new highs–was around late 2016/early 2017. Pic.Twitter.Com/nlweuuqvlt

Bitcoin (BTC) liquidity crunch intensifies

Another market analyst willy woo has recently shared interesting data that shows hodlers are squeezing-in more BTC at the moment.

Red = coins moving to rick astley, the ultimate hodler.

Never gonna give you up

never gonna let you down

never gonna run around and desert you pic.Twitter.Com/rrcixtamj2

In the following tweet, woo writes: “RED zones mean the net flow of coins are moving to participants that are historically strong hodlers. Via on-chain forensics; clustering wallet addresses into participants, then observing their behaviour. Historically we see GREEN, before rallies start to top out”.

The recent bitcoin bull run of 2021 has flabbergasted every market analyst in the financial world. Analyst neil wilson cautions investors at this stage and says that there could be a massive profit-booking and correction in the coming days.

Sharing another interesting fact, morgan creek digital’s founder notes that bitcoin (BTC) has given over 200%+ compounded annual returns over the last 9 years. Probably bitcoin is the only asset class to give such historic returns in the last decade. Even if it continues to surge at one-fourth of this rate, BTC can easily touch $1 million by 2030.

Bitcoin has a 200%+ compound annual growth rate over the last 9 years.

Even if that slowed by 50% over the next 9 years, bitcoin will still reach $1 million before 2030.

Everyone is underestimating this beast.

To keep track of defi updates in real time, check out our defi news feed here.

Bitcoin's trading volume higher than apple's, microsoft's and amazon's combined

Data presented by cryptocurrency trading simulator - crypto parrot indicates that bitcoin's 30-day average daily trading volume stands at $39.1 billion, which is higher compared to the cumulative 30-day average daily trading volume for apple (AAPL), amazon (AMZN), microsoft (MSFT), alphabet (GOOGL), and facebook (FB) stocks that stand at $37.68 billion.

Apple's 30-day average daily trading volume stands at $13.63 billion while amazon recorded $11.42 billion. Microsoft's trading volume over the period stands at $5.92 billion followed by facebook's $4.38 billion while alphabet's is fifth at $2.31 billion.

The average daily trading volume is between december 1 and december 31, 2020, when bitcoin embarked on a major bull run. As of december 31st, the asset was trading at around $29,000 which was a new all-time high price back then. Currently, bitcoin's trading volume is potentially higher after the asset surpassed the $30,000 mark and traded at a new all-time high of over $34,400 on its birthday (january 3, 2021).

Although bitcoin and the highlighted stocks represented a different class asset, the digital currency's high trading volume is impressive. It correlates with a period bitcoin attained a new all-time mainly due to adoption by institutional investors. It is clear that the institutions have had a material impact on the valuation of bitcoin trading volume and liquidity.

Historically, bitcoin's large trading volumes have been a key indicator of imminent price volatility. A surge in trading volume is generally considered a precursor to a big price move. This is evident considering that after the overviewed period, bitcoin continued to surge in value hitting new levels despite the bubble debate.

Several cryptocurrency experts are, however, torn on whether to consider the current price surge as a bubble or not. Europac chairman peter schiff believes most bitcoin buyers are not aware it is a bubble, something that will have a consequential outcome in the end.

"the only valid reason to buy bitcoin is thinking the bubble will get much bigger before it bursts. Most bitcoin buyers don't know it's a bubble so they will never sell. But since most who do will be unable to tell when it's popped, they're also unlikely to get out with a profit," said schiff.

Elsewhere, amid bitcoin's january 3rd anniversary, entrepreneur jeff booth hails the asset as the greatest invention. Booth states that:

"bitcoin might just be humanity's greatest invention because it allows changes without historical precedent, and allows humanity a great leap forward as a result. With a "potential" change of this magnitude, you owe it to yourself to really understand it."

Furthermore, due to the high trading volume of bitcoin as opposed to the stocks, investors might have been influenced by an appetite for short term gains. In the cryptocurrency world, the fear of missing out (or FOMO) is known to influence more people to stock up digital assets. They might therefore be looking for easy to make quick money.

Bitcoin emerging as strong store of value

While bitcoin's trading volume has taken off, the average daily trading volume of the highlighted stocks was still in a recovery mode following the impact of the coronavirus pandemic. At the onset of the health crisis, the stock market collapsed but interestingly, the covered stocks from the technology sector remained resilient. The stocks' parent products helped people navigate the pandemic and led the recovery of the stock market. The $37.68 billion trading volume is at the period the economy received a major boost with the approval of a coronavirus vaccine.

Generally, bitcoin's tremendous trading volume indicates that the asset is competing against established companies like apple and alphabet. As a result, most crypto advocates consider bitcoin as a haven and it can remain stable during a stock market meltdown.

Article source - opalesque is not responsible for the content of external internet sites

Email was send successfully!

Please check your inbox for

our authentication email.

Thank you for registering

to finance magnates.

Please open the email we

sent you and click on the

link to verify your account.

Trading volume on bitcoin suisse doubled in november

The company also increased its bank guarantee to CHF 60 million.

Bitcoin suisse, a zug-based crypto financial services company, announced on tuesday that the number of its client accounts saw a monthly increase of 15 percent in november while the trading volume doubled.

The company detailed that its strong monthly growth was fueled by the introduction of ethereum 2.0 staking services. Its clients initially committed 25 percent of the total ethereum during the network upgradation: the current staked ethereum at bitcoin suisse went over 97,000 ETH worth around $57 million.

Commenting on the impressive demand, bitcoin suisse CEO, dr. Arthur vayloyan said: “our performance in november demonstrates our business principles and our competitive edge. This year has brought a lot of innovation to the crypto space, namely in defi and most recently with the launch of ethereum 2.”

Is switzerland becoming the world’s crypto bank?

The swiss company offers an array of cryptocurrency services, including trading, staking, and collateralized loans, mostly to institutions and wealthy private clients.

Suggested articles

The different types and styles of social trading in forexgo to article >>

Moreover, the company will support the administration of swiss canton zug in receiving local taxes in bitcoin and ethereum from february 2021.

Earlier this year, bitcoin suisse closed its series A financing round, raising CHF 45 million with a valuation of CHF 302.5 million.

The latest announcement further highlighted that the company has increased its bank guarantee from an AA-rated swiss bank to a total of CHF 60 million. This decision was fueled by increasing client demand on the platform.

“we are a strong and reliable partner that helps clients to identify and realize attractive opportunities in the crypto markets when they arise. Thanks to our experience and our scalable and robust platform, we are able to respond quickly to client demand,” dr. Vayloyan added.

Bitcoin price and trading volumes. Is there a connection?

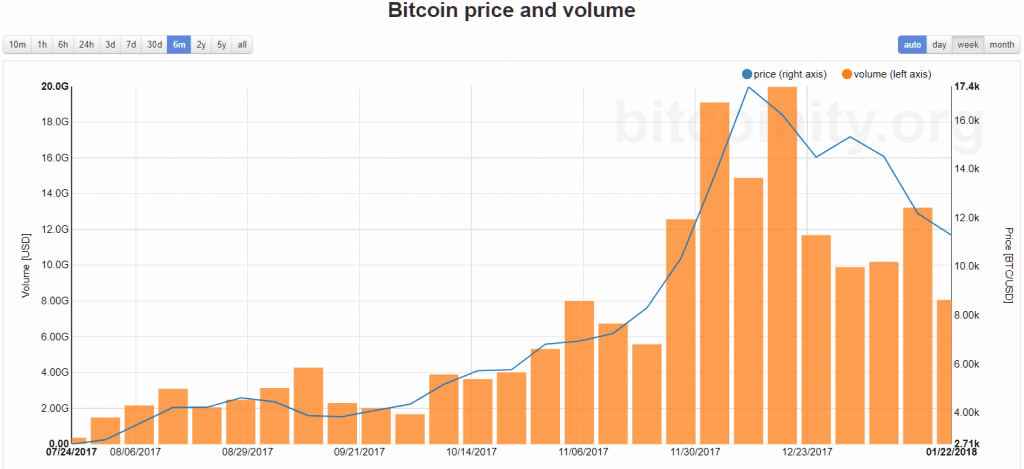

Bitcoin’s price evolution doesn’t need any introduction – it had an incredible journey in 2017, gaining about 1,400% for the year. But what about bitcoin’s trading volume? Is the relationship between the volume and price direct? We’ll try to figure out the answers in the following lines.

On september 15, bitcoin started a long-term and sharp bullish rally from the initial point at $2,991 to a peak of $20,078 recorded on december 17. During this rally, BTC quotation increased almost seven-fold, generating a return of about 590%.

But when we look at the volume figures, the uptrend gets a bit steeper. When bitcoin started its rally at $2,991, the daily trading volume on all exchanges monitored by coinmarketcap was about $3 billion. It went beyond $23 billion on two occasions: on december 18, when the BTC quotation was fluctuating at around $16,000, and on january 6, when bitcoin hit the highest level in 2018, at $17,578.

Thus, we can see that there is more or less a direct relationship between the BTC quotation and bitcoin’s volume expressed in US dollars. The daily volume index as shown on coinmarket cap rose from about $3 billion to a peak of $24 billion, which translates into a jump by over seven times or 700%, a performance that is quite similar with what the price demonstrated for relatively the same period.

To make sure we have a somewhat close ratio between the two indicators, we can use data from bitcoinity:

The chart confirms that the price/volume ratio is actually close.

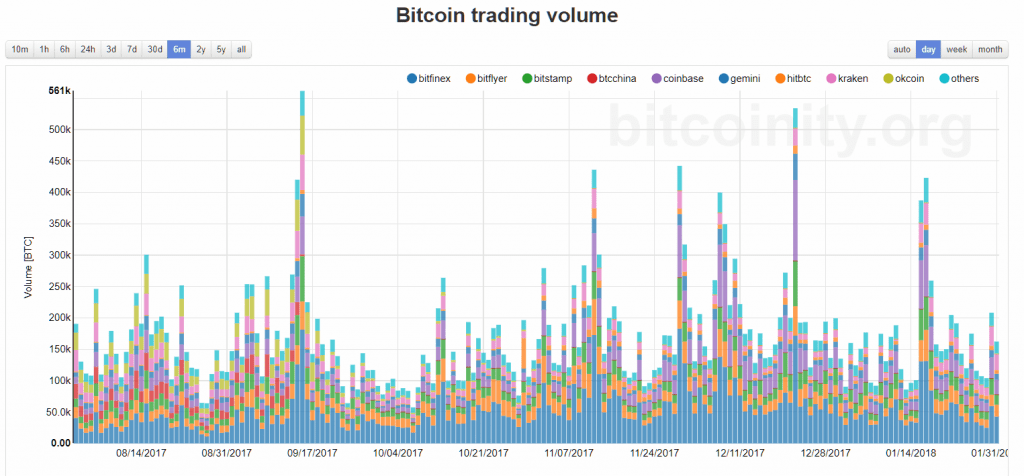

If we talk about the daily volume expressed in the number of bitcoins traded, then we can see a different picture. Given that there is a close relationship between the bitcoin price and the volume indicator expressed in US dollars, we can assume that the volume indicator in terms of traded bitcoins doesn’t show any clear trend at all.

Let’s check data from the same bitcoinity:

As we can see, in the last six months, the BTC volume actually peaked in september rather than december, when its price hit the record high. There is some volatility in the BTC volume, but the indicator moves in a sideways trend.

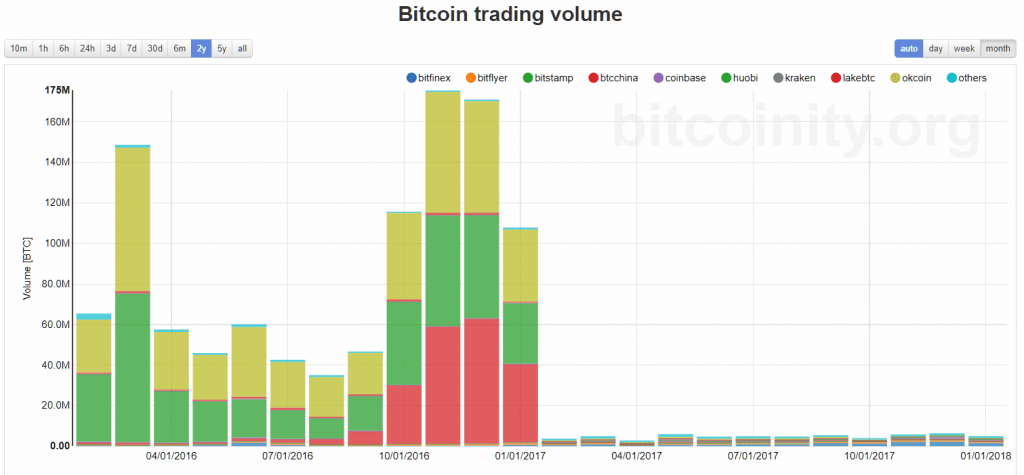

Now here is the surprise, if we check the BTC volume on a two-year chart, then we get something like this:

No – this is not a mistake, the volume in terms of bitcoins traded was much lower in 2017 than in the previous year. The BTC monthly volume in november 2016 peaked at about 170 million BTC. If we check the same indicator since february 2017, we can see that the number of bitcoins traded doesn’t even reach 10 million BTC. Why? Because the price for one bitcoin starts to increase sharply, so fewer and fewer traders can allow spending on it, while the volume expressed in US dollars begins to rise together with the price, as shown in the first chart.

We can also note that china covered about 90% of the whole bitcoin space, with okcoin, BTCC, and huobi being the leading exchanges.

Once the market moved out of china, the BTC volume dramatically fell, but the price showed an astonishing rally, pulling up the volume expressed in USD.

Factors contributing to the growth of volume (USD)

There are several factors that have supported the bitcoin trading volume in terms of US dollars. Here are a few of them:

- BTC price growth – as I have already mentioned above, the accelerating price of bitcoin has a direct and logical impact on the volume indicator. This is because people have to spend more fiat money on each bitcoin. For example, if I sell you one bitcoin at price of $1,000, then we have a trading volume of $1,000, and if I see you one bitcoin priced at $10,000, then we have a trading volume of $10,000. So the BTC volume keeps the same at 1 bitcoin, while the volume expressed in US dollars increases by ten times only because of the price growth.

- Media coverage – bitcoin became the superstar. There is no single day without bloomberg, CNBC, reuters, WSJ, or other huge media name mentioning it from one side or another. As a result, bitcoin became one of the most searched terms on google in 2017, and it is clear that it has a direct impact on demand and consequently on the price and volume.

- The launch of bitcoin futures on the CME and CBOE – in december 2017, chicago-based futures contract providers CME group and CBOE launched bitcoin futures, which supported the BTC price and volume. These events helped bitcoin get closer to the wall street.

The impact of volume growth

A higher bitcoin price and higher trading volume might be great for crypto investors that are thirsty for profits, but the increasing volume became a burden for several large crypto exchanges. Binance, bitfinex, and bittrex are few of the exchanges that were forced to limit and even block the access to new users as the bitcoin and crypto trading volume hit new highs.

Besides bitcoin, cryptocoins like cardano or tron were demonstrating impressive rallies as well, putting pressure on the exchanges that operated with them.

In january 2018, bitfinex registered users that could deposit at least $10,000 and were ready to wait from 6 to 8 weeks for the verification process.

NOTE: this article is not an investment advice. Any references to historical price movements or levels is informational and based on external analysis and we do not warranty that any such movements or levels are likely to reoccur in the future.

In accordance with european securities and markets authority’s (ESMA) requirements, binary and digital options trading is only available to clients categorized as professional clients.

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage.

84% of retail investor accounts lose money when trading cfds with this provider.

You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Bitcoin crosses $35,000 for the first time as trading volume skyrockets to record high

Yuriko nakao/getty images

- Bitcoin crossed $35,000 for the first time on the same day democrats won the runoff elections in georgia and took control of the senate.

- US economists suggest that a democratic senate would likely lead to another round of large fiscal stimulus, crimping demand for assets like the dollar.

- The dollar index fell to a fresh two-year low of 89.29 on wednesday.

- Jpmorgan this week predicted bitcoin could stage a monster rally and reach as high as $100,000, driven by the speculative mania.

- Visit business insider's homepage for more stories.

Bitcoin surpassed $35,000 for the first time on wednesday as trading volumes in the world's most popular cryptocurrency extended record highs.

The digital token hit a new high of $35,783 during intraday trading on wednesday, before falling back to around $34,000.

Bitcoin's rally coincided with the results of the runoff elections in georgia, which showed democrats won both races and will control the senate for the first time since 2015.

US economists have indicated a democratic-controlled senate will likely lead to another large fiscal stimulus package, crimping demand for haven assets like the dollar.

The US dollar index slid 0.2% to 89.29, falling to a fresh two-and-a-half year low. Ordinarily when the dollar depreciates, there is a higher probability that bitcoin will rise.

Bitcoin's jump followed a bullish call from jpmorgan strategists, who predicted the current speculative mania could stage a monster rally and take its price as high as $100,000.

"the simple bullish macro argument appears to be firmly in place for bitcoin, but it is obvious that price action will remain volatile," said edward moya, a senior market analyst at OANDA.

"outlandish calls for bitcoin to rise to $50,000, $100,000 or $200,000 just got its biggest endorsement from jpmorgan's strategists, a goal for the largest cryptocurrency to potentially reach $146,000 in the long-term," he said.

Bitcoin (BTC) 24-hour trading volume close to $1 trillion, liquidity drying up fast

As per the information on coinmarketcap, the 24-hour trading volume for bitcoin has surged 25% coming very close to $1 trillion. As of writing this story, the BTC 24-hour trading volume stands at $98 billion. As a result, popular crypto exchanges like bitstamp and binance have reported record user traffic. As bitstamp recently update, the daily bitcoin trading volume on the exchange crossed $2 billion for the very first time.

Daily volume at bitstamp just reached $2B for the first time ever. Thank you all for your support! �� pic.Twitter.Com/95gv8a7mpj

On the other hand, binance CEO changpeng zhao tweets “insane amount of traffic”. The popular crypto handle on twitter “unfolded” notes that “ contrary to previous months, recent 30-day bitcoin (BTC) trading volumes as high on weekends as on weekdays. This change in activity might be due to increased retail investments, as binance reports record user traffic”.

On the other hand, as per the glassnode data, the active BTC addresses have recently hit an all-time high.

Looks like a new ATH for $BTC active addresses is in ladies and gents! Previous cycle benchmark–when aa’s recorded new highs–was around late 2016/early 2017. Pic.Twitter.Com/nlweuuqvlt

Bitcoin (BTC) liquidity crunch intensifies

Another market analyst willy woo has recently shared interesting data that shows hodlers are squeezing-in more BTC at the moment.

Red = coins moving to rick astley, the ultimate hodler.

Never gonna give you up

never gonna let you down

never gonna run around and desert you pic.Twitter.Com/rrcixtamj2

In the following tweet, woo writes: “RED zones mean the net flow of coins are moving to participants that are historically strong hodlers. Via on-chain forensics; clustering wallet addresses into participants, then observing their behaviour. Historically we see GREEN, before rallies start to top out”.

The recent bitcoin bull run of 2021 has flabbergasted every market analyst in the financial world. Analyst neil wilson cautions investors at this stage and says that there could be a massive profit-booking and correction in the coming days.

Sharing another interesting fact, morgan creek digital’s founder notes that bitcoin (BTC) has given over 200%+ compounded annual returns over the last 9 years. Probably bitcoin is the only asset class to give such historic returns in the last decade. Even if it continues to surge at one-fourth of this rate, BTC can easily touch $1 million by 2030.

Bitcoin has a 200%+ compound annual growth rate over the last 9 years.

Even if that slowed by 50% over the next 9 years, bitcoin will still reach $1 million before 2030.

Cryptocurrency trading volumes hit record $68.3 billion following bitcoin rally, research shows

Bitcoin hit a record high $34,800 (roughly rs. 25 lakhs) on sunday.

Bitcoin's record high came less than three weeks after it crossed $20,000 (roughly rs. 14.6 lakhs)

- Ethereum also on monday hit its highest level since january 2018

- World's biggest cryptocurrency more than quadrupled in price last year

- Bitcoin's advance reflects expectations it will become mainstream payment

Trading volumes on major cryptocurrency exchanges hit a daily record on monday of over $68 billion (roughly rs. 4,97,200 crores), research showed, highlighting the trading frenzy that has accompanied bitcoin's charge to an all-time high.

Bitcoin hit a record high $34,800 (roughly rs. 25.4 lakhs) on sunday, building on a 2020 rally that saw it more than quadruple as bigger US investors jumped into the market. It then fell sharply on monday amid volatility in highly leveraged futures markets, before recovering losses.

The second-biggest cryptocurrency, ethereum, which tends to trade in tandem with bitcoin, also on monday hit its highest level since january 2018, touching $1,170 (roughly rs. 85,600).

Overall daily trading volumes in cryptocurrencies hit $68.3 billion (roughly rs. 4,99,600 crores), the data from UK research firm cryptocompare showed on tuesday. Daily volumes had averaged $13.1 billion (roughly rs. 95,800 crores) in 2020, the data showed.

Bitcoin's record high came less than three weeks after it crossed $20,000 (roughly rs. 14.6 lakhs) for the first time on december 16.

Fuelling bitcoin's rally has been the perception it can act as a hedge against the risk of inflation as governments and central banks turn on the stimulus taps to counter the COVID-19 pandemic. Its potential for fast gains also attracted demand.

Crypto trading volumes regularly spike during periods of extreme price swings, highlighting the central role for speculative traders in digital currency trading.

What will be the most exciting tech launch of 2021? We discussed this on orbital, our weekly technology podcast, which you can subscribe to via apple podcasts, google podcasts, or RSS, download the episode, or just hit the play button below.

So, let's see, what we have: bitcoin (BTC) 24-hour trading volume close to $1 trillion, liquidity drying up fast as per the information on coinmarketcap, the 24-hour trading volume for bitcoin has surged 25% coming very at bitcoin trading volume

Contents

- Top forex bonus list

- Bitcoin (BTC) 24-hour trading volume close to $1 trillion, liquidity drying up fast

- Cryptocurrency trading volumes hit record $68.3 billion following bitcoin rally, research shows

- Bitcoin hit a record high $34,800 (roughly rs. 25 lakhs) on sunday.

- Edited: bitcoin (BTC) 24-hour trading volume close to $100 billion, liquidity drying up fast

- Edited: bitcoin (BTC) 24-hour trading volume close to $100 billion, liquidity drying up fast

- Bitcoin's trading volume higher than apple's, microsoft's and amazon's combined

- Trading volume on bitcoin suisse doubled in november

- The company also increased its bank guarantee to CHF 60 million.

- Is switzerland becoming the world’s crypto bank?

- Suggested articles

- Bitcoin price and trading volumes. Is there a connection?

- Factors contributing to the growth of volume (USD)

- The impact of volume growth

- Bitcoin crosses $35,000 for the first time as trading volume skyrockets to record high

- Bitcoin (BTC) 24-hour trading volume close to $1 trillion, liquidity drying up fast

- Cryptocurrency trading volumes hit record $68.3 billion following bitcoin rally, research shows

- Bitcoin hit a record high $34,800 (roughly rs. 25 lakhs) on sunday.

Comments

Post a Comment