Winklevoss brothers become crypto billionaires, crypto bros.

Crypto bros

Bitcoin's parabolic rise is unsustainable in the near term. Vulnerable to a setback. The target technical upside of $35,000 has been exceeded.According to winklevoss, there’s never been a better time to buy bitcoins than now that the government is involved in stimulus packages that are intended to pump money into the system.Top forex bonus list

Time to take some money off the table.

Winklevoss brothers become crypto billionaires

Tyler and cameron winklevoss, have made billionaires status, thanks to the price surge of bitcoin.

Tyler and cameron winklevoss, the co-founder of a leading american crypto exchange now billionaires, thanks to the price surge of bitcoin.

The brothers had earlier bought $11 million worth of bitcoins in 2013, according to the new york times, and soon became crypto-evangelists, building crypto exchange gemini trust co.

The 39-year-old brothers, who gained fame following the release of the 2010 movie, “the social network,” briefly became billionaires in 2017 when bitcoin soared to a record before plunging to record lows.

In a report credited to bloomberg, each of the twins is now estimated to be worth about $1 billion.

What you should know

- At the timing of writing this report bitcoin price traded at $15,029.58 with a 24-daily trading volume of $30.2 billion.

- BTC price is down -3.5% in the last 24 hours. It has a circulating supply of 19 million coins and a max supply of 21 million coins.

Nairametrics believes the flagship crypto valuation might certainly rise in the high global quantitative easing program, which is a matter of time before it propels bitcoin prices, according to gemini crypto exchange co-founder and CEO, tyler winklevoss.

“the fed continues to set the stage for bitcoin’s next bull run,” winklevoss said in a july 22 tweet, which included an article link on the government agency’s discussions of further stimulus spending.

What they are saying

According to winklevoss, there’s never been a better time to buy bitcoins than now that the government is involved in stimulus packages that are intended to pump money into the system.

In an august essay, the winklevoss brothers elaborated on why they expect bitcoin’s price to reach $500,000.

“inflation is coming. Money stored in a bank will get run over. Money invested in assets like real estate or the stock market will keep pace. Money stored in gold or bitcoin will outrun the scourge. And money stored in bitcoin will run the fastest, overtaking gold,” they said.

Olumide adesina is a france-born nigerian. He is a certified investment trader, with more than 15 years of working expertise in investment trading. Follow olumide on twitter @tokunboadesina or email [email protected] he is a member of the chartered financial analyst society.

Leave a reply

This site uses akismet to reduce spam. Learn how your comment data is processed.

Cryptocurrency

Bitcoin suffers worst drop since march 2020

Bitcoin traded at $33,832.77 with a daily trading volume of $100.2 billion and is down 16.08% for the day.

A large number of crypto investors are presently cashing out at record levels amid a significant drop in the value of bitcoin. The world’s most popular crypto asset dropped as much as $8,000 at the start of monday’s trading session.

This is the worst daily plunge sighted in the dominant crypto asset since march 2020.

What you should know: at the time of drafting this report, bitcoin traded at $33,832.77 with a daily trading volume of $100.2 billion. Bitcoin is down 16.08% for the day. It presently has a market value of $629 billion.

Also, scott minerd, the global chief investment officer of guggenheim partners spoke on the recent bias coming to play at bitcoin’s price action;

“bitcoin’s parabolic rise is unsustainable in the near term. Vulnerable to a setback. The target technical upside of $35,000 has been exceeded. Time to take some money off the table.”

Bitcoin's parabolic rise is unsustainable in the near term. Vulnerable to a setback. The target technical upside of $35,000 has been exceeded. Time to take some money off the table.

However, amid the high sell-offs sighted in the crypto-verse, recent data governing wallet balances from glassnode an advanced crypto analytic firm revealed that major crypto investors with at least 1000 bitcoins are buying from these price dips in play at bitcoin’s market.

Addresses with more than 1k $BTC continue growing at the expense of all others–even as this most recent downturn is taking effect. While you were selling, whales were gobbling up your bitcoin…

Meanwhile, a leading united kingdom’s financial regulator, the financial conduct authority, recently issued a piece of stern advice on crypto investments amid a major strong bearish trend coming to play.

The statement highlighted the risks associated with investing in bitcoin and other leading crypto assets and warned the public there were high chances all their funds could be lost;

- The FCA is aware that some firms are offering investments in crypto assets or lending or investments linked to crypto assets, that promise high returns.

- Investing in crypto assets, or investments and lending linked to them generally involves taking very high risks with investors’ money. If consumers invest in these types of products, they should be prepared to lose all their money.

Crypto bros vs. Blockchain pros

Sir john hargrave

Nov 12, 2018 · 2 min read

In the world of blockchain, two tribes are forming.

On one side are the “crypto bros.” young, mostly male, they are the guys trying to trade “cryptocurrency” to get rich quick.

On the other side are “blockchain pros.” these are the professionals developing blockchain technologies to improve the world.

Crypto bros talk about “lambos,” short for lamborghini, an overpriced car with terrible gas mileage (11 city / 18 highway).

Blockchain pros buy electric cars, which reduce our dependency on oil — increasing world peace by 25 to 50%.

Crypto bros s et up automated trading bots, which will magically make money while they sleep, with no work required.

Blockchain pros do their due diligence on blockchain investing opportunities, going long on a small number of promising investments.

Crypto bros have developed their own slang: “HODL” (always hold — bad investing advice) and “moon” (overly optimistic future returns).

Blockchain pros speak in plain language, making blockchain accessible to as many people as possible, building trust in this new asset class.

Crypto bros are man-children who sport oversized sunglasses and wear too much cologne.

Blockchain pros are the grownups in the room.

If you suspect that you (or someone you love) may be a crypto bro, here’s a quick quiz.

- Am I a bro?

- Do I use the word “crypto”?

- Do I promote icos?

- Is my wardrobe overblown?

- Do I wear too much cologne?

- Do my outflows exceed my inflows?

- To “invest” in crypto, do I borrow?

- When lambo?

If you answered “yes” to three or more of these questions, there is help. You can become a real blockchain investor by using the tools and information at bitcoin market journal. Get our weekly investor briefing delivered for free.

Crypto-bros beware: these artists aren’t buying your version of utopia

Last february, the new york times reported a cadre of crypto high rollers had left the continental united states for puerto rico to start a crypto-utopia—that is, a settlement where their money, air- and yacht-ports all run on the blockchain. The founder, brock pierce, saw an opportunity in the unincorporated organized territory, whose physical infrastructure was destroyed during hurricane maria, and proposed that they could use blockchain technology to repair the damage.

More importantly, U.S. Citizens who move to puerto rico don’t have to pay federal taxes on income sourced there, and they pay zero in capital gains. Pierce, a former child star who made a fortune off bitcoin, wanted to name his utopia “puertopia.” when informed that this translates to “eternal boy playground” in latin, he changed the name to “sol.” and so, impervious to logistics and planning, these men have descended upon the hotels and children’s museum of old san juan to "rebuild" a region still reeling from environmental and economic distress.

It’s hard to get excited about a nascent technology whose strongest proponents seem completely divorced from reality. At san francisco’s telematic gallery, the exhibition eternal boy playground, created by the artist collective anxious to make (liat berdugo and emily martinez), captures the maddening frustration among those of us who haven’t bought into crypto-mania.

The exhibit opens with the video, the insufferable whiteness of being, on the tensions between bitcoin true believers and those who argue that the utopia project is nothing more than disaster capitalism. Text culled from youtube videos and twitter conversations either with or about brock pierce display against backdrops that include paintings of spanish colonizers, the interior of a mansion in puerto rico and storm-demolished roads.

From the pile-up of dialogue, desperation emerges on both sides. Arguments fail for lack of knowledge, or because of the emotional exhaustion that accompanies fighting in online comment sections. Consider this bot-like exchange: “A billionaire is someone who has positively impacted a billion lives.” “A billionaire is someone who has stolen from billions of people.”

What I find troubling about these ardent crypto fans is their insistence that everyone outside of it can’t possibly know what they’re talking about. Their paranoia toward the institutions that enabled their financial gain in the first place routinely show through: “cash and the US dollar is a tool of fascism. If you had a clue about the future of money, you’d understand.”

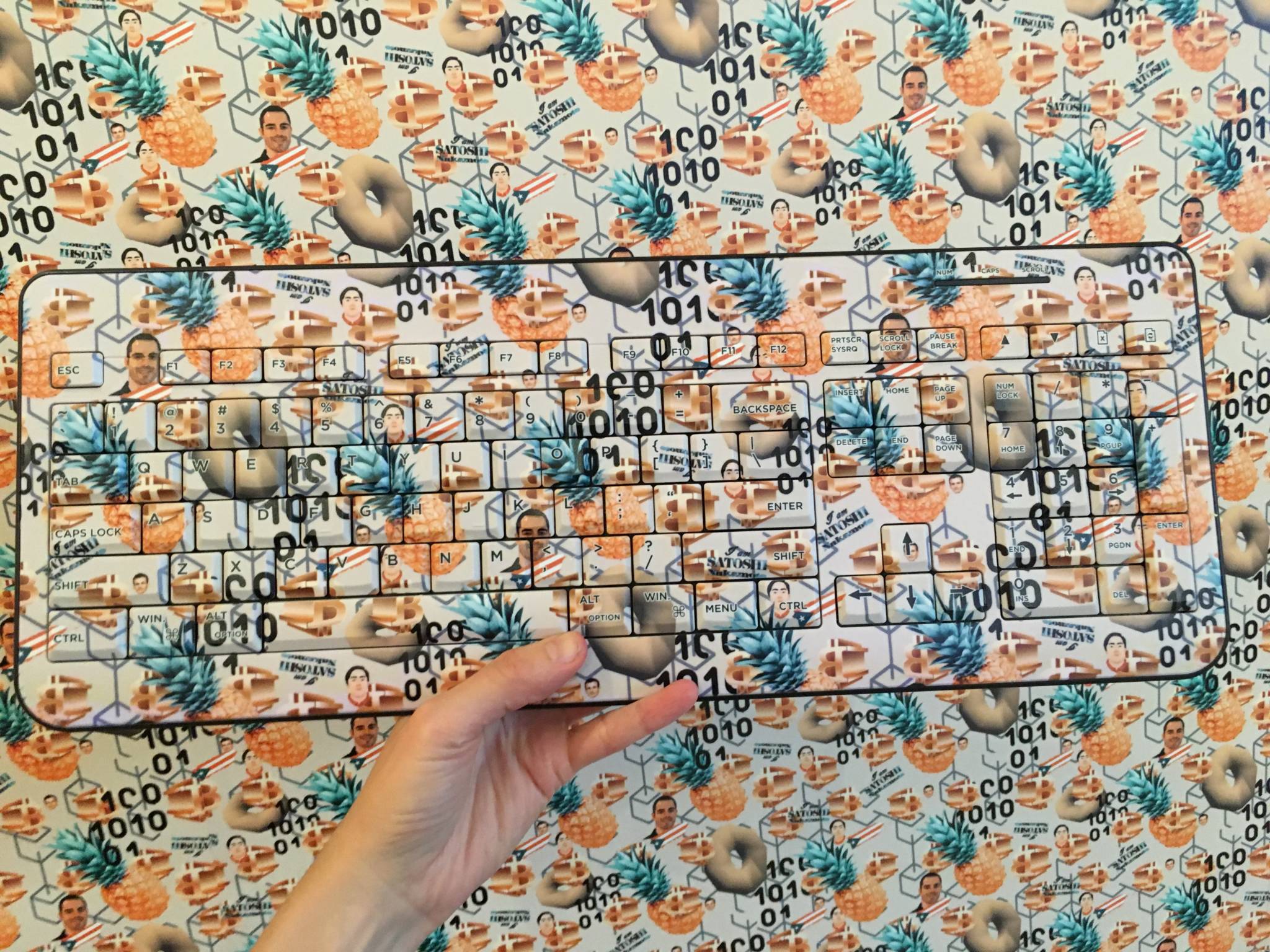

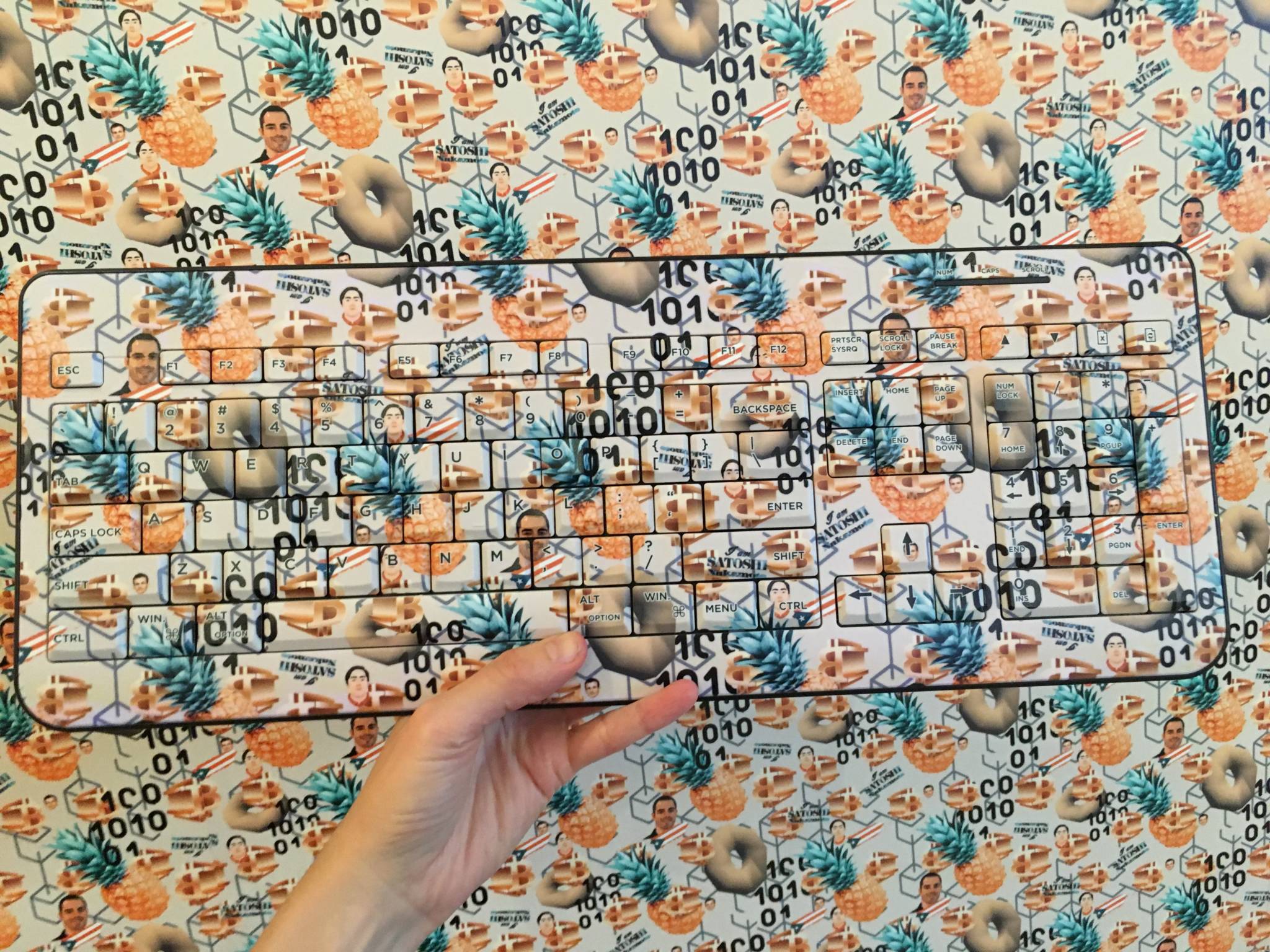

Across from the video projection, a towel drapes across a beach chair bearing a screen-printed still from the insufferable whiteness of being. “yeah, they colonizers,” it reads. The chair sits in front of a wall decked out in what the artists call a “crypto-tropical” or “crypto-camouflage” pattern.

The design is an assortment of crypto-references: a where’s waldo-like who’s-who of mega-investors and crypto-billionaires, pineapples, 1s and 0s, the puerto rican flag, low-res clipart images of the bitcoin logo, and the name “satoshi” (a nod to satoshi nakamoto, the elusive, unknown founder of bitcoin). The scene gets at the crypto bros’ bubble, but anxious to make’s work really shines, and is funnier, when they’re more substantively critical.

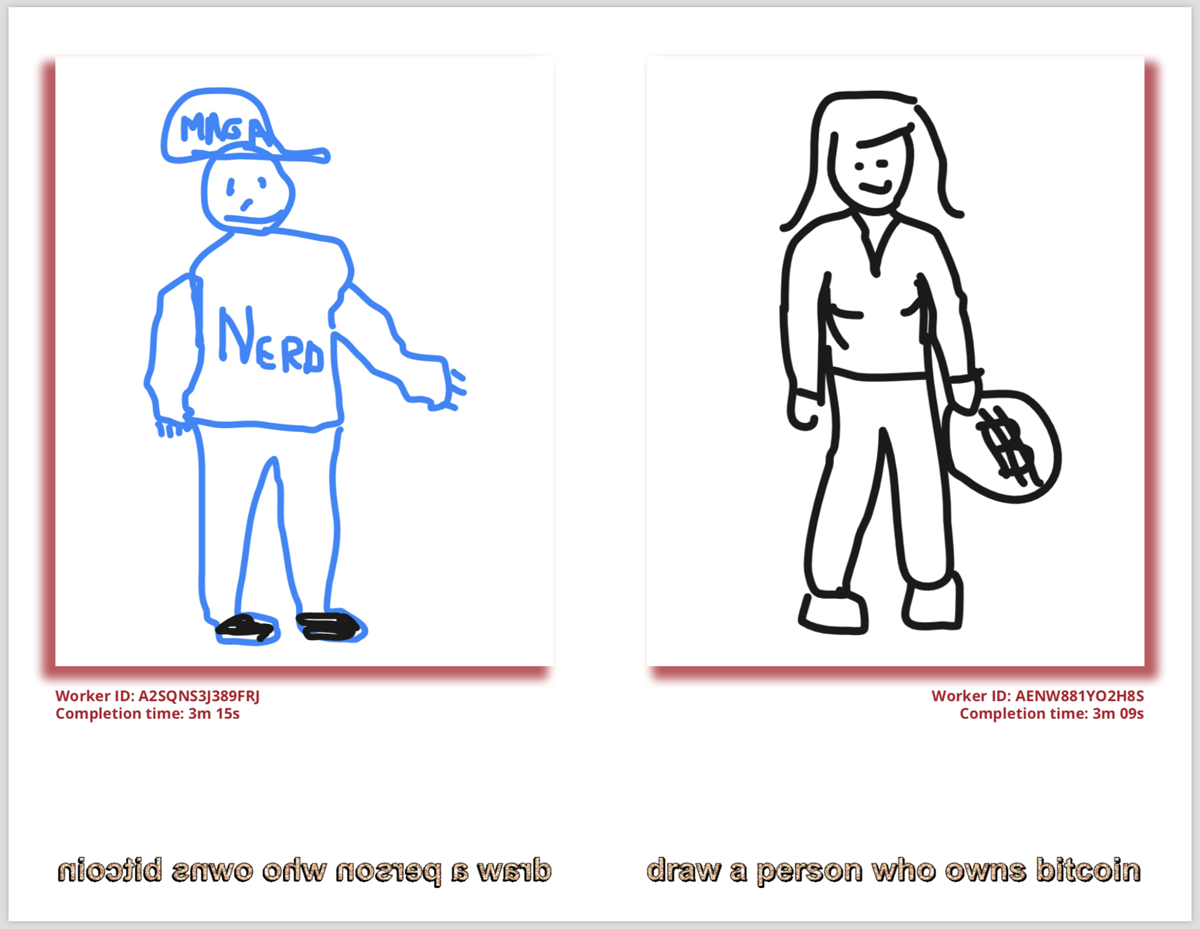

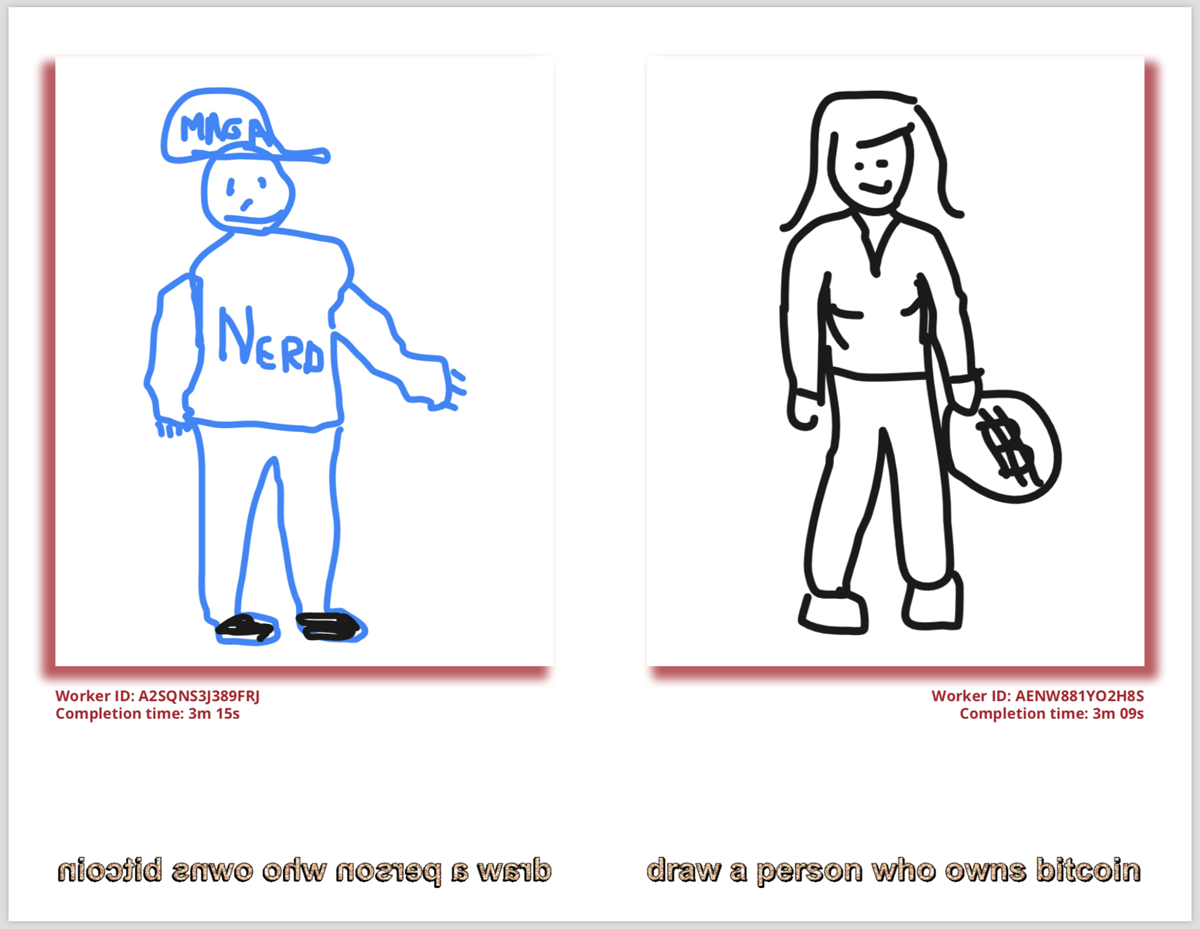

In seeing blocks and crypto bros, anxious to make sources drawings from mechanical turk (mturk), amazon’s crowdsourcing marketplace, to convey a layperson’s understanding of cryptocurrency. The workers were paid in U.S. Dollars, and gallery proceeds from the books' sale support mturk worker-run forums.

The artists gave mturk participants prompts of “draw how crypto works,” “draw the blockchain,” and “draw a person who owns bitcoin.” beneath each drawing is the worker’s ID number and the amount of time it took them to complete the drawing. While I often find mturk-based art to be one-note or exploitive—“look at what the robot people did!”—this is a thoughtful application of the technology.

The drawings are fascinating in their varying levels of detail, sloppiness, humor and confusion: many conflate bitcoin (the currency) with blockchain (the technology that underlies it).

In the corner of the gallery, artificial turf leads to a replica bitcoin ATM flanked by gold spray-painted sandbags, playing on the “speculative” aspect of the speculative currency. But instead of accepting bank cards and dispensing bitcoin, this ATM accepts your fiat currency and prints out cryptocurrecy-related prophecies. These include “the man stuck in the past, back when a pizza cost 10,000 bitcoins, has the most to lose” and “A friend asks only for your time, not your cryptocurrency.”

Art can’t deflect the hubris and idiocy of the present moment, but it can offer perspective. Anxious to make have carved out a modest critique of an island-sized tax shelter in a room-sized gallery space. Instead of directly confronting men (as many have pointed out, they’re almost all men) in futile comment sections, they mine language and image-making to critique the devotional crypto-set.

These are still the early days of blockchain, a technology which has the potential to be a force for good. But in the impulsive puertopians’ hands, altruistic use seems unlikely. We've seen so many complex, too-big-to-fail systems crash spectacularly. In these volatile times, the 99 percent of us who aren’t gazillionaires will need to invest more in our own humility and suspicion, and not in far-fetched schemes.

'eternal boy playground' is on view at telematic gallery (323 10th street, san francisco) through feb. 2, 2019. Details here.

One for the crypto bros

While I remain more bullish on gold, silver, and the precious miners, not to mention non-precious base miners and now deep value oil stocks over the long run if we are indeed headed into a new inflationary regime, it is hard not to notice bitcoin's and the several crypto-related stocks moving sharply higher today.

I would be remiss not to mention the grayscale bitcoin trust (GBTC) as a rough proxy for bitcoin, seen below on its monthly timeframe. Note how significant a move above $15 would be for the long run. You can see the coiling pattern the last few quarters, with plenty of shaking out to frustrate both sides an, in effect, set the stage for an eventual big move one way or other other. In fact, I suspect a fair amount of once-dedicated "crypto bros" migrated over to equities and options since the march lows to splash around in the likes of DKNG NKLA TSLA WKHS, etc..

Thus, crypto has cleared cooled off from its initial mania a few years back, both in terms of sentiment and price action. But it was far from a widespread mania and it may very well have more lives to live. And given the news today of square (SQ) buying $50 million in bitcoin, one can only imagine if the cryptos become more mainstream in the coming years.

Some stock ideas related to crypto: DPW MARA RIOT.

MARKET CHESS SUBSCRIPTION SERVICES

Full-length video recaps & strategy sessions

Winklevoss twins ride bitcoin surge to become billionaires again

Cameron and tyler winklevoss

Photographer: david paul morris/bloomberg

LISTEN TO ARTICLE

SHARE THIS ARTICLE

Cameron and tyler winklevoss

Photographer: david paul morris/bloomberg

Photographer: david paul morris/bloomberg

Tyler and cameron winklevoss, whose fortunes have been on a roller coaster since they jostled with fellow student mark zuckerberg at harvard university more than a decade ago, are once again billionaires thanks to a surge in the price of bitcoin.

The twins bought $11 million worth of bitcoins in 2013, according to the new york times, and soon became evangelists, creating crypto exchange gemini trust co. The 39-year-old brothers, who gained widespread fame following the release of the 2010 movie “the social network,” briefly became billionaires in 2017 when bitcoin soared to a record before the volatile currency plummeted.

Bitcoin has more than doubled this year to $15,433, partly driven by fears that massive central bank easing and fiscal stimulus will debase currencies. Each of the twins is worth about $1 billion, according to the bloomberg billionaires index. They also own other cryptocurrencies including ether.

The winklevoss brothers declined to comment on their wealth through a spokeswoman.

Niche, volatile

Cryptocurrencies have increasingly gained the backing of established firms. Square inc. Last month said it invested about $50 million in bitcoin, while microstrategy inc.’s michael saylor cited the federal reserve’s recent actions as helping convince him to put the lion’s share of the software firm’s cash into the cryptocurrency. Fidelity investments in august disclosed it was starting a passively managed fund for wealthy investors, and hedge fund manager paul tudor jones has said it’s useful as an inflationary hedge.

“the price of bitcoin is being driven by all of the money printing and uncertainty in the world right now,” tyler winklevoss, who is gemini’s chief executive officer, said in a statement.

Still, cryptocurrencies remain niche, risky and highly volatile. Warren buffett famously referred to bitcoin as “rat poison squared” several years ago, and hasn’t changed that view, arguing that cryptocurrencies have no value. Their ownership tends to be highly concentrated, and so-called whales have sway over prices.

“I’m not a huge fan of cryptocurrencies,” ken griffin said during an event last month for the robin hood foundation. The citadel founder expressed concern about some of its “nefarious uses,” the lack of demand for such currencies from sovereigns, and the importance of the U.S. Dollar and its simplicity.

‘overtaking gold’

The winklevoss brothers continue to deepen their involvement in crypto. The U.K.’s financial conduct authority recently approved their application for an electronic-money license, paving the way for the expansion of gemini into the U.K. Market.

In an august essay, the twins said they expect bitcoin’s price to reach $500,000.

“inflation is coming,” they wrote. “money stored in a bank will get run over. Money invested in assets like real estate or the stock market will keep pace. Money stored in gold or bitcoin will outrun the scourge. And money stored in bitcoin will run the fastest, overtaking gold.”

Crypto-bros beware: these artists aren’t buying your version of utopia

Last february, the new york times reported a cadre of crypto high rollers had left the continental united states for puerto rico to start a crypto-utopia—that is, a settlement where their money, air- and yacht-ports all run on the blockchain. The founder, brock pierce, saw an opportunity in the unincorporated organized territory, whose physical infrastructure was destroyed during hurricane maria, and proposed that they could use blockchain technology to repair the damage.

More importantly, U.S. Citizens who move to puerto rico don’t have to pay federal taxes on income sourced there, and they pay zero in capital gains. Pierce, a former child star who made a fortune off bitcoin, wanted to name his utopia “puertopia.” when informed that this translates to “eternal boy playground” in latin, he changed the name to “sol.” and so, impervious to logistics and planning, these men have descended upon the hotels and children’s museum of old san juan to "rebuild" a region still reeling from environmental and economic distress.

It’s hard to get excited about a nascent technology whose strongest proponents seem completely divorced from reality. At san francisco’s telematic gallery, the exhibition eternal boy playground, created by the artist collective anxious to make (liat berdugo and emily martinez), captures the maddening frustration among those of us who haven’t bought into crypto-mania.

The exhibit opens with the video, the insufferable whiteness of being, on the tensions between bitcoin true believers and those who argue that the utopia project is nothing more than disaster capitalism. Text culled from youtube videos and twitter conversations either with or about brock pierce display against backdrops that include paintings of spanish colonizers, the interior of a mansion in puerto rico and storm-demolished roads.

From the pile-up of dialogue, desperation emerges on both sides. Arguments fail for lack of knowledge, or because of the emotional exhaustion that accompanies fighting in online comment sections. Consider this bot-like exchange: “A billionaire is someone who has positively impacted a billion lives.” “A billionaire is someone who has stolen from billions of people.”

What I find troubling about these ardent crypto fans is their insistence that everyone outside of it can’t possibly know what they’re talking about. Their paranoia toward the institutions that enabled their financial gain in the first place routinely show through: “cash and the US dollar is a tool of fascism. If you had a clue about the future of money, you’d understand.”

Across from the video projection, a towel drapes across a beach chair bearing a screen-printed still from the insufferable whiteness of being. “yeah, they colonizers,” it reads. The chair sits in front of a wall decked out in what the artists call a “crypto-tropical” or “crypto-camouflage” pattern.

The design is an assortment of crypto-references: a where’s waldo-like who’s-who of mega-investors and crypto-billionaires, pineapples, 1s and 0s, the puerto rican flag, low-res clipart images of the bitcoin logo, and the name “satoshi” (a nod to satoshi nakamoto, the elusive, unknown founder of bitcoin). The scene gets at the crypto bros’ bubble, but anxious to make’s work really shines, and is funnier, when they’re more substantively critical.

In seeing blocks and crypto bros, anxious to make sources drawings from mechanical turk (mturk), amazon’s crowdsourcing marketplace, to convey a layperson’s understanding of cryptocurrency. The workers were paid in U.S. Dollars, and gallery proceeds from the books' sale support mturk worker-run forums.

The artists gave mturk participants prompts of “draw how crypto works,” “draw the blockchain,” and “draw a person who owns bitcoin.” beneath each drawing is the worker’s ID number and the amount of time it took them to complete the drawing. While I often find mturk-based art to be one-note or exploitive—“look at what the robot people did!”—this is a thoughtful application of the technology.

The drawings are fascinating in their varying levels of detail, sloppiness, humor and confusion: many conflate bitcoin (the currency) with blockchain (the technology that underlies it).

In the corner of the gallery, artificial turf leads to a replica bitcoin ATM flanked by gold spray-painted sandbags, playing on the “speculative” aspect of the speculative currency. But instead of accepting bank cards and dispensing bitcoin, this ATM accepts your fiat currency and prints out cryptocurrecy-related prophecies. These include “the man stuck in the past, back when a pizza cost 10,000 bitcoins, has the most to lose” and “A friend asks only for your time, not your cryptocurrency.”

Art can’t deflect the hubris and idiocy of the present moment, but it can offer perspective. Anxious to make have carved out a modest critique of an island-sized tax shelter in a room-sized gallery space. Instead of directly confronting men (as many have pointed out, they’re almost all men) in futile comment sections, they mine language and image-making to critique the devotional crypto-set.

These are still the early days of blockchain, a technology which has the potential to be a force for good. But in the impulsive puertopians’ hands, altruistic use seems unlikely. We've seen so many complex, too-big-to-fail systems crash spectacularly. In these volatile times, the 99 percent of us who aren’t gazillionaires will need to invest more in our own humility and suspicion, and not in far-fetched schemes.

'eternal boy playground' is on view at telematic gallery (323 10th street, san francisco) through feb. 2, 2019. Details here.

Crypto bros

Looking for a webhost that lets you pay with crypto?

You found it!

Our features

Look below to see what we can do for you.

If there's anything missing contact us and we'll be happy to help!

We make your life easy

Everything you need to make your website a success is here.

Domains web building cpanel access mysql databases big packages with large bandwidth web security

Best hosting service for you

Tired of those others that don't provide?

We are here to make your stay with us a success.

Hosting

State of the art webhosting servers.

Special hosting

Backed up by failover servers to ensure 99% uptime

Web builder

You need a website. We deliver outstanding templates for you to get started.

Cpanel access

Cpanel access to setup your emails and domains and databases.

Linux

We run on open source linux to make sure you have the latest software to keep your site up and running.

Mysql

Mysql databases for all your needs in databases.

About us

It can be hard to find a hoster that accepts payments in cryptocurrencies.

We are here for you and we are staying.

Our company

With experience as dev of various cryptocoins you can be assured we know what we are doing.

We aim to help ensure that these decentralized coins/currencies do have a future and a use by putting our money where our mouth is.

Use your BTC to start your websites and we will do everything we can to make things easy for you.

Servers

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Praesent eget risus vitae massa

semper aliquam quis mattis quam.

Crypto miner bros

Crypto miner bros headquartered in hong kong is one of the largest miner distributors into offline sales. We are a team of professionals with an experience into blockchain management, offline sales, E-commerce and cryptocurrency mining.

Seeing the current scenario and based on the past.

Show more. Crypto miner bros headquartered in hong kong is one of the largest miner distributors into offline sales. We are a team of professionals with an experience into blockchain management, offline sales, E-commerce and cryptocurrency mining.

Seeing the current scenario and based on the past experience it is very difficult for the international buyer to get the product hassle free. It is very hard to find authentic hardware in the mining industry. We deal into brands like bitmain, innosilicon, baikal, ibelink and whatsminer.

We looking into our customers comfort by providing them proper information on products current rates and availability in this fluctuating market. We are partnered with various suppliers in china and hong kong. Our ultimate goal to give the best service and authentic mining products at reasonable prices with superfast delivery.

Cryptocurrency is the future. Bitcoin and crypto-currencies as a logical “next step” money and are close to becoming a mainstream form of payment in the future as per the market study by researchers from imperial college london and the trading platform etoro assessed the roles of traditional currency and measured how close cryptocurrency had come to fulfilling these.

Now cryptocurrencies like bitcoin are in 'panic mode', we might finally see the end of the bullish crypto bro

‘as you get older your brain loses its plasticity at some point and you get wedded to the frameworks that you have,’ said tyler winklevoss. Notably, he also accused crypto critics of being part of a ‘privileged minority’. Pot, kettle, meet winklevoss

Article bookmarked

Find your bookmarks in your independent premium section, under my profile

Article bookmarked

Find your bookmarks in your independent premium section, under my profile

Towards the end of last year, when bitcoin was surging close to $20,000 (£16,000), the buzz around the cryptocurrency became deafening.

Crypto bros were trumpeting their good fortune all over the internet, to the point that the term “crypto bros” was coined. The hype was ramped up even further by tales of bitcoin millionaires, propelled to a life of luxury with a few well-timed trades, and reached fever pitch when the winklevoss twins , of facebook fallout fame, became the world’s first bitcoin billionaires in december 2017.

A few months later, the twins blasted older finance bosses for “failure of the imagination” when it came to cryptocurrencies. These literal crypto bros took aim at ceos such as warren buffett, one of the world’s most successful investors, who warned that bitcoin “definitely will come to a bad ending”.

“as you get older your brain loses its plasticity at some point and you get wedded to the frameworks that you have,” said tyler winklevoss. Notably, he also accused crypto critics of being part of a “privileged minority”. Pot, kettle, meet winklevoss.

Experts are warning that cryptocurrencies have entered “panic mode”, which seems fitting given what’s been going on in the world’s major markets in recent days.

A crisis in the turkish economy has sent a number of emerging market currencies spiralling downwards; the lira itself plummeted against the dollar, the indian rupee plunged to a record low against the greenback.

Meanwhile, bitcoin dropped close to 2018 lows earlier this week , while ethereum fell by almost 20 per cent on tuesday. No wonder the phrase “panic mode” is being bandied about.

Watch more

This isn’t linked to the turkish crisis that’s rocked global markets, although the assets have shown similar, mainly negative, volatility recently. Cryptocurrencies have declined mainly because investors are liquidating crypto holdings gained through initial coin offerings, a popular but controversial form of fundraising.

But the timing of both “panics” serves to highlight the different experiences investors will have in either market.

Central banks can step in to deal with domestic currency moves. For cryptocurrencies, largely unregulated, there is no similar option.

The lack of regulation has allowed crypto scams to proliferate – it’s not unusual to hear about investors losing millions to fraudsters .

But after all the hyping of bitcoin, ethereum and the rest, there are now a lot of investors left in a very different position to the likes of the winklevoss twins, who can afford to take the hit and get out of the crypto game at a loss.

That’s why chatting up of cryptos at the top of the market by people who could afford to withstand huge losses was completely irresponsible.

I know two people who dove into the market when it was more buoyant, confident that they would see their investment go up. These are not people who had previous experience of investing in equities, funds or other, more traditional assets, and they can’t afford to lose a lot.

Watch more

People must take responsibility for their own decisions, of course. Was it stupid to put their money into something they didn’t really understand, without making sure to cover their backs? Yes. It really was.

But the people who shouted about cryptos as a moneymaking asset that the man just didn’t understand also need to take responsibility. They played a part in bringing lots of small fish into the crypto pond, and now they’ve jumped out as the funds are being drained.

The tide has turned in the online forums where cryptocurrencies are discussed 24/7. Where once investors were bullish, in more than one sense of the word, and scathing of any detractors, now there is a lot more tempering of strident, pro-crypto chatter.

When bitcoin was booming, so were the crypto bros. Now it’s not going so well, they’ve gone quiet. More regulation might encourage a bit of restraint next time the market picks up – if it does. If cryptocurrency really is going to be the way of the future, it can’t be a market that only the privileged few can survive.

1 /1 the era of the crypto bro is almost over – and I for one can't wait

The era of the crypto bro is almost over – and I for one can't wait

Comments

Share your thoughts and debate the big issues

About the independent commenting

Independent premium comments can be posted by members of our membership scheme, independent premium. It allows our most engaged readers to debate the big issues, share their own experiences, discuss real-world solutions, and more. Our journalists will try to respond by joining the threads when they can to create a true meeting of independent premium. The most insightful comments on all subjects will be published daily in dedicated articles. You can also choose to be emailed when someone replies to your comment.

The existing open comments threads will continue to exist for those who do not subscribe to independent premium. Due to the sheer scale of this comment community, we are not able to give each post the same level of attention, but we have preserved this area in the interests of open debate. Please continue to respect all commenters and create constructive debates.

Delete comment

Report comment

Please be respectful when making a comment and adhere to our community guidelines.

- You may not agree with our views, or other users’, but please respond to them respectfully

- Swearing, personal abuse, racism, sexism, homophobia and other discriminatory or inciteful language is not acceptable

- Do not impersonate other users or reveal private information about third parties

- We reserve the right to delete inappropriate posts and ban offending users without notification

You can find our community guidelines in full here.

So, let's see, what we have: winklevoss brothers become crypto billionaires cryptocurrency at crypto bros

Contents

- Top forex bonus list

- Winklevoss brothers become crypto billionaires

- Bitcoin suffers worst drop since march 2020

- Crypto bros vs. Blockchain pros

- Crypto-bros beware: these artists aren’t buying your version of utopia

- One for the crypto bros

- Winklevoss twins ride bitcoin surge to become billionaires again

- LISTEN TO ARTICLE

- SHARE THIS ARTICLE

- Crypto-bros beware: these artists aren’t buying your version of utopia

- Crypto bros

- Our features

- We make your life easy

- Best hosting service for you

- About us

- Servers

- Crypto miner bros

- Now cryptocurrencies like bitcoin are in 'panic mode', we might finally see the end of the bullish...

- Article bookmarked

- Article bookmarked

- Watch more

- Watch more

- 1 /1 the era of the crypto bro is almost over – and I for one can't wait

- The era of the crypto bro is almost over – and I for one can't wait

- Comments

- Share your thoughts and debate the big issues

- About the independent commenting

Comments

Post a Comment