Best Cryptocurrency Brokers for 2021, crypto broker.

Crypto broker

But once it was shut down, every broker that depended squarely upon BTC-e was left with no hedging options or market data to put a price on its crypto cfds.

Top forex bonus list

Are short sales available? For many traders, shorting is a crucial strategy option, the lack of which can be a deal breaker with a potential broker. Many brokers tend to offer ‘long’ only since there are only a few hedging solutions when opening short trades.

Best cryptocurrency brokers for 2021

Daniel ‘harris’ major

I have tested 40+ crypto brokers. You can find the best cryptocurrency brokers below. This is by far the easiest way to get started with cryptocurrencies.

Cryptocurrency trading has become really popular in the past years. It’s growing more ever year.

Many big trading brokers have already added some of these cryptocurrencies. Everybody can sign up and start trading bitcoin or other crypto coins. This is the easiest and probably the simplest way to invest in cryptocurrency.

After trying out most brokers, here are the best cryptocurrency brokers:

Best cryptocurrency brokers (non-US traders only)

Plus500 – top rated trading platform

Plus500 is a big name in the trading industry. They have a really low minimum deposit requirement and a great trading site.

Buy/sell cfds on bitcoin in addition to buying stocks, commodities, forex etc (traded only through cfds). Plus500 is the most complete trading platform.

- Trade cfds on bitcoin & many other cryptos

- Minimum deposit is only $100

- Regulated and trusted platform

- Very fast signup process

- Live chat

- Many payment methods (even paypal)

- You cannot withdraw any cryptocurrency

- You have to complete a questionnaire, upon sign up

Plus500 disclaimer: 76.4% of retail CFD accounts lose money.

IQ option – lowest minimum deposit ($10)

If you don’t want to make a huge initial investment, then IQ option is the best broker for you. The minimum deposit requirement is only $10. This is by far the lowest in the industry.

- You can trade many cryptocurrencies

- Minimum deposit is only $10

- Best trading platform

- Multiple account currencies

- Free demo account

- Regulated by CYSEC (#247/14)

Etoro – top crypto broker

Etoro is a really popular trading site. They have been around since 2006. Etoro is regulated by CYSEC, FCA and ASIC.

Buy/sell bitcoin on etoro in addition to buying stocks, commodities, forex etc. Etoro is the most complete trading platform.

- Trade bitcoin & many other cryptos

- Minimum deposit is $200

- Regulated and trusted platform

- Australian traders are also accepted

- Great support team

- Many payment methods (even paypal)

- You cannot withdraw any cryptocurrency

- You have to complete a questionnaire, upon sign up

Etoro disclaimer: 71% of retail CFD accounts lose money.

Highlow – best all-round crypto broker

Due to regulation highlow stopped accepting traders from the EU and UK.

Highlow is an australian trading broker (AFSL no.364264). What I like most about this broker is the intuitive platform. It is so easy to use. Especially new traders will like the clean layout.

I’ve been using highlow for a few years now and I never had a problem. Highlow publishes their number of trades on the homepage. There are millions of trades on this broker each month.

I use the main platform which is web based. This means, that you don’t have to download any software. This platform is stable and safe (they use SSL).

I have also tried the ios app and the android app. They are great, but I just don’t like trading on smartphones in general.

The payouts on highlow are amazing (up to 200%, which is more than on other brokers).

Highlow is a great broker for cryptocurrencies (but only if you are not from EU,UK, US). They have a good reputation, great support team and awesome promotions for new traders.

- Trade bitcoin & other cryptos

- Minimum deposit is only $50

- Regulated and trusted platform

- Fastest signup process (no questionnaires)

- Multiple account currencies

- Free demo account (no registration needed)

Nadex – US traders welcome

Nadex is a CFTC regulated broker. In fact, this is probably the only US broker that has this regulation.

Only US traders are allowed on nadex. Non-US traders check out the next broker.

Update OCTOBER 2019: looks like nadex removed crypto trading. After contacting them I found out that they will add it back soon. Register on nadex now and get updated when they add it.

Recently, nadex started offering bitcoin trading.

- Trade bitcoin, forex or binary options

- Minimum deposit is $250

- CFTC regulated broker

- Great support team

- Many payment methods (even paypal)

Crypto brokers with most cryptocurrencies

Here are the most popular cryptocurrencies offered by cryptocurrency brokers:

- Etoro – bitcoin, ethereum, litecoin, dash, ethereum classic, NEO and ripple.

- Plus500 – bitcoin, ethereum, litecoin, bitcoin cash, ripple, IOTA.

- Avatrade – bitcoin, ethereum, ethereum classic, ripple, dash, bitcoin cash litecoin, monero and NEO.

Lowest minimum deposit brokers

These are the best brokers with low minimum deposit requirements:

- Etoro – $200

- Plus500 – $100

- Avatrade – $100

This is really important because the crypto market itself is unregulated. Depositing on a regulated broker means that your money is safe.

We’ve also looked at the support team and the payment methods. You can deposit easily using multiple payment methods on the brokers below.

Top rated brokers that have cryptocurrencies

While we are all familiar with the broad definition of a broker, is there something more to it when it comes to cryptocurrencies?

Simply put, a cryptocurrency broker refers to a website that traders will visit to trade cryptocurrencies at a set price. In many ways, they are similar to forex brokers whose services are a lot more familiar to the general public.

Etoro disclaimer: 71% of retail CFD accounts lose money.

You still can’t decide which broker is best for you?

How to choose your cryptocurrency broker

Is leverage really necessary? Cryptocurrency markets are volatile in nature with prices fluctuating immensely thereby generating high profits even in the absence of leverage. But for some traders, the desire for more earnings justifies the use of leverage.

Before choosing your broker, settle yourself on whether the already immense profits that come from a cryptocurrency market are enough for you or you would like to use leverage to enhance them even further, bearing in mind, of course, that will also significantly increase the risk factor to your funds.

Negative balance protection: it is always advisable to trade with a broker that affords the negative balance protection facility. That way, you will never be at risk of losing more than what you invested in case you sustain very heavy losses.

How suitable is the required capital for you? This is another subjective part to your decision. Do you prefer trading with a small capital or bigger one to help you zero in on bigger returns? Find out what size trades your broker is offering before you open an account.

Narrow spreads for the win: let us be honest, it is only fair that your broker gets a cut from the money you generated having provided you with the essential facilities for it and all. But let us be honest, you definitely want every last dime for yourself.

A spread refers to the difference between the buying price and selling price of a trade and it varies with each broker. The spread is what counts as fees for your broker so the smaller it is, the lower the cost will be on your part.

Lets go into what aspects you as a trader must consider when choosing a broker to trade cryptocurrencies.

Which cryptocurrencies are you interested in trading?

Make sure you have decided on which cryptocurrencies you want to trade in before signing up with your broker.

If your choice is a prominent cryptocurrency like bitcoin (official site), litecoin (official site), or ethereum(official site), there will be a relatively broad availability of brokers that have trading options for those. However, less prevalent examples like monero, IOTA, or zcash may be a little harder to come by.

So study the cryptocurrencies being offered by a broker before you sign up for an account.

Pros and cons of cryptocurrency brokers

Here are some features that these broker have or don’t:

pros

- Signup up with a crypto broker is probably the fastest way to get started with cryptocurrency trading

- If you are less tech-savvy then a broker is safer for you

- You can start buying cryptocurrency while traditional exchanges don’t always accept this payment method

- Most of the time you can’t withdraw cryptocurrencies from a broker. You have to exchange it back to fiat money (USD/EUR etc.)

Cryptocurrency brokers – what to look for

Here are some of the more understated details about your cryptocurrency broker that could make your trading experiences so much more efficient and successful.

1. What are the weekend hours like?

This is a key detail that distinguishes cryptocurrencies from other prominent trading markets like forex, futures, and equity. Cryptocurrency brokers operate during the weekends as well.

There is virtually no difference in purchasing bitcoin at the end of the week as opposed to the middle of the week during peak hours.

But there is a catch. While digital currency exchanges are available during the weekend, your broker may not (why is the stock market closed on the weekend?). So in effect, if there is considerable movement within your relevant cryptocurrency market during a weekend when your broker is not operating, you may not have the ability to respond in any way.

2. How is it hedging?

Your broker is probably not keen on revealing if it is hedging cryptocurrency traders but it is important information for you to know.

Why is it so important for you to know?

Because, as a trader, you want to be absolutely in the clear regarding the policies for risk management being followed by your broker. Let us not forget that cryptocurrency markets are extremely volatile and an unhedged broker is more easily prone to major losses incurred by its clients. Naturally, those costs will warrant compensation via fatter spreads and additional costs for traders. It will be best to sign up with a broker that will not withhold the relevant information from you.

More great features you could be interested in

Commissions and trading on margin – an important thing to note while trading cryptocurrencies is that their prices tend to be more similar to equities than they are to real currencies. So your broker could be charging you commissions in addition to a wide spread on each trade. That, of course, raises the cost probably a bit much for your liking.

Another similarity with equities is that the margin conditions with cryptocurrencies are significantly more than they are with forex or cfds. Consequently, leverage is usually up to 10x. How considerable the margin rate will be for traders is down to what trading strategies and risk management they subscribe to.

Authenticity of market data – aside from merely evaluating how it influences spreads, market data for cryptocurrency CFD prices can be a good indicator of how the quality of the product will be in the future.

One of the more recent examples of this is BTC-e which was an immensely popular platform for trading bitcoin before it was shut down by feds. BTC-e was the first bitcoin exchange to incorporate forex trades and so made their exchange accessible via MT4 and supplied cryptocurrency liquidity for brokers.

But once it was shut down, every broker that depended squarely upon BTC-e was left with no hedging options or market data to put a price on its crypto cfds.

Are short sales available? For many traders, shorting is a crucial strategy option, the lack of which can be a deal breaker with a potential broker. Many brokers tend to offer ‘long’ only since there are only a few hedging solutions when opening short trades.

As you see, investing in cryptocurrencies can be a truly lucrative venture for you but only if you get it right.

And a lot of that is down to which broker you decide to trade with.

Ready to start trading?

Trade with the cryptocurrency brokers listed above to make sure that your money is safe, you pick a broker with a stellar reputation and you keep the fees low. Excel at trading bitcoin by creating your own trading strategy.

These cryptocurrency brokers make it really easy to trade bitcoin and other coins. You don’t have to be a trading expert. It helps if you know what a blockchain is or how the ledger and transactions work, but this is all optional.

Sign up now and see for yourself how easy it is to get started.

Brokerage 24/7 crypto trading

Our brokerage provides liquidity for banks and

financial service providers.

Disclaimer

Crypto broker AG –

terms & conditions of use of online onboarding application interface

General disclosure

please read the following terms and conditions of use of this online onboarding application interface of crypto broker AG (“online onboarding application interface terms and conditions”) carefully before proceeding further.

Crypto broker AG (“CBAG”) is a subsidiary of crypto finance AG (“cfinag”) and incorporated as a swiss stock corporation with its registered office in zurich, switzerland. As a financial intermediary, CBAG is subject to the swiss anti-money laundering legislation, and, as such, a member of the financial services standards association (VQF) (“VQF”). The VQF acts as a self-regulatory organisation officially recognised by the swiss federal market supervisory authority (FINMA) (“FINMA”), and is obligated to supervise its members with regard to the combatting of money laundering and the prevention of the financing of terrorism. CBAG is not subject to prudential supervision by FINMA, and clients of CBAG do not benefit from any protection under a deposit insurance scheme.

Please note that this online onboarding application interface (“interface”) only allows you to apply online to CBAG to be considered as a prospect and potential future client of CBAG. Please further note that CBAG cannot accept retail clients. Your application and your potential acceptance as a future client of CBAG is subject to the external onboarding requirements under the relevant regulations and laws as well as CBAG’s internal requirements and policies, as applicable at any time. Your application and your use of this interface is subject to this online onboarding application interface terms and conditions.

No offer and no unsolicited applications

this interface does not constitute an offer, or promise to accept you as a client of CBAG. It remains at CBAG’s sole discretion whether and how to proceed with your application to be considered as a potential future client of CBAG. This interface is not intended and shall not be construed in any way as any form of promotion, recommendation, inducement, offer, or solicitation to (i) become a client of CBAG, (ii) purchase, sell or invest in any way in any cryptocurrencies or crypto assets, (iii) transact any other business, or (iv) enter into any other legal transaction, or client or other relationship.

By accessing and using this interface you confirm that you are applying to CBAG on your own behalf, for yourself, and based on your own initiative without having been solicited in any way by CBAG or any of its employees or affiliates.

Consent

by accessing this interface of CBAG within the website of cfinag, you confirm that you have read and understood this online onboarding application interface terms and conditions of CBAG and the terms and conditions of use of cfinag’s website together with its privacy policy and cookie policy as published and amended from time to time, and that you agree to all of the terms and conditions set out herein. If you do not understand, or do not agree to any of the terms and conditions contained in any of the foregoing, please exit this interface of CBAG and the website of cfinag.

Restricted access

this interface of CBAG and the website of cfinag must not be accessed by any person subject to a jurisdiction (e.G. Due to that person’s nationality and/or place of residence and/or tax domicile and/or place of business and/or restrictions in or prohibitions of trading and investing in cryptocurrencies or assets) in which this interface and the access to or use of it is prohibited for any reason. Persons to whom these restrictions apply are prohibited from accessing and using this interface.

Collection of personal and other information

this interface collects the personal and other information you provide in the input fields. This information is stored and processed by CBAG and its affiliates for the sole purpose of assessing your application. You can retrieve and amend the information you have provided by following the provided link. Please see the respective online instructions. Changes are possible until you have marked the information you have provided as final. Please note that the link you receive allows access to your information. You should, therefore, not share it, and keep it strictly confidential.

CBAG will protect the integrity and safety of the information you have provided via this interface to CBAG by adequate measures. You should, however, be aware that the integrity and safety of your information on your side and within your infrastructure when providing, accessing, or amending it is beyond CBAG’s control and under your sole responsibility.

Privacy policy and cookie policy

as this interface of CBAG is hosted on cfinag’s website, cfinag’s privacy policy and cookie policy apply to this interface analogously. For further details, please consult these privacy and cookie policies.

No warranty and no liability

no warranty is given that this interface will operate error free or without interruption, that any faults will be corrected, or that this interface and the related infrastructure and servers will be free of harmful components and programmes. CBAG accepts no liability in respect thereof. CBAG shall not be liable for any direct or indirect loss or damage, including but not limited to, loss of profit that you may incur as a result of accessing and using this interface.

Risk disclosure

investing in cryptocurrencies and crypto assets entails risks. If you are not familiar with the risks, please exit this interface and the website. If you understand the risks involved in trading and investing in cryptocurrencies and crypto assets, you confirm that you are able to take these risks. Trading and investing in cryptocurrencies and crypto assets bears the risk of a total loss of the amount or value traded or invested. Cryptocurrencies and crypto assets are very volatile and their value may fluctuate extremely in a short period of time.

Intellectual property, copyright, and trademark rights

all components of this interface are protected by intellectual property laws and are the property of CBAG and its affiliates or third parties. Components of this interface may not be reproduced in whole or in part in any manner or form. Users are not permitted to create hyperlinks or inline links from other websites to this interface without the prior written consent of CBAG.

Changes to the online onboarding application interface terms and conditions

CBAG reserves the right to change these online onboarding application interface terms and conditions at any time. Please read these online onboarding application interface terms and conditions whenever you access the interface to ensure that you agree to the terms and conditions of any amended version. If you do not understand, or do not agree with any of the terms and conditions contained in the online onboarding application interface terms and conditions currently in effect, please exit this interface and the website.

Applicable law and place of jurisdiction

access to and use of this interface as well as the online onboarding application interface terms and conditions shall be governed by swiss law without giving effect to its conflict of law principles.

Any dispute arising out of or in connection with this interface and the online onboarding application interface terms and conditions shall be submitted to the exclusive jurisdiction of the courts of zurich, switzerland.

Best crypto trading forex brokers for 2021

Below you will find a list of forex brokers that offer cryptocurrency trading instruments (e.G. BTCUSD, ETHUSD, LTCUSD) and allow account funding with major crypto coins. In most cases, these are bitcoin, etherium and litecoin, although certain companies provide more options. Blockchain technologies made crypto transactions very simple and highly anonymous. Hence, some forex brokers don’t even require to undergo an account verification process before you can deposit or withdraw some funds in the form of cryptocurrency.

Who are crypto forex brokers? These are forex brokers that also list cryptocurrency assets on their platforms, usually in combination with fiat currencies to form a crypto-fiat pairing. Examples of crypto-fiat pairs include BTCUSD, DASHUSD, ETHUSD and LTCUSD. These cryptocurrency assets are CFD instruments and do not warrant owning the actual cryptocurrencies in itself.

What crypto assets are offered by crypto forex brokers?

Assets that are offered by crypto forex brokers include various pairings between cryptocurrencies and fiat currencies. Popular cryptos used in these pairings are bitcoin (BTC), ethereum (ETH) and litecoin (LTC). However, other cryptos such as DASH, ripple, NEO and stellar lumens have emerged as crypto assets that are making their way onto platforms featured by crypto forex brokers. Fiat currencies which are used as the counter asset in these pairings are US dollar (most popular), euro and british pound. So you get to find pairings such as BTC/USD, ETH/USD, LTC/USD, DASH/USD, BTC/EUR, etc. The exact combinations will differ from broker to broker. These crypto assets are usually listed on popular platforms such as the MT4, where they can be traded just like any other currency pair of CFD asset. You can use market or pending orders to setup trades, or trade with the regular lot sizes featured on the platforms to setup your trades.

Account opening with crypto forex brokers

Opening an account with a crypto forex broker is quite simple, and follows the regular process of account opening, which involves filling an online form. Account verification is also easier, especially if you are going to use a crypto-only account, or if you will use cryptos for deposits and withdrawals. This is because cryptocurrency transactions are basically anonymous and do not require verification of the identities of the individuals involved in the transaction. So if you opt for a crypto transaction method for deposits and withdrawals, your account will most likely be opened for trading without verification.

Depositing/withdrawing funds on crypto forex broker platforms

Some crypto forex brokers require that you open a dedicated account that can be used to trade cryptocurrency assets, while others allow you to use the same regular trading accounts used to forex and cfds. In the last few years, some crypto forex brokers have opened up new payment channels that allow their clients to deposit and withdraw their holdings in cryptocurrencies. Bitcoin and ethereum are the popular cryptocurrencies used for such deposits and withdrawals. To be able to use these cryptos for deposit and withdrawal transactions, there is a need to get a wallet to be able to hold your assets. These wallets are usually provided by the crypto forex broker. Making a deposit in cryptocurrencies will require you to obtain BTC or ETH from a third party source exchange, store this in an external wallet, and transfer what you want to trade with to your wallet on the crypto forex broker platform. Withdrawals will also follow the same route. The advantage here is that the cryptos used in conducting your deposit transactions are held in a cold wallet and are not accessible to hackers, unlike the ones held in exchanges which are hot wallets and are vulnerable to theft by hackers. Brokers like simplefx typify an emerging trend where crypto forex brokers are increasingly dispensing with fiat deposit methods and replacing these with more crypto-based methods. Presently, simplefx allows users to deposit and withdraw funds in cryptos such as bitcoin, bitcoin cash, ethereum, dash and litecoin. It also offers e-wallets such as fasapay, skrill and neteller. You really would not even find the bank wire or card options here.

For other brokers, you will also be able to use conventional means of payment to transact on your account. This includes the use of bank wires, credit/debit cards and e-wallets such as skrill, neteller and webmoney.

More consistently, you will find that some of the crypto forex brokers in our list offer both fiat and cryptocurrency deposit and withdrawal methods. Thinkmarkets is an example of this hybrid transaction model, as it offers the fiat methods just mentioned as well as the bitcoin method using the bitpay wallet.

How were crypto forex brokers on this list selected?

Certain factors were considered in compiling the list of the best crypto forex brokers you can use today. These factors include leverage/margin requirements, security of transactions and spreads.

Leverage/margin requirements

Trading cryptocurrencies on forex broker platforms in europe and the UK has become very expensive, no thanks to the 1:2 leverage cap imposed by the european securities and markets authority (ESMA). Ordinarily, spreads on some cryptocurrency assets such as BTC/USD are quite high, and margin requirements as well as the inherent volatility of some of these assets may overwhelm most traders’ financial capacity. In compiling our list of the best crypto forex brokers, one of the criteria used for selection was to seek for platforms that had friendlier leverage provisions. The leverage provided by many of the brokers on our list for trading cryptocurrency assets ranges from 1:2 to 1:100. In terms of cost implications to the trader, what does this mean?

Trading LTC/USD with a leverage of 1:2 means that setting up a $100,000 position on this asset will require a margin of $50,000. But on a crypto forex broker platform like that of primexbt (one of the brokers found on our list), the leverage provided for trading this asset is 1:100. This means that you can trade a standard lot with a margin of $1000. Look at the difference in the two positions: $50,000 margin (UK/EU broker) as opposed to $1,000 margin (our broker). It goes without saying that this represents significant cost savings and using our brokers will make crypto trading on a forex platform cheaper.

Security of transactions

For those who opt to use the crypto-based funding and withdrawal methods, a key advantage of using crypto forex brokers is the safety of transactions. Rather than expose your crypto holdings in exchange-based hot wallets, you can use the same holdings in secure cold wallets to fund your account and trade the same assets as cfds. This represents a far more secure way to trade and enables the trader to have immense peace of mind. It should also be mentioned that most crypto forex brokers mentioned here are regulated, and so there is accountability in how business is conducted on those platforms. Using exchanges which are unregulated always carries risks, as users of cryptopia and quadrigacx have found out the very hard way.

Spreads

Cryptos tend to have higher spreads than any other assets on these crypto forex platforms. For instance, the spread on LTC/USD on simplefx is 14,800 points, or $148 for a standard lot position. But comparatively speaking, the spreads on crypto assets with our crypto forex brokers are lower than what you will get on other platforms. Spreads are the trader’s cost, and for assets that carry wider spreads, this cost simply needs to be kept as low as possible. By offering traders lower spreads, the savings that will be realized over time will prove beneficial for the trader.

Best crypto trading forex brokers for 2021

Below you will find a list of forex brokers that offer cryptocurrency trading instruments (e.G. BTCUSD, ETHUSD, LTCUSD) and allow account funding with major crypto coins. In most cases, these are bitcoin, etherium and litecoin, although certain companies provide more options. Blockchain technologies made crypto transactions very simple and highly anonymous. Hence, some forex brokers don’t even require to undergo an account verification process before you can deposit or withdraw some funds in the form of cryptocurrency.

Who are crypto forex brokers? These are forex brokers that also list cryptocurrency assets on their platforms, usually in combination with fiat currencies to form a crypto-fiat pairing. Examples of crypto-fiat pairs include BTCUSD, DASHUSD, ETHUSD and LTCUSD. These cryptocurrency assets are CFD instruments and do not warrant owning the actual cryptocurrencies in itself.

What crypto assets are offered by crypto forex brokers?

Assets that are offered by crypto forex brokers include various pairings between cryptocurrencies and fiat currencies. Popular cryptos used in these pairings are bitcoin (BTC), ethereum (ETH) and litecoin (LTC). However, other cryptos such as DASH, ripple, NEO and stellar lumens have emerged as crypto assets that are making their way onto platforms featured by crypto forex brokers. Fiat currencies which are used as the counter asset in these pairings are US dollar (most popular), euro and british pound. So you get to find pairings such as BTC/USD, ETH/USD, LTC/USD, DASH/USD, BTC/EUR, etc. The exact combinations will differ from broker to broker. These crypto assets are usually listed on popular platforms such as the MT4, where they can be traded just like any other currency pair of CFD asset. You can use market or pending orders to setup trades, or trade with the regular lot sizes featured on the platforms to setup your trades.

Account opening with crypto forex brokers

Opening an account with a crypto forex broker is quite simple, and follows the regular process of account opening, which involves filling an online form. Account verification is also easier, especially if you are going to use a crypto-only account, or if you will use cryptos for deposits and withdrawals. This is because cryptocurrency transactions are basically anonymous and do not require verification of the identities of the individuals involved in the transaction. So if you opt for a crypto transaction method for deposits and withdrawals, your account will most likely be opened for trading without verification.

Depositing/withdrawing funds on crypto forex broker platforms

Some crypto forex brokers require that you open a dedicated account that can be used to trade cryptocurrency assets, while others allow you to use the same regular trading accounts used to forex and cfds. In the last few years, some crypto forex brokers have opened up new payment channels that allow their clients to deposit and withdraw their holdings in cryptocurrencies. Bitcoin and ethereum are the popular cryptocurrencies used for such deposits and withdrawals. To be able to use these cryptos for deposit and withdrawal transactions, there is a need to get a wallet to be able to hold your assets. These wallets are usually provided by the crypto forex broker. Making a deposit in cryptocurrencies will require you to obtain BTC or ETH from a third party source exchange, store this in an external wallet, and transfer what you want to trade with to your wallet on the crypto forex broker platform. Withdrawals will also follow the same route. The advantage here is that the cryptos used in conducting your deposit transactions are held in a cold wallet and are not accessible to hackers, unlike the ones held in exchanges which are hot wallets and are vulnerable to theft by hackers. Brokers like simplefx typify an emerging trend where crypto forex brokers are increasingly dispensing with fiat deposit methods and replacing these with more crypto-based methods. Presently, simplefx allows users to deposit and withdraw funds in cryptos such as bitcoin, bitcoin cash, ethereum, dash and litecoin. It also offers e-wallets such as fasapay, skrill and neteller. You really would not even find the bank wire or card options here.

For other brokers, you will also be able to use conventional means of payment to transact on your account. This includes the use of bank wires, credit/debit cards and e-wallets such as skrill, neteller and webmoney.

More consistently, you will find that some of the crypto forex brokers in our list offer both fiat and cryptocurrency deposit and withdrawal methods. Thinkmarkets is an example of this hybrid transaction model, as it offers the fiat methods just mentioned as well as the bitcoin method using the bitpay wallet.

How were crypto forex brokers on this list selected?

Certain factors were considered in compiling the list of the best crypto forex brokers you can use today. These factors include leverage/margin requirements, security of transactions and spreads.

Leverage/margin requirements

Trading cryptocurrencies on forex broker platforms in europe and the UK has become very expensive, no thanks to the 1:2 leverage cap imposed by the european securities and markets authority (ESMA). Ordinarily, spreads on some cryptocurrency assets such as BTC/USD are quite high, and margin requirements as well as the inherent volatility of some of these assets may overwhelm most traders’ financial capacity. In compiling our list of the best crypto forex brokers, one of the criteria used for selection was to seek for platforms that had friendlier leverage provisions. The leverage provided by many of the brokers on our list for trading cryptocurrency assets ranges from 1:2 to 1:100. In terms of cost implications to the trader, what does this mean?

Trading LTC/USD with a leverage of 1:2 means that setting up a $100,000 position on this asset will require a margin of $50,000. But on a crypto forex broker platform like that of primexbt (one of the brokers found on our list), the leverage provided for trading this asset is 1:100. This means that you can trade a standard lot with a margin of $1000. Look at the difference in the two positions: $50,000 margin (UK/EU broker) as opposed to $1,000 margin (our broker). It goes without saying that this represents significant cost savings and using our brokers will make crypto trading on a forex platform cheaper.

Security of transactions

For those who opt to use the crypto-based funding and withdrawal methods, a key advantage of using crypto forex brokers is the safety of transactions. Rather than expose your crypto holdings in exchange-based hot wallets, you can use the same holdings in secure cold wallets to fund your account and trade the same assets as cfds. This represents a far more secure way to trade and enables the trader to have immense peace of mind. It should also be mentioned that most crypto forex brokers mentioned here are regulated, and so there is accountability in how business is conducted on those platforms. Using exchanges which are unregulated always carries risks, as users of cryptopia and quadrigacx have found out the very hard way.

Spreads

Cryptos tend to have higher spreads than any other assets on these crypto forex platforms. For instance, the spread on LTC/USD on simplefx is 14,800 points, or $148 for a standard lot position. But comparatively speaking, the spreads on crypto assets with our crypto forex brokers are lower than what you will get on other platforms. Spreads are the trader’s cost, and for assets that carry wider spreads, this cost simply needs to be kept as low as possible. By offering traders lower spreads, the savings that will be realized over time will prove beneficial for the trader.

Crypto broker anycoin direct ready for international growth

One of the biggest and most trusted crypto brokers in europe has been getting a lot of attention lately because of their registration at the dutch central bank. This might sound boring, but it actually is a big step forward for the company. The registration means that anycoin direct will be able to offer customers a safe and regulated platform, financial and crypto-related crime prevention. With the registration, anycoin direct became one of the first cryptocurrency services that work within the global regulatory frameworks. In this short article, we will tell you why anycoin direct will keep growing in 2021.

What is anycoin direct?

First, let’s explain what anycoin direct is all about. Anycoin direct is a european cryptocurrency broker that has been active on the market since 2013. Anycoin direct is a revolutionary crypto broker that helps new and experienced traders buy their crypto from a safe platform.

The platform allows users to trade crypto-to-crypto without the need for an exchange. Customers can buy, sell, and secure all of the most popular cryptocurrencies that are currently available. Anycoin direct offers a number of functionalities that we sometimes miss with other brokers.

Payment options

Whether you live in belgium, the netherlands, or anywhere else in europe, the most and frequently used payment methods have been added to make sure customers can buy cryptocurrency from wherever they are.

Anycoin direct currently supports the following payment methods: credit card, SEPA, sofort, ideal, giropay, EPS, mybank, and, bancontact.

Extra content

Since the current crypto market is exploding and is attracting many new customers to the market, anycoin direct has decided to add new content pages to their website aimed at crypto fanatics. The company currently offers extensive guides about buying, selling cryptocurrency, what wallets to use, and even help you with finding the best block explorers. However, the company has announced that even more fresh content is on the way!

Reviews

Anycoin direct is one of the most trusted wallet providers in europe, with currently over 12.000+ positive reviews. Anycoin direct has built a solid and trustworthy platform in the past few years, and with that, they distinguish themselves from other crypto brokers.

Need some help?

Want to know more about an interesting coin? Anycoin direct offers a dedicated page for every coin you can sell or buy. Another thing we’d like to add is that anycoin direct focuses on offering great support to their customers. Their support team is active 7 days a week and has a solid knowledge of cryptocurrency-related topics.

Wrapping it up

If you are looking for a solid and secure crypto broker within europe, anycoin direct is a valid option. The registration at the dutch central bank certainly gives the company a big push when it comes to their trustworthiness.

Get daily crypto news on facebook | twitter | telegram | instagram

DISCLAIMER read more

The views expressed in the article are wholly those of the author and do not represent those of, nor should they be attributed to, zycrypto. This article is not meant to give financial advice. Please carry out your own research before investing in any of the various cryptocurrencies available.

Crypto broker anycoin direct ready for international growth

One of the biggest and most trusted crypto brokers in europe has been getting a lot of attention lately because of their registration at the dutch central bank. This might sound boring, but it actually is a big step forward for the company. The registration means that anycoin direct will be able to offer customers a safe and regulated platform, financial and crypto-related crime prevention. With the registration, anycoin direct became one of the first cryptocurrency services that work within the global regulatory frameworks. In this short article, we will tell you why anycoin direct will keep growing in 2021.

What is anycoin direct?

First, let’s explain what anycoin direct is all about. Anycoin direct is a european cryptocurrency broker that has been active on the market since 2013. Anycoin direct is a revolutionary crypto broker that helps new and experienced traders buy their crypto from a safe platform.

The platform allows users to trade crypto-to-crypto without the need for an exchange. Customers can buy, sell, and secure all of the most popular cryptocurrencies that are currently available. Anycoin direct offers a number of functionalities that we sometimes miss with other brokers.

Payment options

Whether you live in belgium, the netherlands, or anywhere else in europe, the most and frequently used payment methods have been added to make sure customers can buy cryptocurrency from wherever they are.

Anycoin direct currently supports the following payment methods: credit card, SEPA, sofort, ideal, giropay, EPS, mybank, and, bancontact.

Extra content

Since the current crypto market is exploding and is attracting many new customers to the market, anycoin direct has decided to add new content pages to their website aimed at crypto fanatics. The company currently offers extensive guides about buying, selling cryptocurrency, what wallets to use, and even help you with finding the best block explorers. However, the company has announced that even more fresh content is on the way!

Reviews

Anycoin direct is one of the most trusted wallet providers in europe, with currently over 12.000+ positive reviews. Anycoin direct has built a solid and trustworthy platform in the past few years, and with that, they distinguish themselves from other crypto brokers.

Need some help?

Want to know more about an interesting coin? Anycoin direct offers a dedicated page for every coin you can sell or buy. Another thing we’d like to add is that anycoin direct focuses on offering great support to their customers. Their support team is active 7 days a week and has a solid knowledge of cryptocurrency-related topics.

Wrapping it up

If you are looking for a solid and secure crypto broker within europe, anycoin direct is a valid option. The registration at the dutch central bank certainly gives the company a big push when it comes to their trustworthiness.

GO365.Io crypto broker broker review

Reviewer : justin freeman

Published: 12th august, 2020.

Broker information

Platform info

Broker services

Featured forex broker

Avatrade was established in 2006 and is located in dublin, ireland. Offering trading services in over 150 countries with offices located worldwide. Avatrade is a forex broker that is committed to providing a safe trading environment and is fully regulated and licensed in the EU and BVI, with additional regulation in australia, south africa and japan.

Company overview

GO365.Io is an online trading brand that wants to solve the issue of accessing the cryptocurrency market in the safest and the most transparent way possible. The website specializes in providing access to cryptocurrency-related cfds. Clients choosing to open an account will get access to tens of different contracts denominated in USDT, BTC, and ETH, with the main advantage being that all the hurdles encountered with a traditional cryptocurrency exchange platform are avoided and quick trading access is ensured. Trading with leverage (which is both a positive and negative feature) is also possible and will be discussed later in our GO365.Io review.

Main features

- Friendly user experience – GO365.Io has designed a proprietary platform, available via browser and for android devices, that’s very easy to use and any trader, no matter his/her experience, can trade easily.

- Margin trading – at the time of writing, clients can trade with a maximum leverage of 1:20. That enables traders to place big market orders but at the same time makes them vulnerable to countertrend market moves. Using leverage responsibly, though, will ensure that there will be enough available margin at any point, no matter how the market performs, reducing the chances to get a margin call.

- Fiat and crypto deposits – at io clients can deposit fiat funds using a credit/debit card or a wire transfer. The minimum deposit required is $200. At the same time, the broker accepts deposits in BTC. Clients must be aware that blockchain fees might apply, depending on the BTC wallet used.

- Tens of contracts available – traders can trade popular cryptocurrencies like BTC, ETH, LTC, EOS, XRP, and many others via the GO365.Io platform. At present, contracts are denominated in USDT, BTC, and ETH. There are no fiat-to-crypto pairs available.

- Fast customer support service – the live chat feature is one of the most important to mention. There is always a representative available during business days. Also, email and phone customer support has been ensured.

- Standard account type – all GO365.Io clients get access to a standard trading account. They don’t have to make bigger deposits for improved trading features. The minimum deposit, though, is $200.

- Convenient mobile app – monitoring positions at any time are possible thanks to the mobile app designed for android devices. There is no app for ios users at present.

Top 5 brokers

- FXTM

- Cedarfx

- Tickmill - best trading conditions

- Avatrade - BEST CUSTOMER SUPPORT

- Blackbull markets - BEST SPREADS

Trading platform

To provide a customized trading experience, GO365.Io developed a proprietary trading platform that’s available via any modern browser. Traders will find all the common trading features built in. The most important to mention is the integration of tradingview charts, which provides access to a wide range of technical analysis tools. Drawing tools, common and customized price indicators, multiple charts/time frames, and many other functionalities are possible because of that.

The platform is not only a gateway to the market but at the same time has access to all account functionalities. Traders can see their account summary, make deposits, and view the banking history. Its main advantage has to do with the easy-to-use interface that helps beginners place trades easily without any prior experience. The account manager is also available to assist all clients needing help.

To further enhance the offer, the company has designed an android mobile platform allowing on-the-go trading at any time. Using it, traders can trade anytime and anywhere, staying constantly in touch with the latest developments of the cryptocurrency market.

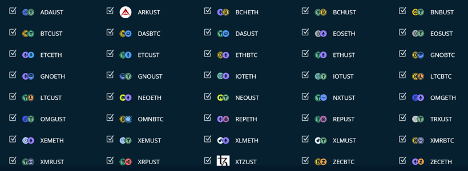

Instruments

At the time of writing, there are tens of different cryptocurrency contracts available on GO365.Io. From BTC, ETH, LTC, and XRP, to XEM, XTZ, ZEC, and OMG, clients will get to trade a wide range of products. Although there are no fiat-to-crypto pairs, all cryptocurrencies can be traded against tether, the most popular stablecoin. Also, pairs denominated in BTC and ETH are available, allowing clients to trade weak cryptocurrencies against strong ones, and vice versa.

What’s different at GO365.Io is that traders don’t buy the underlying instruments, but cfds that track the exact price of cryptocurrencies. They can go short or long, having the ability to profit from both rising and falling markets. Another advantage of trading cfds has to do with leverage, which is set at 1:20 maximum. Also, we must mention the main trading costs are the regular spreads (the difference between the bid and ask price) and overnight swaps (charged at the end of each business day and charged for three days on friday).

Pros and cons

- Easy-to-use web-based trading platform and mobile app.

- BTC, ETH, and USDT cryptocurrency pairs available for trading.

- Standard account with the same trading features for all clients.

- High leverage trading can result in high losses if not treated with caution.

- A $200 inactivity fee applicable for traders who do not open any trade for 60 days.

- Limited access to educational material for beginners who need to learn how to trade.

Top 5 brokers

- FXTM

- Cedarfx

- Tickmill - best trading conditions

- Avatrade - BEST CUSTOMER SUPPORT

- Blackbull markets - BEST SPREADS

Customer service

Clients who have inquiries can use the live chat feature available on go365.Io and a representative will answer their questions very fast. In addition to that, they can ask for help at [email protected] at any time. The company has two phone contact numbers +442033186458 and +442033186477. Bear in mind that the business hours are from monday to thursday between 07:00-18:00 UK time and friday 07:00 – 17:00 UK time.

Go365.Io summary

Although this is a relatively-new crypto trading brand, go365.Io has the advantage of providing access to a lot of interesting trading features. Tens of different crypto cfds, a well-designed trading platform and mobile app, and good customer service are just a few of the advantages. Based on the information available on its website, the company complies with all the regulations set up by the european union, including the latest GDPR, related to data privacy and security. For more information about their services, please visit the website.

Please be advised that certain products and/or multiplier levels may not be available for traders from EEA countries due to legal restrictions.

About the author : justin freeman

Justin has twenty-two years' of experience working in the financial markets with brokers. He's held trading and risk management positions at boutique asset managers and large investment banks. Justin helps people understand their trading options in a clear, jargon-free manner.

Crypto engine review

Crypto engine is a fake crypto trading signals system, that is causing naïve investors to invest with an unregulated or unlicensed broker.

Before you fall victim to the most prevalent crypto trading scam, here are some things you should be aware of with the crypto engine trading software. Read this article & you will understand why this software is a scam!

Crypto engine scam

Do you really think that an anonymous software, with no address or phone number, can turn a $250 deposit at an offshore CFD broker, into a secure $10,000 a month? Sorry, but there is no algorithm trading robot that can make such miracles!

False promises: “secret NEW income opportunity: trade bitcoin and other crypto and earn real profits in 24 hours”

Thousands of people just like you, received an email about crypto engine, but no professional trading actually uses this product. You need to know that there is no software, and the actors you saw, are just a compilation of news videos, with no actual relevance to the company. Once you deposit your money at an offshore broker, you will probably never see it again!

You will lose your money with an offshore broker!

Crypto engine review

The trading signals that crypto engine talks about on their official website: https://thecryptoengine.Net/, do not actually existent. As you can see in the screenshot below, you will need to deposit money at the broker to then get access.

The way this investment scheme works, is by tricking you into signing up with a random offshore broker. The broker then calls you and pitches you to invest with their “experienced money manager”. They will make promises of 25% monthly returns, and try to convince you to deposit $10,000.

These high pressure sales tactics have been used by hundreds of brokers that ran away with peoples money. A professional forex robo-advisor comes with proper risk management controls like; daily max trade limits, stop losses and more controls, see here.

Scam broker warning!

Many people use algorithm trading systems or trading robots for investing. The problem happens when an investor trades with a bad broker. You need to realize that the software is not where your money is, your money is at a “forex broker”.

What crypto engine did, is they make you deposit, before you can see any of the trading signals. That is an outright scam. They can easily take your money and put it with a proven scam broker, or even worse, just keep your money themselves.

Australia warning! “ASIC urges all investors considering trading forex, to check they are dealing with an entity that holds an australian financial services licence.”

Traders who just want to trade crypto / forex without any automated system, should first choose a broker from the best brokers page.

Popular algorithm software

You can see the most popular trading signals and software on the forex trading signals page.

Tell other investors which scam brokers the crypto engine told you to use, in the comment section below.

Top 10 online cryptocurrency trading brokers

The pioneer of social trading is now offering an exclusive opportunity for investors who want exposure to the most popular cryptocurrencies like bitcoin, dash, ethereum and more. Trade crypto 24/7 at etoro with no rollover fees!

- World's leading social trading platform

- Proven track record of security

- Unlimited daily withdrawals

- Min. Deposit of $200 to get started

- Instant trade execution

With over 30 years of trading experience and trades in over 50 countries, city index is a leader in spread betting, CFD and forex trading. Trade in 12,000+ global markets including bitcoin, indices, shares, forex and much more.

- Trade on 12,000+ markets including bitcoin

- Trade anytime, anywhere. Across all devices

- Risk management & transparent pricing

- Fast execution on every trade

Thanks to an excellent reputation, high trading standards, and multilingual customer care, avatrade has become one of the industries leading brokers. Offering highly competitive spreads on a wide variety of trading investments.

- Get up to

14,000 bonus - No commission/no exchange fees

- Trade a wide variety of crypto cfds

With markets.Com get ZERO commission trading on cryptocurrency, forex and commodity cfds with one of the most sophisticated trading platforms in the industry.

- No commission trading

- Use paypal to trade bitcoin futures

- Advanced innovative trading platforms

Easymarkets was formed by bankers and forex experts and has been serving the forex market for 16 years, with transparent pricing, fixed spreads and no commissions on deposits or withdrawals. Now with cryptocurrency cfds!

- Demo account is unlimited

- Trade bitcoin with no slippage - ever!

- No commissions or sneaky fees

T&C's apply to each of the offers above, click "visit site" for more details.

Risk warning: users should be aware that all investment markets carry inherent risks, and past performance does not assure future results. Trading of any kind is a high-risk activity, and you could lose more than you initially deposited. Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 73-89% of retail investor accounts lose money when trading cfds. Please be sure you thoroughly understand the risks involved and do not invest money you cannot afford to lose. Your capital is at risk. Advertiser disclosure: topbrokers.Trade is an independent professional comparison site funded by referral fees. The compensation topbrokers.Trade receives is derived from the companies and advertisements featured on the site. Due to this compensation, we can provide our users with a free comparison tool. Unfortunately we are unable to list every broker or exchange available, however, we do our best to review as many as possible.

The pioneer of social trading is now offering an exclusive opportunity for investors who want exposure to the most popular cryptocurrencies like bitcoin, dash, ethereum and more. Trade crypto 24/7 at etoro with no rollover fees!

With over 30 years of trading experience and trades in over 50 countries, city index is a leader in spread betting, CFD and forex trading. Trade in 12,000+ global markets including bitcoin, indices, shares, forex and much more.

Thanks to an excellent reputation, high trading standards, and multilingual customer care, avatrade has become one of the industries leading brokers. Offering highly competitive spreads on a wide variety of trading investments.

How to get started in cryptocurrency trading

As the trade volumes are reaching billions of dollars a day and the market caps are hitting tens of billions of dollars, it is no wonder that cryptocurrencies fuel the modern day gold rush. Today is an age of digital currencies, with hundreds of cryptocurrencies birthed within the decade. There are already more than a thousand cryptocurrencies in the market, and almost daily a new initial coin offering (ICO) appears.

What is cryptocurrency?

Today, the most famous cryptocurrency is bitcoin. Its inventor attempted to build a “peer-to-peer electronic cash system”. Many have tried this system many times before. However, the main difference between bitcoin and the previous efforts, like digicash, was that it was to be entirely decentralized. Since no overarching entity is controlling the currency, the notion of “trust” would be eliminated from the system.

To combat “double spending”, the major problem in all the digital cash systems at that point, satoshi nakamoto, bitcoin’s inventor, proposed the blockchain technology. The blockchain technology is a revolutionary technology that records all the transactions made with this currency.

For any single balance, transaction, or change to the network to take place, there needs to be a consensus amongst those who validate the network – the miners. Since the invention of bitcoin, many programmers have attempted to use the model and change it to provide what they consider a more functional form of digital cash.

The other kinds of cryptocurrencies include monero, new economy movement, litecoin, and ether. Many of these cryptocurrency efforts tailor their currency for an individual and particular purpose. Some of the most common purposes are speed, privacy, and price.

What are cryptocurrencies used for?

Since cryptocurrency is such a new technology, it may be that people have not used it yet for its eventual use. Still, today people utilize it for many various purposes. These purposes include, but aren’t limited to the following: trading, remittances, payment for goods and services, investment, gambling, private monetary transactions, and as a hedge against national currencies which are suffering from rapid devaluation (greece, venezuela for example).

As the whole cryptocurrency space begins to expand, it’s likely that we will see some additional applications joining the list of purposes for the crypto currency. There are already young services such as steemit, which aims to revolutionize the way people pay for content on social media, in addition to services like musicoin which attempts to find a more equitable way to pay artists without the need for a middleman.

What is the difference between bitcoin and ethereum?

All cryptocurrencies have their own characteristics. However, recently one coin has come to challenge bitcoin more than ever before. Ethereum is the new player on the market. The reasons that it is a challenge to bitcoin are easy to understand.

Ethereum emerged as an effort to try to correct some of the main criticisms made towards bitcoin – especially regarding security.

What ethereum has accomplished to do was to provide transactions that are safer, more flexible contracts that are compatible with any wallet, with short block times for negotiating (where the confirmations are easier). Also, ethereum is available more than bitcoin. Whereas more than two-thirds of bitcoin has already been mined, access to ethereum is still widely available. Another main difference between these two cryptocurrencies is that ethereum allows for different developers to raise funds for their projects. It can, therefore, be in itself a kickstarter for some projects.

One of the main advantages to ethereum is that it’s a more secure, easy to use, flexible, and transact coin. In addition to this advantage, it has brought innovations in terms of entrepreneurship and investment. And this is posing a serious challenge to bitcoin’s market cap.

What is the difference between a cryptocurrency exchange and a cryptocurrency broker?

You can invest in cryptocurrency in two ways. First, cryptocurrency can be bought and sold at a cryptocurrency exchange and stored in a digital wallet. The second method would be to invest in crypto as a CFD with regulated cryptocurrency brokers. With CFD cryptocurrency trading, the digital currency is treated as a speculative investment and traded as a contract for difference (or CFD), through brokers.

Platforms that allow traders to buy and sell cryptocurrencies are cryptocurrency exchanges. Dues to the fact that it is a very recent – and booming – market, the majority of these platforms are relatively new. But, of course, one of the essential questions that people ask is how to know if a particular platform is safe or not.

The only way that you can find out is to check if the exchange provides transparent data of the coins that are in cold storage. What this means is, whether it has the reserves that it requires to provide liquidity to its activities. You can find check this easily by checking whether an exchange is regulated or not.

Trade cryptocurrency online using CFD services

If you are interested in trading because of the opportunity to profit from the incredible volatility of cryptocurrency, your best option is to use an online trading platform that allows CFD services. Currently, there are very few CFD platforms that allow this kind of trade, so to see available options refer to our recommendations above.

CFD brokers are a great option if you want to trade cryptocurrencies with the option to accept multiple forms of payment. If you want to buy cryptocurrency with paypal, you can, and these forums also accept major credit cards and wire transfers as well. Furthermore, if you choose to trade through a forex or CFD platform, you will pay the lowest commissions possible. That is in comparison to other investment alternatives. CFD and forex companies use an exchange rate that is an aggregate of different crypto exchanges.

Trading cryptocurrencies – getting started with cfds (contracts for differences)

Cryptocurrency cfds allow you to trade digital coins without actually owning any. Crypto cfds were generated to give traders exposure to the cryptocurrency market without the need for ownership.

Contracts for differences, also known as “cfds,” represent a contract between trader and exchange. Cfds declare that the difference between the price on entry and the price on exit will be a trader’s profit or loss. Basically, cfds are an agreement held between two parties that simulate an actual asset.

How to make money trading crypto

There are several ways to make money cryptocurrency trading. The most popular is trading bitcoin against the US dollar, known in market terms as the BTC/USD pair. The first method is to find a top cryptocurrency broker and to invest in a digital currency in the same way that you would do with a physical currency – by buying low and selling high. Since cryptocurrency is highly volatile, you should be able to identify the dip with studying and market research.

Read on to learn how to find the best cryptocurrency brokers. Be sure to review the platforms we suggest above, all are fully-registered and come highly recommended. For additional information regarding trading cryptocurrency as a CFD, check out our guide on “the basics of cfds“. It’s important that you remember that leverage works both ways and it will magnify the gains and losses.

How to choose the best cryptocurrency trading broker online

Because there’s so much competition in the market as well as having countless cryptocurrency brokers to choose from, it can be difficult to know which option will be best for you. Here are a few key points we suggest keeping in mind when deciding how to best invest:

Regulation

Each country has its own regulatory body. The regulatory body develops rules, services and programs to protect the integrity of the market. The regulators protect traders, and investors as well as the cryptocurrency brokers themselves. Their main obligation is to help members meet regulatory responsibilities. Due to potential safety concerns regarding deposit, you should exclusively open accounts with regulated firms.

Customer service

Cryptocurrency trading takes place 24 hrs a day, so customer support should be available at all times. Ideally, you will want to speak with a live support person rather than a time-consuming auto-attendant. Give a call to the customer service centre to get an idea of the type of customer service provided. Check on wait times and find out the representative’s ability to answer questions regarding spreads and leverage, trade volume, and company details.

Account types

Your ideal cryptocurrency trading broker should be able to offer either multiple account options or an element of customizability. Look for cryptocurrency brokers that offer competitive spreads and easy deposits/withdrawals.

Currency pairs

Cryptocurrency brokers can provide a selection of cryptocurrency pairs. However, it is most important is that they provide the variety of pairs that interest you. While there are many digital currencies available for trading, there are only a few get the majority of the attention, and as the result, trade with the highest liquidity.

Platform type

The trading platform is the investor’s portal to the markets. With that in mind, look for a platform that’s easy to use, straightforward and offers an advanced collection of analytical and technical and tools. These features will help to enhance your trading experience.

Here at topbrokers.Trade, we take pride in providing the best possible trading brokers comparison, reviews and ratings. These reviews enable you to select the best trading platform for your needs. We don’t just help you to pick a great place to trade, but also do everything that we can, to show you how to get started. For more information on cryptocurrencies, please see our tutorial: the basics of cryptocurrency

The pioneer of social trading is now offering an exclusive opportunity for investors who want exposure to the most popular cryptocurrencies like bitcoin, dash, ethereum and more. Trade crypto 24/7 at etoro with no rollover fees!

So, let's see, what we have: compare the best cryptocurrency brokers. Start trading bitcoin (BTC), bitcoin cash (BCH) ethereum and other coins. Choose safe and legit crypto brokers. At crypto broker

Contents

- Top forex bonus list

- Best cryptocurrency brokers for 2021

- Best cryptocurrency brokers (non-US traders only)

- Plus500 – top rated trading platform

- IQ option – lowest minimum deposit ($10)

- Etoro – top crypto broker

- Highlow – best all-round crypto broker

- Nadex – US traders welcome

- Crypto brokers with most cryptocurrencies

- Lowest minimum deposit brokers

- Top rated brokers that have cryptocurrencies

- How to choose your cryptocurrency broker

- Which cryptocurrencies are you interested in trading?

- Pros and cons of cryptocurrency brokers

- Cryptocurrency brokers – what to look for

- More great features you could be interested in

- Ready to start trading?

- Brokerage 24/7 crypto trading

- Best crypto trading forex brokers for 2021

- What crypto assets are offered by crypto forex brokers?

- Account opening with crypto forex brokers

- Depositing/withdrawing funds on crypto forex broker platforms

- How were crypto forex brokers on this list selected?

- Best crypto trading forex brokers for 2021

- What crypto assets are offered by crypto forex brokers?

- Account opening with crypto forex brokers

- Depositing/withdrawing funds on crypto forex broker platforms

- How were crypto forex brokers on this list selected?

- Crypto broker anycoin direct ready for international growth

- What is anycoin direct?

- Payment options

- Reviews

- Need some help?

- Wrapping it up

- Crypto broker anycoin direct ready for international growth

- What is anycoin direct?

- Payment options

- Reviews

- Need some help?

- Wrapping it up

- GO365.Io crypto broker broker review

- Featured forex broker

- Crypto engine review

- Crypto engine scam

- Crypto engine review

- Scam broker warning!

- Popular algorithm software

- Top 10 online cryptocurrency trading brokers

- How to get started in cryptocurrency trading

- What is cryptocurrency?

- What are cryptocurrencies used for?

- What is the difference between bitcoin and ethereum?

- What is the difference between a cryptocurrency exchange and a cryptocurrency broker?

- Trade cryptocurrency online using CFD services

- Trading cryptocurrencies – getting started with cfds (contracts for differences)

- How to make money trading crypto

- How to choose the best cryptocurrency trading broker online

Comments

Post a Comment