Crypto forthe people /* White Header Styles */, crypto coin trading with paypal.

Crypto coin trading with paypal

1 no transaction fee until 2021. When you buy or sell cryptocurrency, we will disclose an exchange rate and any fees you will be charged for that transaction.

Top forex bonus list

The exchange rate includes a spread that paypal earns on each purchase and sale. For cryptocurrency fees that will apply after december 31, 2020 click here. Buying, selling, and holding cryptocurrencies is not regulated in many states, including the state of california. Paypal, inc. Is licensed to engage in virtual currency business activity by the new york state department of financial services. Buying, selling and holding cryptocurrency with paypal is not available in hawaii and where prohibited by law.

Crypto coin trading with paypal

Now you can discover crypto

in the

paypal app

Start exploring crypto with paypal

34 characters maximum

Screenshots simulated; sequences shortened.

Here’s what you need to know

Start with as little as $1

right in your paypal wallet*

Discover at your own pace and learn about crypto with our articles for beginners.

Buy, hold, and sell crypto

with paypal

You can choose from bitcoin, ethereum, litecoin, and bitcoin cash 1

Discover crypto with

peace of mind

Enjoy the same protections you're used to with paypal. **

Learn more

* paypal cash or cash plus account required. Terms apply.

** keep in mind that we can't protect you from losses as a result of market volatility. Be sure to do your research and buy and sell carefully.

Get started on the paypal app

Select "crypto" from

the dashboard

Click on the buy button and you’ll

be asked to verify your identity

Explore articles about

crypto to learn more

Discover crypto

screenshots simulated, sequences shortened.

Get up to speed on crypto

Crypto is short for cryptocurrency. Many believe that crypto could one day be as commonly used as cash and credit.

The crypto market never sleeps

It’s the only financial market that runs 24/7, 365 days a year. Since all cryptos are global currencies without borders, prices change every minute of every day.

Understanding

volatility and risk

Crypto is considered volatile because of how much and how quickly its value can change. Like all currencies, there's potential for gains and losses.

Ready to get started?

1 no transaction fee until 2021. When you buy or sell cryptocurrency, we will disclose an exchange rate and any fees you will be charged for that transaction. The exchange rate includes a spread that paypal earns on each purchase and sale. For cryptocurrency fees that will apply after december 31, 2020 click here.

Buying and selling cryptocurrency is subject to a number of risks and may result in significant losses. Please see our disclosure here for more details. Paypal does not make any recommendations regarding buying or selling cryptocurrency. Consider seeking advice from your financial and tax advisor. All custody of and trading in cryptocurrency is performed for paypal by its licensed service provider, paxos trust company, LLC.

Buying, selling, and holding cryptocurrencies is not regulated in many states, including the state of california. Paypal, inc. Is licensed to engage in virtual currency business activity by the new york state department of financial services. Buying, selling and holding cryptocurrency with paypal is not available in hawaii and where prohibited by law.

- About

- Newsroom

- Jobs

- Investor relations

- Social innovation

- Public policy

- Sitemap

- Enterprise

- Partners

- © 1999–2021

- Accessibility

- Privacy

- Legal

We’ll use cookies to improve and customize your experience if you continue to browse. Is it OK if we also use cookies to show you personalized ads? Learn more and manage your cookies

The good and the bad about cryptocurrency on paypal

Last updated oct 23, 2020 @ 13:19

Crypto market capitalization surged by $25 billion following the news that paypal would be enabling cryptocurrency payments, but there are a lot of caveats that the average user needs to know about.

Global payments provider paypal has almost 350 million users and 26 million vendors in its network so the introduction of crypto payments has been widely lauded as bullish for the industry.

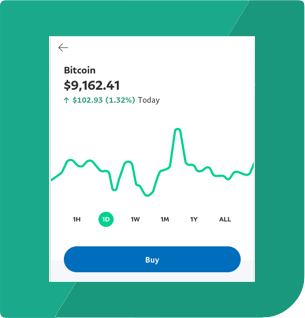

Crypto markets surged and bitcoin cranked to a new 2020 high of $13,200 during the hours after the news broke. Many industry experts have praised the move as a great thing for bitcoin and the entire crypto ecosystem, but all might not be what it seems.

Estimating how many hodlers of BTC from on-chain forensics is from the incredible work of @glassnode. Pic.Twitter.Com/qlokz9wrjz

Enabling decentralized digital assets on a highly centralized platform with astronomical fees may not be the best combination, and here is why.

No crypto withdrawals, big fees

Firstly, paypal will not allow crypto assets to be withdrawn to external wallets, so essentially once they’re on the platform paypal can set whatever price it wants for users needing to convert back to fiat.

If anyone has used paypal to change currencies or send money to an account in another country they’ll be painfully aware of the forex spread which can be as much as 8% depending on the currency being converted. Okcoin COO jason lau pointed out the pain that may be in store regarding the fees.

Paypal’s crypto offering has some caveats:

1) users won’t be able to withdraw.

2) expensive. You have to pay a spread AND fees. Pic.Twitter.Com/zniyb542rb

Additionally, paypal will not allow crypto transfers between different accounts as observed by lawyer jake chervinsky;

This is the highlight of the paypal news for me.

They’re not only preventing withdrawals to self-custody, they won’t even allow transfers between accounts.

I’d be glad to speak with @paypal‘s legal team about why these restrictions aren’t required for regulatory compliance. Pic.Twitter.Com/divuqkckgc

Essentially, paypal has mimicked the purchasing of crypto assets on trading platforms such as robinhood, offering users exposure to the asset but preventing them from owning it independently. Chervinsky added if you can’t make withdrawals to self-custody, and don’t hold your own keys, is it even bitcoin?

The taxman cometh

The whole setup could also open a huge can of worms when it comes to taxes. Paypal is only offering crypto services to U.S. Account holders initially, and america happens to have some of the harshest tax regulations on the planet.

The U.S. Internal revenue service (IRS), classifies crypto assets such as bitcoin as property, not currencies, therefore they are subject to capital gains taxes. The means that paypal users buying, selling, or spending crypto will be generating taxable events that need to be reported.

If a user buys a smartphone using bitcoin, for example, they would need to declare the price they obtained the BTC at, and the price it was when they sold it for the item, paying taxes on any gains it may have made in addition to VAT on any items purchased.

The documentation for reporting is a minefield and paypal has already stated it is down to the individual, not them, to complete tax returns.

“it is your responsibility to determine what taxes, if any, apply to transactions you make using your cryptocurrencies hub.”

The good news is that paypal may introduce the concept of cryptocurrency to millions of new users, but the drawbacks will probably prevent them from using the platform in the long run.

SPECIAL OFFER (sponsored) binance futures 50 USDT FREE voucher: use this link to register & get 10% off fees and 50 USDT when trading 500 USDT (limited offer).

Primexbt special offer: use this link to register & enter CRYPTOPOTATO35 code to get 35% free bonus on any deposit up to 1 BTC.

Paypal reportedly restricted a user’s account for trading cryptocurrency

Last updated nov 25, 2020 @ 21:12

A user complained about paypayl temporarily banning his account after he used it for cryptocurrency daytrading.

Paypal users who use the service for high-frequency crypto trading should be cautious about having their accounts banned. One redditor reportedly learned this lesson recently with the payment giant placing a 180-day hold on his purse that still has about $462.

Apart from the likelihood of users facing account closures for trading crypto on paypal, the situation also brings to light some deficiencies in the company’s customer service, which may present issues for cryptocurrency owners.

Paypal is a crypto purse, not an exchange

In a reddit post on november 25, a user revealed that the global online payments giant paypal permanently blocked his account. The redditor stated that the action was taken after conducting cryptocurrency trading on the platform.

Based on the post, the company’s system marked the account, believing that the user was selling items worth $10,000 in a week. Subsequently, the aggrieved customer had to indicate that the transactions were actually crypto-related.

Following a review of the customer’s activities, paypal decided to permanently bar the account. The paypal customer went on to state that the platform gave no room for appeal nor explanations.

The feedback from the online platform reads:

After a review, we’ve decided to permanently limit your account due to potential risk. You’ll not be able to conduct any further business using paypal.”

In addition, the company as part of its standard protocol, is holding the redditor’s fund for 180 days.

Things to consider

Indeed, while paypal has recently adopted crypto, the purpose of the service veers towards being a funding source for online shopping. Since the company is using a zero-fee model, day trading on its platform could see the payment giant incurring a massive cost burden to cover those transaction costs.

Several respondents on the thread pointed out this same reasoning to the aggrieved redditor. For his part, the user also alluded to the poor customer service as being another issue with paypal’s crypto sojourn.

Paypal made headlines in the crypto sphere back in october 2020. At the time, the company announced that customers would be able to carry out transactions using bitcoin and other cryptocurrencies in late 2020 and in 20201. Since the announcement of its cryptocurrency adoption, the platform has reportedly shown interest in acquiring crypto firms and it is also on a bitcoin buying frenzy.

SPECIAL OFFER (sponsored) binance futures 50 USDT FREE voucher: use this link to register & get 10% off fees and 50 USDT when trading 500 USDT (limited offer).

Primexbt special offer: use this link to register & enter CRYPTOPOTATO35 code to get 35% free bonus on any deposit up to 1 BTC.

Email was send successfully!

Please check your inbox for

our authentication email.

Thank you for registering

to finance magnates.

Please open the email we

sent you and click on the

link to verify your account.

- FM home

- Cryptocurrency

- News

- Paypal, coinbase invest in crypto taxation platform taxbit

Paypal, coinbase invest in crypto taxation platform taxbit

The platform offers automated crypto taxation calculation to partner exchange users.

Paypal has extended its exposure in the cryptocurrency industry with its venture arm’s latest investment into utah-based taxbit, a digital currency tax automation platform.

Announced on thursday, the startup raised an undisclosed sum in its latest funding round from paypal ventures and coinbase ventures. Its existing investor winklevoss capital also participated in the funding round.

Demand for crypto tax calculation tools are rising

The new funding came when the demand for cryptocurrency investments are booming, and the US taxman is focusing more and more to levy taxes on the gains from crypto. The internal revenue services (IRS) is actively sending notices to anyone it suspects of having traded cryptocurrencies and did not reveal the gains in their reporting.

Founded in 2017, taxbit software allows cryptocurrency exchanges to issue tax forms to their users, thus automating the troublesome process of tax calculation.

Though the company did not reveal the sum it raised in the latest high-profile funding round, it already had a chest of $5.8 million from earlier seed rounds, as seen on crunchbase.

Suggested articles

The different types and styles of social trading in forexgo to article >>

Commenting on the funding, taxbit founder and CEO, austin woodward said: “we want to thank our customers, partners, and investors for helping us move the cryptocurrency space forward. This investment will help us achieve our aim of being the most innovative and trustworthy provider of cryptocurrency tax technology.”

Meanwhile, payments giant paypal’s stake in the crypto startup projects its interests in the booming cryptocurrency industry. Earlier, paypal launched crypto buying, selling, and holding services to its users.

Furthermore, the giant will allow users to pay in digital currencies to the merchants on its platform.

Other mainstream payments giants have already shown their interest in cryptocurrencies. American express last month invested in institutional crypto trading platform, falconx.

Bitcoin trading fees on paypal, robinhood, cash app and coinbase: what to know

Brady dale

Bitcoin trading fees on paypal, robinhood, cash app and coinbase: what to know

With bitcoin’s price hitting a new all-time high on monday, retail investors will inevitably want to get in on the original crypto asset.

That said, for first-time buyers and seasoned investors alike, it is important to be careful about any extraneous costs that might eat into gains. That goes double for the major fintech apps that are likely already on your phone.

Here’s how fees stack up on some of the most retail-friendly platforms for buying bitcoin.

Paypal

The largest app on this list, paypal (PYPL) is one of the newest entrants to the world of buying and selling bitcoin.

Subscribe to first mover, our daily newsletter about markets.

The payments giant has come out with an attractively priced offering for retail buyers. It has a very low fee of $0.50 for starter purchases under $25.00. Its highest fees are 2.3% on purchases from $25.00 to $100, with fees falling in increments from there in two additional tranches until it reaches its lowest rate of 1.5% for purchases above $1,000.

The caveat here is that bitcoin purchases in paypal live firmly inside the fintech giant’s walled garden. You can cash out to dollars when the time is right, but the actual bitcoin is never yours to keep.

Robinhood

Robinhood is the investing app that has always made trades of all kinds free. This is also true for cryptocurrency purchases.

Robinhood also puts limit orders on all buys and sells so they don’t execute if the market moves against the customer suddenly after an order is placed.

Robinhood rolled out BTC in 2018 and has promised withdrawals were coming, but it still hasn’t happened. As with paypal, if a user’s holdings become meaningful he or she will just have to trust the company to keep the assets safe.

Coinbase

The downside of coinbase on this list is it is only a cryptocurrency app so, unlike robinhood and paypal, coinbase is not something users will just have already if they haven’t gotten into the industry.

That said, coinbase made its name making buying and selling cryptocurrency easy, and it’s still an app that many tech-savvy retail buyers who haven’t yet taken the crypto plunge are likely to know.

Coinbase’s fee structure is clearly laid out, starting at $0.99 for purchases below $10 and rising to 1.49% for any purchases above $200.

That said, buyers should also note that it adds a 0.5% spread to all purchases and sales, which means users are always buying a tiny bit over the market price and selling a tiny bit under.

Cash app

Square’s (SQ) cash app allows people to easily send money to each other, but it has also become a way to buy stocks, pay small businesses and also to buy bitcoin. In fact, square’s cash app led the way to bringing bitcoin purchases into a mainstream wallet.

The company changed its fee structure for bitcoin purchases and sales last year though, according to the company, the change really only made costs more transparent rather than more expensive.

Cash app doesn’t spell out its explicit fees, despite having a bitcoin fees page where it acknowledges both a trading fee and an occasional bump when the price is very volatile. Coindesk has reached out to square for a precise structure and will update if we hear back. (when we previously looked, coinbase started to outperform cash app for bitcoin purchases around $200 and higher.)

A lot of BTC gets bought and sold on cash app, but profits on those sales do not represent a meaningful portion of income for square.

Email was send successfully!

Please check your inbox for

our authentication email.

Thank you for registering

to finance magnates.

Please open the email we

sent you and click on the

link to verify your account.

Paypal bans user for trading cryptocurrencies

The company permanently banned an account for frequent crypto trading and imposed a 180-day hold on funds.

Online payments giant, paypal has reportedly restricted an account for cryptocurrency trading and placed the balance on hold for six months. The company banned the user citing potential risks associated with crypto day trading.

According to a user post on US-based social news aggregation platform, reddit, the payments company permanently banned his account after paypal’s technical system termed his frequent crypto trading as “item SALES”.

The post mentioned that paypal asked for multiple explanations for buying and selling of cryptocurrencies and the staff did not even know about the crypto services of the company. The user added that he submitted a photo ID and wrote ‘paypal crypto’ in the description for each transaction and called multiple times for an explanation.

Suggested articles

The different types and styles of social trading in forexgo to article >>

“the system flagged my account thinking I was selling items worth $10,000 in one week when I hadn’t done so in the last 6 years I’ve held a paypal account. (US account btw). So I knew the developers didn’t account for this when they released paypal crypto so I submitted the stuff for review with my photo ID and wrote ‘paypal crypto’ for each crypto transaction, I called their phone and he said he’s expedited the review. I went to sleep, the next day (today) my account is permanently limited,” the reddit post states.

No explanation

The user with reddit handle thecooldoc, added that paypal did not give any explanation and imposed a permanent ban citing potential risks associated with cryptocurrency trading. According to the user, he had $462 in the account and the company restricted withdrawals from the account for at least 180 days. “no appeals. No explanation. No consideration that their reviewer may be an ignorant 60-year-old with no knowledge of paypal’s own crypto service. Whenever I’ve called their support about paypal crypto in the past they had no idea what I was talking about even after weeks after release,” the user added.

Paypal announced earlier this month that it has enabled users to trade cryptocurrencies, but the recent post suggests that there are still issues the company needs to address.

Paypal embraces crypto, igniting market as mainstream adoption inches closer

Ian allison

Danny nelson

Paypal embraces crypto, igniting market as mainstream adoption inches closer

Crypto just got a shot at going mainstream in 2021.

Paypal officially confirmed wednesday it is entering the cryptocurrency market. The payments giant, with 346 million active accounts around the world, pledged to make cryptocurrency “a funding source for purchases at its 26 million merchants worldwide.”

What we know:

- Paypal said buy, sell and hold features would be live within the next few weeks but for some users, the features are already available.

- Paypal's service does not allow bitcoin or other cryptocurrencies to be withdrawn or deposited. Once you buy the coins, they stay in your account until you sell.

- Initially, the service supports bitcoin (BTC), bitcoin cash (BCH), ether (ETH) and litecoin (LTC).

- This is a developing story; stay tuned for updates with full coverage below.

Bitcoin and other cryptocurrencies rallied following the announcement, which is one of several recent signs this year of mainstream corporate adoption of the decade-old technology, following microstrategy’s $425 million deployment of its cash surplus into bitcoin and a similar but more modest move by square.

Subscribe to blockchain bites, our daily update with the latest stories.

Coindesk first reported paypal was planning a move into crypto in june, citing anonymous sources. A month later, coindesk reported the paxos exchange had been selected to support paypal in its crypto endeavors.

In a blog post wednesday, paypal said the COVID-19 pandemic had driven the need for digital payments of all sorts, although the move had been in planning since at least late last year, and following paypal’s short-lived dalliance with the facebook-spawned libra project.

Beginning in early 2021, paypal customers will be able to instantly convert their selected cryptocurrency balance to fiat currency, with certainty of value and no incremental fees, paypal said. Its merchants will have no additional integrations or fees, as all transactions will be settled with fiat currency at their current paypal rates.

“in effect, cryptocurrency simply becomes another funding source inside the paypal digital wallet, adding enhanced utility to cryptocurrency holders, while addressing previous concerns surrounding volatility, cost and speed of cryptocurrency-based transactions,” paypal said.

Not your keys.

As bullish for the bitcoin market as this announcement has proven to be, an initial review of paypal’s crypto services terms underscores that a go-it-slow mindset still pervades. Critical caps limit who buyers are, how much they can buy and what they can actually do with their paypal-sourced crypto.

For starters, paypal is refusing to hand over customers’ keys.

“you own the cryptocurrency you buy on paypal but will not be provided with a private key,” paypal wrote in a help post. Paypal casts the restriction as a loss-prevention tactic.

A customer losing private keys makes his or her underlying crypto pretty much gone for good, the post points out. While users will not be liable for “unauthorized” crypto transactions on their account (think: hacks), paypal appears to have no interest in mitigating sloppy private key management.

But keeping keys away from customers ensures paypal can maintain a tighter grip on how customers wield BTC, BCH, LTC and ETH.

Crucially, users will not be allowed to send their crypto around.

“you can only hold the cryptocurrency that you buy on paypal in your account. Additionally, the cryptocurrency in your account cannot be transferred to other accounts on or off paypal,” the help page says.

This prompted the inevitable eagles “hotel california” song reference (“you can check out anytime you like/but you can never leave”) on crypto twitter:

The service rollout also faces a series of real-world restrictions. Only 49 out of 50 U.S. States have coverage at launch, with hawaii, a notoriously tricky state for crypto companies, excluded from the list.

“we plan to expand this service to select global markets in the first half of 2021,” paypal said.

There’s also a $10,000 weekly buying cap and a $50,000 limit per 12-month period. All trades must be executed in U.S. Dollars, paypal said.

Paypal gets bitlicense

As part of wednesday’s formalities, the new york state department of financial services (DFS), said it had granted the first “conditional bitlicense” to paypal for a partnership with paxos trust company, enabling customers to buy and sell cryptocurrencies.

DFS said it was making good on a promise last year from superintendent of financial services linda A. Lacewell to take a fresh look at its regulatory framework for virtual currencies, with a view to fostering innovation in new york state.

“DFS’s approval today follows our june 2020 announcement for a new framework for a conditional bitlicense to encourage, promote and assist interested institutions to have a well-regulated way to access the new york virtual currency marketplace in a way that is both timely and protective of new york consumers, through partnerships with new york authorized virtual currency firms,” said lacewell in a statement.

“DFS will continue to encourage and support financial service providers to operate, grow, remain and expand in new york and work with innovators to enable them to germinate and test their ideas, for a dynamic and forward-looking financial services sector, especially as we work to build new york back better in the midst of this pandemic,” she said.

Now, with the DFS’s approval, new york state-chartered paxos will be able to provide trading and custodial services to paypal to allow the fintech giant’s 346 million customers to buy, sell and hold bitcoin, bitcoin cash, ether and litecoin, according to the DFS statement.

Since 2015, DFS has approved 26 entities to engage in virtual currency business in new york state, including paypal.

Update (oct. 20, 15:08 UTC): added details to introductory paragraphs and a section detailing the strict limitations on what paypal users can do with their crypto.

Paypal suspends user and holds their funds for trading crypto

Recent reports claim that paypal suspended the account of one of its users for trading cryptocurrencies — on paypal’s own platform. Allegedly, the user was trading ‘too frequently,’ and paypal simply limited their account permanently, without any prior warning.

Paypal flags user for trading cryptocurrencies

When paypal announced adding support for cryptocurrencies, many crypto users were excited about the new possibilities. Paypal has been staying away from crypto for a long time, and finally opening up to the industry was seen as a major step in the right direction.

When the online payments giant fulfilled its promise and actually added support for crypto in the US, the move helped launch a new crypto rally that recently took bitcoin closer to its ATH than it has ever been before.

However, it has only been days since new issues started appearing, and the biggest one so far was reported by a US-based reddit user, thecooldoc. The user stated that paypal simply notified them that it had suspended their account due to potential risk, apparently deciding that the user was making too many crypto transactions.

Paypal got suspicious due to a sudden surge in activity

The user revealed that they made around 10 crypto transactions within one week, buying coins when the price was low, and selling them when it grew. Paypal requested an explanation for every transaction that the user had made. Apparently, paypal got suspicious as the user suddenly started selling assets worth $10,000 in a single week, after owning an account for six years during which they never expressed similar behavior.

The system flagged the account, and notified the user that they would no longer be able to use paypal for conducting further business.

Not only that, but the remaining funds that the user had in their account — $462 — were placed under hold for the next 180 days. However, the user revealed that they managed to withdraw the money through other means.

The user insists that they did nothing wrong, and given that paypal raised the imposed limit from $10,000 per week to $20,000, the user certainly did not seem to have broken this rule. While the user believes that this is a misunderstanding, they said that paypal is not a crypto exchange, and that they should not have used it as such.

They certainly do not plan on making that mistake again, going forward.

Email was send successfully!

Please check your inbox for

our authentication email.

Thank you for registering

to finance magnates.

Please open the email we

sent you and click on the

link to verify your account.

- FM home

- Cryptocurrency

- News

- Paypal, coinbase invest in crypto taxation platform taxbit

Paypal, coinbase invest in crypto taxation platform taxbit

The platform offers automated crypto taxation calculation to partner exchange users.

Paypal has extended its exposure in the cryptocurrency industry with its venture arm’s latest investment into utah-based taxbit, a digital currency tax automation platform.

Announced on thursday, the startup raised an undisclosed sum in its latest funding round from paypal ventures and coinbase ventures. Its existing investor winklevoss capital also participated in the funding round.

Demand for crypto tax calculation tools are rising

The new funding came when the demand for cryptocurrency investments are booming, and the US taxman is focusing more and more to levy taxes on the gains from crypto. The internal revenue services (IRS) is actively sending notices to anyone it suspects of having traded cryptocurrencies and did not reveal the gains in their reporting.

Founded in 2017, taxbit software allows cryptocurrency exchanges to issue tax forms to their users, thus automating the troublesome process of tax calculation.

Though the company did not reveal the sum it raised in the latest high-profile funding round, it already had a chest of $5.8 million from earlier seed rounds, as seen on crunchbase.

Suggested articles

The different types and styles of social trading in forexgo to article >>

Commenting on the funding, taxbit founder and CEO, austin woodward said: “we want to thank our customers, partners, and investors for helping us move the cryptocurrency space forward. This investment will help us achieve our aim of being the most innovative and trustworthy provider of cryptocurrency tax technology.”

Meanwhile, payments giant paypal’s stake in the crypto startup projects its interests in the booming cryptocurrency industry. Earlier, paypal launched crypto buying, selling, and holding services to its users.

Furthermore, the giant will allow users to pay in digital currencies to the merchants on its platform.

Other mainstream payments giants have already shown their interest in cryptocurrencies. American express last month invested in institutional crypto trading platform, falconx.

So, let's see, what we have: buy, sell & hold cryptocurrency with paypal. Explore crypto easily & safely with your paypal account and start buying & selling in seconds. At crypto coin trading with paypal

Contents

- Top forex bonus list

- Crypto coin trading with paypal

- Start exploring crypto with paypal

- 34 characters maximum

- Ready to get started?

- The good and the bad about cryptocurrency on paypal

- No crypto withdrawals, big fees

- The taxman cometh

- Paypal reportedly restricted a user’s account for trading cryptocurrency

- Paypal is a crypto purse, not an exchange

- Things to consider

- Paypal, coinbase invest in crypto taxation platform taxbit

- The platform offers automated crypto taxation calculation to partner exchange users.

- Demand for crypto tax calculation tools are rising

- Suggested articles

- Bitcoin trading fees on paypal, robinhood, cash app and coinbase: what to know

- Bitcoin trading fees on paypal, robinhood, cash app and coinbase: what to know

- Paypal

- Robinhood

- Coinbase

- Cash app

- Paypal bans user for trading cryptocurrencies

- The company permanently banned an account for frequent crypto trading and imposed a 180-day hold on...

- Suggested articles

- No explanation

- Paypal embraces crypto, igniting market as mainstream adoption inches closer

- Paypal embraces crypto, igniting market as mainstream adoption inches closer

- What we know:

- Not your keys.

- Paypal gets bitlicense

- Paypal suspends user and holds their funds for trading crypto

- Paypal flags user for trading cryptocurrencies

- Paypal got suspicious due to a sudden surge in activity

- Paypal, coinbase invest in crypto taxation platform taxbit

- The platform offers automated crypto taxation calculation to partner exchange users.

- Demand for crypto tax calculation tools are rising

- Suggested articles

Comments

Post a Comment