Best Bitcoin Brokers; Learn 2 Trade Full 2021 Guide, bitcoin broker fees.

Bitcoin broker fees

It’s super-important for you to understand how your choice of broker can have a major say on the make-up of your bitcoin purchase, so we explain this in more detail in the sections below.

Top forex bonus list

So now that you know the two types of bitcoin brokers currently active in the market, we are now going to discuss payments. After all, you will be buying bitcoin with real-world money – so you need to think about how you intend getting funds in and out of the broker.

Best bitcoin brokers – learn 2 trade full 2021 guide!

Best bitcoin brokers – learn 2 trade full 2021 guide!

Bitcoin brokers, looking to join the cryptocurrency revolution by buying some bitcoin of your own? If so, the easiest and most-effective way of doing this is through a bitcoin broker.

In a nutshell, the best bitcoin brokers allow you to quickly open an account, deposit funds with a debit or credit card – and then buy as much or as little bitcoin as you like.

With that said, there are hundreds of platforms active in the market, so knowing which broker to sign up with is no easy feat. As such, we would suggest reading our guide on the best bitcoin brokers.

Not only do we unravel our top 5 bitcoin broker picks of 2021, but we also explain why opting for bitcoin cfds is the safest, cheapest, and most convenient way of making an investment.

Table of content

Etoro - buy and invest in assets commissions-free

- Buy over 800 stocks, cryptocurrencies, and etfs without paying any commissions

- Trade thousands of cfds

- Deposit funds with a debit/credit card, e-wallet, or bank account and paypal

- Perfect for newbie traders

What are bitcoin brokers?

A bitcoin broker is simply an online trading platform that allows you to buy and sell cryptocurrencies. Much like a traditional online stockbroker, the process requires you to open an account, deposit funds, and then decide how much bitcoin you wish to buy. Brokers typically allow you to use everyday payment methods like a debit/credit card, bank account, or e-wallet, which makes the buying process super-easy.

In return, bitcoin brokers will charge you a fee. This can come in a range of shapes and sizes, so your costs will depend on the broker that you use. For example, while popular bitcoin brokers like coinbase charge fees to deposit funds and make a purchase – platforms like crypto rocket and etoro do not. As such, you need to understand the broker’s fee structure prior to taking the plunge.

With that being said – there are two types of bitcoin brokers active in the online space – so the one that you opt for will depend on your long-term investment goals. Crucially, this will either be a broker that requires you to store your bitcoin in a private wallet, or a broker that facilitates your investment via a regulated CFD.

Types of bitcoin brokers

It’s super-important for you to understand how your choice of broker can have a major say on the make-up of your bitcoin purchase, so we explain this in more detail in the sections below.

✔️ buying ‘actual’ bitcoin

Bitcoin is a decentralized currency – meaning that it is not controlled by any single person or authority. As such, those holding bitcoin in a private wallet are 100% responsible for keeping it safe. In other words, if your bitcoin wallet was hacked – or you transferred funds to an invalid address, your bitcoin would be lost forever.

Unlike a traditional investment, you would not be able to pick up the telephone and ask the broker to investigate the loss. On the contrary, this is the risk of buying ‘actual’ bitcoin, as you need to ensure that you keep it safe at all times.

Now, this isn’t necessarily an issuer per-say if you know how cryptocurrency wallets work. However, if you’re a complete newbie entering the bitcoin space for the first time, the thoughts of having to store your own coins is nothing short of petrifying – especially if large amounts of capital are involved.

Nevertheless, if you do want to own ‘actual’ bitcoin, the broker in question will facilitate your order via an everyday payment method. Once the coins have been purchased, you will then need to withdraw them to a private wallet. Some platforms allow you to store the coins within the broker’s ‘web wallet’ – albeit, this is extremely risky.

✔️ buying bitcoin cfds

So that leaves us with option 2 – buying bitcoin cfds. For those unaware, a CFD (contract-for-difference) is a financial instrument that allows you to invest in an asset without you taking ownership. Instead, you are simply speculating on whether the price of the asset will go up or down.

Not only does this include assets like bitcoin, but literally any financial instrument that is traded in the traditional markets. Think along the lines of gold, oil, stocks, indices, gas, wheat, and etfs. On the one hand, buying a bitcoin CFD will mean that you do not actually own the underlying asset.

In fact, the benefits of using bitcoin brokers that specialize in cfds are four-fold – as we explain below.

1. Fees are much lower

One of the most popular bitcoin brokers in the online space is that of coinbase. The overarching reason for this is that the platform makes it super-easy to buy bitcoin with an everyday debit or credit card. However, coinbase charges handsomely for its services.

For example, you need to pay 3.99% to deposit with a debit/credit card, and then a further 1.5% every time you buy or sell bitcoin. These fees are huge in comparison to bitcoin brokers that specialize in cfds.

In fact, most of the bitcoin brokers that we recommend on this page not only allow you to deposit funds for free – but you can trade bitcoin without paying any commissions.

2. CFD brokers are heavily regulated

Much of the wider cryptocurrency broker space operates in an unregulated manner. This is mainly due to the fact that very few countries have yet to install crypto-specific legislation – meaning that platforms are able to trade without holding a license.

On the contrary, the CFD broker space is heavily regulated – which means that your funds remain safe at all times. For example, all of the top-rated bitcoin brokers listed on this page hold a tier-one regulatory license. This includes bodies such as the UK’s FCA, australia’s ASIC, or cyprus’s cysec.

3. Storage and selling is seamless

As we briefly noted earlier, buying ‘actual’ bitocin is a logistical nightmare. For example, you are required to withdraw the coins out of your chosen broker, and then keep them safe in a private wallet. When it comes to offloading your bitcoin investment, you then need to transfer the coins back into an online broker, and exchange them for cash. This is a highly cumbersome process that is fraught with risk.

With that said, by using a bitcoin broker that specializes in cfds, you do not need to worry about storage at all. This is because cfds merely track the underlying asset – meaning the financial instrument does not exist. As such, there is no fear of your bitcoin being lost or stolen!

Furthermore, this also makes it a breeze when it comes to cashing your investment out. As your bitcoin is stored at the broker via a CFD instrument, you simply need to place a sell order to exit your trade. As soon as you do, you can then withdraw the funds back to your debit/credit card, bank account, or e-wallet.

4. Ability to apply leverage and short-sell

Unlike a conventional bitcoin broker, those offering cryptocurrencies in the form of cfds allow you to apply leverage. For those unaware, this means that you will have the option of trading more than you have in your account.

In the UK, for example, investors are able to apply leverage of up to 2x when trading bitcoin, meaning that a £500 investment would allow you to buy £1,000 worth. In other regions, you can trade well up to 100x – meaning a £500 balance would allow you to trade with £50,000!

Similarly, CFD brokers hosting cryptocurrencies also allow you to short-sell bitcoin. This means that you can make gains in the event bitcoin goes down in value.

Payments at bitcoin brokers

So now that you know the two types of bitcoin brokers currently active in the market, we are now going to discuss payments. After all, you will be buying bitcoin with real-world money – so you need to think about how you intend getting funds in and out of the broker.

Payment methods

Most bitcoin brokers allow you to deposit and withdraw funds with a range of payment methods. This might include:

- Debit cards

- Credit cards

- Local bank transfer

- International bank wire

- Paypal

- Skrill

- Neteller

- Western union

It’s best to check whether or not your preferred payment method is supported prior to opening an account with the broker.

Deposit/withdrawl fees

In some cases, bitcoin brokers will charge you a fee to deposit and/or withdraw funds. As we discussed earlier, the likes of coinbase charge a whopping 3.99% on debit/credit card deposits.

This means that a £1,000 deposit would cost you £39.99 in fees. At the other end of the spectrum, the likes of etoro charge nothing on deposits, and a mere $5 on withdrawals.

Bitcoin broker fees

Bitcoin brokers are in the business of making money, so you need to have a firm grasp of the platform’s fee structure. This can include:

Trading commissions

This is a commission charged by the broker every time you place a trade. This includes a fee when you buy bitcoin, as well as when you sell it. If a trading commission is charged, then you will pay a percentage of the amount you wish to buy.

For example, let’s say that the broker charges a fee of 1.5%, and you wish to buy £2,000 worth of bitcoin. This would translate to an initial fee of £30. However, when it comes to selling your bitcoin you will also need to pay a commission.

For example, let’s say that your £2,000 bitcoin investment is now worth £3,000. This means that you will pay 1.5% on the current market value of £3,000 – which equates to £45. As noted earlier, most of the bitcoin brokers that we recommend on this page charge no trading commissions at all.

Spreads

All bitcoin brokers will charge a spread. Much like the traditional investment space, this is the difference between the ‘buy’ and ‘sell’ price of the asset.

For example, let’s say that bitcoin has a ‘buy’ price of $6,000, and a ‘sell’ price of $6,060. By calculating the difference between the two prices, we get a spread of 1%. This means that you need your bitcoin investment to increase by at least 1% just to break even.

There is often a trade-off between the spreads and commissions charged by bitcoin brokers, so you need to check this before signing up. For example, while a broker might not charge any commissions, you might find that its spreads are somewhat uncompetitive.

How do bitcoin brokers work?

Still confused how the investment process works at a bitcoin broker? If so, you’ll find a simple step-by-step guide outlined below. This unravels the end-to-end process of opening an account, depositing funds, buying bitcoin, and crucially – cashing out your investment.

Step 1: find a bitcoin broker

To get the ball rolling, you’ll need to find a bitcoin broker that meets your needs. If you like the sound of investing in bitcoin via cfds, you’ll find our top-five picks listed towards the bottom of this page.

If you want to own ‘actual’ bitcoin, it might be worth using etoro. This is because the platform is regulated, it accepts heaps of payment methods, and ultimately – you don’t need to withdraw your coins out.

Etoro - buy and invest in assets commissions-free

Bitcoin OTC brokers – buying large amounts of bitcoin

By: ofir beigel | last updated: 11/06/20

The standard methods used by most people for buying bitcoin aren’t always suitable for high volume purchases, due to high transaction fees and a limited supply on bitcoin exchanges.

Moreover, some investors wish to stay under the radar and not drastically affect bitcoin’s price by placing large ‘buy’ orders. This guide will review the top bitcoin OTC brokers and cover the most cost-effective ways to buy bitcoins in large amounts (exceeding $100,000).

Buying large amounts of bitcoin summary

Buying large amounts of bitcoin requires a different approach than the “normal” day to day exchange. There are specific bitcoin OTC (over the counter) brokers that deal with clients looking to place large orders so you’ll be able to get the best price.

Here are the top OTC brokers today:

That’s how you buy large amounts of bitcoin in a nutshell. If you want a more detailed review about the different bitcoin OTC brokers keep on reading, here’s what I’ll cover:

1. Bitcoin OTC brokers vs. Trading platforms

The two main options you have for buying large amounts of bitcoin are OTC brokers (OTC = over the counter) or traditional bitcoin trading platforms. OTC brokers refer to companies or individuals willing to sell you bitcoins directly as opposed to an automated trading platform.

Bitcoin OTC broker benefits

High liquidity – OTC brokers specialize in supplying high volumes of bitcoin for large buyers such as institutional investors. This means that most of the time you will be able to get your order fulfilled in full, faster than on a traditional exchange.

Fixed price – when you buy large amounts of bitcoin on a public automated exchange you will probably see the price rise as your order gets executed.

This is due to the fact that once you finish buying from the “cheap” sellers, you gradually move to the “expensive” sellers. This means you don’t have a fixed price for your purchase. When you use an OTC exchange you can negotiate a fixed price (e.G. “bitstamp rate + 1%”).

Bitcoin OTC broker disadvantages

Less transparency – while on a traditional trading platform the order book is transparent for everyone to see, when buying bitcoins OTC you don’t know exactly who you’re dealing with or the volume that they have to trade. You are basing your information solely on what you get from the seller.

Less regulation – buying OTC means that there is less regulation involved since many of the OTC sellers aren’t listed as money transmitters, hence the risk with these transactions increases.

2. Known bitcoin OTC brokers

Having listed the various pros and cons of using OTC brokers, let’s go over some of the more known brokers in the bitcoin economy. Most of these services require you to apply and pass a specific screening and verification process.

Itbit

Itbit is a well known bitcoin exchange, founded in 2013. It is a regulated exchange in the US that supplies bitcoin trading services for small and institutional investors.

Itbit for institutions is the full-service financial services company for institutions who are trading in bitcoin. The institutional client group (ICG) provides institutions and active traders with personalized service and support.

Itbit’s OTC trading is a personalized service for orders over $100K that has low fees and a quick settlement. Itbit states that its OTC market has very competitive pricing, which makes it very attractive considering it’s also a regulated exchange.

Genesis

Genesis is an institutional trading firm offering two-sided liquidity for digital currency, including bitcoin and ether. Since september 2013, genesis has traded over 1,500,000 bitcoin (BTC), worth over $600 million US dollars, and has completed thousands of trades.

The company has a minimum trade size of $75K. Unlike some other OTC exchanges, genesis is regulated by FINRA and the SEC. They have also submitted their request for a bitlicense in the state of new york.

Cumberland mining

Cumberland mining is a specialized crypto asset trading company within DRW and has been dealing with cryptocurrencies since 2014. Its global head of trading it bobby cho who was formerly a director for itbit and vice president of second market.

Cumberland mining offers competitive pricing for institutional size bitcoin transactions. They supply liquidity to some of the major traditional bitcoin exchanges as well.

The company trades BTC, ETH, and a number of other cryptoassets. They facilitate crypto-to-crypto and crypto-to-fiat transactions.

While there’s not much info on the company’s website, coindesk has researched it in the past and they have also partnered with tradeblock. A minimum trade order with cumberland is $100K.

Falconx

Falconx is a san francisco based OTC trading desk that offers best execution using data science to its clients. The platform is built for institutional investors such as hedge funds, crypto miners, payment providers and proprietary traders but currently there is no minimum order requirement for trade execution.

The company secured $17M funding in 2019 from a group of investors including accel, accomplice, coinbase ventures and fidelity. The trading desk generated over $7 billion dollars in global trading volume.

Satstreet

Satstreet is one of canada’s fastest growing cryptocurrency exchanges. The team is leveraging industry leading apis with smart order routing and domestic banks for fast settlement.

The company’s OTC desk is offering bulk trades in various cryptocurrencies, including bitcoin and ethereum from $25k to over $50M for clients in the united states and canada.

Satstreet is backed by round13 capital and several high net worth investors.

Coinjar

Coinjar is an australian cryptocurrency exchange and wallet service that also has an OTC desk. Individuals and institutions looking to make larger transactions are given privacy and flexibility with their tailored solutions.

OTC trades at coinjar are available from AUD $50,000 and above. The exchange is backed by prominent venture capital funds, like the digital currency group and blackbird ventures.

Kraken

Kraken, founded in 2011 and based in san francisco, is one of the largest bitcoin exchanges in terms of euro volume and liquidity.

For high volume trades (over $100K) kraken offers over the counter services with a 1-on -1 service. Additionally, frequent high volume traders can receive a dedicated account manager to take care of their trading needs. OTC trading is available in canadian dollars, US dollars, euros, and japanese yen.

Kraken acquired circle’s “circle trade” OTC platform in 2019 and has mixed it into their existing OTC service.

Binance

Binance, one of the world’s most popular cryptocurrency exchanges, also provides its own OTC service .

It is distinctly different from the other OTC platforms, in the sense that it does NOT accept fiat currency. Instead, binance OTC takes the stablecoins USDT, USDC, or BUSD.

Binance OTC’s minimum trade size is $10,000 worth of coins, with no fees charged. There is, however, a spread between buy and sell prices.

Bitfinex

Bitfinex is a hong kong operated cryptocurrency exchange that has been in operation since late 2012.

For those who wish to trade major amounts ($100,000+) of cryptocurrency privately, bitfinex provides an over-the-counter (OTC) trading facility. There are two ways to take advantage of the OTC desk:

- Access instant liquidity through bitfinex’s OTC desk

- Trade directly with another bitfinex user.

Hitbtc

Hitbtc, established in 2013 in the APAC region (although not clear exactly where), is a cryptocurrency exchange that supplies dedicated OTC services. The minimum trade for using OTC services is $100,000 and fees are 0.1% per trade.

Hitbtc doesn’t manage the OTC service themselves, they “outsource” it to their partner trustedvolumes.Com.

The cryptocurrency community is somewhat skeptical towards hitbtc, and similar to changelly, the company isn’t very transparent about their business.

Athena investor services

Athena investor services (or AIS) launched in late 2017. It is a high-touch OTC cryptocurrency broker that allows people in the united states to buy and sell between $10,000 and $500,000 in bitcoin, bitcoin cash, ethereum, litecoin and ripple.

Payment is made via wire transfer, and the cryptocurrency is typically sent within a couple of hours, but can take up to 12 hours, depending on how long the user takes to complete the onboarding process.

SFOX (san francisco open exchange), headquartered in san francisco, is a trading platform that supplies bitcoin OTC services as well. It has received funding from top tier venture funds.

SFOX prides itself in its various trading algorithms that allow versatile trading strategies to be executed instantly. If you trade in volumes of over $10K you can get a discount on the algorithm fees as well.

The company sources over 20 exchanges, OTC brokers, and liquidity providers globally to the best price on bitcoin possible.

3. Traditional exchanges suited for large transactions

If you want to use traditional automated and regulated bitcoin exchanges to buy large amounts of bitcoin, there are several exchanges that are suited for that purpose.

Coinbase and coinbase pro

Coinbase is one of the leading bitcoin companies today. There are two options for you to buy large amounts of bitcoins through coinbase: one is coinbase’s brokerage service and the other is coinbase pro (coinbase’s trading platform). You can read my complete coinbase review here.

Coinbase brokerage service

Coinbase’s brokerage service allows you to buy up to $25,000 bitcoins per day, if you’re a fully verified member. Even though the price is very close to the market price, coinbase will take 1% of these transactions which is relatively expensive.

Coinbase pro

Coinbase pro has no limits to how many bitcoins you can purchase on the platform. When you place an order at the market price that gets filled immediately, you are considered a taker and will pay a fee between 0.04% and 0.50%.

If, however, you place an order which is not immediately matched by an existing order, you are considered a maker and your fee will be between 0.00% and 0.50%.

Bitstamp

Bitstamp, the oldest bitcoin exchange around, currently has a relatively large trading volume. Fiat currency deposit fees are as low as 0.05%, and depending on your trading volume you will pay a transaction fee between 0.00%-0.50%.

If you are using SEPA or ACH to transfer your money, you won’t be charged any deposit fees. You can read my complete bitstamp review here.

(on a personal note, I use this method to buy large amounts of coins)

4. Conclusion

Bitcoin is in its infancy and the options to buy large amounts of it are still somewhat limited. However, the services listed above will give you a more than fair solution for this situation.

Regulated trading platforms will give you a more automated process while bitcoin OTC brokers will allow you to stay under the radar and create less price movements.

Once the trade is complete, make sure you have a safe place to store your newly bought bitcoins, such as a hardware wallet or a paper wallet. You wouldn’t want all of this hard work to go to waste….

Free bitcoin crash course

Learn everything you need to know about bitcoin in just 7 days. Daily videos sent straight to your inbox.

Bitcoin trading at lowest or no fees

On this page you find all international and established bitcoin brokers which offer trading at the lowest or even no fees at all. You mostly only have to pay the deposit or withdrawal fees for the cryptocurrency transfers, which have nothing to do with the broker but with the usual blockchain based transfer fees of the network.

Tip for more profitable trading: if you need to refine your skills or struggle with getting profitable, you may want to give a professional trading group a try. We've recently tested bitcoin trade group and were surprised by the quality of their work. Their members accounts grow by about 20% per month (on average). Read our review here.

Current coupons:

Bitcoin trading at lowest or even no fees!

Usually users at bitcoin trading sites are required to pay certain types of fees in order to use the services of the platform.

Deposit or withdrawal fees

In most of the cases the sites charge the users for funding the account through different kind of deposit methods and withdrawing the funds from the accounts. The fees are depending on the type of transfers. Bank wire transfers, credit card top ups and using alternative payment providers costs money even before starting trading. Deposit and withdrawal fees ranges between 1 to 5 %.

On crypto transfers only network fees

Cryptocurrency deposits and withdrawals are usually free of charges, you only have to pay for the transaction fee that is due for the miners. This fee is not set by or payable to the platform, it is rather needed in order to verify the transactions on the blockchain.

Trading fees

Beside funding the account, a bitcoin trading sites can also charge trading fees for making orders on the platform. The trading fees usually ranges between 0.1% to 0.25%, but it can be up to 1% of the trading amount. Some bitcoin broker offers different conditions for market makers and price taker. A maker is a person placing an order into the order book, while the taker is a person taking an order out of the order book. The maker fees are always lower compared to taker fees as in that case the users gives liquidity to the market that benefits the trading community, thus appreciated by the bitcoin broker.

On certain bitcoin trading sites, you do not have to pay any trading fees at all. In this case your order’s trading costs is solely the spread offered by the platform. There is no additional fees applied to the orders.

Advantages of no fees pricing model

When the platform (such as whaleclub or simplefx) decides to run a spread based no fee pricing model it makes the trading activity more popular for those who want to execute orders frequently, especially in the case of high-frequency trading. The no fee pricing model adds significant liquidity to the market. Since the volatility of bitcoin price is considered realtively high compared to traditional assets, the spread based pricing structure lets the users to engage in more trading activity to exploit market opportunities without paying significant amount of fees.

Disadvantages of no fees

Currently there is no regulation in place to rule the amount of spread a bitcoin trading platform can apply. It is advisable to check the order book first before engaging into any trading activity as spreads can change from time to time on any given assets.

No fees opportunities at bitcoin brokers

Whaleclub

Whaleclub generally has a no-fees policy. They do not charge fees on deposits, balances, trades or inactivity. Although withdrawals cost an extra of 0.001 BTC this is just the transaction fees payable to the miners. The only fees applicable is for margin trading.

Simple FX

Simple FX does not charge for deposits or has any trading fees. Cryptocurrency withdrawals in bitcoin and litecoin are free of charges, withdrawals to bank to to credit cards however has some smaller fees.

BC bitcoin cryptocurrency broker – review

Details

| product name | BC bitcoin cryptocurrency broker |

|---|---|

| fiat currencies | GBP, EUR |

| cryptocurrencies | BTC, ETH, BCH, XRP, LTC, EOS, XLM, USDT, ADA, MCO & 110+ more |

| deposit methods | bank transfer credit card debit card bank transfer (SEPA) wire transfer |

| trading fee | fees vary |

| deposit fees | none |

| withdrawal fees | none |

- Local support from UK headquarters

- Buy crypto in EUR or GBP

- Direct deposits available

- User-friendly interface

- Buy/sell calculator displays fees prominently

- Wide selection of cryptocurrencies

- Transfers limited to business hours

- No live trading chart view

- Not regulated

Andrew munro

Andrew munro is the cryptocurrency editor at finder. He was initially writing about insurance, when he accidentally fell in love with digital currency and distributed ledger technology (aka “the blockchain”). Andrew has a bachelor of arts from the university of new south wales, and has written guides about everything from industrial pigments to cosmetic surgery.

What's in this guide?

- Which fiat and cryptocurrencies are supported?

- Which payment methods are accepted?

- What's it like to use BC bitcoin?

- What are BC bitcoin's fees and limits?

- How fast will my funds be available?

- Is BC bitcoin safe to use?

- Customer support

- How do I create a BC bitcoin account?

- In a nutshell

- Compare alternatives

- Frequently asked questions

Which fiat and cryptocurrencies are supported?

- Supported fiat currencies: GBP, EUR

- Supported cryptocurrencies: approximately 122 cryptocurrencies

What cryptocurrencies are supported?

- BTC

- ETH

- XRP

- BCH

- EOS

- LTC

- ADA

- XLM

- MIOTA

- TRX

- IOST

- SNT

- DGB

- AION

- WTC

- BAT

- LRC

- ELF

- ARK

- ARDR

- NEO

- XEM

- VET

- USDT

- ETC

- ICX

- QTUM

- BNB

- OMG

- ZIL

- POLY

- KNC

- GAS

- RDD

- MONA

- FUN

- HT

- SYS

- LINK

- POWR

- LSK

- BTG

- AE

- ONT

- NANO

- STEEM

- ZRX

- SC

- WAN

- DCR

- WAX

- MAID

- FCT

- MCO

- HOT

- NEBL

- ETN

- BFT

- GTO

- MANA

- WAVES

- BTM

- BTS

- BCD

- REP

- STRAT

- MKR

- PPT

- DOGE

- GNT

- GBYTE

- REQ

- THETA

- CND

- ZEN

- NXS

- CS

- VTC

- ENJ

- DATA

Which payment methods are accepted?

- Bank transfer

- Credit card

- Debit card

- Bank transfer (SEPA)

- Wire transfer

go to BC bitcoin's websiteWhat’s it like to use BC bitcoin?

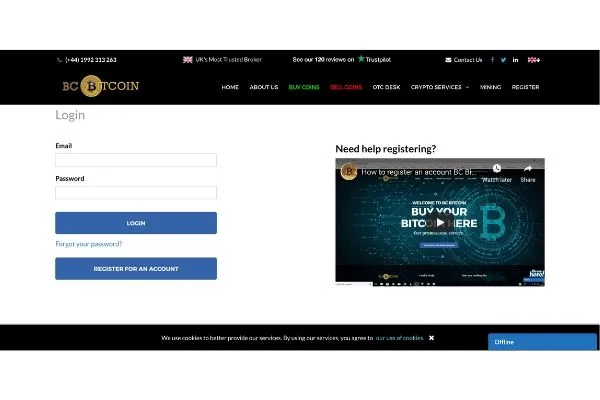

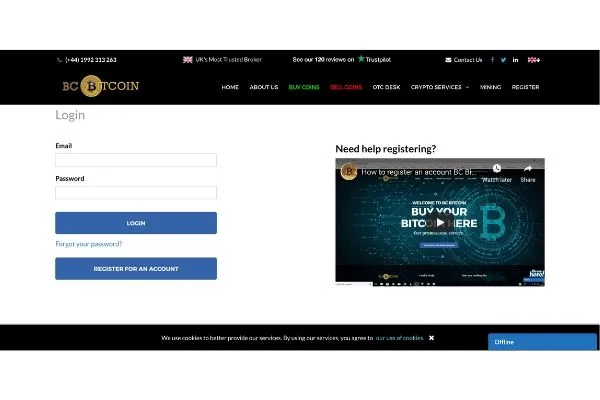

1. Signing up

You can sign up for an account on the homepage by selecting the register option. Enter your email address and password to get started.

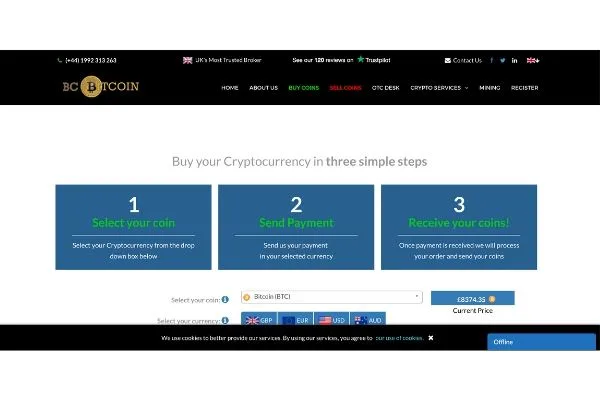

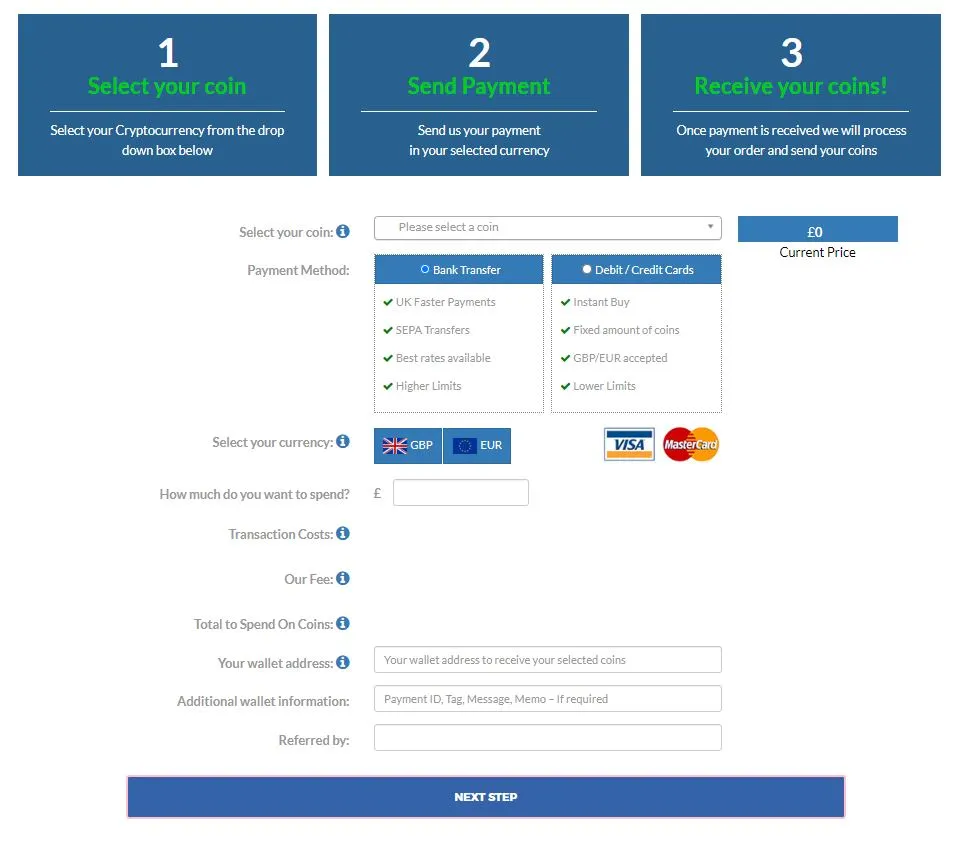

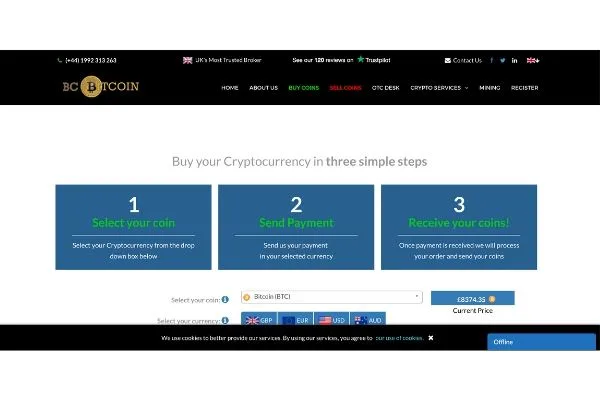

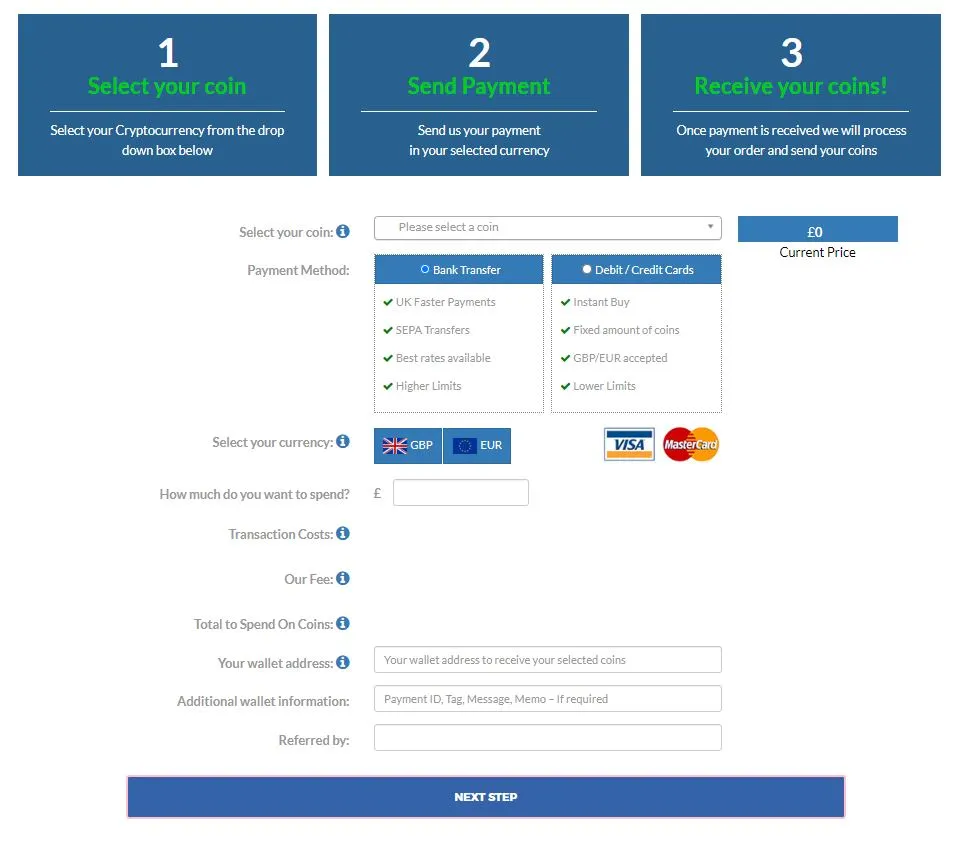

2. Buying cryptocurrency

Explore the wide range of coins available on BC bitcoin. To buy any listed coin, just select it and choose how much you want to purchase.

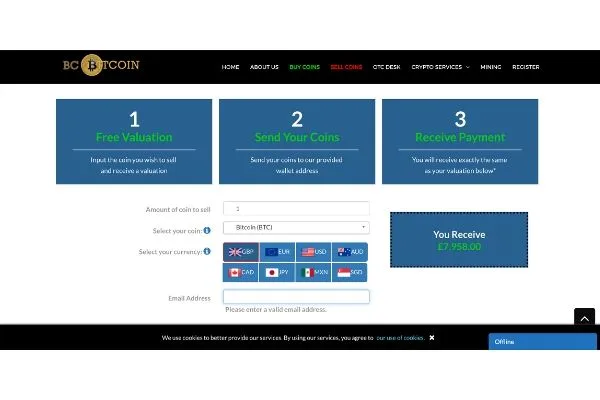

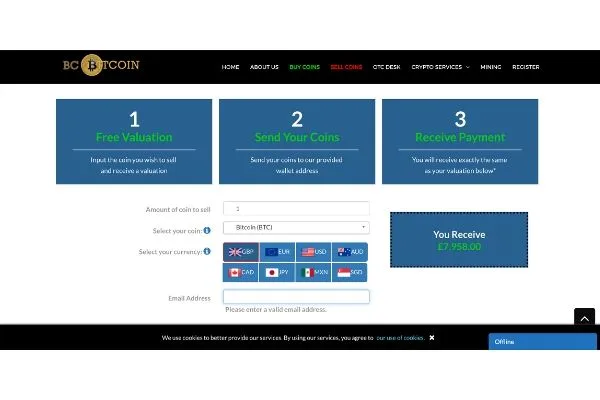

3. Selling cryptocurrency

To sell any listed coin, just select the one you want then let the team know so it can give you a free valuation.

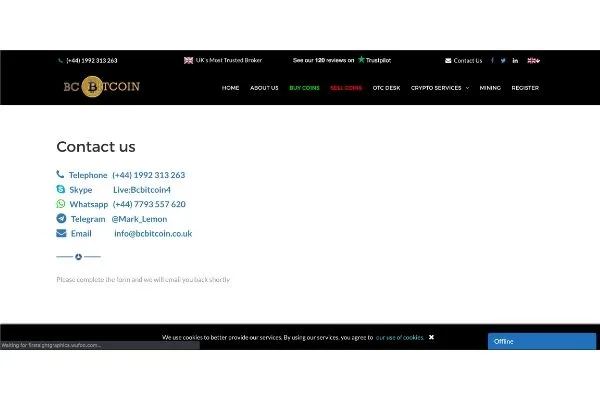

4. Customer service

Get your questions answered quickly by using BC bitcoin's customer service desk.

What are BC bitcoin’s fees and limits?

Platform trading fees

Trading fees vary depending on the amount you’re buying and selling and typically range from 1% to 5%.

You can see a live breakdown of fees on the “buy coins” page. Enter the amount of cryptocurrency you wish to buy and the currency you will pay with. A quote for transaction costs and platform fees will then be displayed.

As cryptocurrency prices can fluctuate by the second, the quote might vary slightly from the actual fee once the payment is processed.

Limits

You can buy or sell up to 25 BTC on BC bitcoin’s brokerage service online. If you’re looking to make higher-value transactions through BC bitcoin, you can contact BC bitcoin about its over-the-counter (OTC) service through its support or online form.

How fast will my funds be available?

Transfer times typically range from same-day to over 1–2 business days.

BC bitcoin’s business hours are on monday to sunday from 8am to 8pm. Requests made outside this period will be processed the next business day.

Cryptocurrency transfers

From 5-10 minutes

Fiat transfers

From same day to 1-2+ days

- Fiat to UK bank accounts: same day

- Fiat to EU accounts: 1 day+

- Fiat to other bank accounts: 1-2 days+

Is BC bitcoin safe to use?

- Verification process. You’ll need to complete a strict verification process before you can start trading on BC bitcoin. This includes providing and verifying your email address and phone number, as well as uploading a photo of your ID and providing proof of your address.

Customer support

Customers will be able to speak with a representative by emailing info@bcbitcoin.Co.Uk or calling +44 (0)1992 313 263.

How do I create a BC bitcoin account?

Step 1: create an account

To sign up for BC bitcoin, go to the “register” button, where you can enter your details.

Step 2: verify your account

BC bitcoin verification requires you to provide:

- Personal identification information. Full name, date of birth, age, nationality, gender, signature, photographs, phone number, home address and email.

- Formal identification information. Passport number, driver’s licence details and national identity card details.

- Financial information. Bank account information, transaction history, trading data, solicitor letters and company formation documents.

- Transaction information. Information about transactions made using BC bitcoin’s services, such as blockchain ids, the amount, timestamp and/or recipient address.

- Online identifiers. Geo location/tracking details, OS, browser name and version and/or personal IP addresses.

- Usage data. Information provided to BC bitcoin’s support team, security questions, user ID and other data collected via cookies and similar technologies.

Once you have been verified, you can start trading.

Step 3: start trading

You can pay in a range of common fiat currencies through bank transfers.

In a nutshell

- Local support from UK headquarters

- Allows users to buy directly in GBP or EUR

- Direct deposits available

- User-friendly interface

- Buying/selling calculator displays fees prominently

- Wide selection of cryptocurrencies

- Transfers limited to business hours

- No live trading chart view

- Not regulated

Compare alternatives

Frequently asked questions

Which countries and currencies does BC bitcoin accept?

BC bitcoin is a british company, but supports both EU and GBP and customers from many countries. BC bitcoin is unable to trade with US residents.

BC bitcoin also does not support users from algeria, ecuador, north korea, bolivia, cambodia, bangladesh, iran, and nepal.

If you’d like to know the full list of supported countries or restricted regions, reach out to BC bitcoin’s customer support team or check its website. If you’d like to pay with a currency other than EUR or GBP, you can also contact BC bitcoin.

Which forms of ID does BC bitcoin accept for account verification?

Can I withdraw funds to a non-british bank account?

Can I use BC bitcoin without verifying my account?

No, only verified users will be able to access and use the site.

How long will verification take?

Once you’ve submitted an account application, BC bitcoin’s verification team will contact you via call or email within 48 hours.

How do I speed up verification?

If you’ve submitted everything according to the instructions and it’s taking a while, it might just mean BC bitcoin is dealing with a high volume of applications.

How to buy bitcoin UK: A beginner’s guide

There are number of online platforms and methods to buy bitcoin in the UK and figuring out where to get started can be daunting. In this beginner’s guide, we explain the ins and outs of how you can buy bitcoin in the UK, as well as the best platforms for doing so. We also explain some the factors that you need to look out for prior to parting with your money – such as regulation, fees, spreads, and withdrawals.

Our recommended UK platform

Don’t have time to read through our guide and simply want to buy bitcoin right now?

If so, we would suggest the broker listed below. Our top-rated platform is regulated by the UK’s FCA, so your funds are safe at all times. You can also deposit funds with heaps of everyday payment methods, and you won’t pay any fees other than the spread.

Etoro: best UK platform for 2020

- Buy physical bitcoins or trade bitcoin cfds

- Copy trading available

- Cysec, FCA and ASIC regulated

Bitcoin in the UK

Consumer demand in the UK for bitcoin took off in late 2017 when the cryptocurrency went on a parabolic run to $20,000. This amounts to an all-time high of around £16,000. To put this into perspective, bitcoin was worth less than 1p back in 2009. Those that were fortunate enough to jump on the band-waggon early are now looking at unprecedented profits.

In terms of availability, the UK is home to a number of popular cryptocurrency brokers. Moreover, a number of regulated CFD brokers now offer markets on bitcoin – including heavyweight firms like plus500, etoro, CMC markets, IG, and even city index. Some brokers even offer a dedicated bitcoin market against the pound sterling.

This is unusual, as the vast majority of the industry is marked-up against the US dollar. Outside of the traditional brokerage space, there are also a number of bitcoin atms scattered around the UK. This allows you to insert cash into the machine, and in return, bitcoin will be transferred to your digital wallet.

What is the best way to buy bitcoin in the UK?

There are heaps of way to invest in bitcoin – such as a bitcoin ATM or peer-to-peer exchange. With that said, the easiest way to get your hands on cryptocurrencies as a first-time buyer is to use an online broker.

The process works largely the same regardless of which platform you sign up with. You’ll need to open an account, deposit some funds, and then specify how much you wish to buy. After that, most brokers allow you to withdraw your newly purchased bitcoin out to a private wallet.

This operates much like a bank account, albeit, you retain full control over your private keys. When it comes to payments, most UK brokers allow you to fund your account with an everyday payment method. This includes the likes of a debit card, credit card, or an e-wallet such as paypal or skrill.

You can also deposit funds via a local UK bank transfer. Finally – and perhaps most importantly, UK brokers must hold a regulatory license. As noted above, this will usually be with the UK’s FCA. As such, client funds will be held in segregated bank accounts. This means that were the broker to collapse, your funds should be protected.

Where to buy bitcoin in the UK

1. Etoro - best bitcoin social trading platform in the UK

Etoro is our top pick from the best trading platforms to buy bitcoin with a debit card in the united kingdom for several reasons. Firstly, etoro is the largest social trading platform in the world with more than 4.5 million users from more than 140 countries. Then, this broker offers a wide range of assets including stocks, commodities, cryptocurrencies, indices, etfs, and currency pairs. But after all, the greatest advantage you can see in our etoro review, is when you compare it to other platforms, is that investors can interact with other members and use the copytrade feature that enables users to copy trades of other successful traders.

Bitcoin trading on etoro can be done through etoro's own cryptocurrency exchange (etorox), or through cfds. As of 2018, etorox is also available in the united states. Investors in the united kingdom on the etoro platform can buy and short-sell bitcoin with a leverage ratio of 2:1. On top of that etoro offers trading on 94 other cryptocurrencies if you choose to buy crypto through cfds.

Founded in 2006, etoro is regulated by top tier regulators such as the financial conduct authority (FCA) in the united kingdom, cysec in europe, and ASIC in australia. Etoro stands out among other exchanges and bitcoin brokers by allowing you to buy and hold digital coins 'physically' or to trade cfds, meaning you speculate on bitcoin price movement without owning the currency.

Assets: cryptocurrencies (cfds and exchange), stocks, forex, etfs, commodities, and indices.

Demo account: yes

Educational material: daily blog & podcast, and video tutorials

Fees: BTC/USD spread - 0.75%, no deposit fee, $5 withdrawal fee, $5 inactivity fee.

Minimum deposit: $200

Special features: social trading platform, copytrade, copyportfolios. Etoro offers its own cryptocurrency exchange and a digital wallet.

Regulation: FCA, cysec, ASIC, mifid

Payment methods: credit/debit card, paypal, sofort, rapid transfer, skrill, wire transfer, neteller, webmoney, unionpay

Best online brokers for bitcoin trading

The best crypto exchanges for US bitcoin trading offer three essential benefits. The first, and most important, is robust security with two-factor authentication, cold storage, and integrated safe wallets. Second is a user-friendly website and platform. Third, they provide access to trading a variety of cryptocurrencies like bitcoin and ethereum.

In our assessment and ranking of cryptocurrency exchanges, we focused on traditional exchanges headquartered and regulated in the united states, as well as the incumbent online brokers in the US, which are expanding to offer bitcoin trading on top of regular stock trading (e.G. Buying shares of apple or google).

Best bitcoin trading platform

- Tradestation - best trading platform

- Coinbase - best crypto exchange

- Etoro - low fees

- Kraken - maker-taker fee schedule

- Bittrex - most altcoins

- Gemini - offers gemnini dollar

- Robinhood - best mobile app

Here's a breakdown of some of the best online brokers for US crypto trading.

Best trading platform - open account

promo offer: commission-free trades on stocks, etfs & options tradesAs a trading technology leader, tradestation supports casual traders through its web-based platform and active traders through its award-winning desktop platform, all with $0 stock and ETF trades. Tradestation crypto allows you to buy, sell, and trade bitcoin, litecoin, ethereum, bitcoin cash and XRP. Tradestation crypto caters to both institutional and recreational clients. Read full review

Best crypto exchange

Founded in june of 2012, coinbase is the largest US-based cryptocurrency exchange, housing over 20 million users. Coinbase is best known for its easy to use website and crypto trading platform, coinbase pro. Coinbase supports 14 different cryptocurrencies for trading, including bitcoin (BTC), ethereum (ETH), and litecoin (LTC), among others.

Low fees - open account

promo offer: 0% commission stocksEtoro is great for traders seeking zero-commission stock and ETF trades, an efficient platform, and access to copy trading. That said, there are hidden fees, education is sub-par, and etoro doesn't offer the same range of investments as traditional brokers. Etoro's crypto offering includes 16 different coins. Although crypto fees are cheap, you can only withdraw your crypto assets with a dedicated etoro wallet.

Maker-taker fee schedule

Kraken was founded in july of 2011 and offers trading on 18 different cryptocurrencies, including monero (XMR), ripple (XRP), and dash (DSH). Kraken currently offers a web platform but does not have a mobile app.

Most altcoins

Bittrex was founded in seattle, washington in 2014. Although bittrex doesn’t provide a mobile or desktop platform, it still offers over 100 tradeable coins, including bitcoin (BTC), ethereum (ETH), and litecoin (LTC).

Offers gemini dollar

Founded in 2015 by the winklevoss twins, gemini is a licensed digital asset exchange and custodian built for both individuals and institutions. Gemini lets users buy, store, and sell bitcoin (BTC), ethereum (ETH), litecoin (LTC), bitcoin cash (BCH), and zcash (ZEC), as well as the self-named gemini dollar (GUSD).

Best mobile app

Robinhood crypto allows users to trade bitcoin (BTC), ethereum (ETH), bitcoin cash (BCH), litecoin (LTC), dogecoin (DOGE), ethereum classic (ETC), and bitcoin SV (BSV). Ten additional coins can be added to a watch list. Robinhood crypto is best-fitted for users who trade multiple classes of assets. Read full review

Pricing details

Below is pricing information for each of the top online brokers for bitcoin trading. Each company uses a different structure.

Tradestation - open account

promo offer: commission-free trades on stocks, etfs & options tradesHeadquartered in plantation, florida, tradestation is a wholly owned subsidiary of monex group, inc., one of japan’s largest online financial services providers. (1). Tradestation's roots date back to the 1982, when the company was formed under the name omega research. The company's flagship tradestation platform was launched in 1991, and tradestation group was a NASDAQ listed company from 1997 - 2011, until it was acquired by monex group (2).

Tradestation crypto features a simple pricing structure. Account balances below $100,000 pay a 0.50% maker fee and a 0.50% taker fee. Account balances over $100,000 don’t pay a maker fee, paying either a 0.25% or 0.125% fee based on account size. At this commission rate, it would cost $5.00 to buy $1,000 worth of bitcoin (BTC).

Coinbase - coinbase.Com

If buying bitcoin from a linked ACH account, the average commission is

1.49%. If buying bitcoin by selling another cryptocurrency you already hold in your coinbase wallet (or vice versa), then the average commission is

.50%. For example, buying $1,000 worth of bitcoin would cost

$15 from a linked bank account.

Etoro - open account

promo offer: 0% commission stocksAs an early pioneer in social copy trading, etoro was founded in israel in 2006 as a financial trading technology developer. After launching its first product, it has since grown to service over 9 million users with an innovative platform that continually evolves to be one of the largest social networks globally, with clients in over 170 countries.

Etoro charges no fees for sending or receiving transactions. Blockchain fees are applicable for sending and receiving. However, etoro does charge a conversion fee of 0.1%, set to market rates. Minimum withdrawal amounts and fees are also imposed for each type of cryptocurrency. The minimum bitcoin withdrawal amount is 0.0086 BTC and the withdrawal fee is 0.0005 units.

Kraken - kraken.Com

Kraken uses a maker-taker fee schedule with price incentives based on your trading volume over the last 30 days. For example, the average customer who trades less than $50,000 a month will pay $2.60 in fees for every $1,000 in trading volume. Fees for market makers range between 0% and 0.16%, while fees for takers range from 0.10% to 0.26%. This fee schedule, is more competitive than competitors like coinbase and gemini.

Bittrex - bittrex.Com

Bittrex has a simple pricing model, and charges a flat 0.25% on all trades. At this commission rate, it would cost $2.50 to buy $1,000 worth of bitcoin (BTC). Higher-volume traders, those trading more than $25,000 a month, should look at kraken for discounted pricing.

Gemini is much more expensive than other exchanges, charging between $0.99 - $2.99 on transactions under $200, and 1.49% on orders over $200. This means it would cost $14.90 to purchase $1,000 worth of bitcoin (BTC). Overall, gemini is the most expensive crypto exchange included in this guide, charging more than five times what other exchanges would charge for the same transaction.

Robinhood

Robinhood crypto does not charge a commission for placing crypto trades; however, it generates tiny profits from each order as it is routed. This routing practice, known as payment for order flow (PFOF), is also how robinhood makes money from stock trades. In their user agreement, robinhood crypto states that they may receive activity-based rebates from crypto exchanges, brokers, and market-makers, among other crypto intermediaries. Bottom line, since robinhood is not transparent with its pricing structure, there is a possibility the all-in costs per trade are actually much higher than some competitors. Unfortunately, there is no way to know for certain.

Pricing details per exchange

Final thoughts

Trading cryptocurrencies is becoming more widespread as investors around the globe become more comfortable with blockchain technology and the exchanges that offer online crypto trading. Security enhancements for digital wallets continue to improve as well, providing traders more confidence that buying bitcoin is safe.

Read next

Explore our other online trading guides:

About the author: blain reinkensmeyer as head of research at stockbrokers.Com, blain reinkensmeyer has 18 years of trading experience with over 1,000 trades placed during that time. Referenced as a leading expert on the US online brokerage industry, blain has been quoted in the wall street journal, the new york times, and the chicago tribune, among others.

About the author: steven hatzakis steven hatzakis is the global director of research for forexbrokers.Com. Steven previously served as an editor for finance magnates, where he authored over 1,000 published articles about the online finance industry. Steven is an active fintech and crypto industry researcher and advises blockchain companies at the board level. Over the past 20 years, steven has held numerous positions within the international forex markets, from writing to consulting to serving as a registered commodity futures representative.

All pricing data was obtained from a published web site as of 01/20/2020 and is believed to be accurate, but is not guaranteed. For stock trade rates, advertised pricing is for a standard order size of 500 shares of stock priced at $30 per share. For options orders, an options regulatory fee per contract may apply.

Advertiser disclosure: stockbrokers.Com helps investors across the globe by spending over 1,000 hours each year testing and researching online brokers. How do we make money? Our partners compensate us through paid advertising. While partners may pay to provide offers or be featured, e.G. Exclusive offers, they cannot pay to alter our recommendations, advice, ratings, or any other content throughout the site. Furthermore, our content and research teams do not participate in any advertising planning nor are they permitted access to advertising campaign data. Here is a list of our partners.

Disclaimer: it is our organization's primary mission to provide reviews, commentary, and analysis that are unbiased and objective. While stockbrokers.Com has all data verified by industry participants, it can vary from time to time. Operating as an online business, this site may be compensated through third party advertisers. Our receipt of such compensation shall not be construed as an endorsement or recommendation by stockbrokers.Com, nor shall it bias our reviews, analysis, and opinions. Please see our general disclaimers for more information.

© 2021 reink media group LLC.

All rights reserved.BC bitcoin cryptocurrency broker – review

Details

product name BC bitcoin cryptocurrency broker fiat currencies GBP, EUR cryptocurrencies BTC, ETH, BCH, XRP, LTC, EOS, XLM, USDT, ADA, MCO & 110+ more deposit methods bank transfer

credit card

debit card

bank transfer (SEPA)

wire transfertrading fee fees vary deposit fees none withdrawal fees none - Local support from UK headquarters

- Buy crypto in EUR or GBP

- Direct deposits available

- User-friendly interface

- Buy/sell calculator displays fees prominently

- Wide selection of cryptocurrencies

- Transfers limited to business hours

- No live trading chart view

- Not regulated

Andrew munro

Andrew munro is the cryptocurrency editor at finder. He was initially writing about insurance, when he accidentally fell in love with digital currency and distributed ledger technology (aka “the blockchain”). Andrew has a bachelor of arts from the university of new south wales, and has written guides about everything from industrial pigments to cosmetic surgery.

What's in this guide?

- Which fiat and cryptocurrencies are supported?

- Which payment methods are accepted?

- What's it like to use BC bitcoin?

- What are BC bitcoin's fees and limits?

- How fast will my funds be available?

- Is BC bitcoin safe to use?

- Customer support

- How do I create a BC bitcoin account?

- In a nutshell

- Compare alternatives

- Frequently asked questions

Which fiat and cryptocurrencies are supported?

- Supported fiat currencies: GBP, EUR

- Supported cryptocurrencies: approximately 122 cryptocurrencies

What cryptocurrencies are supported?

- BTC

- ETH

- XRP

- BCH

- EOS

- LTC

- ADA

- XLM

- MIOTA

- TRX

- IOST

- SNT

- DGB

- AION

- WTC

- BAT

- LRC

- ELF

- ARK

- ARDR

- NEO

- XEM

- VET

- USDT

- ETC

- ICX

- QTUM

- BNB

- OMG

- ZIL

- POLY

- KNC

- GAS

- RDD

- MONA

- FUN

- HT

- SYS

- LINK

- POWR

- LSK

- BTG

- AE

- ONT

- NANO

- STEEM

- ZRX

- SC

- WAN

- DCR

- WAX

- MAID

- FCT

- MCO

- HOT

- NEBL

- ETN

- BFT

- GTO

- MANA

- WAVES

- BTM

- BTS

- BCD

- REP

- STRAT

- MKR

- PPT

- DOGE

- GNT

- GBYTE

- REQ

- THETA

- CND

- ZEN

- NXS

- CS

- VTC

- ENJ

- DATA

Which payment methods are accepted?

- Bank transfer

- Credit card

- Debit card

- Bank transfer (SEPA)

- Wire transfer

go to BC bitcoin's websiteWhat’s it like to use BC bitcoin?

1. Signing up

You can sign up for an account on the homepage by selecting the register option. Enter your email address and password to get started.

2. Buying cryptocurrency

Explore the wide range of coins available on BC bitcoin. To buy any listed coin, just select it and choose how much you want to purchase.

3. Selling cryptocurrency

To sell any listed coin, just select the one you want then let the team know so it can give you a free valuation.

4. Customer service

Get your questions answered quickly by using BC bitcoin's customer service desk.

What are BC bitcoin’s fees and limits?

Platform trading fees

Trading fees vary depending on the amount you’re buying and selling and typically range from 1% to 5%.

You can see a live breakdown of fees on the “buy coins” page. Enter the amount of cryptocurrency you wish to buy and the currency you will pay with. A quote for transaction costs and platform fees will then be displayed.

As cryptocurrency prices can fluctuate by the second, the quote might vary slightly from the actual fee once the payment is processed.

Limits

You can buy or sell up to 25 BTC on BC bitcoin’s brokerage service online. If you’re looking to make higher-value transactions through BC bitcoin, you can contact BC bitcoin about its over-the-counter (OTC) service through its support or online form.

How fast will my funds be available?

Transfer times typically range from same-day to over 1–2 business days.

BC bitcoin’s business hours are on monday to sunday from 8am to 8pm. Requests made outside this period will be processed the next business day.

Cryptocurrency transfers

From 5-10 minutes

Fiat transfers

From same day to 1-2+ days

- Fiat to UK bank accounts: same day

- Fiat to EU accounts: 1 day+

- Fiat to other bank accounts: 1-2 days+

Is BC bitcoin safe to use?

- Verification process. You’ll need to complete a strict verification process before you can start trading on BC bitcoin. This includes providing and verifying your email address and phone number, as well as uploading a photo of your ID and providing proof of your address.

Customer support

Customers will be able to speak with a representative by emailing info@bcbitcoin.Co.Uk or calling +44 (0)1992 313 263.

How do I create a BC bitcoin account?

Step 1: create an account

To sign up for BC bitcoin, go to the “register” button, where you can enter your details.

Step 2: verify your account

BC bitcoin verification requires you to provide:

- Personal identification information. Full name, date of birth, age, nationality, gender, signature, photographs, phone number, home address and email.

- Formal identification information. Passport number, driver’s licence details and national identity card details.

- Financial information. Bank account information, transaction history, trading data, solicitor letters and company formation documents.

- Transaction information. Information about transactions made using BC bitcoin’s services, such as blockchain ids, the amount, timestamp and/or recipient address.

- Online identifiers. Geo location/tracking details, OS, browser name and version and/or personal IP addresses.

- Usage data. Information provided to BC bitcoin’s support team, security questions, user ID and other data collected via cookies and similar technologies.

Once you have been verified, you can start trading.

Step 3: start trading

You can pay in a range of common fiat currencies through bank transfers.

In a nutshell

- Local support from UK headquarters

- Allows users to buy directly in GBP or EUR

- Direct deposits available

- User-friendly interface

- Buying/selling calculator displays fees prominently

- Wide selection of cryptocurrencies

- Transfers limited to business hours

- No live trading chart view

- Not regulated

Compare alternatives

Frequently asked questions

Which countries and currencies does BC bitcoin accept?

BC bitcoin is a british company, but supports both EU and GBP and customers from many countries. BC bitcoin is unable to trade with US residents.

BC bitcoin also does not support users from algeria, ecuador, north korea, bolivia, cambodia, bangladesh, iran, and nepal.

If you’d like to know the full list of supported countries or restricted regions, reach out to BC bitcoin’s customer support team or check its website. If you’d like to pay with a currency other than EUR or GBP, you can also contact BC bitcoin.

Which forms of ID does BC bitcoin accept for account verification?

Can I withdraw funds to a non-british bank account?

Can I use BC bitcoin without verifying my account?

No, only verified users will be able to access and use the site.

How long will verification take?

Once you’ve submitted an account application, BC bitcoin’s verification team will contact you via call or email within 48 hours.

How do I speed up verification?

If you’ve submitted everything according to the instructions and it’s taking a while, it might just mean BC bitcoin is dealing with a high volume of applications.

Bitcoin broker fees

Top 10 best forex brokers accepting bitcoin 2021

Cryptocurrencies have been grown during recent years rapidly and more people are now using them either as a way of transactions or trading them. That’s why I decided to find the best top 10 forex brokers accepting bitcoin for deposit and withdrawal.

Although there are some forex brokers apply bitcoin as a way of transactions, most brokers in the industry haven’t adopted that yet.

You'll see in this article:

Why traders use bitcoin for deposit and withdrawal?

There are a few reasons that a trader may want to use bitcoin for deposit and withdrawal. Let’s take a look at them.

Bitcoin is the only available option

One of the reasons that traders might choose bitcoin in particular or any other cryptocurrencies in general as the way of transactions to their brokers is that they are living in a country that there are some limitations for forex trading.

For example, if you live in the US, there are some rules and regulations that prevent or limit you from using some features or strategies.

For instance, you can’t use more than 1:50 as leverage if you go with a broker that is under the watch of CFTC, the commodity futures trading commission.

That’s not a bad rule in general because prevents retail traders from losing their money, however, if you are a professional trader who is fully aware of money management, trading on leverage, and the risk involved in such a trading; low leverage can be a pain in the neck.

Since offshore brokers offer higher leverage, the traders seeking that kind of leverage are willing to pick them, however, they can’t deposit and withdraw using common methods such as credit cards or bank wires, and the only available option for them is cryptocurrencies.

That’s why they need forex brokers accepting bitcoin or other cryptos as payment options.

There are some other examples from other countries where forex is somehow illegal but the rules are gray and there isn’t a solid tax system so people tend to use cryptocurrencies.

Avoidance of document submission

Another reason is that some people don’t want to share their documents with forex brokers or they want to be anonymous.

Forex brokers have a good reason for asking documents such as proof of ID or proof of address because their regulatory bodies request such documents because of preventing money laundry or anti-terrorism purposes.

On the other hand, there might be reasonable arguments for traders reluctant to give such documents to brokers. One reason could be they don’t want their information to be exposed because of identity theft.

Although it might be the case when we are talking about new unregulated brokers, that barley happens in an unregulated broker that has been around for years and has a good reputation and almost impossible to happen in a well-regulated forex broker.

Another reason that some people don’t want to submit their documents is that they don’t have them. For instance, they can’t provide documents such as utility bills or bank statements which either of them is necessary for the proof of their address.

For whatever reason that you don’t want to or can’t provide the necessary documents for the verification of your account, you need to know all the regulated brokers ask for those documents and there isn’t a single one that does the opposite.

They ask you because the financial authorities that have regulated them request such documents so basically the brokers don’t have any other choices but to ask for the documents.

Even almost all unregulated forex brokers ask such documents, however, there are a few of them that don’t — one of the brokers in our top 10 is one of the few ones.

Transaction fee

The next reason that some people are willing to use bitcoin for deposits and withdrawals is that they want to pay less for their transactions.

As you know, payment options such as online payments, wire banks, or credit cards each charge a fee when you deposit or withdraw money.

Bitcoin is not an exception and when you deposit and withdraw, fees are charged. This is the explanation of blockchain about the fees that are charged:

However, there are some forex brokers that reimburse the fees of deposits and withdrawals. They do that as the bonus they provide to their clients — none in the table means that.

Best forex brokers accepting bitcoin for deposit and withdrawal

Here’s a list of top 10 forex brokers that accept bitcoin for deposit and withdrawal.

- Hotforex

- FXTM

- FX choice

- Justforex

- Coinexx

- Paxforex

- IFC markets

- Liteforex

- Grand capital

- Trader’s way

- Cryptorocket

- Eaglefx

It’s actually 12 brokers but for the sake of the title of this article, let’s called it top 10

Brokers general info regulation platform deposit fee&time

/

withdrawal fee&timedocuments

verificationbanned countries

Min withdrawal: 0.003 BTC

Min withdrawal: 0.001 BTC

Min withdrawal: 0.002 BTC

Min withdrawal: 0.001 BTC

*POI stands for proof of identity such as ID cards, passport, driver’s license, and etc

**POA stands for proof of address such as utility bills, bank statements, and etc

The brokers that have no in their deposit/withdraw fees cover the fees as a bonus

Best cryptocurrency brokers for 2021

Daniel ‘harris’ major

I have tested 40+ crypto brokers. You can find the best cryptocurrency brokers below. This is by far the easiest way to get started with cryptocurrencies.

Cryptocurrency trading has become really popular in the past years. It’s growing more ever year.

Many big trading brokers have already added some of these cryptocurrencies. Everybody can sign up and start trading bitcoin or other crypto coins. This is the easiest and probably the simplest way to invest in cryptocurrency.

After trying out most brokers, here are the best cryptocurrency brokers:

Best cryptocurrency brokers (non-US traders only)

Plus500 – top rated trading platform

Plus500 is a big name in the trading industry. They have a really low minimum deposit requirement and a great trading site.

Buy/sell cfds on bitcoin in addition to buying stocks, commodities, forex etc (traded only through cfds). Plus500 is the most complete trading platform.

- Trade cfds on bitcoin & many other cryptos

- Minimum deposit is only $100

- Regulated and trusted platform

- Very fast signup process

- Live chat

- Many payment methods (even paypal)

- You cannot withdraw any cryptocurrency

- You have to complete a questionnaire, upon sign up

Plus500 disclaimer: 76.4% of retail CFD accounts lose money.

IQ option – lowest minimum deposit ($10)

If you don’t want to make a huge initial investment, then IQ option is the best broker for you. The minimum deposit requirement is only $10. This is by far the lowest in the industry.

- You can trade many cryptocurrencies

- Minimum deposit is only $10

- Best trading platform

- Multiple account currencies

- Free demo account

- Regulated by CYSEC (#247/14)

Etoro – top crypto broker

Etoro is a really popular trading site. They have been around since 2006. Etoro is regulated by CYSEC, FCA and ASIC.

Buy/sell bitcoin on etoro in addition to buying stocks, commodities, forex etc. Etoro is the most complete trading platform.

- Trade bitcoin & many other cryptos

- Minimum deposit is $200

- Regulated and trusted platform

- Australian traders are also accepted

- Great support team

- Many payment methods (even paypal)

- You cannot withdraw any cryptocurrency

- You have to complete a questionnaire, upon sign up

Etoro disclaimer: 71% of retail CFD accounts lose money.

Highlow – best all-round crypto broker

Due to regulation highlow stopped accepting traders from the EU and UK.

Highlow is an australian trading broker (AFSL no.364264). What I like most about this broker is the intuitive platform. It is so easy to use. Especially new traders will like the clean layout.

I’ve been using highlow for a few years now and I never had a problem. Highlow publishes their number of trades on the homepage. There are millions of trades on this broker each month.

I use the main platform which is web based. This means, that you don’t have to download any software. This platform is stable and safe (they use SSL).

I have also tried the ios app and the android app. They are great, but I just don’t like trading on smartphones in general.

The payouts on highlow are amazing (up to 200%, which is more than on other brokers).

Highlow is a great broker for cryptocurrencies (but only if you are not from EU,UK, US). They have a good reputation, great support team and awesome promotions for new traders.

- Trade bitcoin & other cryptos

- Minimum deposit is only $50

- Regulated and trusted platform

- Fastest signup process (no questionnaires)

- Multiple account currencies

- Free demo account (no registration needed)

Nadex – US traders welcome

Nadex is a CFTC regulated broker. In fact, this is probably the only US broker that has this regulation.

Only US traders are allowed on nadex. Non-US traders check out the next broker.

Update OCTOBER 2019: looks like nadex removed crypto trading. After contacting them I found out that they will add it back soon. Register on nadex now and get updated when they add it.

Recently, nadex started offering bitcoin trading.

- Trade bitcoin, forex or binary options

- Minimum deposit is $250

- CFTC regulated broker

- Great support team

- Many payment methods (even paypal)

Crypto brokers with most cryptocurrencies

Here are the most popular cryptocurrencies offered by cryptocurrency brokers:

- Etoro – bitcoin, ethereum, litecoin, dash, ethereum classic, NEO and ripple.

- Plus500 – bitcoin, ethereum, litecoin, bitcoin cash, ripple, IOTA.

- Avatrade – bitcoin, ethereum, ethereum classic, ripple, dash, bitcoin cash litecoin, monero and NEO.

Lowest minimum deposit brokers

These are the best brokers with low minimum deposit requirements:

- Etoro – $200

- Plus500 – $100

- Avatrade – $100

This is really important because the crypto market itself is unregulated. Depositing on a regulated broker means that your money is safe.

We’ve also looked at the support team and the payment methods. You can deposit easily using multiple payment methods on the brokers below.

Top rated brokers that have cryptocurrencies

While we are all familiar with the broad definition of a broker, is there something more to it when it comes to cryptocurrencies?

Simply put, a cryptocurrency broker refers to a website that traders will visit to trade cryptocurrencies at a set price. In many ways, they are similar to forex brokers whose services are a lot more familiar to the general public.

Etoro disclaimer: 71% of retail CFD accounts lose money.

You still can’t decide which broker is best for you?

How to choose your cryptocurrency broker

Is leverage really necessary? Cryptocurrency markets are volatile in nature with prices fluctuating immensely thereby generating high profits even in the absence of leverage. But for some traders, the desire for more earnings justifies the use of leverage.

Before choosing your broker, settle yourself on whether the already immense profits that come from a cryptocurrency market are enough for you or you would like to use leverage to enhance them even further, bearing in mind, of course, that will also significantly increase the risk factor to your funds.

Negative balance protection: it is always advisable to trade with a broker that affords the negative balance protection facility. That way, you will never be at risk of losing more than what you invested in case you sustain very heavy losses.

How suitable is the required capital for you? This is another subjective part to your decision. Do you prefer trading with a small capital or bigger one to help you zero in on bigger returns? Find out what size trades your broker is offering before you open an account.

Narrow spreads for the win: let us be honest, it is only fair that your broker gets a cut from the money you generated having provided you with the essential facilities for it and all. But let us be honest, you definitely want every last dime for yourself.

A spread refers to the difference between the buying price and selling price of a trade and it varies with each broker. The spread is what counts as fees for your broker so the smaller it is, the lower the cost will be on your part.

Lets go into what aspects you as a trader must consider when choosing a broker to trade cryptocurrencies.

Which cryptocurrencies are you interested in trading?

Make sure you have decided on which cryptocurrencies you want to trade in before signing up with your broker.

If your choice is a prominent cryptocurrency like bitcoin (official site), litecoin (official site), or ethereum(official site), there will be a relatively broad availability of brokers that have trading options for those. However, less prevalent examples like monero, IOTA, or zcash may be a little harder to come by.

So study the cryptocurrencies being offered by a broker before you sign up for an account.

Pros and cons of cryptocurrency brokers

Here are some features that these broker have or don’t:

pros- Signup up with a crypto broker is probably the fastest way to get started with cryptocurrency trading

- If you are less tech-savvy then a broker is safer for you

- You can start buying cryptocurrency while traditional exchanges don’t always accept this payment method

- Most of the time you can’t withdraw cryptocurrencies from a broker. You have to exchange it back to fiat money (USD/EUR etc.)

Cryptocurrency brokers – what to look for

Here are some of the more understated details about your cryptocurrency broker that could make your trading experiences so much more efficient and successful.

1. What are the weekend hours like?

This is a key detail that distinguishes cryptocurrencies from other prominent trading markets like forex, futures, and equity. Cryptocurrency brokers operate during the weekends as well.

There is virtually no difference in purchasing bitcoin at the end of the week as opposed to the middle of the week during peak hours.

But there is a catch. While digital currency exchanges are available during the weekend, your broker may not (why is the stock market closed on the weekend?). So in effect, if there is considerable movement within your relevant cryptocurrency market during a weekend when your broker is not operating, you may not have the ability to respond in any way.

2. How is it hedging?

Your broker is probably not keen on revealing if it is hedging cryptocurrency traders but it is important information for you to know.

Why is it so important for you to know?

Because, as a trader, you want to be absolutely in the clear regarding the policies for risk management being followed by your broker. Let us not forget that cryptocurrency markets are extremely volatile and an unhedged broker is more easily prone to major losses incurred by its clients. Naturally, those costs will warrant compensation via fatter spreads and additional costs for traders. It will be best to sign up with a broker that will not withhold the relevant information from you.

More great features you could be interested in

Commissions and trading on margin – an important thing to note while trading cryptocurrencies is that their prices tend to be more similar to equities than they are to real currencies. So your broker could be charging you commissions in addition to a wide spread on each trade. That, of course, raises the cost probably a bit much for your liking.

Another similarity with equities is that the margin conditions with cryptocurrencies are significantly more than they are with forex or cfds. Consequently, leverage is usually up to 10x. How considerable the margin rate will be for traders is down to what trading strategies and risk management they subscribe to.

Authenticity of market data – aside from merely evaluating how it influences spreads, market data for cryptocurrency CFD prices can be a good indicator of how the quality of the product will be in the future.

One of the more recent examples of this is BTC-e which was an immensely popular platform for trading bitcoin before it was shut down by feds. BTC-e was the first bitcoin exchange to incorporate forex trades and so made their exchange accessible via MT4 and supplied cryptocurrency liquidity for brokers.

But once it was shut down, every broker that depended squarely upon BTC-e was left with no hedging options or market data to put a price on its crypto cfds.

Are short sales available? For many traders, shorting is a crucial strategy option, the lack of which can be a deal breaker with a potential broker. Many brokers tend to offer ‘long’ only since there are only a few hedging solutions when opening short trades.

As you see, investing in cryptocurrencies can be a truly lucrative venture for you but only if you get it right.

And a lot of that is down to which broker you decide to trade with.

Ready to start trading?

Trade with the cryptocurrency brokers listed above to make sure that your money is safe, you pick a broker with a stellar reputation and you keep the fees low. Excel at trading bitcoin by creating your own trading strategy.

These cryptocurrency brokers make it really easy to trade bitcoin and other coins. You don’t have to be a trading expert. It helps if you know what a blockchain is or how the ledger and transactions work, but this is all optional.

Sign up now and see for yourself how easy it is to get started.

So, let's see, what we have: looking to buy bitcoin, but don't know where to start? Read our guide on the best bitcoin brokers in 2021. We cover fees, regulation, payments, and more. At bitcoin broker fees

Contents

- Top forex bonus list

- Best bitcoin brokers – learn 2 trade full 2021 guide!

- Best bitcoin brokers – learn 2 trade full 2021 guide!

- Table of content

- What are bitcoin brokers?

- Types of bitcoin brokers

- ✔️ buying ‘actual’ bitcoin

- ✔️ buying bitcoin cfds

- 1. Fees are much lower

- 2. CFD brokers are heavily regulated

- 3. Storage and selling is seamless

- 4. Ability to apply leverage and short-sell

- Payments at bitcoin brokers

- Bitcoin broker fees

- How do bitcoin brokers work?

- Bitcoin OTC brokers – buying large amounts of bitcoin

- Buying large amounts of bitcoin summary