Bitcoin Surges Towards $11,700, Liquidating Millions, cryptocurrency brokers near 11700.

Cryptocurrency brokers near 11700

The leading cryptocurrency has now printed six days of gains in a row, suggesting it is on track for a full reversal of the september losses.

Top forex bonus list

This latest leg higher has resulted in millions of dollars worth of liquidations on futures trading platforms. Skew.Com reports that more than $3 million worth of liquidations has taken place on bitmex’s bitcoin market alone. As bitmex only makes up a small portion of the rest of the crypto futures industry, it’s fair to say that millions more were liquidated on other platforms.

Bitcoin surges towards $11,700, liquidating millions

It appears that bitcoin investors are not fazed by the prospects of a move lower due to the CME futures gap formed at $11,100. The leading cryptocurrency has continued to thrust higher, pushing towards $11,700 just minutes ago as of this article’s writing.

The leading cryptocurrency has now printed six days of gains in a row, suggesting it is on track for a full reversal of the september losses.

Related reading: here’s why ethereum’s defi market may be near A bottom

Bitcoin pushes towards $11,700

Bitcoin is thrusting towards $11,700 after weeks of consolidation between $10,000 and $11,000. The leading cryptocurrency is about to hit $11,700, having pushed 3% higher in the past 24 hours alone. Over the past five days, the cryptocurrency has rocketed from around $10,600 to $11,700, marking a gain of over 10%.

This latest leg higher has resulted in millions of dollars worth of liquidations on futures trading platforms. Skew.Com reports that more than $3 million worth of liquidations has taken place on bitmex’s bitcoin market alone. As bitmex only makes up a small portion of the rest of the crypto futures industry, it’s fair to say that millions more were liquidated on other platforms.

According to crypto derivatives tracker bybt, the funding rates of leading futures exchanges are starting to lean positive across the board for the first time in a number of weeks. This suggests that longs are starting to become more aggressive than shorts. As long as the funding rate remains low, there should not be an immediate concern for long holders.

Related reading: tyler winklevoss: A “tsunami” of capital is coming for bitcoin

All eyes on stimulus discussions

Portions of this rally have been triggered by expectations of another U.S. Stimulus bill passing, which would result in the U.S. Dollar losing value.

It is important that cryptocurrency investors watch these discussions moving forward to ensure that they have a comprehensive view of bitcoin’s price action.

Bitcoin hits fresh record above $11,700

Investing.Com - the price of bitcoin rose to fresh record highs above the $11,700 level on sunday as investors awaited the start later this month of bitcoin futures trading, a potentially major step in the evolution of the digital currency.

On the U.S.-based bitfinex exchange, bitcoin was at $11,661.00 by 08:25 AM ET (13:25 GMT) after earlier hitting a high of $11,780.00, the highest level in its nine-year history.

The U.S. Commodity futures trading commission said friday it would allow two major exchanges to launch bitcoin futures.

CME group, the world's largest derivative exchange operator, said its bitcoin futures would launch december 18 while cboe global markets said it will shortly announce the start date for its new bitcoin contract.

Bitcoin’s price has risen dramatically in 2017. For the year, bitcoin is up more than 900%, having started 2017 at $968.23 and is the biggest gainer of all asset classes this year.

Its meteoric rise has prompted warnings of an increasingly volatile bubble amid signs that it is moving from the periphery of finance towards the mainstream.

CFTC chairman J. Christopher giancarlo on friday warned investors over bitcoin’s extreme volatility.

“market participants should take note that the relatively nascent underlying cash markets and exchanges for bitcoin remain largely unregulated markets over which the CFTC has limited statutory authority,” he said.

“there are concerns about the price volatility and trading practices of participants in these markets.”

Last week goldman sachs CEO lloyd blankfein claimed that bitcoin was “a vehicle to perpetrate fraud” as the value of the cryptocurrency plunged 20% in less than 24 hours.

The comments came after bitcoin topped $11,000 to reach a new record high of $11,395 on wednesday; then fell to a low of $9,000 on thursday, before picking up slightly later in the day.

Blankfein became the latest boss of a major bank to criticize bitcoin, after JP morgan’s chief executive jamie dimon described it as fraud that would ultimately blow up.

Elsewhere in cryptocurrency trading, bitcoin cash was last at $1,595.00, while bitcoin gold was at $323.64.

Ethereum , the second most valuable cryptocurrency by market cap after bitcoin, was at $476.59.

Cryptocurrency market news: bitcoin stares into the abyss as $12,000 hurdle holds

Here is what you need to know on tuesday, august 11, 2020.

Markets:

Bitcoin price continues to struggle with building bearish pressure at $12,000. All attempts made from monday to rise and hold above $12,000 have all ended up in losses towards the short term support at $11,800.

Meanwhile, BTC/USD is trading at $11,774 after adjusting from the intraday high traded at $11,942. Support at $11,800 continues to keep the selling pressure in check as the bulls focus on breaking the resistance at $12,000.

Ethereum just like bitcoin is not able to overcome the resistance at that key level of $400. Trading on monday brushed shoulders with this seller congestion zone but a reversal occurred with ETH/USD retesting support at $395. ETH/USD is exchanging hands at $392 after a minor 1.2% loss on the day. The low volatility means that rapid price actions will be limited.

Ripple price is the only one among the major coins that are trading relatively in the green having soared above $0.30. XRP/USD is trading at $0.3026 amid a building bullish trend. As reported earlier, ripple has the potential to contain the price above $0.30 as buyers plan on staging another attack on the seller congestion at $0.31.

Among the top 50 cryptocurrencies, some altcoins are performing well. The tokens that have printed gains in the last 24 hours according to the data by coinmarketcap include chainlink (8.16%), tezos (8.88%), cosmos (23.55%), ontology (17.43%), band protocol (45.99%) and ren (31.95%).

Chart of the day: XRP/USD 1-hour

Market:

Bitcoin tested $12,000 again on monday but failed to sustain gains to higher levels as discussed earlier. At the moment, the price is trading lock-step between support at $11,700 and the weekly high at $12,084. The head of research at bequant, a digital assets broker in london, denis vinokourov attributed the spike above $12,000 to leverage. Both short and long positions on exchanges such as bitmex were liquidated during the spike to $12,084 and the immediate fall to $11,800. According to vinokourov, “with perpetual rates that are flat to slightly positive, leverage flow will likely try its luck again and look to squeeze into the mid-$12,500 zone.

Industry:

As defi booms in the cryptocurrency market, one of the leading projects in the ecosystem, compound is preparing to launch a decentralized oracle. The open price feed will see the network better manage its lending system. The oracle is currently in trial on various networks including the ethereum’s kovan and ropten testnet. The live price feeds have also been executed on the mainnet for over ten days now. The system continues to be audited with every new feature that is added. It relies on price feed from reporters (exchanges such as coinbase) and posters (those who post on the blockchain).

Regulation:

According to swiss media, the liechtenstein financial market authority (FMA) has rejected the proposal by the union bank to have the CEO of binance, changpeng zhao as a “major” shareholder. The report by the media pointed out that the investment from zhao would have allowed union bank to keep operating and therefore avert closure due to both the financial and legal issues it has been facing. Union bank intended to rebrand itself into a crypto oriented bank. However, it has been forced to continue with the liquidation process.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. Fxstreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in open markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of fxstreet nor its advertisers.

Cryptocurrency market news: OMG network spikes 100% in 24 hours as bitcoin stalls under $12,000

Here is what you need to know on friday, august 21, 2020.

Markets:

Bitcoin price is settling for consolidation after recovery stalled under $11,900. Short term support has been formed at $11,800. Other lower support areas include $11,700 and $11,600. If the technical picture continues to improve, we can expect a breakout above $12,000 during the weekend session.

Ethereum is teetering at $414 following a minor retreat from intraday highs at $418. On the downside support at $410 is important to the bulls because it continues to accord them the anchor needed to plan for the next run-up above $420 and $430 respectively.

Ripple has not been able to recovery above $0.30 after the second retreat from highs above $0.32 in the month of august. For now, resting upon the support at $0.28 is vital to the bulls as it allows them to gather strength for a third breakout past $0.30 in the same month.

NEO is among the best-performing cryptoassets in the market, ignoring the bearish wave. The digital asset has rallied over 7% on the day and continues to build momentum for a run-up above $20.

Consequently, there are some altcoins also performing well. They include monero (10.44%), IOTA (15.03%), OMG network (108%), NEM (12.08%), ontology (20.06%), basic attention token (16.28%) and ox (41.09%).

Chart of the day: OMG/USD 1-hour

Market:

A report by grayscale investments says that the prevailing BTC market structure mimics “that of early 2016 before it began its historic bull run.” the fund management company says that demand for bitcoin is set to skyrocket amid rapidly increasing inflation. Using on-chain metrics, the report found that there has been a significant increase in long term holders as compared to short term speculation even during historic lows. Moreover, BTC daily active addressee has hit levels not seen since the all-time highs in 2017.

Industry:

Ethereum is dealing with a blowback following news said its final testnet in the journey leading to the launch of ETH 2.0 flopped massively. However, raul jordan, an editor at prysmatic labs reckons that the claims are ridiculous and in spite of the drawback will not delay the launch date for ETH 2.0. The drawback happened on august 14 where a bug purged most of the validators on the testnet, sending them offline. Critics of the ethereum network such as bitcoin SV blog coingeek jumped on the opportunity saying, “you can expect significant delays in the launch of ETH 2.0.”

Regulation:

INX exchange is set to launch its much-anticipated initial public offering (IPO) on august 24, 2020. The IPO will see the exchange front the tokens in the market at $0.90 in a bid to raise $111 million minus the expenses as per the filing with the securities and exchange commission (SEC).

The token is making history by being the first to be registered with the SEC and giving regular investors a legal opportunity to participate. The INX tokens are now regarded as hybrid because they bring forth features of security and utility tokens. In addition, they are also regarded as shares in the company.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. Fxstreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in open markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of fxstreet nor its advertisers.

Latest crypto news

Latest crypto news & analysis

Editors’ picks

Bitcoin bull cycle temporarily on hold as altcoins bleed

The cryptocurrency market has opened the week's trading in substantial losses. The market is mainly painted red after bitcoin pulled the majority of cryptocurrencies down. BTC slumped from price levels above $40,000 to an intraday low of around $32,000.

EOS price takes a 20% nosedive after block.One CTO, dan larimer, resigns

EOS experienced a gruesome weekend as the price tanked by more than 20% amid the news that dan larimer had resigned as the chief technology officer (CTO) of block.One. Larimer wrote on voice.Com that he had enjoyed his four-years at block.One but “all good things must come to an end.”

LINK hunts for a local bottom as bulls prepare 40% upswing to $20

Chainlink, alongside ethereum, ripple, litecoin and polkadot, is leading the steep altcoin correction. The breakdown occurred in tandem with bitcoin's slump from highs above $40,000 toward $30,000.

Sushiswap's trading volume skyrockets, SUSHI price set to follow

Sushiswap trading volume has increased significantly over the last 30 days. Santiment shows the volume has increased from $130 million to a 30-day peak of $593 million, representing a 78% growth.

BEST CRYPTO BROKERS/EXCHANGES

Bitcoin weekly forecast: santa rally takes BTC to new all-time high, more fun ahead

It's been a momentous week for bitcoin. The pioneer cryptocurrency broke above psychological $20,000 and hit a new all-time high at $23,770. Since the beginning of october, the coin's value more than doubled; those who were wise enough to buy some BTC in the middle of march got away with 500% returns on their investments.

Crypto partners in your location

Note: all information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Bitcoin extends three-day gains as it jumps above $11,700

Investing.Com - bitcoin extended its rally on thursday, gaining steam for the third-day in a row, even as trading remained thin.

Bitcoin jumped 5.1% to $11,746.90 as of 8:15 AM ET (12:15 GMT) on the investing.Com index. It’s been on a volatile journey for the cryptocurrency lately, reaching a high of $13,929.8 just one week from mid-june, when it was at $7,888.

Other digital coins were mixed, with ethereum up 1% to $293.49 and XRP falling 1.3% to $0.439233 while litecoin surged 3.7% to $123.12.

Trading is expected to be thin, as markets in the U.S. Are closed for the independence day holiday.

The U.S. House of representatives committee on financial services requested that facebook (NASDAQ: FB ) stop developing its cryptocurrency, libra.

In a letter sent on tuesday, the committee said the project could lead ”to an entirely new global financial system that is based out of switzerland and intended to rival U.S. Monetary policy and the dollar.” such a rivalry could cause privacy, national security and monetary policy concerns, the lawmakers said.

Over 30 advocacy groups have asked congress to implement an official moratorium on libra development.

In other news, the UK’s markets watchdog is proposing banning the sale of derivatives based on crypto-assets to retail consumers from early 2020.

Prices of digital coins are volatile, which the financial conduct authority says are ill-suited for retail investors who don’t understand all of the risks involved.

"we estimate the potential benefit to retail consumers from banning these (derivative) products to be in a range from 75 million pounds ($94 million) to 234.3 million pounds a year," the watchdog said.

-reuters contributed to this report.

Related articles

Responding to tweets from elon musk and ben mezrich about payments in bitcoin, vocal bitcoin critic peter schiff has said that getting paid in bitcoin “makes no sense.” mezrich.

Bitcoin (BTC) whales in south korea have been selling heavily across major exchanges throughout the past week. Data shows that multiple $100 million deposits to bithumb have been.

Daniel larimer, the CTO of EOSIO developers block.One and founder of early crypto exchange bitshares and blockchain-based social media platform steem, announced in a short blog.

We encourage you to use comments to engage with users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

- Enrich the conversation

- Stay focused and on track. Only post material that’s relevant to the topic being discussed.

- Be respectful. Even negative opinions can be framed positively and diplomatically.

- Use standard writing style. Include punctuation and upper and lower cases.

- NOTE : spam and/or promotional messages and links within a comment will be removed

- Avoid profanity, slander or personal attacks directed at an author or another user.

- Don’t monopolize the conversation. We appreciate passion and conviction, but we also believe strongly in giving everyone a chance to air their thoughts. Therefore, in addition to civil interaction, we expect commenters to offer their opinions succinctly and thoughtfully, but not so repeatedly that others are annoyed or offended. If we receive complaints about individuals who take over a thread or forum, we reserve the right to ban them from the site, without recourse.

- Only english comments will be allowed.

Brokers to trade cryptocurrencies online

Cryptocurrencies have taken up the fintech industry by storm. This revolutionary alternative to fiat currency or real money is decentralized and peer-to-peer, which means that transactions are fulfilled in real-time since users don’t have to wait for a central entity to process and approve the transfer of funds.

Aside from the ease of sending and receiving these digital assets, people are trying their hand at trading them to expand their cryptocurrency wallets. As with traditional stock trading, you should look for the best forex brokers for crypto for a secure platform.

Here are the top forex brokers for cryptocurrency trading:

1. Etoro

Etoro is a multi-asset brokerage company with registered offices in israel and the united kingdom. It has a social trading program on its website that allows you to follow featured investors and see their investing profiles.

You can use their platform to invest in stocks and cryptocurrencies. Also, you can trade contract for difference or CFD assets. You can buy bitcoin and altcoins like ethereum, ripple, dash, litecoin, and cardano. The company assures users that you won’t have to pay for markups and other fees like for ticketing or managing your portfolio.

2. Swissquote

This swiss online financial platform aims to be a complete banking environment where you can manage and trade traditional and digital funds. They offer safety and security of your assets, diversification of your portfolio, and more straightforward transfers between third-party wallets and your account.

You can trade bitcoin, ethereum, litecoin, ripple, and bitcoin cash with them. They charge a small fee from transactions, depending on the amount. Crypto trading with swissquote requires you to hold a trading account with the company and deposit cash in euro or US dollars.

The platform only acts as a custodian for clients’ cryptocurrencies and doesn’t permit withdrawals from their digital wallet yet. The bank partnered with bitstamp to provide crypto liquidity. This factor allowed them to collateralize their crypto holdings while ensuring that customer accounts are safe from cyberattacks.

3. IC markets

This is an australian-based online forex and CFD broker. You can trade real money or cryptocurrency with the platform. They have crypto CFD where you speculate on the rise and fall of bitcoin and altcoins, then buy or sell depending on the most optimal time.

For instance, you decide to purchase two bitcoin contracts at 4,000 USD, which is the cryptocurrency’s opening price against USD. You have the option to sell the contract at the end of the trading day or a month later. If it increased to 4,300 USD and you choose to sell your contracts at that point, you get a gross profit of 600 USD.

You can trade bitcoin, ripple, litecoin, dash, EOS, emercoin, namecoin, and peercoin, among others. Moreover, their use of a private electronic communication network or ECN means that you won’t have to worry about trade intervention between clients and the market.

4. FBS

FBS considers itself as an international broker with a massive client base of 13 million traders. Their headquarters is in belize, and the company offers users with deposit insurance of up to 100 percent, as well as negative balance protection.

The platform offers these six account types:

- Standard – you can open this account with 100 USD, and it comes with a maximum leverage of up to 3000:1. The fees are computed over a variable spread.

- Cent – if you want to test out the platform first, they have the cent account where you just need to deposit one dollar. Cent lots are also available for trading, and you get a maximum leverage of 1000:1 with average spreads beginning at one pip.

- Micro – the deposit for this account starts at 5 USD with fixed spreads beginning at three pips. Fees are also made clear to each user before they start the venture.

- Zero spread – there’s no spread with this account, but you need to pay a commission that starts at 20 USD per lot RT. It can be managed with deposits from 500 USD.

- ECN – with an ECN account, you get direct access to interbank trading with an initial deposit of 1,000 USD. There’s also no set spread, and you’re required to pay six dollars per lot. Maximum leverage is constant at 500:1.

- Unlimited – this type offers the same features as the standard account. However, it has smaller, floating spreads beginning from 0.2 pips. Leverage can go as high as 500:1. You can start trading under this profile with a minimum deposit of 500 USD.

FBS users can take advantage of the popular metatrader 4 or the younger MT5 version. Both trading platforms provide you with an extensive range of leverage, as well as trade executions without the need for another quotation.

MT features are available for all six accounts. You can work with expert advisors, delve into micro-lot trading, one-click trading, and stay updated through the embedded news section.

5. Thinkmarkets

This broker offers regulated forex and cfds on several asset classes even with cryptocurrencies. It has its registrations in australia and the UK. There are three account types to choose from and a different account for its trade interceptor platform.

Here’s a brief look at the platform’s three account types:

- Standard – this account requires a minimum deposit of 250 USD. You won’t need to pay per-trade commission. Instead, it has wider spreads with compatibility on MT4.

- PRO – the PRO account has lower spreads than the standard type. It has three units per side commission, with six units per RT. You need a minimum account balance of 2,000 USD to be eligible for this account. It can only be useful on the MT4 platform.

- VIP – with this account, the commission rate is negotiable according to the clients’ history and relationship with the platform. It is not available for trade interceptor accounts, though.

Conclusion

Cryptocurrency trading is a lucrative venture to earn extra income and multiply your digital assets. If you’re worried about the volatility of bitcoin and altcoins, opting for a broker platform may assuage your concerns. These channels are registered and licensed to ensure that your funds are secure and safe from cyberattacks.

Note: this article is for an informational purpose only. Coinpedia is not responsible for the accuracy of the content provided in the article. Thereby, readers are advised to consider the company’s policy & T&C before making any investment.

Bitcoin price prediction: BTC/USD returns below $11,000, erases yesterday’s gain

Last updated: 20 september 2020

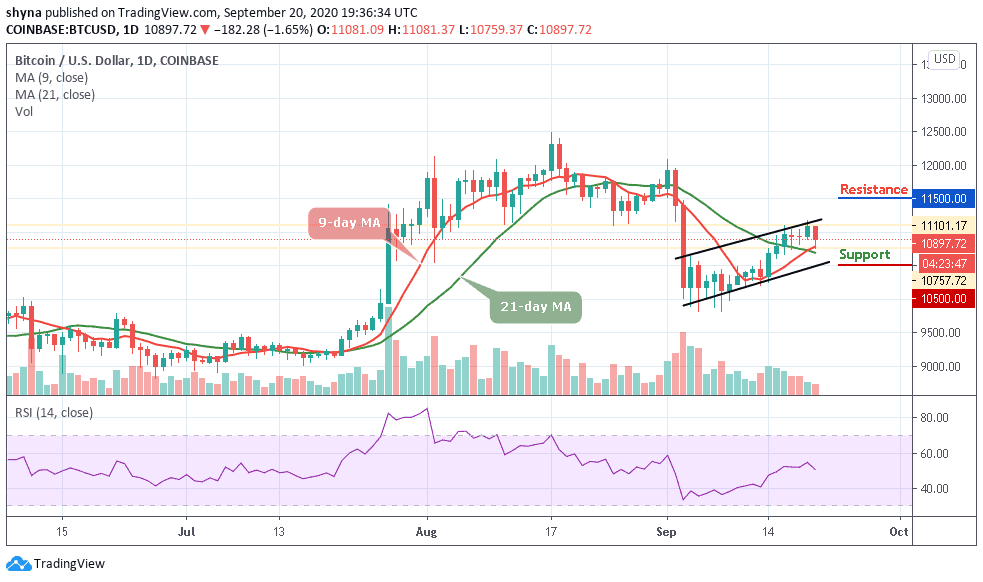

Bitcoin (BTC) price prediction – september 20

Today, the bitcoin price is seen plunging from over $11,000 to touch the low of $10,759.

BTC/USD long-term trend: bearish (daily chart)

Resistance levels: $11,500, $11,700, $11,900

Support levels: $10,500, $10,300, $10,200

BTC/USD drops below $11,000 during the early asian hours of trading but the coin failed to recover above the critical level so far. At the time of writing, the price of bitcoin is moving around $10,897 as the coin is down with 1.65% within 24 hours. The number one cryptocurrency hit a brick wall on the approach to $10,700 and dropped under the pivotal area in a matter of hours.

What to expect from bitcoin (BTC)

An upside break above the 9-day and 21-day moving averages around is a must to start a substantial recovery. Once this happens, the next hurdles may be seen near the resistance levels of $11,500, $11,700, and $11,900. On the downside, initial support is near the 21-day MA at the $10,600 level and if there is a successful break below this level, the bears are likely to gain strength by bringing the price to a low of $10,500, $10,300, and $10,100 respectively.

Currently, bitcoin price follows a dominant bearish bias and a glance at the technical indicator RSI (14) displays a negative picture for BTC in the near-term. In addition, maintaining a gradual downward trend in the negative region, the signal line of RSI (14) decreases as it faces a downward trend for an increase in selling entries.

BTC/USD medium – term trend: bullish (4H chart)

Looking at the 4-hour chart, bitcoin’s price is currently trading around $10,883 and below the 9-day and 21-day moving averages after falling from $11,081 where the coin started trading today. Whereas, the 4-hour chart shows that the bullish supply is coming up slightly in the market while the sellers are trying to drag the price down.

Moreover, if the buyers can strengthen and re-group, they can further push the price back to an $11,000 resistance level. Therefore, breaking the mentioned resistance could also allow the bulls to test the $11,100 and above. Meanwhile, the market is indecisive as the RSI (14) indicator moves below the 50-level, but any further movement below the lower boundary of the channel may reach the support level of $10,650 and below.

Cryptocurrency brokers near 11700

Your daily cryptocurrency market analysis news brought to you by the cryptoaltum cryptomenon team.

This analysis was written at 9:00 am GMT +3, on 20.10.2020

It only took the market a couple of days to bounce back from the news from okex. The cryptocurrency market remains steadfast in the current environment and the news dies down and things become a lot more manageable. The current move higher in this market holds up as investors seem to look forward to positive momentum. With that said, let’s find out what today holds for the cryptocurrencies on october 20th, 2020.

Cryptocurrency recap

Our cryptocurrency trio - bitcoin, ethereum, and ripple - have managed to finally shrug off the effects of the okex news and are back to trading higher, as both ETH and BTC manage to break above current resistances and attempt to break even higher. However, while ripple did bounce back, it wasn’t able to break through its resistances. One thing’s for sure, bullish momentum is quite evident in all cryptocurrencies.

Bitcoin broke through the resistance levels at $10,500 and $10,600, as it continued to move higher towards the $10,800 before stalling and falling slightly towards the $10,750. The bullish momentum still remains strong on this cryptocurrency as more upside potential can be expected. The RSI (relative strength index) does point to overboughtness, however, as long as the price action is able to consolidate at current levels without a deep correction, the RSI should correct as well and be ready for the next move higher.

Ethereum hit the barrier at the $385 after it managed to break above the $380 resistance level, however, with the overwhelming bearish pressure and seller congestion at that level, the cryptocurrency found itself on the backfoot as it tries to maintain its strength above the support at $375. The RSI is still showing bullish momentum as the indicator prints around the 60 level, as long as the price action and RSI are in sync, expect more upward pressure.

Ripple continues to find some kind of positive pressure to move higher as it attempts to break above the $0.2500, which has become the level to beat after failing to break above $0.2600. The cryptocurrency moved higher, but with the current divergence between the RSI and price action indicates that there might be more downside pressure then upside.

Bitcoin’s (check out the chart below; you’ll find that bitcoin is the purple line) performance is printing at 7.34% on a month-to-month basis*. Ethereum’s (red line) performance is printing at -0.37% on a month-to-month basis. Ripple’s (turquoise line) performance is printing at -0.52% on a month-to-month basis.

Cryptocurrency brokers near 11700

Your daily cryptocurrency market analysis news brought to you by the cryptoaltum cryptomenon team.

This analysis was written at 9:00 am GMT +3, on 19.08.2020

Bullishness and bearishness, that’s how financial markets operate. One moment you might see the markets on the rise recording new yearly highs and the very next moment the bearish pressure can be overwhelming the markets and leading them all the way down. This is exactly where we spot our cryptocurrency market this morning; sinking in its retreat after the cryptocurrencies recorded new highs just one day earlier. With that said, let’s find out what today holds for the cryptocurrencies on august 19th, 2020.

Cryptocurrency recap

Our cryptocurrency trio - bitcoin, ethereum, and ripple, have reversed their gains. The rise higher was abrupt but it managed to break above some important barriers like the $12,000 for bitcoin only to drop lower the very next day. Ethereum tested the resistance at $450 and failed once again, only this time it's fall was steep from the highs. Ripple on the other hand seemed to continue with its downward movement even reaching $0.2900 at one point.

Bitcoin (check out the chart below you’ll find that bitcoin is the purple line) fell from the lofty levels it had touched and retraced all the gains it got yesterday to record a performance of 28.51% on a month-to-month basis*. Ethereum (red line) couldn’t handle the pressure of keeping things that high for that long; its levels had to drop. However, it did keep a decent performance of 75.37% on a month-to-month basis. Ripple (orange line) followed the steps of its older cousins and continued to move lower, breaking below the 50% performance to record 47.35% on a month-to-month basis.

What’s the strategy you’re going to use when it comes to these cryptos? Do you believe that the bears will finally control this market? Or do you believe that the bulls will manage to move back up after a short while? Whatever you choose to believe, you can react to it all on cryptoaltum.

Bitcoin moves back below $12,000

Bitcoin is currently struggling to find a decent higher support within the $11,000’s range after the rejection of the august new high around $12,492. The move lower was exacerbated further when the BTC bulls failed to hold the support at $12,200. It was like adding fuel to a small fire that kept on consuming the entire market. The next support target at $12,000 failed to rise to the occasion as well, instead, it allowed the largest cryptocurrency to extend the bearish leg to $11,700 as of this writing.

Currently, the bulls are having a hard time building any kind of meaningful support, especially after the $11,800 has been broken. They’re hoping this support would lead to gains that would propel BTC back above $12,000. The 100 simple moving average (SMA) in the 4-hour range is holding bitcoin in place for the time being. Even though there’s a short move below that trendline, holding that line is going to be of utmost importance for the bulls.

So, let's see, what we have: it appears that bitcoin investors are not fazed by the prospects of a move lower due to the CME futures gap formed at $11,100. The leading cryptocurrency at cryptocurrency brokers near 11700

Contents

- Top forex bonus list

- Bitcoin surges towards $11,700, liquidating millions

- Bitcoin pushes towards $11,700

- All eyes on stimulus discussions

- Bitcoin hits fresh record above $11,700

- Cryptocurrency market news: bitcoin stares into the abyss as $12,000 hurdle holds

- Markets:

- Cryptocurrency market news: OMG network spikes 100% in 24 hours as bitcoin stalls under $12,000

- Markets:

- Chart of the day: OMG/USD 1-hour

- Market:

- Industry:

- Regulation:

- Latest crypto news

- Latest crypto news & analysis

- Editors’ picks

- Bitcoin bull cycle temporarily on hold as altcoins bleed

- EOS price takes a 20% nosedive after block.One CTO, dan larimer, resigns

- LINK hunts for a local bottom as bulls prepare 40% upswing to $20

- Sushiswap's trading volume skyrockets, SUSHI price set to follow

- BEST CRYPTO BROKERS/EXCHANGES

- Bitcoin weekly forecast: santa rally takes BTC to new all-time high, more fun ahead

- Crypto partners in your location

- Bitcoin extends three-day gains as it jumps above $11,700

- Related articles

- Brokers to trade cryptocurrencies online

- Bitcoin price prediction: BTC/USD returns below $11,000, erases yesterday’s gain

- BTC/USD long-term trend: bearish (daily chart)

- What to expect from bitcoin (BTC)

- BTC/USD medium – term trend: bullish (4H chart)

- Cryptocurrency brokers near 11700

- Cryptocurrency recap

- Cryptocurrency brokers near 11700

- Cryptocurrency recap

Comments

Post a Comment