The Best Crypto Trading Bots, cryptocoin trading bot.

Cryptocoin trading bot

They can customize their own trading strategy with cryptohopper’s strategy designer that allows traders to choose out of its list of 30 technical indicators and 90 candlestick patterns.

Top forex bonus list

If you want to try their services but don’t want to risk losing your funds from the start, you can try the simulated paper-trading feature. Crypto trading bots are gaining traction among crypto investors these days, and no wonder! After all, they’re helping crypto investors bolster their trading strategy and generate high returns on their crypto investments.

The best crypto trading bots

Crypto trading bots are gaining traction among crypto investors these days, and no wonder! After all, they’re helping crypto investors bolster their trading strategy and generate high returns on their crypto investments.

Who wouldn’t want to cut down on the time they spend in front of their monitors, carefully eyeing the market, ready to jump at the prospect of any potentially lucrative price movements.

Trading bots generally follow a set of rules and trading strategies chosen and configured by the trader. They track changes in prices, demand, and volume. They can send you trade signals or execute orders automatically.

In our guide, we’ll discuss the importance of these crypto bots in more depth, their pros and cons, and review the most sought-for software on the market right now.

Disclaimer: we may receive a commission for purchases made through the links on our site. However, this does not impact our reviews and comparisons. Learn more about our affiliate disclosure.

Best crypto trading bots: reviews 2021

1. 3commas

- Website:3commas.Io

- Supported exchanges: binance, FTX, bybit, bitmex, deribit, bittrex, binance DEX, binance jersey, binance US, bitfinex, bitstamp, CEX.Io, coinbase pro, gate.Io, exmo, hitbtc, huobi, huobi russia, kraken, kucoin, OKEX, poloniex, and yobit.

The first type of crypto trading bot is the technical bot that uses various indicators and signals to predict and help you capitalize on the next cryptocurrency market movement. The most popular technical bot is 3commas.

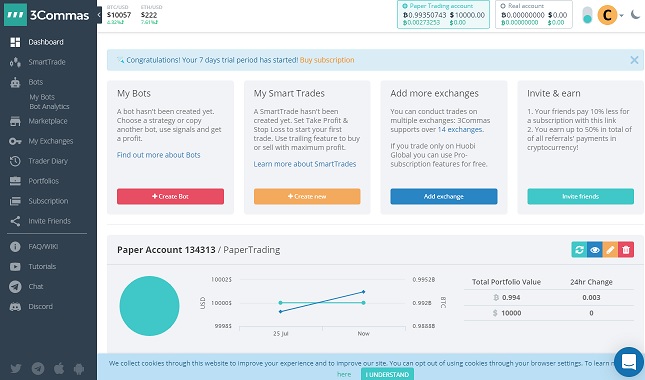

Users can access this cloud-based platform on their computers or smartphones without having to download it. On 3commas, you can customize the algorithmic trading bots based on your trading strategy – use the long bot for bull markets, the short one for bear markets, or a composite one as a mix of the two.

One of their most attractive features is the social copy trading feature. Aimed primarily at beginners, copy trading gives you insight into the trading strategies of other users, lets you monitor and copy them, and later on extend them to fit your own portfolio.

Moreover, 3commas is popular for its smart trade feature called trailing stop tool that keeps your position open even if you reach the desired target gain so that you can make a profit if there’s a sudden price increase. If the price starts falling, the trailing stop automatically closes your position.

With their take profit and stop-loss orders, you can simultaneously set the selling price point for when you want to make a profit and when you want to stop losses.

Pricing

3commas offers several packages for purchase. If you’re only interested in spot and futures, the starter package costs $14.50 per month or $174 per year. For more experienced traders the monthly price of the advanced package is $24.50 or $294 per year.

There’s also a pro package for $49.50 per month or $594 for the whole year. This package supports margin trading, includes composite bots, bitmex and binance futures bots, and a GRID bot. This package also features a selection of free trading courses.

Novices can try out their paper trading feature during a three-day free trial to familiarize themselves with the bots and plan out their strategy.

2. Cryptohopper

- Website:cryptohopper.Com

- Supported exchanges: 13 exchanges incl. Hitbtc, OKEX, bitpanda pro, kucoin, bitvavo, binance, binance US, coinbase pro, bittrex, poloniex, bitfinex, huobi, and kraken.

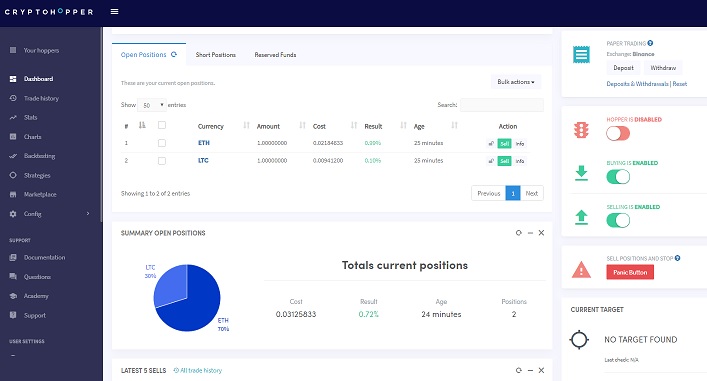

Cryptohopper is another cloud-based crypto trading bot that’s used by thousands of traders around the globe.

The platform is suitable for both beginners and seasoned traders. It has a range of advanced trading features such as backtesting, trailing stop-loss, stop-buy, stop-short, and dollar cost averaging. It features its own tutorial section with extensive educational materials, video courses, and a learning academy to help new users make the most out of crypto trading.

They can customize their own trading strategy with cryptohopper’s strategy designer that allows traders to choose out of its list of 30 technical indicators and 90 candlestick patterns. If you want to try their services but don’t want to risk losing your funds from the start, you can try the simulated paper-trading feature.

Moreover, cryptohopper was the first platform to automatize the process of receiving crypto signals, i.E. Technical analysts who closely follow the market to spot promising crypto assets and earn money by sharing their predictions with subscribed traders.

Now, when technical analysts or “signalers” working for cryptohopper send out trade signals, the hopper bot picks them up and executes a buying/selling order (provided you subscribe to one/some of them first). As a result, traders can spend less time on the trading terminal

Pricing

Cryptohopper offers a free pioneer package for all users that gives you access to 20 positions, manual trading, and portfolio management.

However, if you want to get a real taste of crypto trading with a trading bot, we recommend upgrading to one of these packages:

Explorer starter package.

For $19 per month, you get 80 positions, maximum of 2 triggers, maximum of 15 selected coins, one simulated trading bot, and paper trading.

Adventure medium package.

For $49 per month, you get 200 positions, 5 triggers, 50 selected coins, one simulated trading bot, exchange arbitrage, and paper trading.

Hero pro package.

For $99 per month, you get 500 positions, 10 triggers, 75 selected coins, technical analysis, market arbitrage, and algorithm intelligence (BETA).

3. Haasonline

- Website:haasonline.Com

- Supported exchanges: 20+ exchanges incl. Binance, binance futures, binance.Us, bitfinex, bitmex, bitpanda pro, bitstamp, bittrex, cex.Io, coinbase pro, deribit, gemini, hitbtc, huobi global, ionomy, kraken, kraken futures, kucoin, okcoin, OKEX, OKEX futures, and poloniex.

Haasonline was launched in 2014 by stephen de haas. Unlike many other platforms that avoid revealing the identity of their founders, the haasonline team is known for its transparency and active social media presence.

Until 2020, users had to download and install the haasonline trade server (HTS) and set up an account. This was time-consuming and required some technical background on the part of the user which is why the platform launched its cloud version this year and simplified the whole signing up process.

Haasonline belongs to the group of market-making bots. What these bots do is they place buy and sell orders in an attempt to score a quick and easy profit for you. For example, if your target crypto asset is trading for $100, the haasbot will create a $90 buy order and a $110 sell order. In case one of the orders gets executed, you’ll earn $10.

Similarly to 3commas and cryptohopper, haasonline also offers copy trading and the option to subscribe to technical analysts’ signals. It has advanced backtesting that makes it possible to go 56 weeks back to track the accuracy of some trading strategies.

Pricing

On haasonline, you can subscribe to a 3-month, 6-month, or 12-month trading plan and choose between a beginner, simple, or advanced account. Unlike other platforms, haasonline only accepts BTC payments.

The beginner plan costs 0.073 BTC per year. You get 10 trading bots, access to 11 insurances, 10 safeties, over 20 indicators, restricted core features, chat and ticket support, and a $100 VPS credit.

The simple plan costs 0.127 BTC annually with 20 trading bots, access to 13 insurances, 20 safeties, over 40 indicators, unlimited trades, no fees, restricted core features, chat and ticket support, a $100 VPS credit, and a visual editor.

Finally, the advanced plan costs 0.208 BTC per year offering unrestricted trading bots, insurances, safeties, indicators, and core features, unlimited trades, zero fees, chat and ticket support, a $100 VPS credit, and a visual editor.

4. Shrimpy

- Website:shrimpy.Io

- Supported exchanges: binance, binance US, bittrex, kucoin, coinbase pro, poloniex, kraken, bibox, gemini, huobi, hitbtc, bitmar, bitstamp, OKEX, and bitfinex.

Shrimpy was founded in 2018 by matthew wesly and michael mccarty whose vision was to create a platform that would encourage more people to join the crypto market by allowing them to make crypto trades easily and effectively.

Shrimpy became famous for its automated trading tools and interface and the immediate support it got for leading crypto exchanges. However, what really sets this platform apart is the portfolio auto-rebalancing tool. Although this tool is frequently used in the stock market, shrimpy was the first to introduce it to the crypto market.

Instead, they can realign and specify the weightings of each crypto asset’s value from their portfolio. The shrimpy trading bot would periodically buy or sell these assets to maintain the desired asset levels, i.E. Automatically rebalance them. This is a great strategy to capitalize on sudden crypto rallies. Thanks to the effectiveness of this tool, users no longer have to rely on the buy and hold strategy.

Shrimpy has two main portfolio rebalancing types: time (periodic) and threshold rebalancing. If you choose the first one, shrimpy will rebalance your portfolio daily, weekly, or monthly depending on your preference to achieve your desired crypto weightings. Threshold rebalancing means that when one of your cryptos deviates from the desired percentage by a predetermined amount (e.G. 10%), shrimpy will get you back on track and rebalance your portfolio.

To explore the potential of your strategy, you can use their backtesting services. You can emulate the strategies of other traders with their social services or simply observe them with shrimpy’s insights.

Pricing

Shrimpy offers a monthly membership for its services. The hodler account is free but this subscription allows you to create a portfolio, monitor and track your performance, and link the portfolio to support exchanges.

The professional account costs $19 per month or $13 if you subscribe for one year. Upgrading to a professional account really pays off because you’re allowed to use all trading tools and services including portfolio management and tracking, index builder, rebalancing, backtesting, and social features, and advanced account setting (IP whitelisting).

There’s also enterprise pricing for businesses and crypto companies looking for more customization on shrimpy’s services. You just need to contact their team to agree on the terms and conditions.

Best crypto trading bots 2020 - automate your trades

Best crypto trading bots for 2020

Learn how to automate your trades in this best crypto trading bots guide. Crypto trading bots are a sophisticated way to generate passive income from the cryptocurrency market. In a fast-moving market like cryptocurrency, it’s becoming increasingly popular to automate the entire process of trading. Crypto trading bots are computer programs that use indicators to automate the buying and selling.

Our team at trading strategy guides has done all the research and put together a proprietary bitcoin trading bot that looks for trades, opens trades, and closes trades based on a very unique cryptocurrency strategy. We’re going to talk more about this later.

Before collapsing the infamous biggest bitcoin exchange MT gox was using the willy trading bot to manipulate the price of bitcoin. This was a bitcoin trading bot that led to the bitcoin price bubble and crash months after. This was all happening back at the end of 2013 when the crypto market was still a virgin market.

In this article, we’re not going to deal with these types of crypto trading bots. Instead, we’re going to look at the best crypto trading bots that can help you profit from the day-to-day crypto price fluctuation.

Just like in the stock market and the forex market, there are traders that have gotten involved in creating some of the best crypto trading bots to help maximize their profits.

Let’s dive into what an automated trading bot is, and learn about the most popular crypto bots on the market.

What is a crypto trading bot?

A crypto trading bot is a computer algorithm that uses various indicators and chart pattern recognition scanners to automatically execute trades on your behalf. If you have the right coding skills, you can program a cryptocurrency bot to automatically take and close trades.

However, if you’re not a whiz kid coder, don't worry.

Today, you can automate your trades using the best pre-built crypto trading bots in the market.

The whole financial system has been taken over by algorithms, and soon enough, the cryptocurrency market will experience the same thing.

It will be man versus machine.

As long as there are markets that move, there will always be some human activity. Trading robots can’t eradicate entirely the presence of humans, but it certainly can lead to a tougher environment. Warren buffet is a human that amassed tremendous success and amounts of wealth despite the rise of high-frequency trading.

Even if you’re not a fan of trading bots, you can still carry on with manual trading if you have the right skills.

Before you cast away the trading bots, you have to consider the many advantages that come with using cryptocurrency robots.

Crypto trading bots advantages

The first advantage of trading bots is that it eliminates the emotions out of the decision-making process. That’s kind of a big deal. Many crypto traders fail because they don’t have the discipline to follow a trading plan.

Second, you’ll have more efficient execution of your trades and better entry prices. If you’re quicker in terms of trade execution, you have a time advantage.

A trading bot can also detect chart patterns that are more difficult to spot by a human eye.

Another advantage of using a free bitcoin trading bot is that you don’t need to be with your eyes glued to the screen all day long.

Our team has spent years learning, watching, adapting, and trading different charting patterns. And we built an automated crypto robot based on this research.

Free bitcoin trading bot

If you want a unique opportunity to maximize your crypto returns you can try our almost free bitcoin trading bot.

Frankly, manual crypto trading takes time and the right skills. You can try using the bitcoin signal indicator and trade by yourself. However, the problem is that you still need to know how to only take the “right” trading opportunities. You still need to understand how to manage those trades. This can make the difference between winning and losing.

If you have no idea how cryptocurrency trading works you can use the bitcoin signal robot. This unique trading software will work in the background for you, and it will trade on your behalf.

You only need to follow this simple four-step guide to make money with our crypto trading system.

- Pick a trading broker.

- Install the bitcoin signal robot to your PC.

- Adjust the settings and your risk!

- Watch the account GROW!

You can start trading with as little as $100. So you don’t have to commit a lot of money.

*note: when you sign up and get the robot working and running, we HIGHLY recommend that you use a demo account first to see how the robot works.

Now, let’s see what other trading bots the crypto space can offer you.

See below our top 5 cryptocurrency bots:

Top 5 crypto trading bots

Selecting the right crypto bot for mechanical trading may be difficult, but we have the solution to this problem. We’ve put together a comprehensive review of the top 5 crypto trading bots that the market has to offer you:

Cryptohopper

Cryptohopper automatically buys cheap crypto and looks to sell it for a higher price on a different bitcoin exchange. The interesting thing about this platform is, it allows you to copy other trading strategies. You can also create your own technical analysis and plug it into the platform.

Still learning technical analysis? Cryptohopper allows you to choose from over 130 different indicators and candlestick patterns.

Other features include the ability to manage your accounts in one place, and a social trading platform component.

Prices range from $19 to $99 per month.

Haasbot

Haasbot is probably one of the most expensive crypto bots out there. They're not kidding when it comes to the money you'll have to pay. We can all agree that this crypto trading robot is not for everyone. The subscription price starts to add up to over $10,000 per year for the more advanced version.

Haasbot software definitely targets the more experienced bitcoin traders. Haasbot uses a candlestick pattern recognition feature and some advanced indicators to time the market.

Haasbot is not just a bitcoin trading bot, but it also trades 500+ alt coins across all major cryptocurrency exchanges.

Gekko bot

Gekko is a dedicated, free and 100% open-source platform that allows you to create your own cryptocurrency robot. You simply download and run the software on your own PC.

Gekko has a lot of powerful features that allow you to optimize and backtest your crypto strategy. The only downside is that gekko bot is exclusively for bitcoin trading.

Gekko trading bot also only supports a limited number of crypto exchanges (bitfinex, bitstamp, and poloniex).

You only need to build your own automated crypto bot and gekko trading bot will take care of everything else.

Gunbot

Gunbot is another automated crypto trading bot. Gunbot trading bot is completely customizable so it can fit your risk profile and trading style. Unlike gekko, gunbot works on more crypto exchanges like bittrex, binance, poloniex, bitfinex, cex.Io, GDAX, kucoin, kraken and cryptopia.

This cryptocurrency robot offers you different pricing plans starting from 0.025 bitcoin and can go as high as 0.3 bitcoin for the more advanced version. You only have to pay for a one-lifetime license.

Another interesting feature that gunbot offers is that it has 32 different trading strategies built in from where you can choose.

Bitcoin signal robot

Bitcoin signal robot is our in-house cryptocurrency bot. We are subjective for including bitcoin signal robot in our top 5 crypto bots, but our backtesting results are a solid proof that this crypto bot is capable to generate some nice profits.

Unlike most of the competition, our proprietary crypto bot is available on the meta trader 4 and meta trader 5 platform.

If you’re a forex trader this is very handy as you can manage your crypto and forex exposure all from one place.

Conclusion – best crypto trading bots

We hope you enjoyed this article on the best crypto trading bots. It's important to always do your due diligence and research when choosing a crypto trading bot. Not all crypto trading bots are reliable and trustworthy. The quality of an automated crypto robot is determined by the relationship between the potential cost and the potential profits you can make from using said bot.

Cryptocurrency is a volatile market and not so easy to trade. If you’re an inexperienced trader, you should consider the benefits of using a crypto trading bot to increase your profits. Ultimately, it’s up to you to decide if any of the aforementioned cryptocurrency bots make sense to you.

Feel free to leave any comments below, we do read them all and will respond.

Also, please give this strategy a 5 star if you enjoyed it!

Please share this trading strategy below and keep it for your own personal use! Thanks traders!

Crypto trading bots: all set to make a statement in the cryptocoin market

As the popularity of cryptocurrencies has increased more and more, people are looking for ways to make huge returns on their investment. Most of these traders are using crypto trading bots to increase the value of their portfolios.

We all are aware of the volatile nature of the cryptocoin market and crypto trading bots is capturing the center stage among traders as it offers them to control their trading at all times, even when they are sleeping. Additionally, these automated trading bots expedite the trading process and make it more efficient than the trader would be able to do manually.

What is a trading bot?

Cryptocurrency trading bot is software programs that directly interact with exchanges, monitor price movements, place orders for a trader based on the market data they collect. Typically, this bot analyzes market actions such as orders, volume, price, and time and execute according to the pre-defined and pre-programmed rules.

For instance- traders can deploy a bot to buy and sell bitcoin and any other cryptocurrency. This bot can adhere to a ruleset programmed to buy lower from one market and sell higher in other markets, earning a profit on the difference. If you have ever done with the best crypto exchange, you have probably encountered bots doing this. The main objective of trading bot is to provide its users with a lucrative business day in, day out.

What makes trading bots popular in the cryptocoin market?

Emotion plays a vital role while making trading decisions. With automated trading signals, users can define their goals, stop losses, and profit target beforehand. The trading bot will execute the trades once the set of rules are met enabling the traders to pull the trigger without any hesitation. Apart from this, the trading bot also allows users who are apt to trading cryptos at every perceived opportunity.

24/7 availability

While regular stock markets are only open during the daytime, the cryptocurrency market is open 24/7. Resulting in you can trade continuously trading efficiently into your sleeping or working hours. It is important to note that while the bot can cause you to make money, it can also cause you to lose money depending on the strategy your employ.

Paradox of choice

There are quite a few crypto trading bots available in the market and finding the right one may take you some time. Trading bots such as crypohopper, haasbot, gekko, are profit trailer are highly recommended for the neophytes or those who are searching for a reliable and easy-to-use trading bot. If you have never traded before on the crypto market, a trading bot could be your best option.

Time saving

Trading can get sometimes boring as it only do some repetitive such as price checking and button pressing. A bot can do all that for you with just fewer clicks. You can give your bot some instruction before you sleep and find that a few good trades have been completed when you wake up.

Timely maintenance

Since the market changes all the time, your instructions to the bot should change frequently. This means you keep to constantly update and maintain your bot to make sure that it is making the right choice that you want.

These are some of the key benefits of cryptocurrency trading bots that bring forth vast opportunities for the crypto holders to improve their bottom line. If you also want to enhance your trading experience, join the crypto exchange which offers a trading bot to their users.

3 best crypto grid trading bots (that actually work)

Disclosure: this post may contain affiliate links, which means we may receive a commission if you click a link and purchase something that we recommended. Read about affiliate disclosure here.

Are you looking to start with grid trading bots?

Well, there are only a few grid bots which are quite remarkable, and in the past few months, I had to chance to explore many of them. I infact used all of them to run a grid bot, and here is one of my trade results with grid auto trading bot:

Do notice the frequency of trade (time-stamp).

Now, I feel confident enough to share some of the insights from my learnings, and exploration of these grid trading bots.

However, if you are new here, I highly recommend reading about best crypto trading bots.

Now, moving on to grid trading bots…

Grid trading works best in the ranging sideways market and using a bot you could execute your strategy even when you are sleeping. Grid trading gives you profit with ups and downs of the price fluctuations in the market, and works best when any particular pair is in a range with no clear up or down trend in a longer period.

Disclaimer: trading is a skill, and using a bot doesn’t guarantee you would make money. You should rather invest time learning the basics, and then use a bot to automate your strategy. It took my more than a year to get results, so do not RUSH!

Disclosure: this article contains affiliate links, but every word is unbiased, and based on real-experience.

Those who are into scalp trading, can also take advantage of grid bots to automate their trading strategy. Here I have compiled a list of best available grid auto bots, with my remark and experience. Some of them are free, and a few of them are paid.

My suggestion is to try one or two at a time, and see which one fits your style of trading.

3 best automated grid trading bots:

1. Bituniverse

Bituniverse is a free trading bot which offers various kind of grid bots. What I like about bituniverse (apart from being free is), it offers many advanced features that no other similar tool offers.

- Stop loss feature

- Use AI strategy to auto-set your grid

- Manual grid setting (the one I recommend)

- Leveraged GRID bot

- Margin GRID bot

Getting started is also easy, and it works with all popular exchanges.

Overall, for many who are looking to start for free, bituniverse grid bot is the best available option. You connect with your exchange using API key, and since your crypto assets are not stored on bituniverse, you are safe. They do have a few additional products, which I have not tested, and I suggest not to try anything apart from manual bot trading on bituniverse. Once I have more details, I will write a separate article for the same.

2. 3commas grid bot

I have been a user of 3commas for a long time, and I really like their interface, and mobile app to track the performance or stop the bot. I have talked about 3commas in depth here on my 3commas review, which you must check out.

3commas offers paper trading which is idle for those who want to test grid bot before actually putting in the real money. It also works with all popular cryptocurrency exchanges, and their free tutorials and guides will help you to master the art of grid trading.

3commas also offers AI-based grid trading, where you let their AI decide the upper and lower limit for the grid. Or, you can set a manual upper and lower limit for grid size.

Here are some of my results after using grid bots:

It definitely lacks the feature of stop-loss, or auto grid resizing, which may make a lot of difference for many novices. Unlike others, 3commas is not free, and cost about $49/month for grid bot trading. However, you get 3 days trial, which is good enough for you to test out the system. Either way, in my experience 3commas, is a solid choice for a majority of intermediate and experienced traders.

3. Quadency

Quadency is another popular crypto trading bot, which offers grid bot as a free feature. However, their bot is different than above 2, as you can’t set the upper and lower limit manually.

To be honest, I could not find much detail on how quadency sets the price for grid, but what I like about them is; it gives you the control on what to do when exit price is reached. Here are 4 options:

- Recreate grid around exit price and continue trading

use this option if you have sufficient balance in quote and base to re-create the grid at the point where the price exits the grid. Note – this involves cancelling all open orders and close open positions with a market order. - Cancel all orders and stop bot

use this option if you want to cancel all remain open orders and stop the bot. This option will not close any open positions. A position is open if the bot has bought quantity but has not sold the same amount or conversely if it has sold but has not bought back the same amount. - Cancel all orders, close all positions and stop bot

use this option if you want to close all positions in addition to cancelling any remaining open orders. - Do nothing

use this option if you would rather wait for all open orders to eventually get filled. As the price reenters the grid, the bot will resume trading. However, if the price never re-enters the grid, the orders will remain open indefinitely until manually cancelled.

You can read more about quadency grid bot feature here.

There are a few more options like pionex which is primarily an exchange, but offers bot trading. Though I have not done the diligence of this exchange, so I would not trust this with my money, as it requires us to deposit the fund. Rest other options listed above, let you connect with an exchange using API, and thus your funds are more or less the safe.

Conclusion: which grid bot to use?

Well, bituniverse should be your first choice as it is free.

If you are fairly new, then use 3commas, as they offer 3 days trial and their help guide is good enough to get started.

As it is, I will keep an eye on more new bots which are coming in the market, and will include which is worthy enough to be listed here on our coinsutra resources.

Now, it is your turn to let me know how your experience has been with grid trading. Also, if you know of any other grid trading bot, do let me know via comment section below.

Harsh agrawal is the crypto exchanges and bots experts for coinsutra. He founded coinsutra in 2016, and one of the industry’s most regarded professional blogger in fintech space.

An award-winning blogger with a track record of 10+ years. He has a background in both finance and technology and holds professional qualifications in information technology.

An international speaker and author who loves blockchain and crypto world.

After discovering about decentralized finance and with his background of information technology, he made his mission to help others learn and get started with it via coinsutra.

Join us via email and social channels to get the latest updates straight to your inbox.

Asset 4

Cryptocurrency exchanges are the convenient gateway to buying and selling bitcoin and other cryptos. As one would expect, these exchanges also create arbitrage opportunities. Taking advantage of these “gaps” between bitcoin prices can be quite difficult, especially when things need to be done manually. Thankfully, there are some bitcoin arbitrage bots which facilitate the process somewhat.

6. Crypto arbitrage trader

The crypto arbitrage trader bot should not be confused with C.A.T, which is a closed-source paid trading bot for cryptocurrency users. Crypto arbitrage trader’s source code can be found on github . The project was initially announced in 2013 and includes support for coins-E, BTC-E, and vircurex. However, no major updates have occurred over the past four years, and some users complained there are a few bugs in the code.

5. Tapibot

This particular bitcoin arbitrage bot can be used for different purposes, although it appears only one exchange is supported at this time. BTC-E is a somewhat popular trading platform, yet there is not always an arbitrage opportunity to take advantage of. Tapibot’s source code is available on github , thus allowing experienced users to implement support for other exchanges if they feel the need to do so.

4. Bitcoin dealer

Bitcoin dealer is another bitcoin arbitrage bot that can only be used for one particular exchange. In this case, that exchange is bitstamp, which is far more popular compared to BTC-E. Bitcoin dealer can be found on github as well, although it appears the bot has not received any major developer updates for quite some time now.

3. Bitcoin arbitrage

It is not hard to see the similarities between bitcoin arbitrage and bitcoin dealer. However, when it comes to exchanges, bitcoin arbitrage is more flexible, with support for bitstamp, paymium, and coinbase. Using multiple exchanges increases the odds of finding successful bitcoin arbitrage opportunities.

2. Gekko

We briefly touched upon gekko in our top bitcoin trading bots article , yet it appears the bot also has some arbitrage features. It supports a wide range of exchanges, including kraken, BTC-E, CEX, and bitstamp. The entire project is open source and can be found on github .

1. Blackbird

Blackbird is an open source bitcoin arbitrage bot written in the C++ language. What makes this project so appealing is how blackbird supports multiple exchange platforms, including bitfinex, okcoin, kraken, and gemini. Blackbird is a very easy-to-use arbitrage bot, once everything has been set up. In fact, there are clear instructions on how to set everything up, which makes the bot quite approachable.

If you liked this article, follow us on twitter @themerklenews and make sure to subscribe to our newsletter to receive the latest bitcoin, cryptocurrency, and technology news.

About the author

Jdebunt

JP buntinx is a fintech and bitcoin enthusiast living in belgium. His passion for finance and technology made him one of the world's leading freelance bitcoin writers, and he aims to achieve the same level of respect in the fintech sector.

Meet the bots that let you trade bitcoin in your sleep

Danny bradbury

Meet the bots that let you trade bitcoin in your sleep

With all the allegations of mt. Gox’s automated trading bot, which has been dubbed “willy”, algorithmic trading is getting a bad rap. However, using bots to trade on the financial markets is a long-established and legitimate activity – and it’s easier than anywhere in the cryptocurrency markets.

So, how do these bots work, and can they really make you money?

Trading bots are software programs that talk directly to financial exchanges, and place buy and sell orders on your behalf. They make those decisions by watching the market’s price movements, and reacting according to a set of predefined rules.

Joseph lee is living proof that they can make money. Lee, who founded derivatives exchange BTC.Sx, based its trading engine on algorithmic trading bots that he wrote himself, and used between 2011 and 2013.

He claims to have turned a simple $100 buy order into $200,000 in profits using his private software army. While that seems astonishing, the devil is in the detail, of course: a lot of that price increase stems from the massive price increase in bitcoin late last year.

In fact, the real profits are far more marginal, he has said, so don’t expect to install a plug-in and write your own rags-to-riches story.

Lee, who claims that his bots shifted 10% of the market’s entire volume in the early days, started using his methods when the price sat at $2-$4 per bitcoin.

Market maker

Lee’s first trading bot used inter-exchange arbitrage, noticing differences in prices between orders on different exchanges, and buying on some exchanges while selling on others.

“I was essentially taking liquidity from a market where there was some and injecting it into a market where there wasn’t,” he explained. Back then, mt. Gox dominated the market, and other exchanges had poor pricing because their supply of bitcoins was limited.

“so, I bought for cheap on mt. Gox and sold them to other markets. I bought a lot of bitcoin into tertiary markets.”

In short, he acted as a market maker on less-established exchanges.

Established practice

Lee may have written his own bots, but today, the bitcoin trading bot market is far more established, with several available off the shelf.

Examples include butter bot, which offers an online trading bot accessed via a google chrome plug-in, and haas online, which sells a windows-based personal trading server. Cryptotrader offers a trading bot marketplace, which allows people to develop bots using different trading strategies, and then rent them to others.

Trading by algorithm isn’t new in the financial world: companies in the conventional financial markets have been using the method for years. Lee said, however, that the bitcoin exchange community is one of the first where exchanges grant customers’ computers direct market access (DMA).

This enables individual traders to have their computer access the exchange’s electronic order books directly. That’s a service normally only available to brokers and investment houses in the conventional markets.

“in the past, it was the people who had the means to pay for a $10,000-plus a year bloomberg terminal with an API connection who could try their hand at bot trading,” lee explained.

So, why isn’t everyone doing it?

Pablo lema, founder of butter bot, says that bots aren’t a ‘fire and forget’ technology that enable dilettantes to make money without trying:

“trading bots require users to have at least a basic understanding of the market, need to be modified and tweaked by the user according to the predominant market conditions, and also according to their own risk profile.”

Trading bot strategy

Lee started off capitalising in a highly inefficient market, where exchanges with sufficient liquidity could be counted on one hand.

The situation – while still needing improvement – is at least a little better now. Opportunities for inter-exchange arbitrage still exist, but he recommends using technical analysis bots.

But trading isn’t necessarily based on technical analysis alone. It’s difficult to program a computer to react to fundamental market conditions such as, say, rumours about the chinese government taking a new stance on bitcoin, or the latest bitcoin-based black market trading site shutting down.

Many bots will use an exponential moving average (EMA) as a starting point. These averages track market prices over a set time span, and bots can be programmed to react to what that price does – such as moving beyond certain thresholds.

“if you have a conservative appetite, choose to trade on a slower basis,” lee advised. “if you picked daily rather than hourly periods, it’s generally seen as a safe bet to get involved in the basics of trading, let alone bot trading.”

Others suggest tweaks to the EMA approach.

“if you look to the biggest downside of an EMA then you see it’s almost always to late. And this is the part that can be improved,” said stephan de haas, founder of the haas online trading bot company, adding.

“this improvement could be done by using a DEMA [double exponential moving average] or TEMA [triple exponential moving average] instead. Those have the ability to respond faster then the EMA and their calculation is EMA-related, so it looks the same while it gives off better momentum.”

There are still other methods, he pointed out, such as relative strength indicators and regression analysis.

“this type of analysis works perfectly for processes (in this case a price market) that are unstable,” he says, in a description which seems to sum up the roller-coaster world of bitcoin.

“using that data, it can make good sense of what’s to be expected in the […] future.”

Secret strategies

However, technical analysis is a discipline, and these things are indicators, not strategies. You’re still going to have to come up with your own set of trading rules, if you’re going to tell a bot how to make decisions.

“the really good strategies are kept secret and closed source,” says lema. “that’s done by everyone: the mid [and] high level [traders] and clearing houses. It’s hard for a trader who’s new to understand the market.”

BTC or bust, the creator of the crackin’ kraken bot found on cryptotrader, points to a set of algorithms in a library of technical analysis algorithms known as TA-lib, along with custom indicators developed by the bot author. These are typically combined to find buy and sell signals in the market, BTC or bust told coindesk.

Bots can be programmed to be predictive or reactive, or a combination of both, using these combined algorithms, it said, explaining:

“for example, let’s say the bitcoin price is crashing. A predictive algorithm might start buying as it expects the price will quickly rebound, while a reactive algorithm might start selling as it sees the price is dropping. Both types have their advantages and disadvantages – the challenge is to have the bot employ the correct strategy at the correct time.”

The ability to set these strategies is one of things that will stop bots from unbalancing the market. Even if lots of people use them, the theory goes that the different strategies they employ would stop them all moving the market in one direction and creating an artificial bubble – or worse, a ‘flash crash‘.

Not for everyone

Is bot trading for you? Possibly. They offer a variety of advantages, not least of which is the ability to diligently trade on your behalf, 24/7, and the ability to remove all of the emotion from trading (assuming you don’t barge in and terminate them when you’re feeling irrationally antsy).

On the other hand, if you don’t have the financial smarts to put together a trading strategy, then bots could simply end up automating a set of poor market trading decisions.

For many, then, who believe in bitcoin’s long-term potential, the most basic trading strategy could be buy-and-hold.

Whether or not you decide to automate your trades, the basic rules apply: don’t trade more than you can afford to lose, and don’t go into any investment without at least a basic understanding of what you’re doing.

Disclaimer: statements in this article should not be considered investment advice, which is best sought directly from a qualified professional.

Automated cryptocurrency

FX trading and arbitrage betting system

Buy and sell crytocurrency pairs with our auto trading bot, and make massive profit with our arbitrage betting strategy system

Create your account

Signup to our platform its free.

Add bitcoin to your account

Once your acoount is created can deposit funds in it.

Buy or sell orders

Relax while we trade and invest for you..

Powerful bitcoin trading and arbitrage betting.

Cryptocoin10x is a sophisticated and accurate binary options trading software that combines the power of fundamental and technical analysis of the market to generate profitable signals which can be synced automatically to your broker account without any hindrances.

What makes this software so powerful and profitable is it’s ability to analyze current trends in the market and able to depict which currency pairs are best traded at any particular moment we also provide plenty of trading instruments and highly sophisticated calculators to enable you gain a firm foothold in global market and improve your trading experience.

Cover all outcomes in a match and make a profit no matter who wins. You win every time. Our arbitrage betting strategy system always ensures steady and substantial profits with no/little risk

Why choose us

Trading with cryptocoin will be like never before.

Safe & secure

We guarantee that every transaction you make with us is a secure transaction. Our site uses an encryption, 128-bit secure socket layers (SSL).

Optimized trading

We cover the need for you to register on various bookmakers and brokers. We bring various bookmarkers and brokers to your door step.

Mobile apps

Using a desktop, a tablet or a smartphone, our platform enables you to trade anytime no matter where you are we send signals just in time for you..

Bitcoin trading on all your devices

Trading easy has never been like before. We offer the most sophisticated platform on both andriod and ios for trading..

8 best cryptocurrency trading bots [free, paid, open-source] for 2021

Cryptocurrency trading bot (software) automates the process of trading on exchanges. We listed 8 best crypto trading bots for automated trading including free, open-source, API, subscription-based crypto trading bots.

Cryptocurrency trading is an emerging business and with more and more crypto traders flocking the market, the growth of digital currency exchange has risen to a whole new level. However, many new investors especially the novice find it extremely difficult to evaluate the cryptocurrency market conditions and to cope up with the volatile nature of the market.

The cryptocurrency trading bots is relatively a new concept and have made crypto trading easy and popular especially among the novice traders.

Cryptocurrencies can be traded directly from crypto exchange platforms or through the help of crypto trading bots. Due to the volatile nature of the crypto market, many investors are gradually relying on the trading bots to do the job for them.

What is crypto trading bot?

A crypto trading bot automates the process of cryptocurrency trading and trades on behalf of the trader. It is a computer algorithm that scans and tracks your trade pattern and executes the task at your command. For that, you need to have some coding skills and you can program your very own customized trading bot. However, if you do not have the required expertise, the market offers some of the best trading bots and you can subscribe to one of them.

How does a free cryptocurrency trading bot works?

The free bitcoin signal robot is an automated trading software that will understand and manage your trades on your behalf. The software is almost free and will double your crypto returns in no time.

You can start your crypto trading with as little as $100. You start by choosing a trading broker and install the bitcoin trading software on your computer. You can customize the settings and you are ready to go.

Advantages of cryptocurrency trading bots

- A crypto trading bot completely automizes the trading process thereby eliminating delay in decision making and makes trading faster and at favorable trading prices.

- The crypto bots track the chart patterns regularly and you do not have to be present all the time for trading. They will do the job for you in your absence.

- Manual traders also use bitcoin price prediction tools for analysis to execute profitable trading. These subscriptions are mostly paid and required recurring payments.

Features of a good cryptocurrency trading bot

- One of the most important features of a good trading bot is its reliability. Look for bots that are used frequently by users and have positive feedback.

- When you are choosing a trading bot you are doing it at your own risk. You are giving authority to your bot to take control of your funds and trade with it in the market. So, you need to be cautious and completely sure before choosing a trading bot. So, it is advisable to do complete research before choosing a trading bot.

- Whether the trading bot is profitable or not depends on its prior performance in the market. So, while choosing a trading bot find out whether the trading bot is profitable or not.

- The cryptocurrency market is based on mutual trust and transparency. So, before you choose a trading bot to look into the profile and history of its developers. See if they are popular in the community or not.

- The main purpose of using crypto trading bot is to automate the process of crypto trading and make it easy for users. Look for trading bots that have a user-friendly interface and you must be able to control the software entirely.

Best crypto trading bots

Trading with bots is not secure if you started with a scam website. There are many bot platforms are available in the market. We tried to shortlist few reliable, and trusted players of the market in this article. Let us now look into the top 5 crypto trading bots in the industry.

3commas is also comparatively a new trading bot in the market. One of its unique features is to trail the crypto market and close the trade at the right time to maximize your profitability. The bot quickly adapts to the changing pattern of the volatile crypto market and ensures a maximum return to your investment.

- Automizes trading maximizes profit and avoids loss from trading.

- The bot is hosted online and is available from anywhere and any device having an internet connection.

- The bot has partnered with 13 popular crypto exchanges including binance, kucoin, bittrex, etc.

- 3commas is available in 3 package plans starting from $22 to $75 per month. However, users can use the bot for free if they have an account at the huboi exchange.

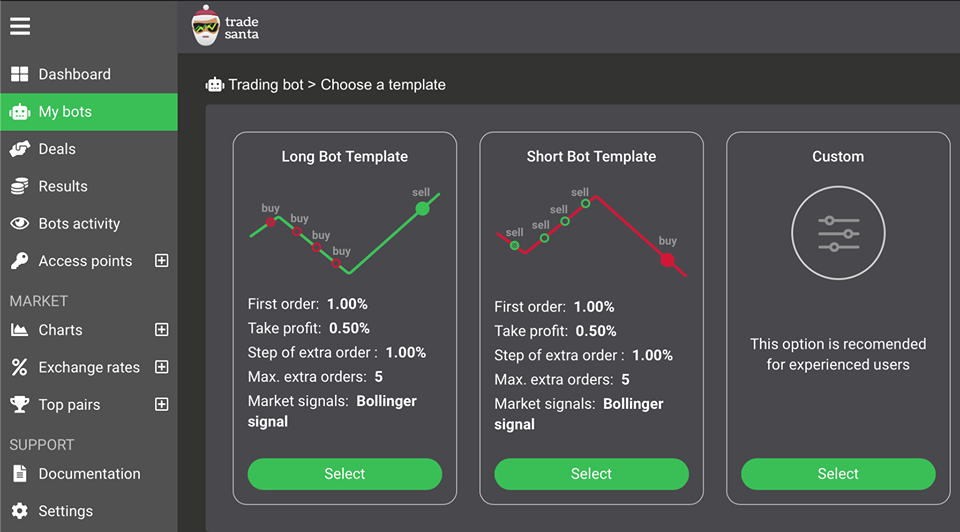

Tradesanta

Tradesanta is a popular cloud-based trading bot software that allows users to make a profit at the time of market fluctuation. It provides automated trading with the help of algorithms and there are tools like filters, signals which are very much helpful to take decision. It automatically executes orders on behalf of the users without accessing your funds. These bots are basically computer programs which are fast, works 24×7 with different market analysis and calculations. Tradesanta offers free and paid both plans. In a free plan, users can create up to 2 bots and trade up to volume $3k. For paid plans payment can be made through bitcoin, ethereum, and tether.

- Streamlined process, multiple tools, and user-friendly interface;

- Top cryptocurrency exchanges are integrated such as binance, huobi, bittrex, bitmex, bitfinex, and many more.

- Users will get flexible telegram notifications.

- Bot templates are available to launch your trade bot in a minute.

- Fee as well as paid plans available

- Telegram community with 24/7 support

Cryptohopper

Cryptohopper is considerably new in the market but has already gained immense popularity due to its wide range of features and technical leverage over other bots. Few highlighted features are:

- One of the main limitations of earlier crypto trading bots is that they could only operate when the PC is on. Cryptohopper uses cloud-based technology wherein, you can run and trade with your bot on a cloud and use it any time of the day even when you are offline.

- Cryptohopper allows you to run your bot in autopilot mode and set your trading signals. This is extremely useful for new users who often fail to set their own trading signals.

- Cryptohopper is enriched with other special features like technical analysis which helps you to customize your bot’s settings and templates through which you can design a new setting for your bot.

- Cryptohopper offers several plans to choose from starting from $19 to $99 a month.

- You can trade on multiple exchange platforms like binance, huboi, kucoin, bittrex, coinbase, etc.

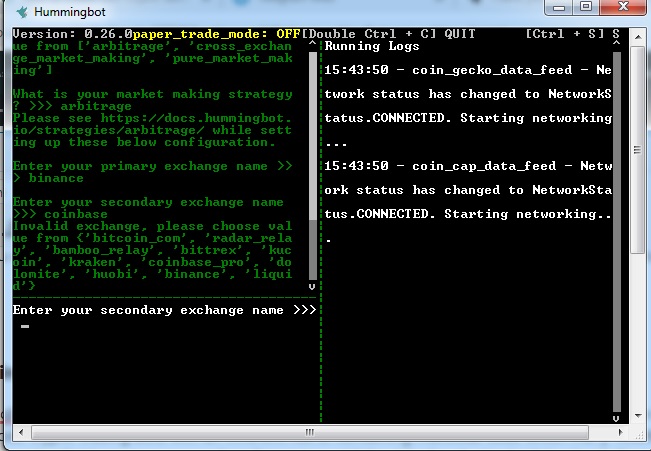

Hummingbot

Hummingbot, is an opensource cryptocurrency trading bot solution backed by coinalpha. Unlike the other closed source code crypto trading bots with an inherent risk of containing malicious code which ma7y results to loss of the funds, hummimgbot is open source code software to avoid the risk of such attacks. It is a local client software, private keys, and API keys are stored locally.

- Open source code licensed under apache 2.0.

- Supports both centralized and decentralized exchanges like binance, coinbase, 0X, huobi, bittrex, kucoin, and more.

- Uses local software client which means pct keys and API keys are secure.

- Partnership with projects and exchanges to offer incentives to the users

Disadvantages:

- Difficult to understand, not for beginners.

Zignaly is still at its initial stage of development. However, users can use the free beta version of the bot. The final version of the app will be launched soon and users can avail of its services in exchange for fees.

Even at its basic level, zignaly has a handy interface and has been designed exclusively for the users.

- Zignaly is integrated with tradingview which allows it to trade on the binance trading exchange. Currently, it is working only with binance and hopes to integrate with other trading platforms in the future.

- Zignaly shares developer details openly in their community forums thus building a sense of trust and transparency among its users.

- The developers are always available in case there is any query from the customers.

- Traders here can customize their trading strategies and allows flexibility to its traders.

Wunderbit trading

Wunderbit is a trading platform which allows users to start trading and investing in cryptocurrency automatically. Users can copy and trade the best crypto traders with transparent track records or create fully automated trading bot using tradingview. Below are some remarkable features of the platform:

- Trading terminal: if it offers multi-exchange crypto trading terminal with strategy automation so that users can create orders: adding take profit and stop loss to any order on exchanges. Currently, supporting binance, kraken, kucoin, and bittrex exchange.

- Trading bots: with the help of tradingview’s pineeditor you can create any trading strategy for popular crypto pairs, backtesting any idea, and instantly see how profitable your strategy is.

- Social trading: investor can choose a trader of his choice to manage their investments for a commission which will be taken from profitable trades only.

- Free: all trading tools available are absolutely free of charge for users. Traders can start trading without any monthly subscription.

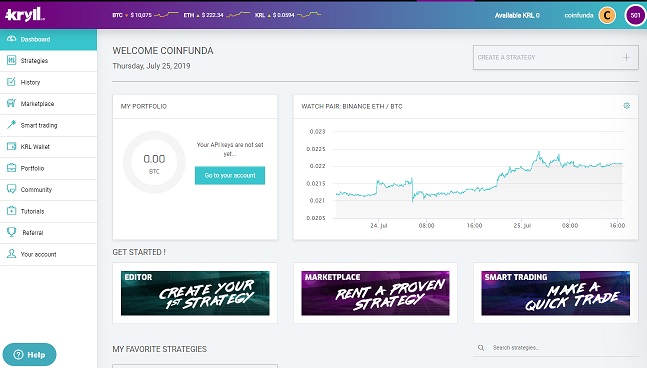

Launched in 2018, kryll.Io is one of the most advanced crypto trading bots and helps its traders to deal with the volatility of the market. Kryll.Io helps traders to create their very own trading strategy and predict the right moment to invest their funds.

- Io comes with a flexible editor and advanced features.

- Create your very own basic or advanced trading strategies with the drag and drop editor and that too can be done without any coding knowledge.

- The app comes with additional features like market indicators, risk analysis tools, and notification blocks.

- AI-based tools such as sentiment analysis and market trend prediction done by deep learning.

- Fees as low as 1% per month.

- Users can earn through affiliate programs by referring their friends and relatives.

- The publisher mode allows users to publish their trading strategies on the community and earn passive revenue.

Gunbot is a popular trading bot with over 6000 traders using its services daily. The app is available for windows, linux, and mac operating systems. It offers paid plans in BTC. Few important features are listed below:

- The app is available on multiple trading exchanges including binance and GDAX.

- Users can run it effectively in their local pcs without any trouble.

- Gunbot supports 32 different trading strategies including bollinger band, step gain, and ping pong.

- To avail the services of gunbot, users have to pay a one-time lifetime charge of 0.05BTC to 0.125BTC depending on the features they use. The lite version is available at lesser fees.

- The app comes with customer support and will resolve your issues within a day. However, users are advised to turn off their bot in case the market is too volatile to avoid the risk of losses.

Conclusion

Cryptocurrency trading bots are useful for automated trading and can be very profitable if used carefully. There are some trading software such as the bitcoin era platform which can be used for trading purposes. It is very much recommended to use any platform with proper knowledge and research and choose only reputed and secure bot software.

7 cryptocurrency trading bots for beginners

Trading bots are computer programs configured to complete buy-and-sell orders automatically. These bots are gaining popularity by the day, and among their best features are good profits, security, user-friendliness, speed, and many others. Bots are also independent of decisions based on human emotions.

The upsurge in the number of companies offering trading bot services makes them a perfect item of discussion. The main reason behind the use of trading bots is the crypto market volatility. Since the crypto market is a 24-hour economy, market trends change in seconds. Automated trading allows the crypto traders to react to any changes even when they are away from their trading platforms.

As a trader, you might often wonder what bot is the best for use. Keep on reading to know the seven best trading bots as listed below.

Shrimpy

This web-based platform was launched in 2018. It works by automating functions to allow traders to manage their portfolio, analyze the market, and execute their strategies.

Anyone can start using shrimpy by signing up from the website and connecting their exchange account to shrimpy. Although it’s a new product in the market, it’s rapidly gaining popularity among new and seasoned traders due to the excellent services.

Shrimpy supports an extensive list of crypto exchanges, along with an endless list of cryptocurrencies. Some of the exchanges supported are bittrex, kucoin, coinbase pro, bitmart, bitstamp, gemini, huobi, bibox, binance, and bitfinex.

Shrimpy also comes with the best pricing plans for new and even experienced crypto users. Its paid plan allows traders to access almost all service functionalities, including unlimited exchanges, custom portfolios, and rebalancing.

Shrimpy’s plans start as low as $8.99 per month. The subscription gives full access to the features above and features a full social trading platform with complete portfolio backtesting.

Shrimpy has a simple, very clean, and easy to use interface. Setting up trading bots is easy. The functionalities are quite easy to use, so the platform is generally user-friendly.

Cryptohopper trading bot

The cryptohopper domain and platform was registered in 2017 and is owned and operated by cryptohopper BV, a netherland based company. The platform serves as a web-based platform and comes with a user-friendly interface that operates 24/7. It is a platform that allows for both algorithmic and social trading.

The technology involved allows for full automatic tradings by integrating the API to the crypto exchanges. The services are easy to use on any internet-enabled device.

The platform incorporates configurable and savable templates, a bot backtesting tool, and customizable technical indicators. Cryptohopper is compatible with several exchanges, i.E., kraken, coinbase pro, cryptopia, huobi, binance, kucoin, poloniex, bitfinex, and bittrex.

Cryptotrader

Cryptotrader is a project run by algocraft limited and allows users to use their strategies to automated trading via the scripting language based on coffee-script . Members of the platform can trade bitcoins and other cryptos without other software, and the bot operates 24/7.

The platform is web-based, and the vpncloud hosts the automated bots. It allows its users to use backtesting and live testing strategies.

Cryptotrader platform provides an API that can link with different exchanges and give developers full trading algorithms writing rights. Crypto exchanges supported in the platform include coinbase, huobi, binance, bitfinex, bitstamp, bittrex, kraken, and poloniex. It operates on subscription. Therefore, a trader can choose a paid plan that best suits their needs.

Zignaly

Zignaly , a spain-based platform, was founded in 2018. It’s a trading terminal that allows bitcoin and other cryptos. The platform excels at both manual and automated trading.

The platform is cloud-based, which automatically updates without you having to do it manually. Any changes you make in your system are automatically updated into the cloud, and you can get access to the information from any device.

A trader gets external signals from the systems signal providers. The signals help to analyze the market and make strategies based on market conditions. This means that a trader doesn’t need to devote all of his time to trading. However, there is not much information about the reliability and safety of the platform. The price of zignaly’s beta plan is $9 per month .

Kryll

Kryll was launched in 2018 through an ICO but was introduced to the public in january 2018. Kryll’s block-like strategy structure makes it easy for traders to use trade as their primary income mode.

Although it has gained popularity in the past two years and has received positive reviews from users and critics, it’s still less popular than its competitors. The exchanges supported in this platform include binance, bittrex, liquid, kucoin, poloniex, coinbase pro (GDAX), hitbtc, and bitstamp. However, kryll is still trying to make more exchanges compatible with its system.

Kryll is user-friendly so that even beginners can easily use it.

3commas

3commas is best for the more experienced crypto traders since its user interface is a little complicated. The interface can be accessed anywhere using a desktop, phone, or any other internet-connected device.

This cloud-based platform incorporates a smart trading terminal, reliable trading bots, copy trading, and portfolio management. The platform supports 23 different exchanges, including binance, bitfinex, and others.

3commas allows the user to do either manual or automated trading. Its pricing plan for starters is $14.5 per month , and you can change your plan as you progress.

Haasbot

Haasbot platform was founded in 2014 and had a transparent team. The platform offers a wide range of services, including technical indicators and backtesting of real-time and historical safety and insurance.

The platform requires users to install the software on their laptops, which comes with an excellent interface and customizable dashboards that appeal to them. Haasbot supports both linux and windows OS, and a user can trade at any time.

Haasbot is compatible with 20 exchanges, including bitfinex, bitstamp, binance, and bitmex. Plan payments are made in bitcoins, and the prices range from 0.04 BTC for a 3-month plan to 0.32BTC for a 12-month advance payment plan.

Bottomline

Crypto trading bots are a must-have tool for any trader who would like to make significant trades. These programs help you trade, even while you are away, and make wise investment decisions that are not clouded by emotions.

There are several trading bots available in the market, all of which come with different features. If you are looking for one, you may find it challenging to choose the best. Luckily for you, we’ve rounded up the seven best bots you can use to give you a headstart.

So, let's see, what we have: crypto trading bots are all the hype right now. Properly configured bots can give you some really impressive results, these are our top picks at cryptocoin trading bot

Contents

- Top forex bonus list

- The best crypto trading bots

- Best crypto trading bots: reviews 2021

- Best crypto trading bots 2020 - automate your trades

- Best crypto trading bots for 2020

- What is a crypto trading bot?

- Crypto trading bots advantages

- Free bitcoin trading bot

- Top 5 crypto trading bots

- Conclusion – best crypto trading bots

- Crypto trading bots: all set to make a statement in the cryptocoin market

- 3 best crypto grid trading bots (that actually work)

- 3 best automated grid trading bots:

- Conclusion: which grid bot to use?

- Asset 4

- Meet the bots that let you trade bitcoin in your sleep

- Market maker

- Established practice

- Trading bot strategy

- Secret strategies

- Not for everyone

- Automated cryptocurrency FX trading and arbitrage betting system

- Powerful bitcoin trading and arbitrage betting.

- Why choose us

- Bitcoin trading on all your devices

- 8 best cryptocurrency trading bots [free, paid, open-source] for 2021

- What is crypto trading bot?

- How does a free cryptocurrency trading bot works?

- Advantages of cryptocurrency trading bots

- Features of a good cryptocurrency trading bot

- Best crypto trading bots

- Conclusion

- 7 cryptocurrency trading bots for beginners

- Shrimpy

- Cryptohopper trading bot

- Cryptotrader

- Zignaly

- Kryll

- 3commas

- Haasbot

- Bottomline

Comments

Post a Comment