Free real money forex no deposit, free trading account with real money.

Free trading account with real money

2. Once the client registers with the broker and is set to trade, the broke gives the trader access to an account with a certain amount of real money with which the trader can trade the live forex market on the condition that the trader does not withdraw the money.

Top forex bonus list

The money is there and can be traded with but the trader does not have the ability to make withdrawals from the no deposit account until some conditions are met. 3. For the trader to withdraw some real money from his or her no deposit account, the trader must have accumulated some trade points and made some profits. Form the profit made, the trader is expected to make some deposit to his account, which will serve as a trade capital, after which the trader can freely withdraw the rest of the profit made.

Free real money forex no deposit

Among forex brokers, there is a tough competition going on as to who will get the most number of novice traders. The race for new clients is so important to forex brokers that they are willing to sponsor their new clients by giving them access to take part in live forex trades without making any deposit. This is called the fore no deposit account.

With this development, it is now possible to actually trade the forex market without making any financial commitments at all. The normal trend was to sign up with a broker and make some deposits in your real account before you can start trading the forex market, but things has changed and broker have devised new ways of getting new clients every day. Once you sign up with the broker, you get real money in your account with which you can trade the forex market with.

In as much as this is basically to encourage people to trade the forex market, it is also important t know that there are terms and conditions attached to the forex no deposit accounts. These terms and conditions help the forex broker stay safe and not exposed to huge risks seeing as they are the ones sponsoring their new clients with their no deposit accounts. Some of the terms and conditions are

1. The trader must register with the broker and trade with the platform offered by the broker. This is the main reason why brokers go as far as offering traders the opportunity to trade the forex market without any deposit.

2. Once the client registers with the broker and is set to trade, the broke gives the trader access to an account with a certain amount of real money with which the trader can trade the live forex market on the condition that the trader does not withdraw the money. The money is there and can be traded with but the trader does not have the ability to make withdrawals from the no deposit account until some conditions are met.

3. For the trader to withdraw some real money from his or her no deposit account, the trader must have accumulated some trade points and made some profits. Form the profit made, the trader is expected to make some deposit to his account, which will serve as a trade capital, after which the trader can freely withdraw the rest of the profit made.

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of liteforex. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of directive 2004/39/EC.

Free trading demo account review

Are you looking for a free and unlimited trading demo account? – then this page is for you. In more than 7 years of experience in online trading, we have tested many providers and present you in the lower table in our top 3. Additionally, you will learn on this page why a demo account with virtual credit is so important for beginners and advanced traders.

| Broker: | review: | spreads: | advantages: | open account: |

|---|---|---|---|---|

1. IQ option  | ➜ read the review | starting 1.0 pips | + FX & options + best platform + start with $10 |

Criteria for a good trading demo account:

Not every trading demo account is optimal for the private trader. That’s why there are different criteria that make a good trader. All in all, however, it can be said that nowadays almost every online broker offers a free demo account. Sometimes, however, there are runtime restrictions or other functions that are limited.

The demo account is intended to simulate real money trading. Therefore, it is essential to choose a reputable provider. With brokers with an official regulation and financial license, there are no differences in the demo and real money trading from our experience.

- Free demo account

- Unlimited demo account

- There is no difference between the demo account and real money trading

- The account can be recharged with virtual money as desired

- All functions are available

Why is a demo account so important for beginners and advanced users?

A trading demo account is an account filled with virtual credit (play money). It simulates real money trading. Traders can therefore trade real market situations without risk. The account is particularly suitable for beginners who want to start trading. The first experiences can be collected in the demo account.

In general, it is about getting to know the trading platform of the broker better. In our experience, most beginners find it very complex to trade on the financial markets at first. After a few explanations and tests, however, one realizes that it is not so difficult. In addition to the trading platform, the broker can also test the trading conditions.

The spread and trading commission in the demo account is the same as in the real money account. New markets should also first be tested in virtual mode, especially in the short-term area (day trading). Beginners and advanced traders can benefit from this. In addition, trading strategies can be tried out or developed. In summary, the rule is that you should trade in the demo account until you are profitable and make progress.

Facts about the demo account:

- Trading in the demo account is risk-free and simulates real money trading

- Test the trading platforms sufficiently

- Learn online trading and control order execution

- Test the broker’s fees

- Test and develop new trading strategies

Free and unlimited demo account

In general, a demo account is always free of charge. From our experience, 99% of online brokers offer this service. Some few providers require a minimum deposit. From such offerers is urgently to be advised against, because these are often unserious. In addition, the account should have an unlimited duration.

Some providers have fixed expiration times for the test account. By a message to the support, this problem can be solved however and the running time was extended from my experiences up to now always. In summary, beginners and advanced traders have the opportunity to test open trading platforms and brokers. A demo account like the real money account should always be ready to trade.

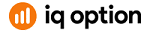

IQ option trading demo account

No difference between real money and virtual credit

With good brokers there is no difference between demo and real money trading. The price movements and executions are the same. Gladly, the trader can also check this himself. With regulated providers you do not have to worry. Therefore, be sure to obtain an official license from a financial supervisory authority.

The top recommended brokers all have an official license and are even regulated several times. Also, the trading fees and/or the spread has no difference in the demo account to the real money trade. With these accounts, you can simulate real money trading 1 to 1.

- Choose a reputable provider for your trading demo account as well

- You trade in both accounts under the same conditions

Account recharge is quite simple

With the demo account, there is the possibility to recharge the credit as desired. Since it is a test account, the credit can shrink quickly. But this is no problem at all. Because over the web page of the broker one can recharge the account very simply in few clicks. If you have any questions you can contact the support.

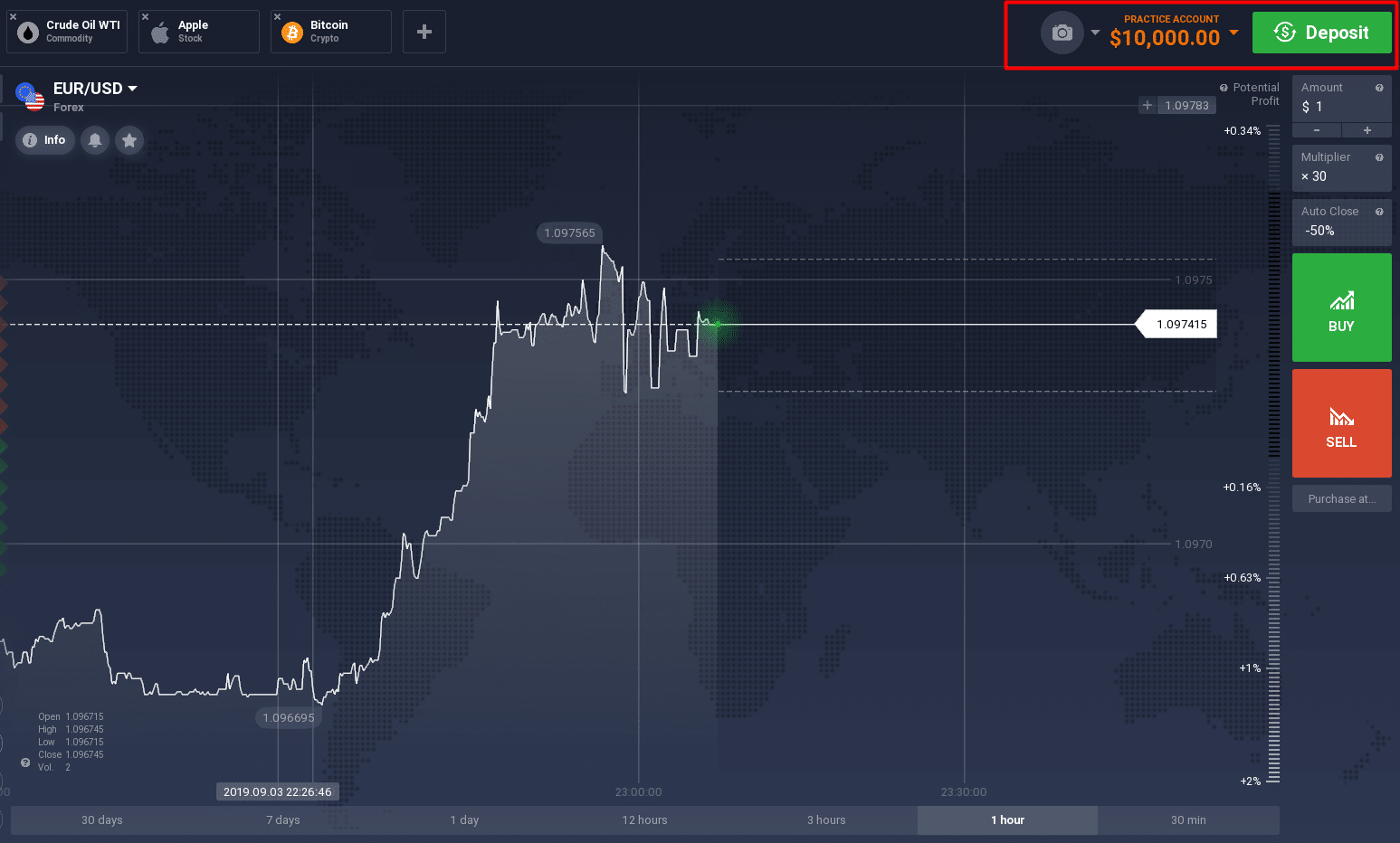

Further training for traders

Especially many beginners trade in the demo account and this is also absolutely necessary for a newcomer. The brokers offer concrete training material. The offer ranges from trade tutorials to free-market analyses and webinars. The demo account is the best way to expand your knowledge.

In addition, you can gain personal experience in various market situations. Professionals generally talk about the fact that it takes several thousand hours of screening time to act successfully. Read also our 10 trading tips.

Education center (videos and more)

How long should I practice in a demo account?

From our experience, one should practice in the demo account until one has made demonstrably the first profits over a longer period of time. From our experience, a period of one month is suitable here. If you make a good profit week after week, you can slowly dare to trade real money.

It is important that you keep a statistic about your trades. The trading platform, however, already shows this very transparently. Alternatively, further tools can be added. It is best not to rush into anything. Trading a week longer in a demo account is better than losing real money because you don’t feel safe enough.

Conclusion: the demo account is the best way to learn online trading

The trading demo account is suitable for any trader and should be used before trading real money. It has many advantages which we have described to you on this page.

In addition, the creation of such an account is done in a few minutes. Online brokers meanwhile offer very easy access to the trading platform. Should he feel sure that a trader is safe enough for real money trading, he can start it directly.

In summary, the demo account is one of the most important tools of a trader, because with this account you can try many things about real market situations for free and without risk.

Good luck with your trading.

A demo account is necessary for each type of trader. You can try to trade the markets without risk.

Free trading account with real money

What we dream of is that from very first day we are going to be profitable every single day! Look at these great profits we are piling up!

And yet reality is made of losses too!

So I’ve created a completely hypothetical spreadsheet of our performance: every cell displays the daily profit/loss, and every box of 5 cells is a week of trading.

This time we are accounting for losses too: you can see first 2 weeks are in loss, following 3 are in profit, this could resemble the optimal performance of a good trader.

So I’ve repeated than this for 52 weeks to obtain this beautiful and optimistic chart of our first year of trading!

But the reality is that we want to enjoy our life as a trader right? So I’ve added a couple of inactive weeks where the p/l line goes flat, and also 3 withdrawals from our profitable account.

I am myself a funded-trader with earn2trade since I participated in and won the gauntlet at the end of 2018; earn2trade pays to the profitable trader the first 5k he withdraws at a 100%, after that helios will take its 20% profit share (this could be 30%, based on your performance) monthly: in this chart you can see how the p/l line goes down a little every month after my first withdrawal; the other funders like savius take their profit share every time you withdraw; topsteptrader as well offers the first 5k at 100%, while oneuptrader goes as far as to 8k at 100%.

I plan on letting my account grow nicely before taking any withdrawal: the further I’ll be from the drawdown the better I’ll trade.

Remember: broker and platform fees have been accounted for in the trading profit&loss, these are taken immediately! While the data fee (105$ monthly per product) will need to be paid out by you! Some funders ask you to pay directly, others will take it from the profit in your account. Obviously the costs for your trading platform are on you.

So while the first unrealistic projection was to grow our account from 25k to almost 80k in the first year, the truth is that even by being a consistently profitable trader our account will be (remember that this is pure speculation) closer to 37k at the end of the first year: but you enjoyed 2 weeks of holiday, and a nice 15k$ withdrawn in your bank account!

Furthermore you have 1 full year of trading with real money under your belt, while you had zero risk on your savings! Not a bad experience right?

The following year you will keep your successful strategy exactly as is and yet perhaps make the most of this growing account to, let say, double your size in contract? That is double your profit!

So year 2: 2 weeks of holiday, and 30k $ withdrawn!

The sky is the limit! Don’t be greedy, use your wisdom, and your life will be fulfilled and happy.

Best free trading apps in 2021

Mobile apps became very popular. They make your life a lot easier. There is an app for everything now. You can buy flight tickets, book a hotel or trade on the stock exchange.

There are a lot of trading apps out there so, to save you time, we selected the best free trading apps for you. Apps providing free stock and ETF trading are gaining popularity, so it is worth taking a look at them if you don't want to spend fortunes on your trading fees!

What are trading apps great for?

Trading apps can be used for trading, learning, charting, finding trading ideas, and also for market data and news. Some of the apps offer all of these features, while others only a few. Don't worry, we have made trading app top lists for all of these features!

Trading apps are usually offered by financial companies such as online brokers or banks. These apps can be great add-ons to your web or desktop trading platform, but they can also be the flagship product of a company, for instance in the case of robinhood and freetrade.

We see trading apps as excellent complementary tools to web-based trading platforms and other financial portals. When you want to buy a stock, you can make fundamental or technical analyses on a computer more conveniently, but it's easier to follow the price of the stocks you've already bought through a trading app. You can also intervene faster via an app, when, for example, you quickly need to sell your stocks.

And now, let's see the best free trading apps in 2021!

| app | approves clients from | app score | US stock trading fee |

|---|---|---|---|

| robinhood | US | 5.0 stars | $0.0 |

| trading 212 | globally | 4.9 stars | $0.0 |

| merrill edge | US | 4.8 stars | $0.0 |

| TD ameritrade | US, china, hong kong, malaysia, singapore, thailand, taiwan, canada (through TD direct investing) | 4.8 stars | $0.0 |

| freetrade | UK | 4.7 stars | $0.0 |

Just to make it clear again: with these apps, you can trade stocks and etfs for free.

Besides the best free trading apps, we have also selected the best trading apps for charting, trading ideas, market data, news, and learning.

| Name | best apps | score |

|---|---|---|

| best apps for charting a nd trading ide as | ||

| tradingview | best app for charting | 5.0 |

| stocktwits | best app for trading ideas | 5.0 |

| best apps for market data and news | ||

| investing.Com | best app for market data | 5.0 |

| bloomberg | best app for market news | 5.0 |

| best apps for learning | ||

| invstr | best app for learning to trade | 5.0 |

| trading game | best app for learning forex trading | 4.0 |

Now, let's take a closer look at the best trading apps in 2021!

Free bitcoin

Try executium for free

Free bitcoin for you

When you first sign up to executium, you will be pleased to know that we offer all of our new users a free sign up bonus of 0.002 bitcoin. This free bitcoin is given to you, by us, to show you just how much each and every one of our new users means to us. It also means that you can start trading right away.

Enabling you to trade instantly

We give every new sign up this free bitcoin which is basically going to be a way for you to cover the commissions that are taken by us, during your early days of using our platform. This means that you do not have to initially deposit any money into the system, allowing you to trial executium without having to worry about losing any of your own money.

Make your cryptocurrency work for you

When it comes to the commissions we take, here at executitum we pride ourselves on taking one of the lowest commission fees in the business, at the very low 0.015% commission. This means that, should you put in an order for 1 bitcoin, then we would take our 0.015% commission, which would actually come off of your free bitcoin.

So, if you were considering signing up with executium and giving our platform a go, then why not take advantage of this free bitcoin offer and spend a little bit of time trying us out, before you realise just how great we are. You are going to love it.

What is day trading with bitcoin?

A day trader is an investor who prefers to take advantage of the minor fluctuations in the token price that take place within the opening and the closing bell. This means that a day trader would close out all positions when the day ends and would start again the next day. By that time, he would have 100% cash position to purchase and sell. According to the securities and exchange commission, a day trader is someone who invests and makes same-day buy and sell transactions for at least 4 times in a 5-day time frame.

If you buy something from the market on monday and then sell it on tuesday, then that won't fall under day trading. Same day trading must be at least 6% of an investor's activity. To be a good day trader, an investor should make sure that they have a good understanding of the cryptocurrencies and bitcoin they are currently holding and how they have been performing, in order to give them a better understanding of when to hold on to them, when to buy more of them, and when to sell.

Some of the investors keep at least 2 accounts to separate the trading accounts. Doing this will prevent confusion, as they perform day trading on one account and intra-day trading on another account.

What is intra-day trading?

An intra-day trader is an investor who doesn't only limit themselves to same-day trading. Intra-day trading (or short term trading) doesn't have the same limitations and restrictions as day trading. Investors in bitcoin and cryptocurrencies can easily start this trading method even with a small amount of capital. The biggest notable difference between the two is that a day trader only profits on small price fluctuations while an intra-day trader profits by holding the positions for a number of days, hoping for the profit to be bigger.

Some suggest that intra-day trading is a lot less hectic than day trading, as you are not trying to get it all done within a one day margin, so you can relax a little bit more. However, those who are involved in trading will tell you that this is not always the case, as along with the possibility of bigger profits from intra-day trading, also comes the possibility of bigger losses.

Free trading account with real money

Published: 07:53, 2 april 2019 | updated: 14:54, 2 april 2019

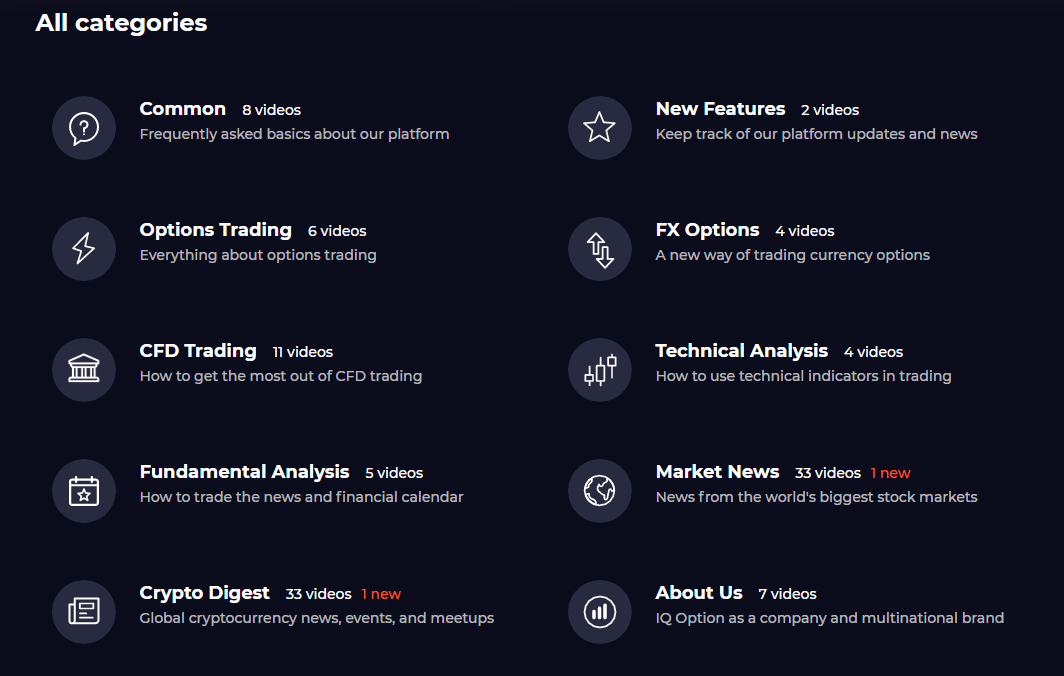

A new breed of investment platforms has cropped up in recent years allowing users to buy and sell company shares without incurring a broker charge.

Commission-free share trading is one of the latest exports from the US, where the rapid growth of zero-fee platforms like robinhood is eating into the margins of wall street banks.

At present, there are only two investment platforms in britain offering this: trading 212 and freetrade.

Both trading 212 and freetrade offer zero-commission share trading as a carrot to prise custom away from the more established rivals

They will have their work cut out to prise market share from big established rivals, such as hargreaves lansdown, which boasts £85.9billion of private investors assets under management.

And investors tempted by the idea of not forking out £10 or more in dealing costs every time they buy or sell shares are likely to be sorely tempted.

However, both services come without the bells and whistles of the big DIY investing platforms and with potentially limited investment options.

RELATED ARTICLES

Share this article

HOW THIS IS MONEY CAN HELP

The cost of buying and selling shares has fallen steeply since the start of the 2000s thanks to a digital revolution.

In the not too distance past, investors who wanted to buy and sell stocks and shares would have to do this through a stockbroker or a financial adviser who took a sizeable chunk of commission with every deal.

But times changed and online DIY investing platforms give investors the ability to buy and sell at their fingertips, whether from the comfort of their computer or even their phone.

The cost of buying and selling shares has fallen over time, but still remains sizeable at some platforms, with hargreaves lansdown charging £11.95, interactive investor £10 and AJ bell £9.95. Halifax-owned iweb deserves and honorable mention as it charges just £5

The fee-free share dealing firms

Trading 212 and freetrade both have an eye-catching offer designed to pull customers in: neither charges a penny to buy or sell shares.

But why offer this and who are these two firms?

For trading 212, it was a case of adding another string to its bow when contracts for difference (CFD) trading - one of its flagship offerings and main revenue driver -was hit by a regulatory crackdown.

A CFD is a form of derivative trading that allows you to speculate on the rising or falling prices of global financial markets, such as forex, indices, commodities, shares and treasuries. It carries a higher level of risk compared to conventional shares and bonds investments.

Crucially, investors do not buy shares but use derivatives to either simply mimic prices, or magnify moves through the use of leverage, as borrowed money is known.

New european rules, which came into effect in august last year, have reduced the amount CFD traders can leverage, as concern grew that big losses were being incurred by inexperienced investors. Britain's financial watchdog, the FCA is also tightening rules. These measures have trimmed CFD platforms's prospectts.

Trading 212 became the first retail broker in britain to introduced a commission-free share dealing service in 2017.

In the case of freetrade, commission-free share dealing, either through a standard account or isa, is the only service the digital broker currently offers. It plans to expand into new areas in future. It's free to open an isa account until july 2019. The cost will be £3 thereafter.

Both challenger investment platforms have adopted this model as a carrot to tempt customers away from established rivals, such as hargreaves lansdown, interactive investor and AJ bell.

The average commission charged by five of the largest online share-dealing platforms run at £8.31 per trade, with leading brokers such as hargreaves lansdown and interactive investor charging £11.95 and £10 respectively, according to DJB research.

Commission-free sharing dealing looks set to further disrupt a market that is already experiencing a downward pressure on investment fees amid regulatory pressure.

Where can you invest?

It's worth noting that freetrade's and trading 212 respective investment universe is relatively small compared to that of more established rivals.

A total of 335 stocks, etfs and investment trusts sit on the freetrade platform. The selection comprises of 122 US stocks and 136 UK securities - including 33 investment trusts and 44 etfs. The firm expects to increase this figure on an ongoing basis.

Meanwhile, trading 212 hosts more than 1,800 investment opportunities comprising shares in companies based in the UK, the US and in some european markets, as well as etfs.

To put this into perspective, hargreaves lansdown offers 1,643 UK shares, 7,184 overseas shares, 1,170 etfs and 386 investment trusts.

Crucially, neither trading 212 or freetrade allow you to invest in investment funds or individual corporate bonds outside an ETF.

Hargreaves, meanwhile, hosts 470 corporate bonds plus 7,099 funds from the UK and abroad.

Both trading 212 and freetrade offer an isa wrapper, but neither offer a self invested personal pension.

How do these platforms make money?

Ivan ashminov, co-founder of trading 212, told this is money that actual trading costs are less than £1, so waiving trading commission does not have a detrimental effect.

The charges levied on the platform's other services should more than cover a shortfall from these costs, he added.

Things to consider before moving platform

Investors are free to move DIY investing platform and should track down the one that is best for their needs.

However, they need to be aware of fees for moving from their existing platform and from one they sign up to if they don't like it.

Investors should calculate the potential annual saving they would make by switching and a reasonable expectation of investment growth under the new platform against the cost of moving and any exit fees.

Things like customer services offered by the respective platforms may seem like a small detail but can make the world of difference.

Trading 212 adopts a 'freemium' model - like mobile games that are free to download but have in app purchases - in the hope that some customers will shell out for additional services that it develops down the line, such as robo-advice on which stocks to buy.

Customers of newcomer freetrade can only trade shares without incurring a broker charge if transacted outside an isa wrapper through it's 'basic trade' service.

Basic trade means the buys and sells are aggregated and dealt around 4pm every day.

This isn't a huge problem if you plan on holding shares for a long time, but more experienced investors often want to be able to trade instantly at a set price.

Free trades are never quite free

There is no such thing as a free trade. Period.

This is because of a concept called the bid-offer spread, which is essentially the gap between the highest price a buyer is willing to pay you for shares and the lowest price a seller is willing to sell them to you for.

You will pay closer to the higher price to purchase a share and sell nearer the lower price.

The size of the gap depends on how liquid a share is, ie how easy it is to buy and sell, and larger companies therefore tend to have tighter spreads.

These prices are different to the mid-price, which is the one you will generally see quoted in market reports and headline share data.

At the time of publication, shares in tesco were trading at 234.05p, however, the offer was 234.1 and the bid was 234p. The spread here is 0.04 per cent. Another cost in buying shares is stamp duty charged at 0.5 per cent.

When buying a foreign stock, you'll also have factor in the cost of the converting currency. Trading 212 passes on the charge at the spot rate. Whereas freetrade charges spot rate plus 0.45 per cent on these transactions.

Freetrade was founded back in 2015 but officially launched its commission-free share dealing app in september 2018.

Will commission-free trading free trade last?

That's dependent on whether the model can pull enough people for these companies to make money off other things they charge for.

At some point, the platform's respective financial backers will want some return on their investment, and zero commission trading removes a major source of revenue.

Commission-free share trading is novel, but eventually investors might crave a more expansive investment universe, with access to more shares, funds and investment trusts.

So the main challenge for these platforms in future may be to keep hold of the customers they've lured in through the zero-commission share trading service by adding new features that complement their evolution as investors.

Both trading 212 and freetrade are legitimate digital stockbrokers, authorised and regulated by the FCA.

If either platforms ever go under, your investments are covered by up to £85,000 (up from £50,000 as of 1 april) under the financial services compensation scheme safety net.

The saying 'there's no such thing as a free lunch' certainly applies here. While basic share dealing services are free any bells and whistles cost more and there is the spread and tax to take into account.

Also, free trading may tempt you to change your investment style and invest more frequently than necessary. Doing so can increase internal costs and potentially hinder your long-term returns.

When weighing up the right platform to invest for you, it's important to look at the service that it offers, along with administration charges and dealing fees, plus any other extra costs.

| provider | admin charge | charges notes | fund dealing | standard share, investment trusts, ETF dealing | regular investing | dividend reinvestment | |

|---|---|---|---|---|---|---|---|

| trading 212 | n/a | - | n/a | free (investment trust trades unavailable) | n/a | n/a | more details |

| freetrade | n/a | - | n/a | free | n/a | n/a | more details |

| hargreaves lansdown | 0.45% | capped at £45 a year for shares, trusts, etfs | free | £11.95 | £1.50 | 1% (£1 min, £10 max) | more details |

| barclays direct investing* | 0.2% on funds, 0.1% on other investments | min monthly fee £4, max £125 | £3 | £6 | £1 | free | more details |

| share centre | £57.60 | - | 1% £7.50 min | 1% £7.50 min | 0.5%, min £1 | 0.5%, min £1 | more details |

Free share dealing snapshot

Trading 212

Trading 212, which was founded in bulgaria 16 years ago, has operated an online commodities and currency trading platform in the UK for five years. The firm became the first retail broker in britain to introduced a commission-free share dealing service in 2017.

The service, now called, trading 212 invest, provides access to stocks and etfs across the world’s leading stock exchanges and currencies, including cryptocurrencies, like bitcoin, and commodities.

Trading 212 doesn't levy an administration fees on trades, the only costs to be aware of are the bid-ask spread and the foreign exchange spot price when trading shares overseas. Money held in an isa incurs no additional charge.

Freetrade

Freetrade was founded back in 2015 by adam dodds, a former KPMG manager, but officially launched its commission-free share dealing app in september 2018.

In order to offer fee-free trading, freetrade got an FCA licence and joined the london stock exchange in order to processes its own 'basic' orders in bulk each day at 4pm.

The online broker does not levy for trades that are aggregated and dealt around 4pm every day. UK and US shares cost £1 to trade instantly and a foreign exchange charge which comprises of the spot rate (the price quoted for immediate settlement on a commodity, a security or a currency) plus 0.45 per cent.

Isas are currently free until july 2019 but will cost users £3 a month thereafter. Transferring money out of either an isa or general account into a bank account cost £5 a pop. The bid-ask spread costs also apply.

Coming soon? Etoro and revolut

Etoro could be the next the latest investment platform to launch a commission-free share dealing platform.

Users will be able to trade 1,340 shares that sit on the platform without incurring a broker fee. A spokesman for the firm said the service will land before the end of summer and it won't cap users' amount of free trading.

Digital-only bank revolut is also building a commission-free trading platform on its app, its latest bid to use technology to undercut traditional financial services.

Revolut said users will be able to buy and sell listed stocks in seconds, without paying commission. The firm said the product would generate income from premium subscriptions, which will give perks to paying customers, as well as margin trading, securities lending and interest on cash held. No release date has been given.

No deposit bonuses

The term "no deposit" refers to the fact that you can open a forex no deposit account to benefit from a free money trading bonus. The purpose of this is to give the broker a promotional edge and attract new traders. A no deposit bonus means that you can trade on the platform before you decide whether or not to make a real money deposit.

Many forex brokers are offering this incentive. The amounts they offer will vary, and it will take time to search for the one that offers what you are looking for. In addition to the free bonus it is useful to find one that offers a demo account. This way you get lots of chance to practice before you risk your own money.

We spend our time reviewing the various brokers so if you don't have time to trawl through the best forex brokers, fear not! Our team are experienced in forex trading. They know what to look for, what makes a good broker and what you need. Select from our list of recommended brokers and choose the one that best suits your needs.

In this article, you will learn:

Why forex brokers offer no deposit bonuses the pros and cons of using this type of bonus tips for using your sign up incentive well

Top rated forex sites

Risk warning: the products offered by the companies listed on this website carry a high level of risk and can result in the loss of all your funds. You should never risk money that you cannot afford to lose.

Ad disclosure: some of the links that you will find on this website are advertisements for which we do receive financial gain for referring new customers.

How to use your bonus

When you open a forex account, you should have a clear trading strategy. You might find that those that offer forex bonuses don't provide a demo account and vice versa. If you can find one that provides both and ticks all of your other boxes then this gives you a good start. So how should you use your forex no deposit bonus?

Testing the platform

While you may be able to sign up for a free demo account and should if, given the opportunity, there is nothing like trading on the live platform, making real trades. The no deposit forex bonus allows you to try out the desktop and mobile versions of the site before you deposit your funds.

Comparing brokers

You may be stuck between two brokers and struggling to decide which one is for you. If they both offer a no deposit bonus, you can try them both to see which one you prefer. That way you haven't had to spend your money to find out which best suits your requirements.

Try something new

If you have experience in trading the USD/GBP for example but not the USD/AUD, then you may want to use your free bonus to try this new currency pair. You may be used to investing in the more major pairs and fancy trying a pair where you might get a greater spread. Tropical pairs, as they are called, are often very profitable.

Practise early trades

While a no deposit bonus won't be huge, it does allow you to practise on those first few trades and get any early mistakes out of the way before you risk your own money. This way, when you eventually start investing with your real money, you have more of an idea of what you are doing.

You can use the demo account to get used to trading on the platform and then you can use the bonus to make live trades. This is all before you even consider touching your own money. The two complement each other to provide you with the best trading experience.

I'll find you an awesome forex site in seconds. Ready to go?

What type of device do you trade on?

What style of financial bonus suits you best?

How fast do you want to withdraw profits?

What amount are you thinking to deposit?

I'm checking 75+ sites to find your best match.

Risk warning: the products offered by the companies listed on this website carry a high level of risk and can result in the loss of all your funds. You should never risk money that you cannot afford to lose.

Ad disclosure: some of the links that you will find on this website are advertisements for which we do receive financial gain for referring new customers.

Why brokers offer deals

Forex bonuses are probably the most significant promotion that a forex broker offers. Along with this form of incentive you will also see match deposits, demo accounts, refer a friend and several other incentives. They are all designed to give the broker the edge and make them stand out from all the other companies. It can be a very competitive environment with everyone trying to corner the market and be the best.

The trouble is there is only so far that they can go. While one broker might offer a massive no deposit forex bonus, another broker might provide an excellent demo account. When looking for the right broker for you there will be many different choices with quite a complex range of forex bonuses. From $5, $10, $20, $25 to amounts stating "up to $1,500" bonus, it can be hard to know where to begin. Each broker tries to differentiate themselves in any way they can.

This is good news for you as a trader. It means that there is plenty of choices when you are searching for the perfect broker. If you can find a broker that offers a forex no deposit bonus to use on your live account, a demo account, and one that has a mobile app and a website that provides plenty of education tools then you have pretty much everything you need. Of course you must make sure that they are trustworthy and reliable as well.

7 best free stock trading platforms

Thanks to the rise of fintech, investors now have the option to buy and sell stocks online or through mobile apps - and often free of charge.

There are dozens of trading apps and platforms that allow investors to invest cash in a variety of securities with minimal to no fees. With the increase in choices, here are the best free stock-trading platforms and how they compare.

7 best free stock trading platforms

Whether you're a beginner investor or have been playing the market since before the last recession, free stock trading platforms and apps provide a great opportunity to maximize your returns and keep trading easy and simple.

These investment platforms are top-notch.

1. E*TRADE

Although E*TRADE (ETFC) - get report accounts aren't always free, there are some promotions and accounts that allow investors to invest for free. Currently, E*TRADE is having a promotion when you open a new account. The promotion offers 60 days of commission-free trading for up to 500 trades with a minimum deposit of $10,000 or more.

The site offers 24/7 customer service, easy mobile trading, data and research information, and has trading vehicles that range from etfs to options. And while E*TRADE's commissions usually hit just under the $7 mark for normal (nonpromotional) trades, the site is still very popular for its ease of use and retirement services.

2. Robinhood

The free stock trading app has seen a meteoric rise in popularity in recent years, accumulating 6 million users in 2019 - and with good reason. Robinhood seems to be the darling of commission-free trading - as a fintech startup founded by baiju bhatt and vlad tenev in 2013 with their free stock trading model.

Although there has been some speculation over how robinhood makes money (given their free trading model), the app is very popular for its easy, free trading and variety of investment vehicles - including options and even cryptocurrency.

To get started, you simply have to submit an application to robinhood and meet a few basic requirements (although if you are planning to participate in options trading, additional requirements are necessary) - with no account minimum. As a bonus, there are no maintenance fees.

As somewhat of a drawback, robinhood doesn't currently allow fractional investing (you can only buy whole shares). But for its cost-efficiency and easily-accessible app format, robinhood is clearly a crowd favorite for a reason.

3. Charles schwab

Ideal for investors looking to get into etfs, charles schwab (SCHW) - get report has an impressive array of 200 etfs to choose from, all commission-free. And, as a bank and stockbroker all-in-one, the schwab app is a great one-stop-shop for investors.

Schwab also has no-transaction-fee mutual funds, with around 4,000 available. Their regular trades will set you back around $5 apiece. There is no minimum balance requirement (although normal accounts typically come with a $1,000 minimum).

Because of their wide selection of the commission-free etfs and mutual funds, schwab is a strong contender for free stock trading.

4. Acorns

If you're a beginner investor looking to make money in stocks, acorns is the perfect introductory stock trading app.

Acorns specializes in micro-investing - that is, investing your spare change in stocks. There is no minimum to create an account, but there is a $5 minimum to start investing.

The app takes the spare change you've got from linked debit or credit cards to invest in commission-free etfs. There are no fees for inactivity.

5. Vanguard

Boasting around 1,800 commission-free etfs (just shy of robinhood's 2,000,) vanguard offers a wide selection of free trading options. The platform offers over 3,000 transaction-free mutual funds to boot - including S&P 500 index funds.

The trading platform doesn't have a minimum account requirement, but they do charge $20 a year for a service fee.

6. TD ameritrade

Much like E*TRADE, TD ameritrade (AMTD) - get report offers a free trading promotional if you open an account. You can get up to 60 days of commission-free trading for options, etfs and other equities, as well as up to $600 if you deposit $3,000 or more.

And even when the 60 days runs out, trades average about $6.95 a trade - on par with several other competitors. But TD ameritrade also offers over 300 commission-free etfs, and hundreds of transaction-fee-free mutual funds to choose from.

As one of the biggest online trading platforms, TD ameritrade offers a variety of top-notch services including research, data, and information on stocks as well as cash management, among others.

7. M1 finance

M1 finance does things a bit differently (think: customization.)

In addition to being completely commission-free and fee-free, M1 finance allows investors to invest in fractional shares as small as one penny. And, what makes M1 finance different is it allows users to create "pies" - that is, pie graphs that are comprised of a variety of etfs, stocks, and bonds. The app also allows users to choose different kinds of pies based on their investment needs and risk tolerance.

Although there is a $100 minimum for investing, the app allows for total customization of your own portfolio, and offers different kinds of "pies" from moderate to "ultra-aggressive" or "market cap 100."

For a completely free, zero-commission stock trading app, M1 finance seems to offer a pretty good deal for the DIY investor.

The bottom line

So, which free stock trading platform is best for you?

While some platforms like TD ameritrade and E*TRADE only offer short-term free stock trading services through promotions or new accounts, they do offer some industry-leading services that may be worth the extra cost you'll incur when your trial run ends.

However, for the investor who wants a truly free stock trading experience, robinhood, acorns and M1 finance offer a formidable range of services and offerings - even including cryptocurrency and options. And, as trading is increasingly becoming mobile, these app-focused companies are optimized to provide a solid, easy-to-use trading experience from the comfort of your ios or android-enabled device.

Still, as always, it is important to examine your personal investment goals and be realistic about how much you are willing to pay for extra services (if you do opt for one of the bigger brokerage names). But thanks to the surge of fintech companies in recent years, there are plenty of investment options that offer free stock trading services that can help grow your returns - all with the touch of a button.

Best free trading apps in 2021

Mobile apps became very popular. They make your life a lot easier. There is an app for everything now. You can buy flight tickets, book a hotel or trade on the stock exchange.

There are a lot of trading apps out there so, to save you time, we selected the best free trading apps for you. Apps providing free stock and ETF trading are gaining popularity, so it is worth taking a look at them if you don't want to spend fortunes on your trading fees!

What are trading apps great for?

Trading apps can be used for trading, learning, charting, finding trading ideas, and also for market data and news. Some of the apps offer all of these features, while others only a few. Don't worry, we have made trading app top lists for all of these features!

Trading apps are usually offered by financial companies such as online brokers or banks. These apps can be great add-ons to your web or desktop trading platform, but they can also be the flagship product of a company, for instance in the case of robinhood and freetrade.

We see trading apps as excellent complementary tools to web-based trading platforms and other financial portals. When you want to buy a stock, you can make fundamental or technical analyses on a computer more conveniently, but it's easier to follow the price of the stocks you've already bought through a trading app. You can also intervene faster via an app, when, for example, you quickly need to sell your stocks.

And now, let's see the best free trading apps in 2021!

| app | approves clients from | app score | US stock trading fee |

|---|---|---|---|

| robinhood | US | 5.0 stars | $0.0 |

| trading 212 | globally | 4.9 stars | $0.0 |

| merrill edge | US | 4.8 stars | $0.0 |

| TD ameritrade | US, china, hong kong, malaysia, singapore, thailand, taiwan, canada (through TD direct investing) | 4.8 stars | $0.0 |

| freetrade | UK | 4.7 stars | $0.0 |

Just to make it clear again: with these apps, you can trade stocks and etfs for free.

Besides the best free trading apps, we have also selected the best trading apps for charting, trading ideas, market data, news, and learning.

| Name | best apps | score |

|---|---|---|

| best apps for charting a nd trading ide as | ||

| tradingview | best app for charting | 5.0 |

| stocktwits | best app for trading ideas | 5.0 |

| best apps for market data and news | ||

| investing.Com | best app for market data | 5.0 |

| bloomberg | best app for market news | 5.0 |

| best apps for learning | ||

| invstr | best app for learning to trade | 5.0 |

| trading game | best app for learning forex trading | 4.0 |

Now, let's take a closer look at the best trading apps in 2021!

So, let's see, what we have: FOREX NO DEPOSIT ACCOUNT at free trading account with real money

Contents

- Top forex bonus list

- Free real money forex no deposit

- Free trading demo account review

- Criteria for a good trading demo account:

- Why is a demo account so important for beginners and advanced users?

- Free and unlimited demo account

- No difference between real money and virtual credit

- Account recharge is quite simple

- Further training for traders

- How long should I practice in a demo account?

- Conclusion: the demo account is the best way to learn online trading

- Free trading account with real money

- Best free trading apps in 2021

- Free bitcoin

- Try executium for free

- Free bitcoin for you

- Enabling you to trade instantly

- Make your cryptocurrency work for you

- What is day trading with bitcoin?

- What is intra-day trading?

- Free trading account with real money

- RELATED ARTICLES

- Share this article

- HOW THIS IS MONEY CAN HELP

- The fee-free share dealing firms

- Where can you invest?

- How do these platforms make money?

- Free trades are never quite free

- Will commission-free trading free trade last?

- Trading 212

- Freetrade

- Coming soon? Etoro and revolut

- No deposit bonuses

- How to use your bonus

- Why brokers offer deals

- 7 best free stock trading platforms

- 7 best free stock trading platforms

- The bottom line

- Best free trading apps in 2021

Comments

Post a Comment