5 Profit Making Cryptocurrency Trading Strategieseval(ez_write_tag( 468,60, forexop_com-box-3, ezslot_10,138, 0, 0 )), crypto trading strategies.

Crypto trading strategies

On the other hand, there are some complex dynamics at play. Halving may cause some miners to give up because the rewards are less than running costs of the expensive mining rigs that are necessary these days to mine bitcoin.

Top forex bonus list

This will cut supply further and fewer miners will arguably make the network less secure, which could hit the demand side. With ratio trading, you calculate the mean line then trade towards that line. When the litecoin-bitcoin ratio is high, above the mean line, that might be a time to switch out of litecoin and into bitcoin. When it’s low, that’s a time to start switching out of bitcoin and into litecoin.

5 profit making cryptocurrency trading strategies

In this article, we will look at five easy cryptocurrency trading strategies.

1. Bitcoin-altcoin ratios

When looking at a crypto currency chart, remember that half and probably a lot more of the price action has nothing at all to do with that crypto asset, or even crypto currencies in general. It has far more to do with the underlying fiat currency.

Let’s take the pair BTCUSD as an example. If the US dollar rallies against other currencies then all things equal we’ll likely see a big drop in bitcoin versus the US dollar for the simple reason that dollars are a more expensive asset at that point in time.

There may be little change in the number of bitcoin buyers and sellers, but the drop happens anyway because if it didn’t it would open an opportunity for risk free profit.

Precious metals traders have been dealing with that problem for years. One useful chart that they use is the gold-silver ratio chart. This plots the price of gold against the price of silver. When the ratio is high it means that gold is expensive relative to silver. And when it’s low the opposite is true.

You can use any coin ratio but since many people liken bitcoin to digital gold and litecoin to digital silver, let’s stick with that. So think of the litecoin-bitcoin ratio as the digital equivalent of the silver to gold ratio.

With ratio trading, you calculate the mean line then trade towards that line. When the litecoin-bitcoin ratio is high, above the mean line, that might be a time to switch out of litecoin and into bitcoin. When it’s low, that’s a time to start switching out of bitcoin and into litecoin.

Ratio trading can be a very profitable strategy if it’s performed consistently and over the long haul.

The great thing about using such ratio charts is that they eliminate many unrelated variables. You’re comparing like with like.

The slight problem though is that gold and silver have very long trading histories, going back thousands of years. Crypto currencies have only been around a few years. That means these historical ranges have not yet had a time to establish themselves. However ranges and mean lines will always exist, but prepare for them to evolve a little as the technology matures.

Remember that at some point in time you might want to change back into a fiat currency and at that time, the crypto to fiat exchange rate becomes relevant again.

2. Cross crypto arbitrage

Crypto currencies trade relative to their underlying fiat currency in much the same way as fiat currencies trade relative to one another.

Most exchanges and brokers will list a crypto asset against a range of other major fiat currencies. These cross rates can create a trading opportunity known as arbitrage. Arbitrage simply means the chance to make a risk free profit.

BTCUSD is trading at $6500 / $6505

BTCGBP is trading at £5300 / £5305

GBPUSD is trading at 1.2000 / 1.2010

You do the calculation and see that BTCGBP is cheap relative to BTCUSD. From the exchange rate, it should really be trading at £5416/£5420.

The arbitrage trade is then placed to buy the lower priced asset and sell the higher priced asset.

Sell BTCUSD at $6500

buy BTCGBP at £5305

You then wait for the price gap to close so that there’s no price differential. If it adjusts to the correct exchange rate, and say BTCUSD stays fixed, BTCGBP should rise to £5416/£5420. Let’s assume this happens 1 hour later. You then unwind the trade.

Buy BTCUSD at $6505, profit -$5

sell BTCGBP at £5416, profit +£111

Assuming you sell your pounds for dollars your total profit is then $97.4. This is a very simplified example but it demonstrates how arbitrage works.

Remember, when doing arbitrage the profits can be small so trading fees like spreads and swaps are very important.

When markets are working efficiently, arbitrage opportunities are seldom and the gaps are slim. They’re quickly found and traded away. Crypto currency markets are getting much more efficient than they were a few years back, because there are far more people trading them now.

3. Stable coin arbitrage

Another kind of arbitrage is with stable coins. Stable coins have their value fixed to some underlying asset. Most are pegged to a fiat currency such as the USD dollar so that there’s a 1:1 ratio between the coin and the underlying fiat currency.

Some stable coins are specifically designed to be arbitraged. Any deviation away from the peg creates an arbitrage opportunity. This means arbitrage traders can move the price back to the peg and make a profit for their efforts.

DAI is one example. The ratio is 1 dollar to 1 DAI. Unlike tether for example, another stable coin, DAI doesn’t rely on any central backing for its peg to be maintained. The DAI token is backed, or collateralized by ethereum.

DAI can be generated or borrowed by depositing some coins into a vault. On doing this you’ll get back a certain dollar amount of DAI, and at an exchange rate of 1 dollar to 1 DAI. The exact collateral you need to deposit varies from time to time.

As a simple example, suppose DAI is trading at $1.11. This is too high. You have 10 ethereum coins in your crypto wallet and the price of one ETH is $100. You could generate DAI at a cost of $1. You’d then sell your DAI on the exchange at a rate of $1.1.

When enough people do this, the external supply of DAI increases and so the price should adjust downwards. At that time you buy back your DAI tokens at $1 and redeem your ETH from the vault. Of course, if ETH is no longer $100 this could make the actual dollar profit smaller or bigger. But if you planned on holding your ethereum anyway, this wouldn’t matter. You’ve pocketed a bit of income.

Scalping

Daily pips

Essential for anyone serious about making money by scalping. It shows by example how to scalp trends, retracements and candle patterns as well as how to manage risk. It shows how to avoid the mistakes that many new scalp traders fall into.

The other way to arbitrage stable coins is simply to buy or sell the coins directly on an exchange. With tether for example, you could sell when it’s above $1 and buy when it’s below. Then wait for the gap to close before closing the position to take profits.

As with all arbitraging, the profits are meagre and trading costs can be high. This isn’t a strategy you’d want to sit at your desk doing all day long. It works better when automated with software and that’s how most arbitragers do business.

Take note that currency pegs can break down. The breaking of the EURCHF peg is one that took many traders by surprise and even bankrupted a couple of brokers.

4. Trading the bitcoin/altcoin adoption curve

Blockchain and crypto currencies are new technology. Just like the train, the automobile and the internet these technologies historically evolve into what’s known as the s-curve adoption model.

The s-curve is highly typical of new technological breakthroughs so the relationship is a fairly strong one. Pioneers are first in, next early adopters cause the curve to rise. Then there’s a rapid rise as the majority see the potential of the new technology. This flattens as the technology becomes more mainstream, widespread and accepted.

While there is no guarantee that history will repeat, the adoption curve model is one of the strongest long-term buy and sell signals for bitcoin that we currently have. Those who’ve bought at the base of the curve and sold at the top would have made a tidy profit.

Trading the adoption curve is a strategy for the long haul. There certainly can be some ups and down and large deviations from the s-curve. However, over the long-run, history tends to repeat this kind of price progression where innovative technologies merge into mainstream use.

5. Bitcoin and altcoin halving events

Finally, there are the bitcoin halving events. Bitcoin and other crypto assets are unique in that their supply follows a known-in-advance set of rules that are programmed into the protocol.

With bitcoin for example, each halving event, cuts the supply of bitcoin in half.

Bitcoin supply currently comes from miners. Miners are computers that validate new blocks on the blockchain by solving a hard computational hashing problem. By doing this, the miners maintain the network and keep it secure. Miners are rewarded with new bitcoin. This is the block reward and is where the supply of new bitcoin comes from.

The next halving event is 13 th may 2020 and it will cut the issuance of new bitcoins from 12.5 to 6.25 bitcoins for each new block.

Halving events create a speculative fever because many bitcoin hodlers expect the price to skyrocket afterwards. These people have already bought in so that we can expect that some of the halving is already priced into bitcoin. This is our old friend “buy the rumor, sell the fact” at work.

If history is to go by, then the volatility of bitcoin will increase sharply after the halving event. Previous halving events created dramatic price gains in the following months.

On the other hand, there are some complex dynamics at play. Halving may cause some miners to give up because the rewards are less than running costs of the expensive mining rigs that are necessary these days to mine bitcoin. This will cut supply further and fewer miners will arguably make the network less secure, which could hit the demand side.

Bitcoin’s clever protocol anticipates this and adjusts it hashing difficulty to the number of miners. Overall then this may effect may be nullified.

Only time will tell what the next halving event brings. One thing is clear though, it will create some interesting trading opportunities.

Ebook trader's pack

4x popular ebooks

Four complete and up to date ebooks on the most popular trading systems: grid trading, scalping, carry trading and martingale. These ebooks explain how to implement real trading strategies and to manage risk.

Really great information! Thanks for sharing this article!

Cryptocurrency investing strategies in 2020

Whether you’re looking for a side gig, a hobby, or even a career, crypto investing can be a lucrative endeavor.

The blockchain industry is young and still ripe for disruption, which provides a major opportunity to profit. Let’s explore three cryptocurrency investing strategies.

Like everybody else, you are here to make money right?

And you see crypto as your one-way ticket for a hefty pot of gold. It is a great wealth creation machine, I’d give you that. But if you want to have better odds than winning the lottery, you need a proper strategy.

Back in early 2017, just about any new cryptocurrency project can spike 20x or 30x in a few weeks or months. So there was no problem making money even for new investors.

Today, the crypto landscape is quite different. But that doesn’t mean there is no pot of gold anymore. And it certainly doesn’t mean the days of 20x and 30x are over.

Crypto is still in its bleeding edge phase. The entire market cap hasn’t even reached a trillion dollars. Upside potential is still enormous.

By the way, I’ve only included the top cryptocurrency investing strategies that have a high probability of earning profit.

Now before we proceed any further I want to stress that HODL is not a crypto trading strategy. It just isn’t. I’ve tried it for two years and can testify that it’s a terrible way to make money in crypto.

For that reason, I didn’t include it in this list.

3 crypto investing strategies

1) dollar cost averaging

Good for: busy people who have no time to spend on the market

Pros: very easy; not time intensive

cons: not as profitable as other strategies; just as likely to backfire

This strategy is fairly easy for new investors to follow. Dollar cost averaging is simply the purchase of cryptocurrencies at regular intervals no matter which direction the price is moving. This scheme can last several months or indefinitely.

While the amount invested in each interval remains the same, the total number of coins you buy will vary depending on the price fluctuations.

Dollar cost averaging allows an investor to average out his purchase price within this set intervals, thereby, managing short-term risk.

The average price will ultimately end up being much lower or higher than if you were to purchase in one payment.

For instance, if you plan to purchase $3000 in EOS but don’t want to do it in one go. Therefore, you decide to invest $750 every first day of each month for the next four months.

For this example, let’s use the real chart history of EOS from june to september 2019, it would look something like this:

Taken from coinmarketcap

June — the price of EOS is $8.24. You buy 91.01 EOS.

July — the price of EOS is $5.90. You buy 127.11 EOS.

August — the price of EOS is $4.42. You buy 169.68 EOS.

September — the price of EOS is $3.04. You buy 246.71 EOS.

If you had followed this strategy, you’d be able to accumulate 634.51 EOS, instead of owning only 364.07 EOS had you purchased it all in one sitting the first month.

Afterwards, it’s your choice whether you want to hold on to your cryptocurrency or sell.

Some investors prefer to continue buying indefinitely until the price goes to the moon. And then they sell.

Among the cryptocurrency investing strategies, this is the most beginner-friendly. With that being said, this is also the least effective money-making technique in this list.

I suggest that if you have more time, try to learn the other strategies as they have better chances and higher profits.

2) trading strategy

Good for: people who have a lot of free time or are planning to make crypto their primary source of income

Pros: very profitable; earnings are consistent

cons: relatively difficult to learn; mentors are costly

Some people might prefer to call this technical analysis, but it’s not. Let me show you the difference.

Technical analysis is a trading discipline employed to identify trading opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume.

But it’s not a strategy by itself. It is only one ingredient of it.

If you want to make money in crypto, you need a detailed systematic plan on where to place entry points, exit points, as well as what tools to use.

A trader needs to know when to trade and when not to trade. You have to have guidelines that objectively let you decide the best course of action.

Indicators

Indicators are one of many trader tools, but note that they are not useful on their own.

Therefore, it is important to know which indicator to use, because there over five thousand of them. How the hell would you know which one to use?

Some self-proclaimed “crypto trading gurus” will teach phony tactics using these tools. As if indicators alone can make you money. Utter nonsense.

I worked for one of the best traders in the world, and he showed me the truth. With evidence! No indicator alone can consistently win profits for you.

Resistance and support levels

Resistance and support levels are barriers that prevent the price of a token from getting pushed in a certain direction.

Support is when a downward price movement (selling) is interrupted because of buyer demand.

Resistance is when an upward price movement (buying) is interrupted due to a sell-off when the price becomes too high.

Trading strategy is more of a short-term profit-making strategy, usually lasting hours if not a day or a week. That said, some trends can last for months.

By that I don’t mean you can only profit short-term. Because you can definitely make money indefinitely in trading. I meant that money is quick with this type of crypto investing strategy.

Learn and get a mentor

But to become competent at trading strategy, you have to be comfortable analyzing charts. It won’t give you a crystal ball, but it allows you to manage risks and maximize profits in order to make better and more informed trading decisions.

I highly recommend you get a proper mentor when learning to trade cryptocurrencies. This isn’t something that you can easily learn on your own.

Maybe you can, but it’s going to take a while and you will make a whole lot more mistakes. Furthermore, you will likely catch bad habits that will be very difficult to unlearn later on.

It’s just not worth it. If I were in your position, knowing what I know, I’d rather spend money on a mentor than blowing out my first few trading accounts.

Learning proper trading strategy is probably the best if not second best cryptocurrency investing strategy you can make. The other one being value investing.

3) value investing

Good for: semi-busy people who have spare time probably on weekends

Pros: extremely profitable (5x-20x); not very time intensive

cons: inconsistent profits; a little difficult to learn

Value investing is less about charts and trend lines and more about finding crypto assets that are priced below their intrinsic value. The best measuring technique for value investing is fundamental analysis.

Fundamental analysis

Fundamental analysis is a method of measuring a security’s intrinsic value by examining related economic and financial factors.

This involves studying anything that could influence an asset’s value such as the founding team, the industry it is servicing, the partnerships it has garnered.

The goal here is to be able to pick out undervalued cryptos from a sea of substandard blockchain startups.

These “gems”, as most crypto enthusiasts call them, are usually altcoins with low market capitalization but have phenomenal capabilities that exceed their competitors, or even outclass them.

Fundamental analysis in the crypto industry works very differently from traditional markets since there are no cut and dried metrics to assess a coin’s value.

Furthermore, the industry is nascent and highly speculative, which tends to have higher risks and rewards.

However, there are several factors that can serve as substitute metrics for a coin’s value such as:

- Proof of concept

- Technology

- Team

- Roadmap

- Liquidity

- Tokenomics

- Real world use case

- Competitors

- Whitepaper quality

- Community support

This type of investing strategy requires a bit of research, which shouldn’t be a problem since most altcoin developers provide most if not all the necessary information online.

Successful execution, however, involves timing as well. To know when to buy and when to sell, you must be updated on major announcements of the digital coin market.

- Partnerships

- Exchange listings

- Forks (when an altcoin splits into two, creating two separate currencies)

When enjin coin announced its partnership with samsung, its value swiftly pumped from $0.09 to $0.18 (100% increase) in less than seven hours, and then peaked at nearly $0.25 after two days.

Value investing is more of a long-term strategy but it is likely the most rewarding. Back in 2013, many people scoffed at bitcoin when it was being traded at $100. But some value investors saw something others couldn’t.

They saw the underlying value of bitcoin and years later became multi-millionaires. Even kids.

Conclusion

These three cryptocurrency trading strategies may seem different, but they work best when implemented together.

Trading and value investing both have weak points, but they complement each other.

Dollar cost averaging still requires studying the coin you’re investing in as well as analyzing trends, therefore, it needs to utilize both fundamentals and technicals a little.

If you want to learn more ways to earn income in the crypto market and blockchain industry, be sure to subscribe to the crypto skillset newsletter.

I am not a financial advisor and this isn’t financial advice.

Cryptocurrency trading strategies

Every day, someone gets tired of sitting at a desk and decides to become a trader. Many people think that the cryptocurrency market is a very easy niche, to begin with. This is the first and main reason for their failure.

However, many people learn how to trade. After acquiring basic knowledge, they understand the necessity of strategies. Traders can’t win with technical analysis or fundamental analysis alone. Learning different tactics and how to implement them is a must.

A cryptocurrency trading strategy is a set of actions aimed at creating profit in the cryptocurrency market. No one can give you a 100% guarantee that you will always have income. However, a trading strategy will guarantee that you won’t fail.

Crypto trading strategy

Why is trading so popular, yet the world is only aware of a few really successful and rich stockbrokers or cryptocurrency traders? That’s because of the mass of information that you have to absorb. Moreover, you have to use all of this material when choosing a strategy.

Don’t follow someone else’s ideas. Follow the market situation and try to understand its cues.

First of all, when creating or using a crypto trading strategy, you must understand that it’s a very unstable market. You may see price fluctuations of between 20-30% in just a few days. When trading on stock indices, it’s almost impossible to see that kind of shift in a day. However, the cryptocurrency index might change by 100% or even more. Secondly, bitcoin is “the father” of cryptocurrencies. Hence, prices very often follow its trend. If you’re going to trade altcoins, the most important part of your strategy should be to see what’s going on with bitcoin.

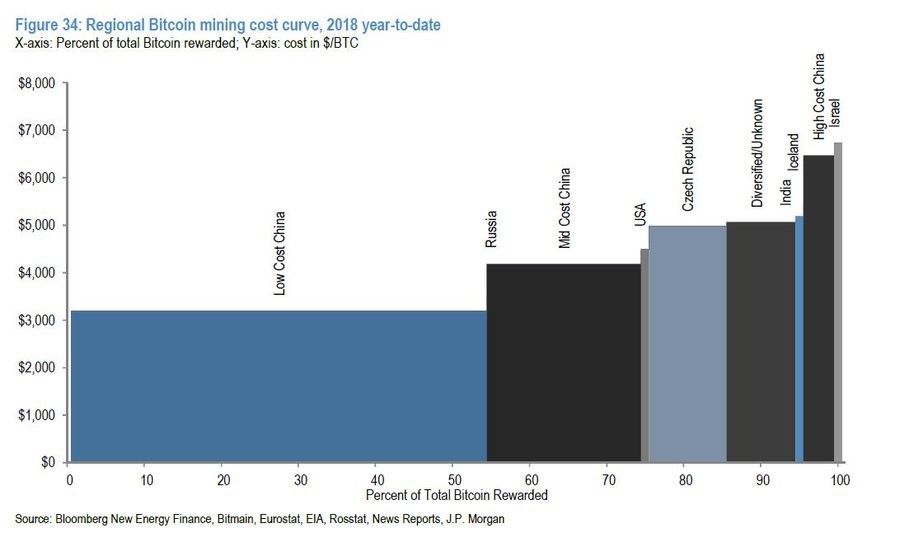

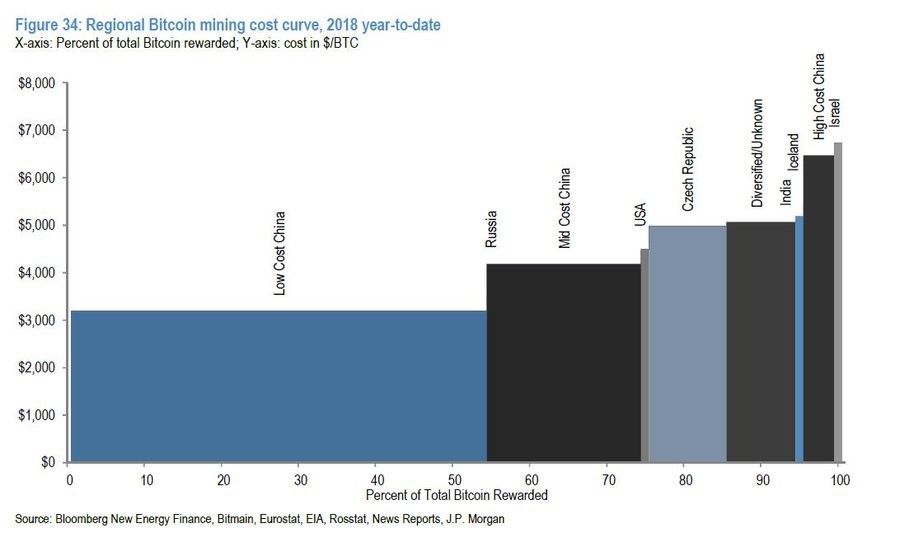

Usually, cryptocurrency traders don’t mine coins. Nevertheless, they are always aware of the cost of mining. For example, bitcoin cash has become very valuable since its hard fork on 1 august 2017 because miners need many resources to find new blocks. If mining cost increases, the coin’s price also rises.

Lastly, you have to follow all political and economic news. They have a great influence on this market. For example, when iran attacked US military bases in iraq, bitcoin’s price rose from $8,000 to $8,300. This situation created an uptrend for the whole market. You can’t be a successful trader if you don’t follow the news.

These are the three main principles of cryptocurrency trading. From these points, traders have created several strategies.

- Buy & hold. This strategy is more about investing than trading. People buy an asset and hold it for a long time. They try to predict prices for months and check charts for long periods of time. This strategy is mostly based on fundamental analysis.

- Swing trading. This cryptocurrency trading strategy is about using the correction during the formation of a trend. Traders have to enter the trend at the time of correction. Swing trading means to wriggle after the trend.

- Day trading. This strategy means trading on the exchange within one trading session during the day. Positions opened on this day are not transferred overnight to the next session.

- Scalping. This is a high-speed, high-frequency form of trading. A trader opens and closes positions within a period of 1 to 15 minutes. Each deal ideally brings a small profit. Altogether, the series of small profits from each transaction yields high income.

Day trading strategy

Most day traders spend their life making profit from cryptocurrency trades. They make dozens of exchanges and transactions every day. You can earn enormous rewards, but you need a lot of time (months, even years) to become a successful day trader.

An exchange with lots of distinctive cryptocurrency pairs is the first thing you should find.

A pair means two coins or tokens that are being traded. For example, if you think that monero’s price might rise against litecoin’s, you have to find an XMR/LTC pairing

The next requirement is a high-liquidity platform. It is your guarantee for a permanent buyer/seller connection. Otherwise, you won’t be able to make a deal when the price is falling.

Very often, people try to associate day trading with an easy path to wealth. In fact, this rarely happens. It’s a very long, hard path to having a billion dollars in your bank account. The SEC warns: “day traders tend to face serious financial losses in the first month of trading”.

You have to analyse a lot of information and be ready to connect each trap with bearish or bullish trends. As a trader, you must have a deep understanding of price fluctuations and use them for your personal gain.

Day cryptocurrency trading tips

Day trading may provide both large incomes and losses. If you’re interested in making lots of money, you should remember that it isn’t ‘free money’. You have to resist stress and stay cool-headed in addition to following all of your tactics.

Before day trading, you should check for high volatility of cryptocurrency being traded. This provides more opportunities to make deals, allowing you to gain more profit.

The traded cryptocurrency should be liquid. Check the exchange platform and the coin (token) to see how liquid it is. How do you do this? You can go to coinmarketcap and look at the cryptocurrency’s 24-hour trading volume.

Trading strategy for beginners

The beginning is the most difficult stage in every niche. On the other hand, it’s also the simplest stage because you have to do very little to reach your first achievements. Traders say that HODL is the easiest scheme for beginners. ‘HODL’ means holding assets for the long-term in the belief that the price will rise in the future.

It’s very easy because a trader only needs a little knowledge for it to be rewarding. Why? Almost all cryptocurrencies experience enormous growth over the long-term. Moreover, you can also invest in popular coins or tokens to minimise your risks.

So, what should you do? Buy promising cryptocurrencies and hold onto them for months. For instance, you could buy 100 ethereum and just check the index in 3 years. The probability that it’ll be higher is almost 100%.

You’re not obligated to check the prices very often. You should actually avoid checking it regularly because you may sell your assets too early.

This strategy is one of the less effective ones. There is no guarantee that every cryptocurrency will rise over the years. Nevertheless, trading is about statistics. Charts show that all the people who bought cryptocurrency during the bearish trend at the beginning of 2018 have a 100-200% increase in income today.

Best cryptocurrency trading strategies for 2020

One of the most popular strategies among traders is statistical arbitrage. It seems very complex, but after several deals, you’ll see that it’s simple enough. The way this strategy works is you buy coins on an exchange, then sell them on another platform and, finally, sell that for fiat currency. The logic of this trading strategy is to take advantage of the lag in price corrections across these exchanges.

The only difficulty is the fee. You have to use platforms with a low commission to earn a profit. Be vigilant when using statistical arbitrage because a fee can be even higher than the potential income.

Following the bears on the market for the last two years, many investors quit cryptocurrencies. As a result, the market’s volatility fell. That’s good for banks but not for traders, most of whom say that HODL will be more popular in 2020 than in previous years.

Bitcoin trading strategy

Most people begin their trading path with BTC because it’s the most traded and valuable cryptocurrency. That’s why you have to be fluent with crypto trading methodology. While choosing a bitcoin trading strategy, you should rely on your own experience and style.

If you’re very emotional and tend to make mistakes, you have to use an algorithmic strategy. That means using formulas to identify points at which you need to place different orders. Today, these strategies are associated with using trading robots, but you have to configure them the right way to be successful.

If you’re disciplined and can easily manage risks, you could try margin trading. This allows you to deposit less, but gain the same profit. However, you have to place every order very carefully, or you might end up in debt.

Trading strategy for bitcoin 2020

Your trading strategy for bitcoin will be the same as those used for alternative cryptocurrencies, like swing, day trading, scalping and others. Most of your tactics will be similar, but you’ll have more opportunities because bitcoin is the most popular digital currency.

However, if you’ve already invested in BTC, you may want to diversify risks with a hedging strategy. This is the practice of making tactical orders to decrease the risks of existing positions.

In this case, you’ll open a short position on BTC, which involves selling the asset for the actual market value while under the pretence that it might decline. If it really falls, you would buy it back for a lower cost and margin the difference. This means that any loss to your first BTC position would be countered by the income from the short position.

Bitcoin day trading strategy

Day trading has the same principles for each cryptocurrency. Nevertheless, there are some benefits to day trading bitcoin:

- High supply and demand

- Many exchanges allow leverage trading with BTC

- Universal access – all exchanges have added BTC to their lists

- BTC-oriented exchanges provide lower fees and minimum deposits for BTC.

There are two highly popular day-trading tactics for BTC:

- Breakout. This opportunity comes up when the coin passes a certain level of support or resistance. Once the level is broken, the cryptocurrency is traded in the same trend. When you see the potential breakout, you have to open the position. The ‘stop-loss’ should be placed below the first resistance zone.

- Breakout retest. There might be an uptrend after the first breakout, but then, bulls will go back to this level to check the resistance. If the volume is higher at this stage, it means that prices will achieve a new maximum.

How to become a successful cryptocurrency trader

There is one simple answer: be fully prepared. We already mentioned some points:

- Understand the market.

- Manage your risks.

- Follow the news.

- Check BTC charts.

- Be aware of the cost of mining.

One more important step is to build a trading plan. This should include your goals for each period of trading, style (how often you plan to trade) and attitude toward risk. Check out other cryptocurrency traders’ twitter accounts. Very often, they give some useful information. But only use it them only for your analytics, not for making trades.

Avoid all pump and dump groups. Many newbies in this market think that they can profit by connecting with such groups. In fact, they are strategies based on inaccurate statements and analytics. That means you’ll have a bigger chance of losing all of your money.

Lastly, learn as much as possible. This market is very new, so there are many unknown hacks and pitfalls. You should stay up-to-date on all market news to be successful.

Choose a trusted crypto exchange

One of the most important rules every trader has is to use only trusted exchanges. This will provide fast deals, high security and easy withdrawals. Moreover, your personal data will not be used for someone else’s purposes. How do you choose an exchange?

- Check for daily volume.

- Read its documentation.

- Find out about its headquarters and exchange team.

- Check for safe HTTP connections (the web address should begin with “HTTPS”).

Furthermore, try to use an exchange from your country. This may simplify compliance with regulatory changes. Please note that some platforms only support a limited number of countries.

Use a reliable platform for cryptocurrency trading

Nowadays, you can find many exchanges with different conditions. However, as previously mentioned, you should choose a trust crypto exchange. Here is a list of some popular platforms that provide good client service:

- Binance

- Kraken

- Poloniex

- Stormgain

Remember this: if you choose a deceitful platform, you may lose your trading budget and your personal data to boot, including billing information.

5 profit making cryptocurrency trading strategies

In this article, we will look at five easy cryptocurrency trading strategies.

1. Bitcoin-altcoin ratios

When looking at a crypto currency chart, remember that half and probably a lot more of the price action has nothing at all to do with that crypto asset, or even crypto currencies in general. It has far more to do with the underlying fiat currency.

Let’s take the pair BTCUSD as an example. If the US dollar rallies against other currencies then all things equal we’ll likely see a big drop in bitcoin versus the US dollar for the simple reason that dollars are a more expensive asset at that point in time.

There may be little change in the number of bitcoin buyers and sellers, but the drop happens anyway because if it didn’t it would open an opportunity for risk free profit.

Precious metals traders have been dealing with that problem for years. One useful chart that they use is the gold-silver ratio chart. This plots the price of gold against the price of silver. When the ratio is high it means that gold is expensive relative to silver. And when it’s low the opposite is true.

You can use any coin ratio but since many people liken bitcoin to digital gold and litecoin to digital silver, let’s stick with that. So think of the litecoin-bitcoin ratio as the digital equivalent of the silver to gold ratio.

With ratio trading, you calculate the mean line then trade towards that line. When the litecoin-bitcoin ratio is high, above the mean line, that might be a time to switch out of litecoin and into bitcoin. When it’s low, that’s a time to start switching out of bitcoin and into litecoin.

Ratio trading can be a very profitable strategy if it’s performed consistently and over the long haul.

The great thing about using such ratio charts is that they eliminate many unrelated variables. You’re comparing like with like.

The slight problem though is that gold and silver have very long trading histories, going back thousands of years. Crypto currencies have only been around a few years. That means these historical ranges have not yet had a time to establish themselves. However ranges and mean lines will always exist, but prepare for them to evolve a little as the technology matures.

Remember that at some point in time you might want to change back into a fiat currency and at that time, the crypto to fiat exchange rate becomes relevant again.

2. Cross crypto arbitrage

Crypto currencies trade relative to their underlying fiat currency in much the same way as fiat currencies trade relative to one another.

Most exchanges and brokers will list a crypto asset against a range of other major fiat currencies. These cross rates can create a trading opportunity known as arbitrage. Arbitrage simply means the chance to make a risk free profit.

BTCUSD is trading at $6500 / $6505

BTCGBP is trading at £5300 / £5305

GBPUSD is trading at 1.2000 / 1.2010

You do the calculation and see that BTCGBP is cheap relative to BTCUSD. From the exchange rate, it should really be trading at £5416/£5420.

The arbitrage trade is then placed to buy the lower priced asset and sell the higher priced asset.

Sell BTCUSD at $6500

buy BTCGBP at £5305

You then wait for the price gap to close so that there’s no price differential. If it adjusts to the correct exchange rate, and say BTCUSD stays fixed, BTCGBP should rise to £5416/£5420. Let’s assume this happens 1 hour later. You then unwind the trade.

Buy BTCUSD at $6505, profit -$5

sell BTCGBP at £5416, profit +£111

Assuming you sell your pounds for dollars your total profit is then $97.4. This is a very simplified example but it demonstrates how arbitrage works.

Remember, when doing arbitrage the profits can be small so trading fees like spreads and swaps are very important.

When markets are working efficiently, arbitrage opportunities are seldom and the gaps are slim. They’re quickly found and traded away. Crypto currency markets are getting much more efficient than they were a few years back, because there are far more people trading them now.

3. Stable coin arbitrage

Another kind of arbitrage is with stable coins. Stable coins have their value fixed to some underlying asset. Most are pegged to a fiat currency such as the USD dollar so that there’s a 1:1 ratio between the coin and the underlying fiat currency.

Some stable coins are specifically designed to be arbitraged. Any deviation away from the peg creates an arbitrage opportunity. This means arbitrage traders can move the price back to the peg and make a profit for their efforts.

DAI is one example. The ratio is 1 dollar to 1 DAI. Unlike tether for example, another stable coin, DAI doesn’t rely on any central backing for its peg to be maintained. The DAI token is backed, or collateralized by ethereum.

DAI can be generated or borrowed by depositing some coins into a vault. On doing this you’ll get back a certain dollar amount of DAI, and at an exchange rate of 1 dollar to 1 DAI. The exact collateral you need to deposit varies from time to time.

As a simple example, suppose DAI is trading at $1.11. This is too high. You have 10 ethereum coins in your crypto wallet and the price of one ETH is $100. You could generate DAI at a cost of $1. You’d then sell your DAI on the exchange at a rate of $1.1.

When enough people do this, the external supply of DAI increases and so the price should adjust downwards. At that time you buy back your DAI tokens at $1 and redeem your ETH from the vault. Of course, if ETH is no longer $100 this could make the actual dollar profit smaller or bigger. But if you planned on holding your ethereum anyway, this wouldn’t matter. You’ve pocketed a bit of income.

Scalping

Daily pips

Essential for anyone serious about making money by scalping. It shows by example how to scalp trends, retracements and candle patterns as well as how to manage risk. It shows how to avoid the mistakes that many new scalp traders fall into.

The other way to arbitrage stable coins is simply to buy or sell the coins directly on an exchange. With tether for example, you could sell when it’s above $1 and buy when it’s below. Then wait for the gap to close before closing the position to take profits.

As with all arbitraging, the profits are meagre and trading costs can be high. This isn’t a strategy you’d want to sit at your desk doing all day long. It works better when automated with software and that’s how most arbitragers do business.

Take note that currency pegs can break down. The breaking of the EURCHF peg is one that took many traders by surprise and even bankrupted a couple of brokers.

4. Trading the bitcoin/altcoin adoption curve

Blockchain and crypto currencies are new technology. Just like the train, the automobile and the internet these technologies historically evolve into what’s known as the s-curve adoption model.

The s-curve is highly typical of new technological breakthroughs so the relationship is a fairly strong one. Pioneers are first in, next early adopters cause the curve to rise. Then there’s a rapid rise as the majority see the potential of the new technology. This flattens as the technology becomes more mainstream, widespread and accepted.

While there is no guarantee that history will repeat, the adoption curve model is one of the strongest long-term buy and sell signals for bitcoin that we currently have. Those who’ve bought at the base of the curve and sold at the top would have made a tidy profit.

Trading the adoption curve is a strategy for the long haul. There certainly can be some ups and down and large deviations from the s-curve. However, over the long-run, history tends to repeat this kind of price progression where innovative technologies merge into mainstream use.

5. Bitcoin and altcoin halving events

Finally, there are the bitcoin halving events. Bitcoin and other crypto assets are unique in that their supply follows a known-in-advance set of rules that are programmed into the protocol.

With bitcoin for example, each halving event, cuts the supply of bitcoin in half.

Bitcoin supply currently comes from miners. Miners are computers that validate new blocks on the blockchain by solving a hard computational hashing problem. By doing this, the miners maintain the network and keep it secure. Miners are rewarded with new bitcoin. This is the block reward and is where the supply of new bitcoin comes from.

The next halving event is 13 th may 2020 and it will cut the issuance of new bitcoins from 12.5 to 6.25 bitcoins for each new block.

Halving events create a speculative fever because many bitcoin hodlers expect the price to skyrocket afterwards. These people have already bought in so that we can expect that some of the halving is already priced into bitcoin. This is our old friend “buy the rumor, sell the fact” at work.

If history is to go by, then the volatility of bitcoin will increase sharply after the halving event. Previous halving events created dramatic price gains in the following months.

On the other hand, there are some complex dynamics at play. Halving may cause some miners to give up because the rewards are less than running costs of the expensive mining rigs that are necessary these days to mine bitcoin. This will cut supply further and fewer miners will arguably make the network less secure, which could hit the demand side.

Bitcoin’s clever protocol anticipates this and adjusts it hashing difficulty to the number of miners. Overall then this may effect may be nullified.

Only time will tell what the next halving event brings. One thing is clear though, it will create some interesting trading opportunities.

Ebook trader's pack

4x popular ebooks

Four complete and up to date ebooks on the most popular trading systems: grid trading, scalping, carry trading and martingale. These ebooks explain how to implement real trading strategies and to manage risk.

Really great information! Thanks for sharing this article!

12 best cryptocurrency trading strategies | ultimate bitcoin & altcoin trading strategies

The cryptocurrency craze has become the talk of this year. More and more people are finding the blockchain technology exciting and profitable. As the technology is new, even the traders or investors are apparently new to this space. In order to assist the enthusiasts in this burgeoning crypto industry, we have created an easy-to-understand cryptocurrency strategy guide, which helps traders from committing any trading mistakes.

First, we shall discuss the daily cryptocurrency trading tips, and then we can discuss the common mistakes by the investors.

So, what are the ultimate crypto trading strategies for beginners & pros?

Learn as much as possible

Google can help power all sorts of knowledge regarding cryptocurrencies and blockchain-related applications. So, learn more about these topics. First of all, learn about all the crypto jargons like HODL and dynamics like “pump and dump”. Youtube has several blockchain and cryptocurrency-related material, which you can go through to build on your crypto knowledge. This is the foremost and one of the best crypto strategies to trade cryptocurrencies.

Follow crypto leaders and crypto news

Follow the tweets by the important people in the crypto world. Pay special attention to the crypto markets news. Positive news has a huge impact on the demand for a cryptocurrency. It also means to avoid the negative press which acts as FUD which is short for fear, uncertainty, and doubt. You can follow the latest crypto market news and insights as well.

Analyse about the coin you’re planning to invest

Ask yourself these four questions before finally giving into:

- Which market is the coin disrupting, for eg virtual payments, cloud storage, etc?

- What is the technology behind the currency? Is it easy to use, accessible and scalable)

- Research about the minds behind the creation of the coin, know its market potential, read about it more and more from sources like coinmarketcap.

- Last, but not the least what is the acceptance ratio of that coin. What is it that distinguishes this coin from its peers, i.E, what is the USP?

Advice: beware of the FOMO factor. Do not invest because you feel like you are missing on the opportunity. This is the top cryptocurrency trading strategy.

Install a price ticker

A price ticker will alert you whenever the price fluctuates. So, it's better to install on your phone. Depending on the price, you can make wise investment decisions. Actually, it is not the price which should be the sole factor to watch out before investing. You should always observe the market capitalization as that is an eminent factor. This is one of the common day to day altcoin trading strategy (crypto trading strategy). One of the best crypto to day trade is EOS.

Trading bots

If you are not able to understand the difficult technology behind blockchain technology, you should start using a trading bot with API enabled will help do the trading for you. This is one of the best cryptocurrency trading system for amateur traders.

HODL in the crypto world means holding onto your cryptocurrencies when things are not going as planned. HODL is not a typo after it appeared in the bitcoin talk forum by a member named gamkyubi in 2013 under the thread “I am hodling”. (crypto trading tips 2019)

Let’s talk about the mistakes which can lead to a great loss:

Crypto trading mistakes

Chasing pump and dump schemes

Pump and dump is a scheme that boosts the price through recommendations based on false, misleading or greatly exaggerated statements. So, it's better to not fall in these traps.

Not diversifying your portfolio to protect your investment

The most effective strategy for minimizing risk is diversification. A well-diversified portfolio consists of different types of securities from diverse industries, with varying degrees of risk. While diversification can’t guarantee against a loss, it is the most important component to helping you reach your long-range financial goals, while minimizing your risk.

Never let FOMO ( fear of missing out ) control your emotions. Try to feel and think logically to shatter the dreams of high returns. When you notice the market going up, try to avoid feeling like investing in the hopes of it going higher.

Not protecting your accounts with 2-factor authentication

Two-factor authentication, or 2FA, adds an extra layer of security to your account.

When logging into your account, in addition to your email and password you'll enter a code generated by an authentication app on your smartphone. This secures the account.

Falling for phishing scams and email account scams or airdrop scams

Falling for an email scam is something that can happen to anyone. It’s a frightening concept and one that frequently results in undiluted panic. Also known as a phishing scam, it involves using email and fraudulent websites to steal sensitive information such as passwords, credit card numbers, account data, addresses, and more.

With the increasing popularity of cryptocurrency airdrops, it is no surprise that there are also many scams out there.

Losing your private keys

This may be the greatest mistake in the crypto community to date. If you’re unfamiliar with what your “private keys” are, or what types of wallets you should be using, check out this article: https://coinswitch.Co/news/top-10-multi-cryptocurrency-wallets

Losing private keys will waste all your money as you can’t do anything if you have forgotten the password. These are the cryptocurrencies tricks which should help you become an informed investor. It will save you from making whimsical decisions. At the same time, never ever dare to commit any of the crypto mistakes mentioned above, especially the last point.

Frequently asked questions (FAQ)

1. How do you trade in cryptocurrency?

You can trade in more than 300 cryptocurrencies here.

2. How to pick crypto for day trading?

You have to do a lot of research and analysis before picking or investing ant cryptocurrencies.

3. Can you make money in bitcoin trading?

Yes, you can, some of the investors turned into millionaires after making wise trading decisions.

4. Which coin is best for day trading?

There are more than one. You can go here to find out in a detailed manner.

Interested in buying cryptos? You can exchange more than 300 cryptocurrencies at best rates from coinswitch instantly.

Cryptocurrency investing strategies in 2020

Whether you’re looking for a side gig, a hobby, or even a career, crypto investing can be a lucrative endeavor.

The blockchain industry is young and still ripe for disruption, which provides a major opportunity to profit. Let’s explore three cryptocurrency investing strategies.

Like everybody else, you are here to make money right?

And you see crypto as your one-way ticket for a hefty pot of gold. It is a great wealth creation machine, I’d give you that. But if you want to have better odds than winning the lottery, you need a proper strategy.

Back in early 2017, just about any new cryptocurrency project can spike 20x or 30x in a few weeks or months. So there was no problem making money even for new investors.

Today, the crypto landscape is quite different. But that doesn’t mean there is no pot of gold anymore. And it certainly doesn’t mean the days of 20x and 30x are over.

Crypto is still in its bleeding edge phase. The entire market cap hasn’t even reached a trillion dollars. Upside potential is still enormous.

By the way, I’ve only included the top cryptocurrency investing strategies that have a high probability of earning profit.

Now before we proceed any further I want to stress that HODL is not a crypto trading strategy. It just isn’t. I’ve tried it for two years and can testify that it’s a terrible way to make money in crypto.

For that reason, I didn’t include it in this list.

3 crypto investing strategies

1) dollar cost averaging

Good for: busy people who have no time to spend on the market

Pros: very easy; not time intensive

cons: not as profitable as other strategies; just as likely to backfire

This strategy is fairly easy for new investors to follow. Dollar cost averaging is simply the purchase of cryptocurrencies at regular intervals no matter which direction the price is moving. This scheme can last several months or indefinitely.

While the amount invested in each interval remains the same, the total number of coins you buy will vary depending on the price fluctuations.

Dollar cost averaging allows an investor to average out his purchase price within this set intervals, thereby, managing short-term risk.

The average price will ultimately end up being much lower or higher than if you were to purchase in one payment.

For instance, if you plan to purchase $3000 in EOS but don’t want to do it in one go. Therefore, you decide to invest $750 every first day of each month for the next four months.

For this example, let’s use the real chart history of EOS from june to september 2019, it would look something like this:

Taken from coinmarketcap

June — the price of EOS is $8.24. You buy 91.01 EOS.

July — the price of EOS is $5.90. You buy 127.11 EOS.

August — the price of EOS is $4.42. You buy 169.68 EOS.

September — the price of EOS is $3.04. You buy 246.71 EOS.

If you had followed this strategy, you’d be able to accumulate 634.51 EOS, instead of owning only 364.07 EOS had you purchased it all in one sitting the first month.

Afterwards, it’s your choice whether you want to hold on to your cryptocurrency or sell.

Some investors prefer to continue buying indefinitely until the price goes to the moon. And then they sell.

Among the cryptocurrency investing strategies, this is the most beginner-friendly. With that being said, this is also the least effective money-making technique in this list.

I suggest that if you have more time, try to learn the other strategies as they have better chances and higher profits.

2) trading strategy

Good for: people who have a lot of free time or are planning to make crypto their primary source of income

Pros: very profitable; earnings are consistent

cons: relatively difficult to learn; mentors are costly

Some people might prefer to call this technical analysis, but it’s not. Let me show you the difference.

Technical analysis is a trading discipline employed to identify trading opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume.

But it’s not a strategy by itself. It is only one ingredient of it.

If you want to make money in crypto, you need a detailed systematic plan on where to place entry points, exit points, as well as what tools to use.

A trader needs to know when to trade and when not to trade. You have to have guidelines that objectively let you decide the best course of action.

Indicators

Indicators are one of many trader tools, but note that they are not useful on their own.

Therefore, it is important to know which indicator to use, because there over five thousand of them. How the hell would you know which one to use?

Some self-proclaimed “crypto trading gurus” will teach phony tactics using these tools. As if indicators alone can make you money. Utter nonsense.

I worked for one of the best traders in the world, and he showed me the truth. With evidence! No indicator alone can consistently win profits for you.

Resistance and support levels

Resistance and support levels are barriers that prevent the price of a token from getting pushed in a certain direction.

Support is when a downward price movement (selling) is interrupted because of buyer demand.

Resistance is when an upward price movement (buying) is interrupted due to a sell-off when the price becomes too high.

Trading strategy is more of a short-term profit-making strategy, usually lasting hours if not a day or a week. That said, some trends can last for months.

By that I don’t mean you can only profit short-term. Because you can definitely make money indefinitely in trading. I meant that money is quick with this type of crypto investing strategy.

Learn and get a mentor

But to become competent at trading strategy, you have to be comfortable analyzing charts. It won’t give you a crystal ball, but it allows you to manage risks and maximize profits in order to make better and more informed trading decisions.

I highly recommend you get a proper mentor when learning to trade cryptocurrencies. This isn’t something that you can easily learn on your own.

Maybe you can, but it’s going to take a while and you will make a whole lot more mistakes. Furthermore, you will likely catch bad habits that will be very difficult to unlearn later on.

It’s just not worth it. If I were in your position, knowing what I know, I’d rather spend money on a mentor than blowing out my first few trading accounts.

Learning proper trading strategy is probably the best if not second best cryptocurrency investing strategy you can make. The other one being value investing.

3) value investing

Good for: semi-busy people who have spare time probably on weekends

Pros: extremely profitable (5x-20x); not very time intensive

cons: inconsistent profits; a little difficult to learn

Value investing is less about charts and trend lines and more about finding crypto assets that are priced below their intrinsic value. The best measuring technique for value investing is fundamental analysis.

Fundamental analysis

Fundamental analysis is a method of measuring a security’s intrinsic value by examining related economic and financial factors.

This involves studying anything that could influence an asset’s value such as the founding team, the industry it is servicing, the partnerships it has garnered.

The goal here is to be able to pick out undervalued cryptos from a sea of substandard blockchain startups.

These “gems”, as most crypto enthusiasts call them, are usually altcoins with low market capitalization but have phenomenal capabilities that exceed their competitors, or even outclass them.

Fundamental analysis in the crypto industry works very differently from traditional markets since there are no cut and dried metrics to assess a coin’s value.

Furthermore, the industry is nascent and highly speculative, which tends to have higher risks and rewards.

However, there are several factors that can serve as substitute metrics for a coin’s value such as:

- Proof of concept

- Technology

- Team

- Roadmap

- Liquidity

- Tokenomics

- Real world use case

- Competitors

- Whitepaper quality

- Community support

This type of investing strategy requires a bit of research, which shouldn’t be a problem since most altcoin developers provide most if not all the necessary information online.

Successful execution, however, involves timing as well. To know when to buy and when to sell, you must be updated on major announcements of the digital coin market.

- Partnerships

- Exchange listings

- Forks (when an altcoin splits into two, creating two separate currencies)

When enjin coin announced its partnership with samsung, its value swiftly pumped from $0.09 to $0.18 (100% increase) in less than seven hours, and then peaked at nearly $0.25 after two days.

Value investing is more of a long-term strategy but it is likely the most rewarding. Back in 2013, many people scoffed at bitcoin when it was being traded at $100. But some value investors saw something others couldn’t.

They saw the underlying value of bitcoin and years later became multi-millionaires. Even kids.

Conclusion

These three cryptocurrency trading strategies may seem different, but they work best when implemented together.

Trading and value investing both have weak points, but they complement each other.

Dollar cost averaging still requires studying the coin you’re investing in as well as analyzing trends, therefore, it needs to utilize both fundamentals and technicals a little.

If you want to learn more ways to earn income in the crypto market and blockchain industry, be sure to subscribe to the crypto skillset newsletter.

I am not a financial advisor and this isn’t financial advice.

Day trading cryptocurrency – how to make $500/day with consistency

Would you like to learn day trading cryptocurrency and make a consistent $500 per day? We often hear about all the money you can make by day trading stocks. But what about crypto day trading? In today’s lesson, you’ll learn how to day trade cryptocurrency using our favorite crypto analysis tools.

Our team at trading strategy guides is lucky to have over 50 years of combined day trading experience. We’re going to share with you what it takes to day trade for a living, and hopefully, by the end of this trading guide, you’ll know if you have what it takes to succeed in this business.

First and foremost, when day trading, it’s essential to have a structured approach and a rule-based strategy. The same as swing trading or positional trading you are not going to trade every day, and you’re not going to make money every day. So, you need a day trading cryptocurrency strategy to protect your balance.

The high volatility nature of bitcoin and other cryptocurrencies has made the crypto market like a roller-coaster. This is the perfect environment for day trading because during the day you’ll have enough up and down swings to make a decent profit.

Moving forward, we’re going to teach you what you need to learn how to day trade cryptocurrency and we’re going to share some out-of-the-box rule-based day trading strategies.

How to day trade cryptocurrency

The crypto market’s unique characteristics require you to have a firm understanding of how it works. Otherwise, your experience can be like skydiving without a parachute.

The good news is that we’re going to provide you with everything you need to survive crypto day trading.

Day trading the cryptocurrency market can be a very lucrative business because of the high volatility. Since the crypto market is a relatively new asset class, it has led to significant price swings.

Before day trading bitcoin or any other altcoins, it’s prudent to wait until we have a high reading of volatility. The good news is that even when we have a low reading of volatility relative to other asset classes, this volatility is still high enough that you can generate a modest profit on your trades.

Crypto day trading also requires the right timing and good liquidity to make precise entries.

A lot of the cryptocurrencies and crypto exchanges are very illiquid and don’t have the liquidity to offer instant execution that you might find when trading forex currencies.

Before day trading bitcoin or any other alt coins, it’s also important to check how liquid the cryptocurrency you wish to trade is. You can do so by simply verifying the 24-hour volume of the crypto trade.

Coinmarketcap is a good free resource to read and gauge the market volume of any particular coin.

Note* always remember that not having enough liquidity could lead to substantial slippage and subsequent to bigger losses.

As previously stated, crypto day trading doesn’t require trading every single day. We only like day trading cryptocurrencies when all the conditions align in our favor. In this case, avoid trading on weekends and limit trading only on the highest-volume days.

Put your seatbelt on because next, we’re going to reveal how professional traders are day trading cryptocurrencies.

Crypto day trading strategy

The idea behind crypto day trading is to look for trading opportunities that offer you the potential to make a quick profit. If day trading suits your own personality, let’s dive in and get through a step-by-step guide on how to day trade cryptocurrency.

Now, before we go any further, we always recommend taking a piece of paper and a pen and note down the rules of this scalping strategy.

In this article, we’re going to look at the 'buy' side.

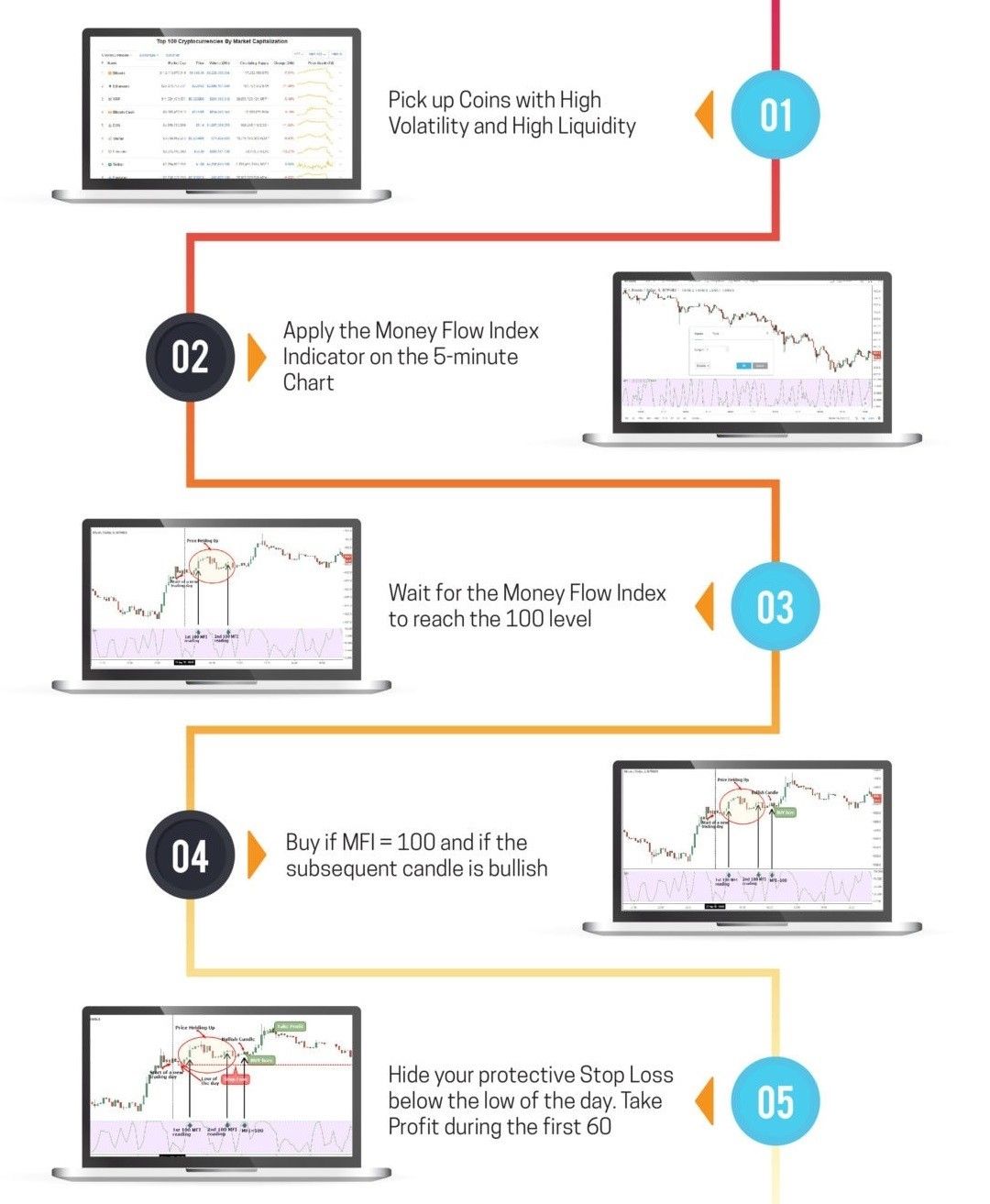

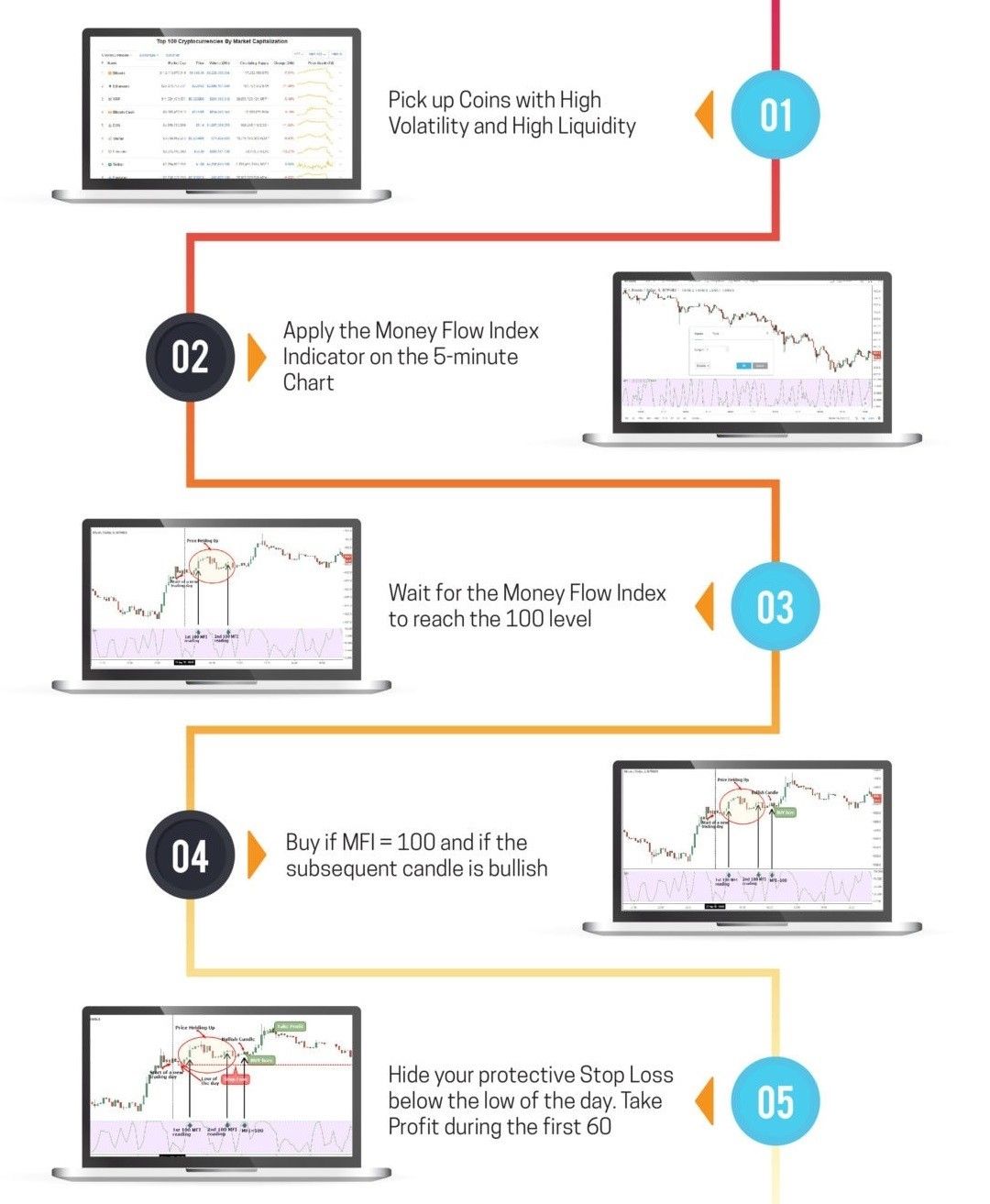

Step #1: pick up coins with high volatility and high liquidity

As previously discussed, the number one choice you need to make is to pick coins that have high volatility and high liquidity. If you’re not day trading bitcoin, which is the most liquid coin out there, and you like the altcoins, try to pick those coins that have good liquidity and volatility.

There are more than 1600 coins on the market and growing. By following only the top cryptocurrencies, you’ll reduce your area of selection.

Day trading smaller cryptocurrencies can also be a very lucrative business, but there are higher risks. Remember, crypto prices can crash just as fast as they have risen.

Moving forward, you’re going to learn how you can make money crypto day trading.

Step #2: apply the money flow index indicator on the 5-minute chart

This specific day trading strategy uses one simple technical indicator, namely the money flow index. We use this indicator to track the activity of the smart money and to gauge when the institutions are buying and selling cryptocurrencies.

The preferred settings for the MFI indicator are 3 periods.

We’re also going to alter the default buying and selling levels from 80 to 100 and respectively from 20 to 0.

How to use the IMF indicator will be outlined during the next step.

Step #3: wait for the money flow index to reach the 100 level

An MFI reading of 100 shows the presence of the big sharks stepping into the markets. When buying, smart money can’t hide their footsteps. They inevitably leave tracks of their activity in the market and we can read that activity through the MFI indicator.

Technical indicators aren’t always right, so in order to fine-tune our day trading strategy, we’ve added a few more conditions. Namely, during the current day, we need to skip the first two MFI readings of 100 and study the crypto price reaction.

The price needs to hold up during the first and second 100 MFI reading.

If the price drops after the first two MFI 100 readings, then this suggests that most likely we’re going to have a down day.

Let’s now determine the appropriate place to go buy bitcoin and what are the technical conditions that need to be satisfied.

Step #4: buy if MFI = 100 and if the subsequent candle is bullish

We can now wait for the third MFI reading above 100. It doesn’t necessarily have to be the third MFI = 100 reading, you can take every other MFI = 100 readings. If your time doesn’t allow you to catch the third 100 reading on the MFI indicator, you can simply pick the next one as long as all the other technical conditions are satisfied.

Next, we also need the candlestick when we got the MFI = 100 reading to be a bullish candle. The close of this candle needs to be near the upper end, giving us a candle with very small wicks.

This brings us to the next important thing that we need to establish when day trading cryptocurrency, which is where to place our protective stop loss and where to take profits.

Step #5: hide your protective stop loss below the low of the day. Take profit during the first 60 minutes after you opened the trade.

The obvious place to hide your protective stop loss is below the low of the day. A break below it will signal a shift in the market sentiment, and it’s best to get out of the trade. This can also signal a reversal day.

We’re more flexible when it comes to our exit strategy. However, the only rule you need to abide by is to take profits during the first 60 minutes or the first hour after your trade got triggered. Holding the trade longer than one hour will result in a lower success rate. At least that’s what our backtested results showed us.

Conclusion – crypto day trading

If you took the time to read the whole day trading crypto guide, then you should be able to buy and sell bitcoin and alts and make some daily profits. If you are interested in learning how to day trade cryptocurrency, be sure to equip yourself with enough information before diving into the market.

Crypto day trading can be a great way to grow your crypto portfolio and it’s a very lucrative alternative to the holding mentality that it’s crippling the crypto community.

Making a living day trading cryptocurrency can be a lot easier due to the high volatility nature of the crypto market. High volatility suits day trading very well, so you have the right environment to succeed. You may also be interested in reading our guide on the best cryptocurrencies investments for 2019.

Feel free to leave any comments below, we do read them all and will respond.

Also, please give this strategy a 5 star if you enjoyed it!

Please share this trading strategy below and keep it for your own personal use! Thanks, traders!

Cryptocurrency trading strategies

Every day, someone gets tired of sitting at a desk and decides to become a trader. Many people think that the cryptocurrency market is a very easy niche, to begin with. This is the first and main reason for their failure.

However, many people learn how to trade. After acquiring basic knowledge, they understand the necessity of strategies. Traders can’t win with technical analysis or fundamental analysis alone. Learning different tactics and how to implement them is a must.

A cryptocurrency trading strategy is a set of actions aimed at creating profit in the cryptocurrency market. No one can give you a 100% guarantee that you will always have income. However, a trading strategy will guarantee that you won’t fail.

Crypto trading strategy

Why is trading so popular, yet the world is only aware of a few really successful and rich stockbrokers or cryptocurrency traders? That’s because of the mass of information that you have to absorb. Moreover, you have to use all of this material when choosing a strategy.

Don’t follow someone else’s ideas. Follow the market situation and try to understand its cues.

First of all, when creating or using a crypto trading strategy, you must understand that it’s a very unstable market. You may see price fluctuations of between 20-30% in just a few days. When trading on stock indices, it’s almost impossible to see that kind of shift in a day. However, the cryptocurrency index might change by 100% or even more. Secondly, bitcoin is “the father” of cryptocurrencies. Hence, prices very often follow its trend. If you’re going to trade altcoins, the most important part of your strategy should be to see what’s going on with bitcoin.

Usually, cryptocurrency traders don’t mine coins. Nevertheless, they are always aware of the cost of mining. For example, bitcoin cash has become very valuable since its hard fork on 1 august 2017 because miners need many resources to find new blocks. If mining cost increases, the coin’s price also rises.

Lastly, you have to follow all political and economic news. They have a great influence on this market. For example, when iran attacked US military bases in iraq, bitcoin’s price rose from $8,000 to $8,300. This situation created an uptrend for the whole market. You can’t be a successful trader if you don’t follow the news.

These are the three main principles of cryptocurrency trading. From these points, traders have created several strategies.

- Buy & hold. This strategy is more about investing than trading. People buy an asset and hold it for a long time. They try to predict prices for months and check charts for long periods of time. This strategy is mostly based on fundamental analysis.

- Swing trading. This cryptocurrency trading strategy is about using the correction during the formation of a trend. Traders have to enter the trend at the time of correction. Swing trading means to wriggle after the trend.

- Day trading. This strategy means trading on the exchange within one trading session during the day. Positions opened on this day are not transferred overnight to the next session.

- Scalping. This is a high-speed, high-frequency form of trading. A trader opens and closes positions within a period of 1 to 15 minutes. Each deal ideally brings a small profit. Altogether, the series of small profits from each transaction yields high income.

Day trading strategy

Most day traders spend their life making profit from cryptocurrency trades. They make dozens of exchanges and transactions every day. You can earn enormous rewards, but you need a lot of time (months, even years) to become a successful day trader.

An exchange with lots of distinctive cryptocurrency pairs is the first thing you should find.

A pair means two coins or tokens that are being traded. For example, if you think that monero’s price might rise against litecoin’s, you have to find an XMR/LTC pairing

The next requirement is a high-liquidity platform. It is your guarantee for a permanent buyer/seller connection. Otherwise, you won’t be able to make a deal when the price is falling.

Very often, people try to associate day trading with an easy path to wealth. In fact, this rarely happens. It’s a very long, hard path to having a billion dollars in your bank account. The SEC warns: “day traders tend to face serious financial losses in the first month of trading”.

You have to analyse a lot of information and be ready to connect each trap with bearish or bullish trends. As a trader, you must have a deep understanding of price fluctuations and use them for your personal gain.

Day cryptocurrency trading tips

Day trading may provide both large incomes and losses. If you’re interested in making lots of money, you should remember that it isn’t ‘free money’. You have to resist stress and stay cool-headed in addition to following all of your tactics.

Before day trading, you should check for high volatility of cryptocurrency being traded. This provides more opportunities to make deals, allowing you to gain more profit.

The traded cryptocurrency should be liquid. Check the exchange platform and the coin (token) to see how liquid it is. How do you do this? You can go to coinmarketcap and look at the cryptocurrency’s 24-hour trading volume.

Trading strategy for beginners

The beginning is the most difficult stage in every niche. On the other hand, it’s also the simplest stage because you have to do very little to reach your first achievements. Traders say that HODL is the easiest scheme for beginners. ‘HODL’ means holding assets for the long-term in the belief that the price will rise in the future.

It’s very easy because a trader only needs a little knowledge for it to be rewarding. Why? Almost all cryptocurrencies experience enormous growth over the long-term. Moreover, you can also invest in popular coins or tokens to minimise your risks.

So, what should you do? Buy promising cryptocurrencies and hold onto them for months. For instance, you could buy 100 ethereum and just check the index in 3 years. The probability that it’ll be higher is almost 100%.

You’re not obligated to check the prices very often. You should actually avoid checking it regularly because you may sell your assets too early.

This strategy is one of the less effective ones. There is no guarantee that every cryptocurrency will rise over the years. Nevertheless, trading is about statistics. Charts show that all the people who bought cryptocurrency during the bearish trend at the beginning of 2018 have a 100-200% increase in income today.

Best cryptocurrency trading strategies for 2020

One of the most popular strategies among traders is statistical arbitrage. It seems very complex, but after several deals, you’ll see that it’s simple enough. The way this strategy works is you buy coins on an exchange, then sell them on another platform and, finally, sell that for fiat currency. The logic of this trading strategy is to take advantage of the lag in price corrections across these exchanges.

The only difficulty is the fee. You have to use platforms with a low commission to earn a profit. Be vigilant when using statistical arbitrage because a fee can be even higher than the potential income.

Following the bears on the market for the last two years, many investors quit cryptocurrencies. As a result, the market’s volatility fell. That’s good for banks but not for traders, most of whom say that HODL will be more popular in 2020 than in previous years.

Bitcoin trading strategy

Most people begin their trading path with BTC because it’s the most traded and valuable cryptocurrency. That’s why you have to be fluent with crypto trading methodology. While choosing a bitcoin trading strategy, you should rely on your own experience and style.

If you’re very emotional and tend to make mistakes, you have to use an algorithmic strategy. That means using formulas to identify points at which you need to place different orders. Today, these strategies are associated with using trading robots, but you have to configure them the right way to be successful.

If you’re disciplined and can easily manage risks, you could try margin trading. This allows you to deposit less, but gain the same profit. However, you have to place every order very carefully, or you might end up in debt.

Trading strategy for bitcoin 2020

Your trading strategy for bitcoin will be the same as those used for alternative cryptocurrencies, like swing, day trading, scalping and others. Most of your tactics will be similar, but you’ll have more opportunities because bitcoin is the most popular digital currency.

However, if you’ve already invested in BTC, you may want to diversify risks with a hedging strategy. This is the practice of making tactical orders to decrease the risks of existing positions.

In this case, you’ll open a short position on BTC, which involves selling the asset for the actual market value while under the pretence that it might decline. If it really falls, you would buy it back for a lower cost and margin the difference. This means that any loss to your first BTC position would be countered by the income from the short position.

Bitcoin day trading strategy

Day trading has the same principles for each cryptocurrency. Nevertheless, there are some benefits to day trading bitcoin:

- High supply and demand

- Many exchanges allow leverage trading with BTC

- Universal access – all exchanges have added BTC to their lists

- BTC-oriented exchanges provide lower fees and minimum deposits for BTC.

There are two highly popular day-trading tactics for BTC: