How Much Leverage Is Right for You in Forex Trades, best forex leverage for $100.

Best forex leverage for $100

Forex traders should choose the level of leverage that makes them most comfortable.

Top forex bonus list

If you are conservative and don’t like taking many risks, or if you’re still learning how to trade currencies, a lower level of leverage like 5:1 or 10:1 might be more appropriate. So, should a new currency trader select a low level of leverage such as 5:1 or roll the dice and ratchet the ratio up to 50:1? Before answering, it’s important to take a look at examples showing the amount of money that can be gained or lost with various levels of leverage.

How much leverage is right for you in forex trades

Understanding how to trade foreign currencies requires detailed knowledge about the economies and political situations of individual countries, global macroeconomics, and the impact of volatility on specific markets. But the truth is, it isn’t usually economics or global finance that trip up first-time forex traders. Instead, a basic lack of knowledge on how to use leverage is often at the root of trading losses.

Data disclosed by the largest foreign-exchange brokerages as part of the dodd-frank wall street reform and consumer protection act indicates that a majority of retail forex customers lose money. The misuse of leverage is often viewed as the reason for these losses. this article explains the risks of high leverage in the forex markets, outlines ways to offset risky leverage levels, and educates readers on ways to pick the right level of exposure for their comfort.

Key takeaways

- Leverage is the use of borrowed funds to increase one's trading position beyond what would be available from their cash balance alone.

- Forex traders often use leverage to profit from relatively small price changes in currency pairs.

- Since leverage, can amplify both profits as well as losses, choosing the right amount is a key risk determination for traders.

- Leverage in the forex markets can be 50:1 to 100:1 or more, which is significantly larger than the 2:1 leverage commonly provided on equities and the 15:1 leverage provided in the futures market.

The risks of high leverage

Leverage is a process in which an investor borrows money in order to invest in or purchase something. In forex trading, capital is typically acquired from a broker. While forex traders are able to borrow significant amounts of capital on initial margin requirements, they can gain even more from successful trades.

In the past, many brokers had the ability to offer significant leverage ratios as high as 400:1. This means, that with only a $250 deposit, a trader could control roughly $100,000 in currency on the global forex markets. However, financial regulations in 2010 limited the leverage ratio that brokers could offer to U.S.-based traders to 50:1 (still a rather large amount). this means that with the same $250 deposit, traders can control $12,500 in currency.

So, should a new currency trader select a low level of leverage such as 5:1 or roll the dice and ratchet the ratio up to 50:1? Before answering, it’s important to take a look at examples showing the amount of money that can be gained or lost with various levels of leverage.

Example using maximum leverage

Imagine trader A has an account with $10,000 cash. He decides to use the 50:1 leverage, which means that he can trade up to $500,000. In the world of forex, this represents five standard lots. There are three basic trade sizes in forex: a standard lot (100,000 units of quote currency), a mini lot (10,000 units of the base currency), and a micro lot (1,000 units of quote currency). Movements are measured in pips. Each one-pip movement in a standard lot is a 10 unit change.

Because the trader purchased five standard lots, each one-pip movement will cost $50 ($10 change/standard lot X 5 standard lots). If the trade goes against the investor by 50 pips, the investor would lose 50 pips X $50 = $2,500. This is 25% of the total $10,000 trading account.

Example using less leverage

Let’s move on to trader B. Instead of maxing out leverage at 50:1, she chooses a more conservative leverage of 5:1. If trader B has an account with $10,000 cash, she will be able to trade $50,000 of currency. Each mini-lot would cost $10,000. In a mini lot, each pip is a $1 change. Since trader B has 5 mini lots, each pip is a $5 change.

Should the investment fall that same amount, by 50 pips, then the trader would lose 50 pips X $5 = $250. This is just 2.5% of the total position.

How to pick the right leverage level

There are widely accepted rules that investors should review before selecting a leverage level. The easiest three rules of leverage are:

- Maintain low levels of leverage.

- Use trailing stops to reduce downside and protect capital.

- Limit capital to 1% to 2% of total trading capital on each position taken.

Forex traders should choose the level of leverage that makes them most comfortable. If you are conservative and don’t like taking many risks, or if you’re still learning how to trade currencies, a lower level of leverage like 5:1 or 10:1 might be more appropriate.

Trailing or limit stops provide investors with a reliable way to reduce their losses when a trade goes in the wrong direction. By using limit stops, investors can ensure that they can continue to learn how to trade currencies but limit potential losses if a trade fails. These stops are also important because they help reduce the emotion of trading and allow individuals to pull themselves away from their trading desks without emotion.

The bottom line

Selecting the right forex leverage level depends on a trader’s experience, risk tolerance, and comfort when operating in the global currency markets. New traders should familiarize themselves with the terminology and remain conservative as they learn how to trade and build experience. Using trailing stops, keeping positions small, and limiting the amount of capital for each position is a good start to learning the proper way to manage leverage.

Leverage 1:100 forex brokers

Most brokers offer leverage ranging from 1:2 to more than 1:1,000, depending on the requirements and initial investment of their clients. In most cases, traders would be able to choose between 1:50, 1:100, 1:200, etc. Leverage rate when trading currency pairs. Different leverage levels would be suitable for traders with different knowledge and experience. When deciding how much to borrow from their broker, traders also need to consider their individual needs and the strategy they plan to apply.

Best forex brokers for united kingdom

What is financial leverage?

The purpose of leverage is to allow investing without the need to use too much equity. The idea is that the after-tax profit from a leveraged transaction would exceed the borrowing costs. One simple example of using leverage would be mortgage – when we are purchasing a real estate, we are financing a portion of the purchase price with mortgage debt. In other words, we use leverage to avoid paying the full price with our equity.

Leverage in trading

Also referred to as margin trading, leveraged trading is offered by brokers for different financial instruments, including options, futures, and forex trades. Leverage is commonly used when trading contracts for difference (cfds) but it can also be applied to stocks or indices, for instance. It is important to understand that leverage does not increase the profit potential of a trade – rather, it multiplies the profits or losses from a transaction.

Margin

There is a simple formula that shows the connection between leverage and margin – to calculate the leverage ratio, we just need to divide the value of the total transaction to the margin level we are required to deposit. For instance, if the value of the transaction is $100,000 (which is the value of a standard lot in forex trading) and the required margin is 1%, then in monetary terms, we will need to have $1,000 as margin to open the position.

To calculate the used leverage for this trade, we divide $100,000 by $1,000. Thus, the leverage ratio is 100:1. It is often displayed in reverse, however – 1:100. This is quite high leverage but it is also very common in currency trading.

How does leverage work in forex?

As we can see, price movements are very slight, while transactions are carried out in sizable amounts. A forex trade worth $100,000, which is the standard trading lot, is then very common. However, the vast majority of retail traders would never be able to afford to trade such huge volumes and the foreign exchange market would be accessible only to large banks and institutional traders.

This is where leverage comes in – it allows individual, retail traders to buy and sell sizable amounts of currency pairs with only a fraction of the required value for the transaction. When we trade amounts of $100,000 or even more, the potential profits from even the slightest price changes could be significant. Moreover, retail traders can open leveraged positions with micro and mini lots with even less capital.

The available leverage levels may differ considerably, depending on the broker traders choose to work with, as well as on the type of financial instrument they wish to trade. In addition, financial regulators in certain jurisdictions restrict the maximum leverage that can be offered on derivative products such as cfds or on forex pairs. The majority of large, respectable forex brokers would not provide leverage ratios of more than 1:400 even on the major currency pairs. However, brokers operating without a proper license would sometimes offer prospective clients cash bonuses and leverage of over 1:500.

Is 1:100 leverage suitable for you?

Once traders decide they wish to trade on the foreign exchange market, they can choose from hundreds of online forex brokers. Each firm would offer them different trading conditions and among the most important things to consider is the leverage level for currency pairs. It is difficult to determine the best leverage traders should use since the specific levels depend on a range of factors, including the individual knowledge, trading strategy, and tolerance for risk.

Moreover, the particular leverage ratio should depend on traders’ projection for the upcoming market movements. Traders should decide how long they should keep a position open before they pick a specific level of leverage. Typically, smaller leverage should be used with positions that remain open for long periods of time. When traders plan to keep a position open for only a few minutes or even seconds, they should be looking for the maximum leverage they can get. This is how they can extract the maximum profit with limited equity and within a limited amount of time.

Many forex brokers would offer their clients leverage up to 1:100. For some traders, this may be too high, whereas, for others, this level is standard for trading major currency pairs. In reality, traders should decide whether 1:100 leverage is suitable for them based on the strategy they have chosen to apply. Such levels are best for scalping, for instance. Scalpers would typically use leverage ranging from 1:50 to 1:500 or even higher in an attempt to extract the maximum potential profit from multiple short-term trades.

Scalping is a method for trading, which is based on real-time technical analysis and involves holding an asset for a few seconds or for up to a few minutes. It is mostly used by forex brokers since the market is extremely liquid, allowing them to enter and exit trades several times a day. Scalpers look to make small profits from multiple trades during the busiest hours of the day. They typically aim at investing less equity per trade compared to other types of traders but they pair it with higher leverage.

Leverage levels around 1:100 are also suitable for day traders and for those who are experienced enough in the foreign exchange market. It is perfect for those who wish to trade with higher leverage and are able to manage the risks arising from it. It should be noted, however, that the available leverage would often depend on the account deposit level. Brokers would not offer 1:100 leverage to new clients who have opened mini and micro accounts with minimum capital.

Advantages of 1:100 leverage in forex

This means that with a capital of only $100, traders can open positions worth up to $10,000, which is referred to as 1 mini lot. Of course, traders can trade 10 mini lots with a total value of $100,000 and they will need to invest only $1,000. If their trades are successful, they could make a profit of up to a few thousand dollars.

There are several other great advantages of using leverage for forex trading some novices struggle to comprehend. Most importantly, when using 1:100 leverage, for instance, traders use borrowed capital that is 100 times their own investment. However, this “debt” is only virtual, which means that they do not actually receive this money. Therefore, they do not need to repay anything to the broker.

The leverage they get – the virtual borrowed capital, acts as a boost to their account and is active only as long as the position is kept open. Once traders close their leveraged position, their profits would be based on the combined amount of the borrowed funds and their own funds.

Another great thing about forex leverage is that it comes with no interest. Unlike the leverage example, we described above for purchasing property, trading leverage does not cost additionally for borrowing money. The mortgage we take when buying a home comes with an interest rate paid monthly to the bank. Forex brokers, on the other hand, offer leverage for free and instead earn their profits from the spread and various commission fees.

Risks of using 1:100 leverage

For example, if you invest $1,000 and use a leverage of 1:100, you will be able to spend $100,000 on an open position. This is a very attractive offer, especially if you are confident that your strategy will work. However, if you fail to predict even the slightest price movements, then it is very likely that you will lose your entire investment in a matter of hours.

In fact, it is possible to lose thousands of dollars if the market moves against you and you are trading large volumes with high leverage – higher than you could normally afford. It is a good tactic to never risk more than 2% of your entire balance on a single trade – if the potential loss from the transaction is 2% of your capital, you simply need to reconsider your trading style and decision-making. This is particularly important for those who are still new to forex trading with leverage – they should stick to even lower percentages for the potential losses and lower levels of leverage.

What is 1:100 leverage meaning?

One can venture into the world of forex trading with limited investment. Some forex brokers even let their clients open an account with a minimum deposit as low as $100. Whether you have limited capital or not, everyone wants to use a higher sum than their actual investment to make more profits. This is possible with leverage.

Leverage plays a vital role in forex trading and is offered by the broker. Let’s explore the term, its advantages, and its disadvantages.

What is leverage in forex trading?

Leverage can use a small amount of capital in traders’ accounts controlling a larger amount in the market. Leverage is the ratio of the trader’s funds to the size of the broker’s credit. Brokerage accounts allow the use of leverage through margin trading, or in other words, brokers provide the borrowed funds to traders to increase trading positions. The leverage ratio can amplify both profits as well as losses.

For a layman, leverage would be a small thing that can be used for bigger purposes. In forex trading, it is the ratio at which a small investment in your trading account controls a larger investment that is operating in the market. This difference in the two capitals is also known as the trading on margin in the stocks or forex market. There is an interest charged on this margin in the stocks market, but such is not the case in the forex market. Traders are not required to pay any interest on this margin irrespective of your credit type and account type. Your forex broker will offer a margin to you that you can use to trade.

You can read more details about what is leverage in forex in our article.

What is instrument leverage 1:100?

So, leverage we can describe as the ability to control a large amount of money using very little of your own. But, what is 1:100 leverage meaning?

In the foreign exchange markets, the leverage ratio is commonly as high as 1:100. Leverage 1:100 means that for every $1,000 in the trading account, traders can trade in the market up to $100,000 in value.

What are the benefits of trading using leverage?

Leverage is an important feature offered by forex brokers. It helps you trade with higher capital and make more profits. For example, consider operating with a 1:100 leverage . This is the most common leverage in forex. It means that with an investment of $1, you will be operating investment of $100 in the market. $1 is your money, and $99 is the borrowed money, your leverage. Since your operating amount is $100, you will be able to make more profits. This borrowed money will be sponsored by your broker and needs to be repaid.

Before leverage was introduced in the forex market, a 10 % movement in the account for a year was something to look forward to. Everything was slow, but leverage has changed it. Thus, the benefit of leverage is that it allows you to quickly invest more money in the market to fetch more profits.

How to calculate leverage and trading margin?

The main leverage formula is:

margin-based leverage ratio = total value of transaction / margin required

In this case, if the margin-based leverage expressed ratio is 1:100, then the margin required of total transaction value will be 1.00%. The margin requirement for 2% is 1:50 leverage.

Different leverages

The brokers fix leverage amounts at their discretion. Different brokers have different ratios to offer to their clients. Their terms and conditions also vary. The most popular ones are explained below:

- 50:1 – this leverage is on the lower side and means that you can use $50 to place a trade in the market for every dollar in your account. For example, if you have a deposit of $100 with a broker, you can trade with an amount that 50 times higher. In this case, $5000.

- 100:1 – as mentioned earlier, this is the most popular leverage in forex trading and is usually offered to standard lot account holders. You get to trade $100 for every dollar in your account. As the minimum deposit amount for a standard account is typical $2000, you can trade with an amount equivalent to $200,000.

- 200:1 – this leverage amount is offered to mini account holders with a typical minimum deposit of $500. With this leverage, you can trade 200 times the amount in your account. If you only have a minimum deposit, you can still control $100,000 in the market.

- 400:1 – this leverage is on a higher side. All the brokers do not offer this leverage. You can usually get this if you are holding a mini account. As the minimum deposit is around $500, you can control a sum of $200,000 in the market.

How to handle leverage professionally

High leverage amounts do not blind professional traders. They generally use 20:1 or 10:1 leverage and make several small trades. This safeguards their capital. If you want to take full advantage of leverage, do not invest all the amount in one trade. Move gradually and aim for consistent returns rather than a miraculous one-time deal. These professional tricks followed by veteran traders and investors will help you establish yourself as a forex trader.

The best option for traders is to have brokers that can offer various leverages. In that case, the trader can change the leverage ratio in the broker’s website dashboard.

Leverage is nothing but borrowed money. You can make more profits with it, but it can take an ugly turn as well. It only promises extra investment, not profit. Many aspects govern whether there will be gains or losses. Many traders, especially the new ones, aim for higher leverage, like fx trading 400 leverage, with the hope of making more profits. Higher leverage does not necessarily translate into higher profits. It can lead to equally high losses. We would suggest you aim for the leverage that you can easily manage and keep in mind that the chances of making losses are real. Instead of having an optimist approach, have a realist approach towards leverage and forex trading.

Campforex.Com

Managed forex accounts $1000 minimum

Best forex leverage for $100, $500 or $1000 in the face of new regulation

The european securities & markets authority (ESMA) has passed a regulation which will restrict forex brokers from providing excessive leverage to traders. If this legislation is implemented, it will restrict maximum leverage that eurozone forex brokers can provide their clients to 30:1 (for major pairs like the EURUSD) and 20:1 (for minor pairs).

Since regulators proposed this legislation, I have been receiving emails from traders who want to know whether this is the end of forex trading in the eurozone.

Well, this is not the end of forex trading for those with small accounts.

However, if traders are to stay in the game in the event that maximum leverage is restricted to 30:1, they’ll need to first understand how the new legislation will affect their forex trading in the real world.

How to pick the best forex leverage for $100, $500 or any account size

The new legislation, if implemented, will be a double edge sword. On one hand, it will favor conservative traders who don’t like taking huge risks. On the other hand, it will restrict traders with a small account, even if they know how to trade.

In the midst of this uncertainty, it would be necessary to learn a few things as far as best forex leverage is concerned.

The simplest rules of leverage are as follows:

- Accept to trade with low leverage

- The use of trailing stops will help preserve your trading capital

- Limit the amount that you will be risking with reference to your trading capital. I cannot say your risk should be 2% or 5% of your trading capital. It depends with the percentage of risk that you are comfortable with.

A leverage of 50:1, 30:1 or 10:1 would be ideal if you are a conservative trader. In essence, the new legislation will not affect this group of traders.

Will it affect small forex accounts?

If regulators actually implement it, will this affect a trading account worth $100 or $500? The answer is yes. You will be able to trade less volume, and thus less returns if other factors are kept constant.

P.S: this news is most likely saddening to those who have a small account. If this sounds like you, I implore you to look into my trading course where I recently gave a tutorial of how to trade and make profits even with low leverage.

In this training, I teach my students the principles of successful trading in addition to what they must do in order to compound and grow their accounts faster.

Note: if you are a forex beginner, please watch the video below in order to understand what leverage is and how it affects you. If you have any questions, don’t hesitate to contact me.

How to trade forex with $100 in just 5 minutes december, 2020

Posted by andy | last updated dec 23, 2020 | forex guides | 0

Forex is one of the most reliable and best online trading methods. There are numerous investors across the globe are working keenly with this platform to achieve a remarkable profit by the end of the day. However, the different strategy to focus on the profit is by getting into the proper systematic way.

The newcomers will face a complex task at the entry level of the authorized system. With effective training, you can yield an idea about the real-time analysis of trade’s future patterns and the reliable investing amount.

Hence, all together it will move on to the winning path. In this scenario, many investors afraid about the investment of huge amount for forex trading rather than with a low investment. Such cases, we do not inform that you will not face any risk factor by investing higher than a hundred dollars.

Forex trading

You can easily become a successful trader if you understand the leverage working process, which is most essential. If you ignore the leverage during the trading process then it will end in a disaster. If you are comfortable taking the risks by trading with a huge amount of money may lead to no return. You can also gain significantly if the trade favors on your part.

- Your daily financial responsibilities should not interfere with your forex trading investment or capital.

- You should not invest a huge amount for forex trading because it may even halt your life if anything goes wrong.

- Please remember not to take any risk limit to open trades or invest beyond your level.

This is not to make a quick rich strategy. You need to know how simple by converting $100 into $1000 or more than your forex trading. It is always risky and also a possible step. Leverage is very similar and comparable like a double-edged sword, which helps your profit to boost potentially.

It can plunge your down and boost your risks into the abyss. Your potential losses will be magnified by the leverage if you trade into the negative direction.

The leverage of trading with 100:1 will allow you to trade with a maximum amount of $10,000 and can get every $100 credited to your account. If it is $100,000 trading then you can get $1,000 into your account. With the help of leverage, you can easily earn with a huge profit that is equivalent to $100,000 into your trading account. Even leverage may cause you a heavy loss to your trading account.

Reliable steps to trade forex with $100 december, 2020

Step 1: start to invest your money in XM trading

You can start the trading journey by investing a hundred dollars in xm market

To do this visit XM.Com and open an real account

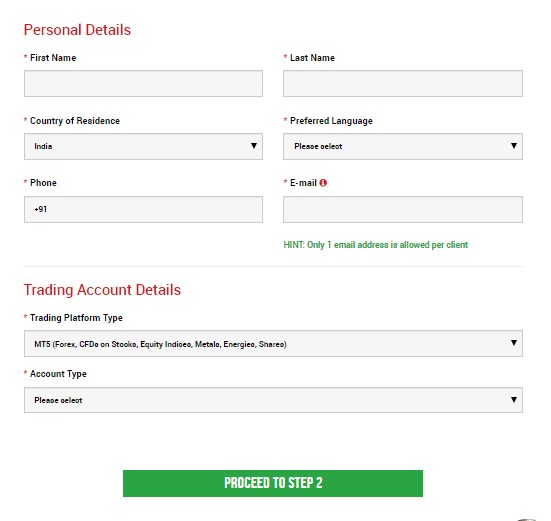

Step 2: filling the personal details

Fill all the box with accurate details

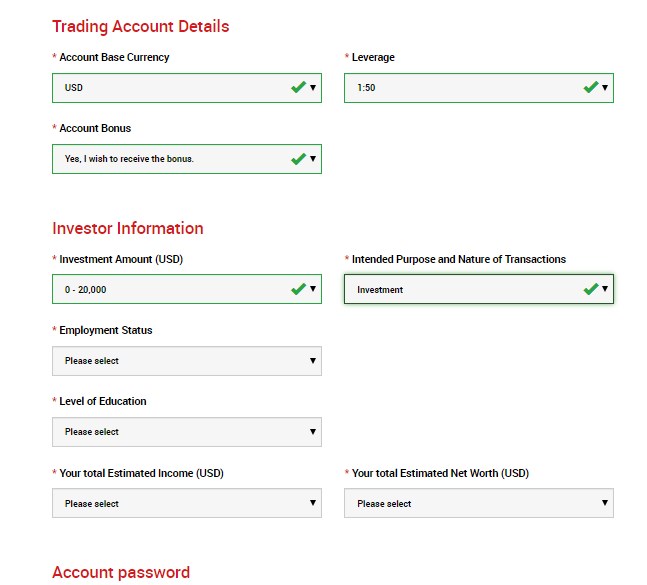

Step 3: investor information & trading account details

Step 4: depositing $100 to trade

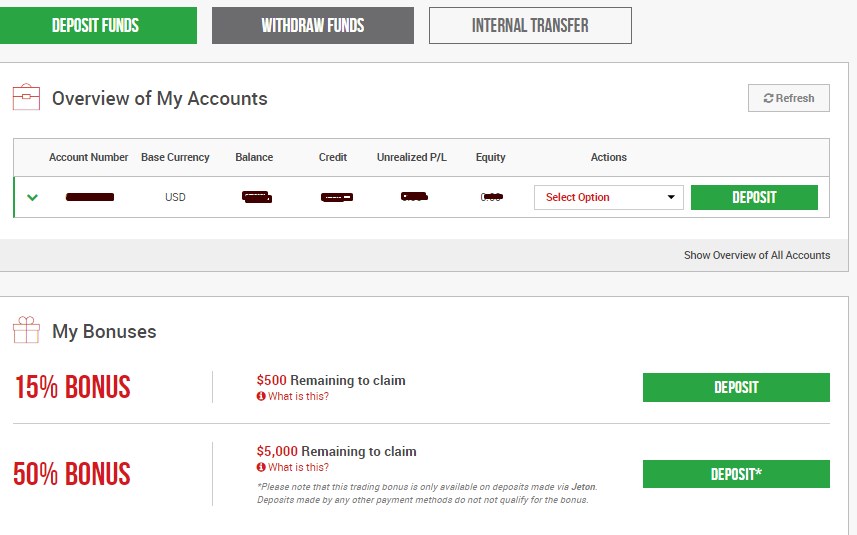

After opening your account you must confirm your email address and then login to XM account with your account username and password.

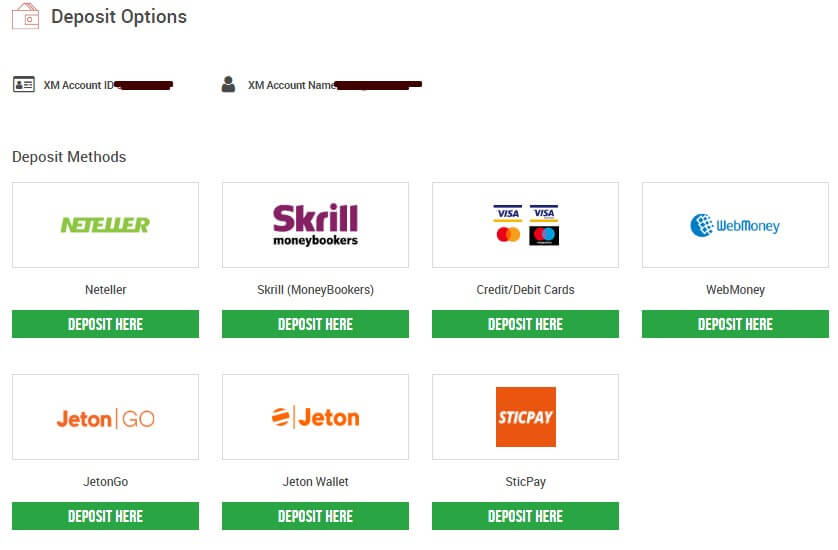

Click deposit button

Click any of the gateways you prefer. For this article i’m choosing credit/debit cards option

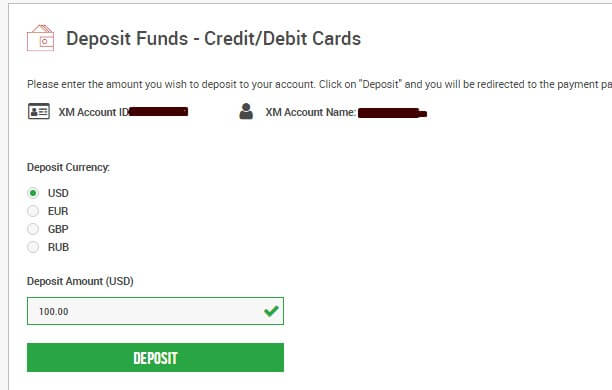

I’m choosing USD and 100 USD as the deposit amount. You choose which currency you prefer and finish the payment.

Hooray! Now you opened real forex trading account with just $100 easily. That’s all go and trade with your skills and make huge money.

Most important point after opening trading account with $100

Please find below the most important points on how to trade forex for a living and start with a trading account:

The margin calculation takes place

The most important battle in trading is the calculation between the two financial units like USD or euro. You should consider investing money in USD units. You need to explore by using euros to get the marginal values with final requirements. Please work on your marginal value and five micro lots to achieve the final value around $60.

Existing margin value calculation – you can place this only trading option to yield the best value with your margin calculation.

Find the equity – you need to analyze your current position and move on with its accordance. The total of two values will be equal to your equity.

Explore your free margin – the calculated equity can be obtained from reducing the existing marginal value with the amount of free marginal value.

Obtain the margin level – the future trading outcomes can be decided to depend upon the percentage of margin level.

You can easily follow the above-provided reliable steps on your forex trading account to yield a profitable change.

Battle procrastination:

The most important step within the forex trading and we all know that the successful traders within the market will never procrastinate. You can easily achieve the trading targets by properly seizing each and every opportunity you received.

Never postpone any tasks or priorities to tomorrow which has to be done by today. You can trade by using the demo account, which can easily assist you with the battling procrastination.

Keep practicing:

The famous quote “practice makes us perfect”, in a similar way, you can practice with the help of demo account to get hands-on experience. This could be much helpful to understand the forex trading platforms working process and get familiar to make use of its features. Learning forex trading will take a lot of passion, effort, and as well as time.

Recognition:

Please be self-aware within the forex marketing, you need to analyze the involved risk, and safety zones to achieve the maximum profit. You can trade accordingly by considering your analysis on object and goals. This is an essential step particularly for the beginners who prefer to start the forex trading.

Investment

The new trader should have started the forex trading with minimal capital and gradually increase the investment from their entire profit and not by any further deposits. The profit cannot be earned or not to invest as a fortune.

You can easily maximize the amount with successful trading. With a minimal investment, you can reduce the great losses risk when it comes to a large amount of money.

Single currency pair

Forex trading with the world of currency is much complex because of its members obstinacies, different characters, and unpredictability of markets. Within the financial world, it is not much easier to groom as a perfect trader. You can start with your familiar single currency pair. It is always better to choose the global wide or your country currency for trading.

Stay vigilant

Please don’t confuse with your emotions that your concern about the forex trading effects. You can easily maintain a logical and practical approach about your trading as it can give you greed, panic, or excitement feeling that can ruin your forex trading career. You can become a successful trader by following the predetermined trading strategy.

Keep a record

You can easily learn the importance of your mistakes. You should track all the records of your success and failures, as well as key mistakes, or any other positive steps that you had followed to reach your desired goal. You can make use of the charts and understand the key indicators by reviewing the losses and wins.

Possibility vs. Probability

Theoretically, with your forex trading account, it is very much possible with any pattern of loss or gain. If you are preferred to do anything that is possible, it doesn’t mean that you can easily implement the same. This could be the main reason, why you should remain safe and very careful during the forex trading with leverage.

Follow the above steps to start forex trading with $100 easily.

Fxdailyreport.Com

One of the reasons that many people are attracted to the foreign exchange markets are the high amounts of leverage that many brokers offer. It means that even starting with just a little you can potentially make a whole lot but what is leverage and what are the implications of forex trading with high leverage? In this article we will take a look at exactly what leverage is, consider the benefits of forex trading high leverage and highlight a few of the potential pitfalls.

What is leverage ?

Leverage is a simple concept to understand. It allows you to use your broker’s money in order to trade a position bigger than you would otherwise be able to trade from the amount in your account alone. For example, if your account balance was $1,000 and your broker offered you 100:1 leverage, you would effectively be able to trade with $100,000 worth of capital.

In other words, your broker is loaning you money to trade with based on the amount you have deposited in your account.

Trusted forex brokers with 100:1 leverage

| broker | info | bonus | open account |

|---|---|---|---|

| min deposit: $5 spread: from 0.2 pips leverage: 500:1 regulation: FSA (saint vincent and the grenadines), cysec | 50% deposit bonus, real contest 1st prize luxury car BMW X5 M, copy trading, trade&win. | Visit broker | |

| min deposit: $1 spread: from 0 pips leverage: 3000:1 regulation: cysec, IFSC | $100 no-deposit bonus, 100% deposit bonus | visit broker | |

| min deposit: $5 spread: from 0 pips leverage: 888:1 “*this leverage does not apply to all the entities of XM group.” regulation: ASIC, cysec, IFSC belize | “50% +20% deposit bonus up to $5,000, loyalty program bonus “*clients registered under the EU regulated entity of the group are not eligible for the bonus and the loyalty program” | visit broker |

| min deposit: $1 spread: from 0 pips leverage: 2000:1 regulation: FCA UK, cysec, FSP, bafin, CRFIN | 35% of the account deposit | visit broker | |

| min deposit: $100 spread: starting 0 pips leverage: up to 400:1 regulation: FCA UK, NFA, CFTC, ASIC, IIROC, FSA, CIMA | visit broker | |

| min deposit: $200 spread: starting 0 pips leverage: 500:1 regulation: ASIC australia, FCA UK | visit broker | ||

| min deposit: $200 spread: from 3 pips leverage: 400:1 regulation: NFA, FCA, cysec | visit broker | |

| min deposit: $100 spread: starting 0 pips leverage: up to 500:1 regulation: FCA UK, ASIC australia, MAS singapore | visit broker | ||

| min deposit: $1 spread: fixed spread from 3 pips leverage: up to 1:1000 regulation: CBR, cysec and FFMS | 30% forex deposit bonus | visit broker | |

| min deposit: $250 spread: as low as 0.1 pips leverage: up to 400:1 regulation: ASIC australia and FCA UK | visit broker |

What are the implications of forex trading with high leverage?

To illustrate the implications of forex trading with high leverage, let’s use a simplified example:

Let’s say that you have $1,000 to invest. After some careful analysis, you conclude that the great british pound is looking strong against the dollar and probably set to rise. Your $1,000 buys you approximately £765,

A short time later, your pounds gain in strength and you are able to buy back £1,050 for the same £765, netting you a cool $50 (not including commissions and such like). Welcome to the world of foreign currency exchange!

Now imagine, however, that some nice broker had loaned you $99,000 to go with your existing $1,000 to buy pounds. Instead of buying £765 worth of great british pounds, you were able to buy £76,500 worth of great british pounds. That means that instead of making just $50 profit, you would have made one hundred times that amount of profit, or $5,000! That’s a whopping 400% return on your comparatively small investment of just $1,000.

The flip side, of course, is that leverage amplifies both profits and losses.

Now imagine that when you traded your pounds back to dollars that the dollar had increased in value against the pound, meaning you only got $950 back instead of your original $1,000. Using $1,000 of your own money, you would have simply lost $50 equating to a 5% loss of your original capital. Using 100:1 leverage, however, your losses would have been magnified to $5,000 equating to a 500% loss of capital.

The pros and cons

- Leverage allows you to maximize your potential profits. As seen in the example above, leverage can maximize your returns. It could take months, or even years, to achieve similar returns using only your own capital, even if you took advantage of compounding and reinvested all your returns.

- Leverage can help grow small accounts fast. It could help you double or even treble your account size in a very short space of time as demonstrated in the example above with the 400% return on investment.

- Leverage increases your options. With only a small amount of capital investment opportunities can be limited. Using 100:1 leverage can increase your options and allow you to take positions you would otherwise not be able to take.

- Leverage can be risky. It is easy to forget just how much capital is actually at risk. One mistake a lot of new traders make, for example, is to think in terms of their stop loss as their total capital at risk. In a way it is. However, it is better to always think in terms of the total capital at risk in order to appreciate your full position size and keep perspective on both profits and losses.

- Leverage increases variance. Taking bigger positions means sometimes taking bigger losses, just as it sometimes means getting bigger wins. This variance will inevitably play out in your account balance.

- Leverage can go wrong very quickly. If you are highly leveraged and a position turns against you, it can go wrong rapidly and prove very expensive. This is why whenever you are using leverage it is important to always ensure that you have stop losses in place and appreciate your full position size.

Campforex.Com

Managed forex accounts $1000 minimum

Best forex leverage for $100, $500 or $1000 in the face of new regulation

The european securities & markets authority (ESMA) has passed a regulation which will restrict forex brokers from providing excessive leverage to traders. If this legislation is implemented, it will restrict maximum leverage that eurozone forex brokers can provide their clients to 30:1 (for major pairs like the EURUSD) and 20:1 (for minor pairs).

Since regulators proposed this legislation, I have been receiving emails from traders who want to know whether this is the end of forex trading in the eurozone.

Well, this is not the end of forex trading for those with small accounts.

However, if traders are to stay in the game in the event that maximum leverage is restricted to 30:1, they’ll need to first understand how the new legislation will affect their forex trading in the real world.

How to pick the best forex leverage for $100, $500 or any account size

The new legislation, if implemented, will be a double edge sword. On one hand, it will favor conservative traders who don’t like taking huge risks. On the other hand, it will restrict traders with a small account, even if they know how to trade.

In the midst of this uncertainty, it would be necessary to learn a few things as far as best forex leverage is concerned.

The simplest rules of leverage are as follows:

- Accept to trade with low leverage

- The use of trailing stops will help preserve your trading capital

- Limit the amount that you will be risking with reference to your trading capital. I cannot say your risk should be 2% or 5% of your trading capital. It depends with the percentage of risk that you are comfortable with.

A leverage of 50:1, 30:1 or 10:1 would be ideal if you are a conservative trader. In essence, the new legislation will not affect this group of traders.

Will it affect small forex accounts?

If regulators actually implement it, will this affect a trading account worth $100 or $500? The answer is yes. You will be able to trade less volume, and thus less returns if other factors are kept constant.

P.S: this news is most likely saddening to those who have a small account. If this sounds like you, I implore you to look into my trading course where I recently gave a tutorial of how to trade and make profits even with low leverage.

In this training, I teach my students the principles of successful trading in addition to what they must do in order to compound and grow their accounts faster.

Note: if you are a forex beginner, please watch the video below in order to understand what leverage is and how it affects you. If you have any questions, don’t hesitate to contact me.

Top 10 best high leverage forex brokers 2021

Top rated:

Are you looking for the best high leverage forex brokers because these days you are only finding forex brokers with very low leverage?

Are you an EU resident and would you like to find serious brokers with high leverage?

Do you want to know what are the top high leverage brokers specifically in the UK?

Some of the major forex brokers still offer the possibility of trading with high leverage.

But let’s see everything together.

Typically, high leverage forex brokers have the advantage of offering tempting conditions for the rookie trader. High leverage usually comes with no minimum deposit requirement or just a symbolic one, for instance.

Therefore, traders are attracted by the simplicity and easiness to access the interbank market, while ignoring the rule of thumb regarding the risk.

Higher leverage, by definition, means higher risk.

Are high leverage forex brokers riskier than other ones? The right answer is no.

All of them offer different types of trading accounts that suit every kind of trader. Swing traders and investors alike have access to quality execution, ECN accounts, and excellent trading conditions.

Even among the best forex brokers with high leverage, some trading accounts and conditions are incredible. Moreover, the high leverage refers to only specific types of trading accounts and doesn’t apply to all regions of the world.

As usual, we’ve put together the top ten brokers fitting this category, with all the things to consider like regulation, brokerage type, minimum deposit conditions or the markets offered for trading.

Higher leverage in a trading account is perceived as riskier due to the possibility of consuming all the funds if things go wrong. As beginners, traders who usually ignore money management techniques, are destined to face harsh market conditions sooner rather than later.

Therefore, pay close attention and try to consider all risks well and manage them as best you can, especially if you decide to use high leverage.

What is 1:100 leverage meaning?

One can venture into the world of forex trading with limited investment. Some forex brokers even let their clients open an account with a minimum deposit as low as $100. Whether you have limited capital or not, everyone wants to use a higher sum than their actual investment to make more profits. This is possible with leverage.

Leverage plays a vital role in forex trading and is offered by the broker. Let’s explore the term, its advantages, and its disadvantages.

What is leverage in forex trading?

Leverage can use a small amount of capital in traders’ accounts controlling a larger amount in the market. Leverage is the ratio of the trader’s funds to the size of the broker’s credit. Brokerage accounts allow the use of leverage through margin trading, or in other words, brokers provide the borrowed funds to traders to increase trading positions. The leverage ratio can amplify both profits as well as losses.

For a layman, leverage would be a small thing that can be used for bigger purposes. In forex trading, it is the ratio at which a small investment in your trading account controls a larger investment that is operating in the market. This difference in the two capitals is also known as the trading on margin in the stocks or forex market. There is an interest charged on this margin in the stocks market, but such is not the case in the forex market. Traders are not required to pay any interest on this margin irrespective of your credit type and account type. Your forex broker will offer a margin to you that you can use to trade.

You can read more details about what is leverage in forex in our article.

What is instrument leverage 1:100?

So, leverage we can describe as the ability to control a large amount of money using very little of your own. But, what is 1:100 leverage meaning?

In the foreign exchange markets, the leverage ratio is commonly as high as 1:100. Leverage 1:100 means that for every $1,000 in the trading account, traders can trade in the market up to $100,000 in value.

What are the benefits of trading using leverage?

Leverage is an important feature offered by forex brokers. It helps you trade with higher capital and make more profits. For example, consider operating with a 1:100 leverage . This is the most common leverage in forex. It means that with an investment of $1, you will be operating investment of $100 in the market. $1 is your money, and $99 is the borrowed money, your leverage. Since your operating amount is $100, you will be able to make more profits. This borrowed money will be sponsored by your broker and needs to be repaid.

Before leverage was introduced in the forex market, a 10 % movement in the account for a year was something to look forward to. Everything was slow, but leverage has changed it. Thus, the benefit of leverage is that it allows you to quickly invest more money in the market to fetch more profits.

How to calculate leverage and trading margin?

The main leverage formula is:

margin-based leverage ratio = total value of transaction / margin required

In this case, if the margin-based leverage expressed ratio is 1:100, then the margin required of total transaction value will be 1.00%. The margin requirement for 2% is 1:50 leverage.

Different leverages

The brokers fix leverage amounts at their discretion. Different brokers have different ratios to offer to their clients. Their terms and conditions also vary. The most popular ones are explained below:

- 50:1 – this leverage is on the lower side and means that you can use $50 to place a trade in the market for every dollar in your account. For example, if you have a deposit of $100 with a broker, you can trade with an amount that 50 times higher. In this case, $5000.

- 100:1 – as mentioned earlier, this is the most popular leverage in forex trading and is usually offered to standard lot account holders. You get to trade $100 for every dollar in your account. As the minimum deposit amount for a standard account is typical $2000, you can trade with an amount equivalent to $200,000.

- 200:1 – this leverage amount is offered to mini account holders with a typical minimum deposit of $500. With this leverage, you can trade 200 times the amount in your account. If you only have a minimum deposit, you can still control $100,000 in the market.

- 400:1 – this leverage is on a higher side. All the brokers do not offer this leverage. You can usually get this if you are holding a mini account. As the minimum deposit is around $500, you can control a sum of $200,000 in the market.

How to handle leverage professionally

High leverage amounts do not blind professional traders. They generally use 20:1 or 10:1 leverage and make several small trades. This safeguards their capital. If you want to take full advantage of leverage, do not invest all the amount in one trade. Move gradually and aim for consistent returns rather than a miraculous one-time deal. These professional tricks followed by veteran traders and investors will help you establish yourself as a forex trader.

The best option for traders is to have brokers that can offer various leverages. In that case, the trader can change the leverage ratio in the broker’s website dashboard.

Leverage is nothing but borrowed money. You can make more profits with it, but it can take an ugly turn as well. It only promises extra investment, not profit. Many aspects govern whether there will be gains or losses. Many traders, especially the new ones, aim for higher leverage, like fx trading 400 leverage, with the hope of making more profits. Higher leverage does not necessarily translate into higher profits. It can lead to equally high losses. We would suggest you aim for the leverage that you can easily manage and keep in mind that the chances of making losses are real. Instead of having an optimist approach, have a realist approach towards leverage and forex trading.

So, let's see, what we have: it isn’t economics or global finance that trip up first-time forex traders. Instead, a basic lack of knowledge on how to use leverage is at the root of trading losses. At best forex leverage for $100

Contents

- Top forex bonus list

- How much leverage is right for you in forex trades

- The risks of high leverage

- Example using maximum leverage

- Example using less leverage

- How to pick the right leverage level

- The bottom line

- Leverage 1:100 forex brokers

- Best forex brokers for united kingdom

- What is financial leverage?

- How does leverage work in forex?

- Is 1:100 leverage suitable for you?

- Advantages of 1:100 leverage in forex

- Risks of using 1:100 leverage

- What is 1:100 leverage meaning?

- Campforex.Com

- How to pick the best forex leverage for $100, $500 or any account size

- Will it affect small forex accounts?

- How to trade forex with $100 in just 5 minutes december, 2020

- Reliable steps to trade forex with $100 december, 2020

- Step 1: start to invest your money in XM trading

- Step 2: filling the personal details

- Step 3: investor information & trading account details

- Step 4: depositing $100 to trade

- Most important point after opening trading account with $100

- Battle procrastination:

- Keep practicing:

- Recognition:

- Investment

- Single currency pair

- Stay vigilant

- Keep a record

- Possibility vs. Probability

- Fxdailyreport.Com

- Trusted forex brokers with 100:1 leverage

- Campforex.Com

- How to pick the best forex leverage for $100, $500 or any account size

- Will it affect small forex accounts?

- Top 10 best high leverage forex brokers 2021

- What is 1:100 leverage meaning?

Comments

Post a Comment