5 ways to approach the Bitcoin trading process, bitcoin trading world.

Bitcoin trading world

This way you will ensure the start of your trading journey, thus, allow you to increase the rates of future success regarding the bitcoin trading journey.

Top forex bonus list

No. 2 – finding the best bitcoin trading platform

the following step that will lead you to reach your goals of success in the process of bitcoin trading, is finding the best-suited bitcoin trading platform. The modern world of tech advances is full of various chances to learn how to trade crypto with bitcoin future that promise to help you reach your goals of becoming a successful bitcoin trader, however, you should make sure that you are choosing the one that works the best for you and corresponds with your specific trading preferences. This is of great significance because different bitcoin trading platform offers different opportunities regarding the trading process, so have to make sure that you have made the right choice.

5 ways to approach the bitcoin trading process

Related

When dealing with the approach of the crypto trading world, the absolute most important thing that you have to take care of establishing the perfect foundation that will help you kick-start your trading journey in the right direction. This explains the attention that you have to put on the subject of finding the best way to start the trading journey so that you will get closer to reaching the points of success. All of this might sound like the obvious step you have to take, however, when you are dealing with such a new and interesting segment, you will have to start things from the very beginning.

Here, you will get a chance to deal with the basic notion of cryptocurrencies that represent all of the digital values and assets that can be exchanged through the internet. In this process, people can get a chance to trade, invest, purchase, and so much more, just by using these impressive digital values as a medium of making a profit. However, before you proceed with the segment of trading and making profits, you will have to find a designated cryptocurrency that will be the focal point of your trading journey. If you are interested in dealing with bitcoin and all of the additional opportunities that are incorporated in this popular digital value then you are in the right place.

In this article, you will find five simple ways that will help you in the process of bitcoin trading, so let’s get right into it.

No. 1 – building your prior knowledge

one of the most important things when it comes to dealing with the advances that the crypto trading world has to offer is to build your prior knowledge. Here, you will have to make sure that you are covering all of the most important segments that are crucial in the future trading process, meaning, you will have to complete thorough research regarding the most significant points that you have to look for when dealing with bitcoin trading opportunities.

This way you will ensure the start of your trading journey, thus, allow you to increase the rates of future success regarding the bitcoin trading journey.

No. 2 – finding the best bitcoin trading platform

the following step that will lead you to reach your goals of success in the process of bitcoin trading, is finding the best-suited bitcoin trading platform. The modern world of tech advances is full of various chances to learn how to trade crypto with bitcoin future that promise to help you reach your goals of becoming a successful bitcoin trader, however, you should make sure that you are choosing the one that works the best for you and corresponds with your specific trading preferences.

This is of great significance because different bitcoin trading platform offers different opportunities regarding the trading process, so have to make sure that you have made the right choice.

No. 3 – testing the bitcoin trading platform

this segment allows you to understand the importance of completing your own research regarding the platform you have chosen. With the implementation of this segment, you will get a chance to explore the variety of opportunities that the platform of choice has to offer, as well as see whether it is beginner-friendly if you are just now starting the bitcoin trading process.

Just by taking care of these things, you will get a chance to establish the perfect test that will allow you to determine whether the platform is useful, or you will have to change things up.

No. 4 – establish your bitcoin trading account

once you have completed the first portion of the bitcoin trading journey, you will get a chance to get closer to approaching the points of success if you decide to set up your trading account. You can easily achieve this just by filling out the registration form on the platform.

Provide all of the necessary information regarding this segment and be mindful of the security measures that you have to take. If you have completed everything so far, you are ready to place your initial trading investment that will allow you to access the live bitcoin trading portion.

No. 5 – take advantage of the bitcoin trading algorithm

the final segment that you have to cover in order to approach the bitcoin trading process is by exploring the benefits that the bitcoin trading algorithm has to offer. Here you will get a chance to establish a better understanding of the data and deposit that you put in your account and see how they will affect the trading opportunities that will follow.

But, before you go any further, make sure that you are carefully approaching the segment of bitcoin trading so that you can get the best trading deals.

5 easy steps for bitcoin trading for profit and beginners

Bitcoin trading can be extremely profitable for professionals or beginners. The market is new, highly fragmented with huge spreads. Arbitrage and margin trading are widely available. Therefore, many people can make money trading bitcoins.

Bitcoin’s history of bubbles and volatility has perhaps done more to bring in new users and investors than any other aspect of the crpytocurrency.

Each bitcoin bubble creates hype that puts bitcoin’s name in the news. The media attention causes more to become interested, and the price rises until the hype fades.

Each time bitcoin’s price rises, new investors and speculators want their share of profits. Because bitcoin is global and easy to send anywhere, trading bitcoin is simple.

Compared to other financial instruments, bitcoin trading has very little barrier to entry. If you already own bitcoins, you can start trading almost instantly. In many cases, verification isn’t even required in order to trade.

If you are interested in trading bitcoin then there are many online trading companies offering this product usually as a contract for difference or CFD.

Avatrade offers 20 to 1 leverage and good trading conditions on its bitcoin CFD trading program.

Why trade bitcoin?

Before we show you how to trade bitcoin, it’s important to understand why bitcoin trading is both exciting and unique.

Bitcoin is global

Bitcoin isn’t fiat currency, meaning its price isn’t directly related to the economy or policies of any single country. Throughout its history, bitcoin’s price has reacted to a wide range of events, from china’s devaluation of the yuan to greek capital controls.

General economic uncertainty and panic has driven some of bitcoin’s past price increases. Some claim, for example, that cyprus’s capital controls brought attention to bitcoin and caused the price to rise during the 2013 bubble.

Bitcoin trades 24/7

Unlike stock markets, there are no official bitcoin exchanges. Instead, there are hundreds of exchanges around the world that operate 24/7. Because there is no official bitcoin exchange, there is also no official bitcoin price. This can create arbitrage opportunities, but most of the time exchanges stay within the same general price range.

Bitcoin is volatile

Bitcoin is known for its rapid and frequent price movements. Looking at this daily chart from the coindesk BPI, it’s easy to spot multiple days with swings of 5% or more:

Bitcoin’s volatility creates exciting opportunities for traders who can reap quick benefits at anytime.

Find an exchange

As mentioned earlier, there is no official bitcoin exchange. Users have many choices and should consider the following factors when deciding on an exchange:

Regulation & trust – is the exchange trustworthy? Could the exchange run away with customer funds?

Location – if you must deposit fiat currency, and exchange that accepts payments from your country is required.

Fees - what percent of each trade is charged?

Liquidity – large traders will need a bitcoin exchange with high liquidity and good market depth.

Based on the factors above, the following exchanges dominate the bitcoin exchange market:

Bitfinex - bitfinex is the world’s #1 bitcoin exchange in terms of USD trading volume, with about 25,000 BTC traded per day. Customers can trade with no verification if cryptocurrency is used as the deposit method.

Bitstamp - bitstamp was founded in 2011 making it one of bitcoin’s oldest exchanges. It’s currently the world’s second largest exchange based on USD volume, with a little under 10,000 BTC traded per day.

Okcoin - bitcoin exchange based in china but trades in USD.

Coinbase -

Coinbase - coinbase exchange was the first regulated bitcoin exchange in the united states. With about 8,000 BTC traded daily, it’s the world’s 4 th largest exchange based on USD volume.

Kraken - kraken is the #1 exchange in terms of EUR trading volume at

6,000 BTC per day. It’s currently a top-15 exchange in terms of USD volume.

Bitcoin trading in china

Global bitcoin trading data shows that a very large percent of the global price trading volume comes from china. It’s important to understand that the chinese exchanges lead the market, while the exchanges above simply follow china’s lead.

The main reason china dominates bitcoin trading is because financial regulations in china are less strict than in other countries. Therefor, chinese exchanges can offer leverage, lending, and futures options that exchanges in other countries can’t. Additionally, chinese exchanges charge no fees so bots are free to trade back and forth to create volume.

If you’d like to learn more about bitcoin trading in china, this video from bitmain’s jihan wu provides additional insight.

How to trade bitcoin

Kraken will be used as an example for this guide. The process and basic principles remain the same across all exchanges.

First, create an account on kraken by clicking the black sign up box in the right corner:

You’ll have to confirm your account via email. Once your account is confirmed and you’ve logged in, you must verify your personal information. All bitcoin exchanges require varying levels of verification as required by AML and KYC laws. Below you can find the first three verification levels:

Once your account is verified, head over to the “funding” tab. You should see something similar to the screenshot below. Select your funding method from the left side:

Kraken offers many deposit methods, which are listed here:

EUR SEPA deposit (free) - EEA countries only

EUR bank wire deposit (€5) - EEA countries only

USD bank wire deposit (free until 3/1/2016, then $5 USD) - US only

USD SEPA and SWIFT deposit (0.19%, $20 minimum)

GBP SEPA and SWIFT deposit (0.19%, £10 minimum)

JPY bank deposit (free, ¥5,000 deposit minimum) - japan only

CAD interac deposit (free until 3/1/2016, then 1%, $10 CAD fee minimum, $5,000 CAD deposit maximum)

CAD EFT deposit (free until 3/1/2016, then 1%, $10 CAD fee minimum, $50 CAD fee maximum, $10,000 CAD deposit maximum)

Deposits made using the traditional banking system will take anywhere from one to three days. Bitcoin deposits require six confirmations, which is about one hour.

Now, navigate to the “trade” tab. Using the black bar at the top of the page, you can switch trading pairs. In this example we’ll use XBT/USD. We want to buy bitcoins, so let’s put in an order. Navigate to the “new order” tab.

Let’s say I’ve deposited $300 into my account with a USD bank wire. In the example below, I’ve submitted an order to buy 0.5 bitcoins (XBT) at a price of $370 per bitcoin.

Check the black bar at the top, and you’ll notice that the last trade price was $383.17.

Why submit an order to buy at $370 per bitcoin (XBT) and not $383.17? One may submit an order lower than the current price if one expects the price of bitcoin to fall. In this case, since my order is lower than other offers in the orderbook, I won’t receive my order for 0.5 bitcoin immediately. Placing an order at a specified price is called a _limit order._ before placing an order, be sure to check the orderbook for your trading pair.

In the example orderbook below, you can see that the highest buy offer is for $382.5 per bitcoin, while the lowest sell order is at $384.07 per bitcoin.

Using the order form there’s also an option for “market”.

A market order in this case would submit a buy order for XBT at the price of the lowest available sell order. Using the orderbook above, a market order for 0.5 XBT would purchase 0.5 XBT at $384.07 per XBT. If selling bitcoins, a market order would sell bitcoins for the highest available price based on the current buy orderbook—in this case $382.5.

Trading risks

Bitcoin trading is exciting because of bitcoin’s price movements, global nature, and 24/7 trading. It’s important, however, to understand the many risks that come with trading bitcoin.

Leaving money on an exchange

Perhaps one of the most famous events in bitcoin’s history is the collapse of mt. Gox. In bitcoin’s early days, gox was the largest bitcoin exchange and the easiest way to buy bitcoins. Customers from all over the world were happy to wire money to mt. Gox’s japanese bank account just to get their hands on some bitcoins.

Many users forgot one of the most important features of bitcoin—controlling your own money—and left more than 800,000 bitcoins in gox accounts. In february 2014, gox halted withdrawals and customers were unable to withdrawal their funds. The company’s CEO claimed that the majority of bitcoins were lost due to a bug in the bitcoin software. Customers still have not received any of their funds from gox accounts.

Gox’s catastrophic collapse highlights the risk that any trader takes by leaving money on an exchange. Using a regulated bitcoin exchange like kraken can decrease your risk.

Your capital is at risk

Remember that as with any type of trading, your capital is at risk. New traders should start trading with small amounts or trade on paper to practice. Beginners should also learn bitcoin trading strategies and understand market signals.

Bitcoin trading tools & resources

Cryptowatch & bitcoin wisdom – live price charts of all major bitcoin exchanges.

Bitcoin charts – more price charts to help you understand bitcoin’s price history.

Bitcoinmarkets – A bitcoin trading sub-reddit. New users can ask questions and receive guidance on trading techniques and strategy.

Tradingview – trading community and a great resource for trading charts and ideas.

Bitcoin trading - 800 pct SURGE as trades near sunday record of $34,800

Bitcoin traded at $33,365 in asia on monday, after soaring to a record high of $34,800 on sunday as investors continue to bet the digital currency is on its way to becoming a mainstream asset.

The latest milestone for the world`s most popular cryptocurrency came less than three weeks after it crossed $20,000 for the first time, on dec. 16, and bitcoin has now surged some 800% since mid-march.

See zee business live TV streaming below:

With bitcoin`s supply capped at 21 million, some see it as a hedge against the risk of inflation as governments and central banks turn on the stimulus taps in response to the COVID-19 pandemic. Some also view it as a safe-haven play during the COVID-19 pandemic, akin to gold.

"some of it is reflecting the fear of a weaker dollar," bank of singapore currency analyst moh siong sim said of the most recent rally.

"it seems like people are preferring bitcoin as an expression of concern over currency debasement, relative to gold."

Bitcoin`s advance also reflects increasing expectations it will become a mainstream payment method, with paypal opening its network to cryptocurrencies.

The potential for quick gains has also attracted demand from larger U.S. Investors, as well as from traders who normally stick to equities.

"the rally gained even more momentum as insatiable investors continued trading from home" during the new year holidays, said dave chapman, executive director at hong kong based digital asset company BC group.

Institutional investors see the potential for greater risk-adjusted returns compared to traditional investments, he said.

Bitcoin trades on numerous exchanges, one of the largest of which is coinbase, itself preparing to go public to become the first major U.S. Cryptocurrency exchange to list on wall street.

Multiple competitor cryptocurrencies use similar blockchain, or electronic ledger, technology. Ethereum, the second biggest, shot to a record $1,014 on sunday.

Bitcoin and crypto trading tips from poker world champion annie duke

It is critical for anyone who is trading crypto to have the best research and information at their fingertips. However, that is not enough. You also need to be disciplined and thoughtful when it comes to trading, especially when the stakes get raised or the market sees some volatility.

Few in the world are more skilled at this than world series of poker champion annie duke. Aside from holding one of the coveted gold bracelets given out to winners each year, she has also won the 2004 world series of poker tournament of champions and the national heads-up poker championship in 2010.

Duke is also a highly-sought after speaker and consultant in the field of risk management for investors. Over her two decades of experience in this field, she has created a framework that can help everyone from quantitative hedge funds to passive investors understand the risk that comes with investing in volatile industries such as crypto and make tactical decisions without losing their long-term perspective. She also shares some great tips for deciding when you should press a position or strategically close it.

Forbes: welcome annie. Most people know you as being one of the most famous poker champions of all time. However, many are unaware of your prestigious academic background or years of experience as an advisor to some of the most successful investors in the world. Could you please share with us how you got into this industry?

Annie duke: I started off my adult life at the university of pennsylvania, doing five years of ph.D. Work in cognitive science. The only reason I didn't end up becoming a professor is because I got sick, right at the end of that. I needed to take a year off from school, and it was during that year off that I started playing poker. I fell in love with the game and did that pretty exclusively for about eight years. But then in 2002, I got asked by a hedge fund to speak to their traders about how poker might inform the way that they think about risk. I had been thinking about this connection implicitly, but this was the first time that I thought explicitly about the connection between cognitive science, behavioral psychology, behavioral economics and poker, which is a very real world, fast-paced, high stakes instantiation of the problems that these disciplines are trying to tackle. I ended up getting referred out from that original engagement in 2002 and started to give lots of talks, began consulting, and wrote several books on poker, behavioral economics and decision making. Ultimately in 2012, I rolled out of poker and made the consultant work much more full time and continued writing. Today, I’m back at penn doing research, so I’ve kind of come full circle back into academics.

Forbes: how accurately do you think people assess their investing prowess? What are some of the biggest mental traps you’ve seen in the course of your career and research?

Duke: many people do not assess themselves accurately, and when you look at most of the main cognitive biases, they mostly fall into the overoptimism category. As soon as you get into something that people feel like they know how to do and obviously, that would be true for investors, most people become overconfident. There’s something called a better than average effect. For example, if you ask people how good of a driver do they think they are in comparison to the population, something like 90% of people put themselves in the top half. It is the same thing with investors, most of whom are going to rate themselves more highly than they should. You also get the illusion where people think they have more control over their outcomes than they do.

The problem in both investing and poker is that there's a lot of uncertainty. The world is stochastic, that's one problem—that there's luck. And the other is that there's hidden information. Information can also reveal itself after the fact, too. Sometimes there's information that never reveals itself. That allows an untethering of the results from the actual skill that went into the decision. The point is that I can win, even though I do everything wrong. And I can lose, even though I do everything right. This creates a really huge problem, at least in the short run. It can become especially dangerous when we ascribe our good fortune entirely to skill, without accounting for luck.

Forbes: what are some of the best practices you recommend so that investors can structure the decision making process in a way that is regimented? Can you share anything that is particularly relevant for investors in crypto, which can be especially volatile?

Duke: that's really such a great question. Essentially, you want to do the advance work. Say I've got someone who is interested in bitcoin. When I'm making that investment, I want to understand why I think the investment is good and actually make that explicit. When it comes to something like investing in something that's highly volatile, such as crypto, this becomes really, really important. You need to be able to separate out what was due to luck and the assumptions that you went in with so you can circle back to them later. You also need to take a second step, which is to determine the conditions under which you would sell. Meaning, what would need to happen to tell you that your assumptions were wrong or this is no longer a good investment.

Forbes: turning more directly to crypto, regardless of the models we build and metrics we use there will always be a degree of uncertainty. As much as we try, it is impossible to know everything. What is your advice for finding ways to feel comfortable in that position?

Duke: right now we know less about crypto than something like tech stocks. But just to be clear, we also know less about tech stocks than we think we do. That’s the first thing you need to understand. The second thing you need to realize is that the higher degree of uncertainty, the less likely it is that your model is going to be perfectly accurate.

Under those circumstances you need to think about mitigating downside outcomes. This is critical because when you have less accuracy in your prediction models there is a higher probability of receiving an unpleasant outcome. This first way is to make sure you have a really good quitting strategy. So what do I mean by that? The higher the uncertainty, the more you should value liquidity. Stop-losses are another valuable tool.

On the flip side, you might want to change your mind in both directions, meaning under different circumstances you could want to press your position. Another useful strategy is spreading your bets, so that you’re mitigating the chance that you are wrong about any single investment.

Forbes: as a way of grounding this discussion for the readers, can you walk us through the process of setting up and testing an investment assumption regarding crypto?

Duke: sure. There are things happening at the fed regarding interest rates that could cause you to change what you want to do. If I’m buying bitcoin as a hedge against inflation, what I need to make explicit is that I believe inflation is imminent. What that does is make you look to see if inflation is actually on the near-term horizon or within the time period that I'm saying it would have to occur. Additionally, once I make this assumption explicit, I can also ask, what would have to be occurring in the world in the future that would make me want to change that assumption? Putting it all together, if you believe that inflation is going to rise in the next eight years to a level making it worthwhile to invest in bitcoin as a hedge, then you should also ask yourself what are the signals that could make me change my mind and not think that inflation was imminent or occur at a high enough level to justify investing in bitcoin for that reason alone?

By challenging your assumptions, it makes you look for signs in the future. And if bitcoin goes through the roof and inflation stays low, it stops you from taking credit for it. You should want to do it because it means that bitcoin won for a different reason than you thought it would.

Forbes: since the pandemic hit there has been an explosion of online trading in the retail sector, which can be very addictive. While it is important to stay aware of what is happening in the market, everyone must find a balance so they do not become overwhelmed and make emotional trading decisions that could prove to be erroneous. Do you have any suggestions for the readers?

Duke: the best investors actually are reducing the attention they're paying in the short run, and the reason is that the way we make decisions is quite past-dependent. So when you’re ticker watching, which is what you would call checking the price all the time, you’re going to feel those momentary ups and downs. They’re going to distort decisions you make in quite a bad way. In poker we call this a tilt. Now, obviously, in poker, you cannot not see your chips go down. But in investing, you can because you can just not check it. This is important because we know that there's going to be natural variances, and people tend to make better decisions when they aren’t checking it every single day. A better plan would be to decide what you will do if certain things happen in the world, such as a development at the fed or reaching an up or down price barrier. If those things are not happening, do not even look at the price. Because it’s going to screw your decision making up, there’s nothing good that will come from it. I promise you.

Forbes: any final thoughts for the readers?

Duke: I would say just generally, sort of back to the beginning of the conversation, it’s really easy to fool ourselves into thinking that we know something more than we do. You should also be actively seeking information that proves you are wrong. It is easy to find people who agree with investing in bitcoin as a hedge against future inflation. What you should be doing is finding the smartest people you can find who say that’s not true. That doesn’t mean that investing in crypto isn’t a good idea, even if an assumption isn’t true. But you should want to find that out because that’s what's going to help you be a better decision maker. The more that you're approaching your ideas about investment decisions from the standpoint of asking why this is wrong, the better off you're going to be.

Bitcoin trading - 800 pct SURGE as trades near sunday record of $34,800

Bitcoin traded at $33,365 in asia on monday, after soaring to a record high of $34,800 on sunday as investors continue to bet the digital currency is on its way to becoming a mainstream asset.

The latest milestone for the world`s most popular cryptocurrency came less than three weeks after it crossed $20,000 for the first time, on dec. 16, and bitcoin has now surged some 800% since mid-march.

See zee business live TV streaming below:

With bitcoin`s supply capped at 21 million, some see it as a hedge against the risk of inflation as governments and central banks turn on the stimulus taps in response to the COVID-19 pandemic. Some also view it as a safe-haven play during the COVID-19 pandemic, akin to gold.

"some of it is reflecting the fear of a weaker dollar," bank of singapore currency analyst moh siong sim said of the most recent rally.

"it seems like people are preferring bitcoin as an expression of concern over currency debasement, relative to gold."

Bitcoin`s advance also reflects increasing expectations it will become a mainstream payment method, with paypal opening its network to cryptocurrencies.

The potential for quick gains has also attracted demand from larger U.S. Investors, as well as from traders who normally stick to equities.

"the rally gained even more momentum as insatiable investors continued trading from home" during the new year holidays, said dave chapman, executive director at hong kong based digital asset company BC group.

Institutional investors see the potential for greater risk-adjusted returns compared to traditional investments, he said.

Bitcoin trades on numerous exchanges, one of the largest of which is coinbase, itself preparing to go public to become the first major U.S. Cryptocurrency exchange to list on wall street.

Multiple competitor cryptocurrencies use similar blockchain, or electronic ledger, technology. Ethereum, the second biggest, shot to a record $1,014 on sunday.

Bitcoin trading for short-term profit

Share via:

Financial trading is a fantasy career for thousands of people around the world. The dream of financial independence. The challenge to outsmart the market. But are the odds of success any better with cryptocurrency compared to traditional financial trading with shares, precious metals, or forex? Let’s explore.

This guide will help you navigate the exciting yet risky opportunity of trading cryptocurrency.

Written by a crypto insider with 5-years experience trading crypto plus 12-years trading stocks and options, you’ll discover key principles and hard earned lessons to help you approach trading with the right mindset.

Our goal is to give you a sensible perspective about crypto trading that most traders only learn after months… or even years of trial, error and loss.

First things first: trading is not a consistent, or even reliable way to make money. In fact, the general statistics for all financial traders is that ‘most traders end up losing money’ — despite what trading platform advertisers would lead you to believe.

Ok. Here comes the disclaimer. This guide does not provide any financial advice. Trading is entirely at your own risk. This guide is provided for educational purposes only. We hope it helps you manage the risks and make better choices if you do decide to trade cryptocurrency.

3 keys to bitcoin trading

Crypto trading means buying and selling digital assets (tokens, coins, ‘cryptos’) such as those you’ll find listed on our cryptocurrency prices page.

Different to ‘investing’, a traders mentality is shorter-term. Aiming to ‘get in and get out’ with a profit rather than waiting for the long-term that investors typically aim for.

Since most people lose money trading, how do the minority actually end up turning a profit?

There are 3 keys to trading:

- Fundamental analysis considers the ‘fundamentals’ of a company or project, including its product vision, its existing customer base, quality of the team, partnerships, current revenue, etc.

- Technical analysis focuses on the price chart using various indicators to make future price predictions based on historical price patterns. This is the main focus of most trading.

- Psychological game is about developing the right patience, discipline and trading methods to reduce risk. This is the most important element of trading strategy.

In this guide, the first in a new series on crypto trading, we’ll focus on the psychological game with a big perspective on the market, some tips on fundamental analysis, and a quick intro to ‘technicals’.

The essential questions of trading reduce to this:

- What to buy?

- How much to buy?

- When to buy?

- When to sell?

Coins go up and down in value based on market perception about their value. That perception is a mixture of traders looking at the patterns of the price chart (technical analysis) and other market participants watching the news for project updates (fundamental analysis).

Successful projects (or at least those with the best marketing) will see greater interest in their tokens, leading to buyers paying a higher price for coins, which pushes the value of the token higher.

Choosing what to buy and when depends on a great deal of research, and some might say ‘lucky timing’ based on the cycle of the market.

The boom/bust market cycle

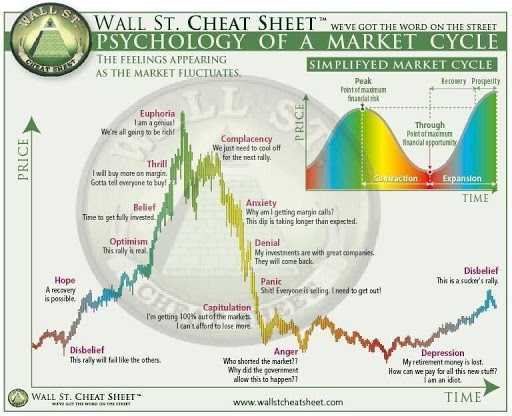

One of the most popular ideas in the crypto space is the ‘boom and bust’ market cycle, described by the ‘wall street cheat sheet’ as shown:

The idea presented here is that markets repeat somewhat predictable trends:

- Bull trend (prices going up and up where hope turns to optimism which becomes belief and then thrill and finally euphoria as prices reach astronomic levels…) leading to the start of a major…

- Bear trend (where prices begin to drop and investors are complacent to sell as they think the upwards movement will continue, but then anxiety sets in as prices continue to decline, leading to denial, then panic, anger and depression)… which finally results in the start of new hope as the next bull cycle begins.

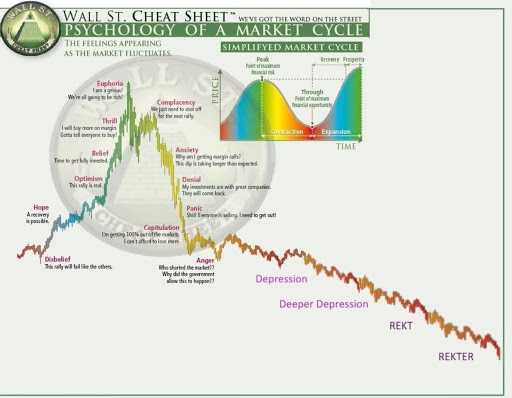

- Memes have been created out of this concept, with this one particularly amusing…. Or painful…

REKT signifies being ‘wrecked’, like a ship wreck.

A full market cycle from boom to bust can take many months or even years.

The top of the previous boom for cryptocurrency was january 2018 when bitcoin reached a price of $17.000.

The bottom of the bust was december 2018 with a low bitcoin price of around $2.700.

Visit our bitcoin price page to see the current price chart for BTC.

Since then, the phase of ‘disbelief’ gradually turned back towards ‘hope’ as a new possible boom cycle began.

What is usually not understood is that this pattern is essentially a fractal, which means it repeats across all time-frames. Tiny boom bust cycles within medium boom bust cycles within big boom bust cycles.

They don’t always show the exact same pattern, but the principle is there to be seen.

This allows the discerning trader to spot cycles at different time frames (hourly, daily, weekly, monthly) and then take advantage at the right moment by timing entry and exit positions accordingly…

The danger however, is getting drawn into the day to day, hour to hour, even minute to minute volatility of the markets, leading newbie traders to ‘over trade’ based on the heat of the moment…

Avoid emotional trading

Learning technical and fundamental analysis certainly takes some time. But it’s not the most difficult part of trading. The toughest job that traders have is managing their own emotion and being disciplined enough to follow their own chosen strategy.

All traders struggle with emotional trading. The temptation to trade is almost overwhelming. We can see so much profit potential. Coins jumping 5% here, 8% there. Then dropping back down again. If only we could capture those frequent % moves!

Unfortunately, this is a good way of losing money rapidly due to mis-timing the market.

Analysing trades requires a ton of discipline. Most people see some hype about a particular stock or a crypto coin, they see the price is already starting to shoot up and they don’t want to get left behind, so they buy too much at once (often called FOMO: fear of missing out).. And then … yes, the market cycle reverses and prices start to tumble… and the person either sweats with anxiety until their hopeful position recovers and enters profit again, or they sell for a loss.

This is emotion-based trading. It is common. It is not a good strategy.

Key to successful trading is to remove the natural emotion of hope, greed, panic, guilt and excitement. Traders are not meant to be gamblers. They are meant to be strategic, objective, rational planners.

Why most investor accounts lose money

In the traditional financial world over many decades, one difficult truth is well known by insiders: most retail investor accounts lose money. Retail investors is what the industry calls non-professional investors.

Most trading platforms would of course not mention that, unless required to do so due to legal compliance. Often it’s in the small print.

Amateur traders are introduced to complex financial instruments such as spread betting or cfds (contracts for difference).

Important side note: some modern banking apps offer cryptocurrency in the form of cfds which is actually not genuine cryptocurrency. It is more like a claim on cryptocurrency. At kriptomat, you receive the genuine crypto, held on a wallet that you control.

In the modern area of bitcoin or crypto trading, while big winners are often visible on social media, we expect that most people attempting to trade bitcoin on a day to day basis will experience the same risk of losing money.

The markets are designed to take money away from the amateurs and hand it over to professional traders. Remember, if you attempt to day trade (buying and selling in the heat of the moment based on real-time price fluctuations), you may have a high risk of losing based on historical performance of amateur day traders.

Gradually accumulating bitcoin and a diversified portfolio of cryptocurrency has a higher statistical chance of ‘beating the market’ over time.

Pump and dump schemes

Unfortunately, unscrupulous individuals or groups attempt to take advantage of the excitement and greed of trading by rallying buyers to invest in a particular crypto which does not have very much trading volume.

This causes a surge in the tokens price, at which point the scammers will sell their own tokens raking in lots of profit, while the other investors are then left holding coins they bought at a high price, while watching the price tumble back down, based on lack of genuine market interest.

This is known as a ‘pump and dump scheme’.

To avoid these schemes, consider the trading volume of the coins you are interested to invest or trade, and avoid the temptation of FOMO. That fear of missing out indicates when investors buy because they see the price running higher and higher and don’t want to ‘miss out’ on the hot opportunity.

Technical analysis — an easy way to start

In future guides we’ll explore the intricate details of technical analysis. To get started, a good approach that new traders can make use of is to look for market correlations by comparing price charts for different coins.

For example, check to see if the coin you want to trade is positively or negatively correlated with bitcoin. That is, if it tends to move in a similar direction as bitcoin or not, on the time-frame that you want to trade at.

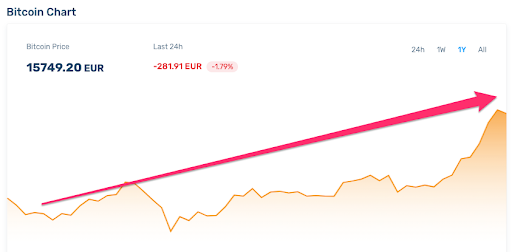

Here’s the price chart for bitcoin (BTC) showing 1 year worth of data:

Here’s the price chart for propy (PRO) showing 1 year of data.

As you can see, the price of propy has been volatile over the past year, but at the time of writing, the price is near enough at the same level that it was a full year ago. From that perspective, holding bitcoin during the same period of time would have been much more profitable. Unless you bought at the low point and benefited from that sudden spike upwards (as indicated by the green arrow).

This type of analysis may help you decide whether to keep more of your portfolio in BTC vs other coins, which may either be gaining value compared to bitcoin or losing value compared to bitcoin.

Having a diversified portfolio is both sensible, and typically shows the best performance in the long run.

Fundamental analysis

To help you explore the details of each coin project, we are working with researchers, market analysts, and representatives from crypto projects, to develop resource guides for each coin that kriptomat makes available on our exchange.

Visit the cryptocurrency prices page and click on any coin to explore each project’s fundamentals.

Continue learning

Kriptomat account owners will have access to regular trading tips and analysis. Register for a kriptomat account and you’ll be notified when new trading information becomes available.

Bitcoin trading FAQ

Is trading in bitcoin safe?

Like any type of financial trading, bitcoin trading carries risk of loss. We advise caution. Becoming a successful trader requires education and discipline. Checking the price charts often enough to make accurate buying and selling decisions does not suit everyone’s personality or lifestyle. If you want to trade bitcoin, you may decide to fund a trading account or bitcoin wallet with a comfortable amount of money, and then ‘giving it a go’. Perhaps that amount for you is €50 or €500 or more. Kriptomat makes buying and selling easy, and secure. But if you time the market incorrectly by buying at a high point, the price of bitcoin may reduce suddenly, leaving you at a temporary loss. Check out the guide above for key principles that will help you begin trading bitcoin.

Can you get rich by trading bitcoin?

Many hundreds, if not thousands of people are ‘getting rich’ by trading bitcoin. So too are many people losing money due to price volatility and emotional trading decisions. In the guide above we take time to explain why short-term day trading may be best avoided, with a long-term approach to accumulating bitcoin as the safest and most profitable approach. This is something each individual will have to decide.

What is the best bitcoin trader?

We suggest that the ‘best’ bitcoin trader is one who takes a long term strategic view on accumulating a healthy cryptocurrency balance. This depends on each individuals choice. You may want to take short-term trading opportunities such as buying when prices suddenly drop due to bad news and then begin to recover. Or when prices spike high with the expectation they will fall down again to capture the gains you have made. Bottom line: trading bitcoin is risky and potentially life changing.

Bitcoin’s wild weekends turn efficient market theory inside out

- It’s on saturdays and sundays, when most other assets barely budge, that bitcoin tends to go particularly nuts

- Bitcoin surged about 40% over the seven days through friday

Bitcoin just notched one of its best weeks on record, surging about 40% over the seven days through friday. Anyone expecting the notoriously volatile digital currency to take a breather this weekend had better buckle up.

It’s on saturdays and sundays, when most other assets barely budge, that bitcoin tends to go particularly nuts. Take the first weekend of 2021. Coming off a 300% gain last year, the world’s largest digital coin rose as much as 14% jan. 2 and another 10% jan. 3, a period when most of wall street was still in holiday mode. The swings were bigger than on any weekday in the prior two weeks and the biggest intraday moves since the weekend before, when it jumped 10% on dec. 26, according to bloomberg data.

IT department rejects requests for further extension of tax return filing due date

California virus deaths top 30,000 after deadliest weekend

Guterres to run for second term as UN chief: official

Saudi arabia aims to raise over $5 billion in bond-market return

Bitcoin’s not alone in trading all day, every day. What sets the coin apart is how big its price swings are outside of established business hours. It’s tough to find pricing for the dollar, for example, with currency-market participants usually in agreement to take weekends off. Bitcoin’s average swing on saturdays and sundays during the fourth quarter, on the other hand, was 1.5%.

The cryptocurrency’s weekend volatility spikes owe to a couple of factors. One is that it’s held by relatively few people -- about 2% of accounts control 95% of all available bitcoin supply. If these whales trade when volumes are thin, price swings will be magnified. Another is its market structure, which consists of hundreds of disconnected exchanges that in effect are their own islands of liquidity.

“people always tout bitcoin as 24/7, 365 liquidity, but what that actually means is you have periods of very thin liquidity," said nic carter, a partner at crypto-focused venture firm castle island ventures. “if you want to deploy $500 million of bitcoin, you probably want to do it during core banking hours."

The crypto market is relatively nascent. Bitcoin, the original crypto, brought forth the movement a little more than 10 years ago. According to greg bunn, chief strategy officer at digital-asset firm crosstower, the market remains hugely fragmented from an infrastructure standpoint.

Many platforms operate under different standards and with “different philosophies," said bunn, who spent decades with firms including citadel and deutsche bank. Yet it lacks a centralized market structure akin to that of traditional assets, which tend to have common means of custody and settlement, for instance.

“if you think about the structure, that makes it conducive to things that are going to be very volatile and where you’re going to have big moves," he said. “that’s obviously going to be impacted by when people are trading, when people are awake, when people are watching the markets."

To binance.US’s catherine coley, bitcoin’s wild weekend patterns are reminiscent of her time trading currencies in hong kong in the early 2010s. Volatility sometimes became subdued during lunchtime lulls and around holidays. Professional traders, she says, tend to keep monday-through-friday schedules, so it makes sense that liquidity -- or how easily an asset can be traded -- would wane on weekends.

What’s seen as liquidity requires a steady supply of both buyers and sellers -- an ease in freeing up the value of one asset for another. If there are fewer buyers than sellers -- or vice versa -- then that makes transactions harder, a situation that usually leads to either a spike or crash in prices. Last weekend, bitcoin’s price was “absolutely ripping on low liquidity," said coley, who is binance.US’s chief executive officer. “in these periods of illiquid times, you’re going to be getting pricing that is a little bit cushioned."

That could mean someone with a large sell order can’t as easily unload a position over weekend trading. “to some extent, it’s going to be more difficult for them to offload the risk that they’ve got," she said. “so that’s where you see these weekend moves of dramatic price spiking."

No one knows for sure and theories explaining bitcoin’s weekend action abound. Bitwise asset management’s teddy fusaro says it’s also possible liquidity providers and market-makers are lightly staffed on weekends, which can lead to volatility.

“it’s a feature of the market that has always been there and we expect that it will be a feature of the market that remains into the future," fusaro, the company’s chief operating officer, said. “efficient market hypothesis people would assume that the market should price in the idea that there could be less liquidity on the weekends."

Mati greenspan, founder of quantum economics, says that while institutional players have been in the spotlight recently, retail investors could be re-entering the space again, as well. They played a big role in bitcoin’s notorious 2017 run-up -- and many got burned when it crashed the following year.

Bitcoin trading volume has increased, hitting a record recently, with about $80 billion changing hands on a weekly basis, according to data from researcher messari.

“we’re breaking through barriers at breakneck speeds," said greenspan. “this entire move from $10,000 to $40,000, this is mind-blowing and I’m saying this as someone who witnessed 2013 and 2017 -- it’s just much bigger."

This story has been published from a wire agency feed without modifications to the text. Only the headline has been changed.

Beware this ‘celebrity’ bitcoin scam

Losses of up to £200,000 are being reported by victims of a sophisticated global investment fraud

Share this page

Criminals are exploiting trusted global websites to post fake celebrity endorsements for cryptocurrency, in one of the most prolific internet scams which? Has seen.

Victims of a prolific bitcoin scam are reporting individual losses of up to £200,000 after following links on AOL, MSN, yahoo and facebook.

Which? Has spoken to dozens of people who’ve encountered the scam – which falsely claims celebrities have backed a bitcoin investment scheme – while browsing legitimate sites.

In many cases, the fake advertorials are convincingly designed to look like pages from the BBC or mirror websites.

Read on to find out how the scam works, how to avoid falling for it, and why which? Is calling time on legitimate sites hosting dodgy links.

Celebrity ‘endorsements’ used to ensnare investors

Celebrities used in these fake advertorials include deborah meaden and peter jones from dragon’s den, ant mcpartlin of presenting duo ant and dec, billionaire businessmen lord sugar, sir philip green and sir james dyson, presenters simon cowell and holly willoughby, and former love island contestant charlie brake.

To be clear, none of these celebrities are responsible for the fraud, but their images and reputations are being ruthlessly abused by organised scammers.

We’ve found countless variations of the scam still live at least three years after it first surfaced, but most of them proceed in a similar way.

How the scam unfolds

Imagine you’re browsing AOL.Co.Uk. On the sidebar you spot a picture of dragons’ den star deborah meaden, with a black eye.

There’s nothing obvious to suggest it’s an advert – it looks like an image from a legitimate news story.

Clicking on it takes you to a news story on a third-party page, which seems like a respectable news site for investors. It describes how meaden and her fellow dragons were impressed with a bitcoin investment scheme on an episode of the show.

The strange photo of meaden’s black eye is forgotten as you read how the dragons chose to invest and reaped the financial rewards. At the bottom of the page is a web form where you can express interest in joining the investment scheme.

Heeding the warnings that the scheme will soon close to new investors, you submit your name, email address and phone number.

The buy-in

A short while later, you receive a phone call from your ‘investment manager’. She or he encourages you to make a surprisingly modest initial investment to purchase £250 worth of bitcoin.

By email you receive a link and login details to the ‘trading platform’ where your bitcoins are being held. Over the coming weeks the value of your bitcoin holdings appears to increase, and your investment manager calls you frequently, encouraging you to buy more.

When you refuse to pay anything further and mention that you’re thinking of cashing out, your investment manager releases £40 to your bank account so you can ‘enjoy the profits’. Reassured, you carry on investing.

Months later, you’ve sunk £5,000 into the scheme – although your bitcoins are valued at £50,000 on the trading platform.

Now you decide it’s time to enjoy your returns, so your manager directs you to deposit their commission – a further £5,000 – into a bank account and await a phone call releasing your funds.

This was the appalling experience of one which? Reader, who has asked to remain anonymous.

The scale of the problem

We’ve obtained exclusive data from police fraud reporting centre action fraud, which shows the huge scale of the problem.

There were 1,560 cases of cryptocurrency investment frauds reported in the first six months of 2019 alone. In the same period, there were 212 reports of investment fraud where celebrity endorsement was specifically cited by the victim as an enabler of the scam.

Action fraud is a self-reporting tool now no longer used in scotland, so it’s likely that these alarming figures are in fact underrepresenting the scale of the problem.

What is bitcoin?

Bitcoin is a cryptocurrency – a form of digital money which can be bought with other currencies, traded for them and (where retailers accept it) used to buy goods and services. Cryptocurrencies such as bitcoin run on a technology called blockchain – essentially a huge online database of transactions.

Blockchain’s great strength is that it’s considered unhackable. This is because rather than transactions being recorded on a traditional centralised database which someone could manipulate, they’re recorded and updated in many locations simultaneously.

Bitcoin is far from the only cryptocurrency to be targeted by scammers. In july 2018, we explored the sometimes murky world of ‘initial coin offerings’. Unlike bitcoin, which has achieved some respectability and is accepted by some retailers, there is no guarantee that investors will be able to spend these newly established cryptocurrencies anywhere.

How to stay safe

This scam proceeds along classic psychological principles – appealing to authority (using celebrities and trusted sites), starting out with small demands (£250) before gradually escalating and releasing a nominal sum to trick you into thinking you can get the rest.

All the traditional investment advice applies. Be extremely sceptical of grandiose claims, and seek advice from a financial adviser registered by the financial conduct authority if you’re not sure about something.

Novice investors should consider traditional investments first and aim to build wealth gradually through a diversified portfolio.

The websites respond

We’re extremely concerned to hear reports of legitimate websites serving up scam adverts – some of them in recent weeks – and we put our allegations to them.

A facebook spokesperson said: ‘we don’t tolerate fraud on our platform, which is why we’re taking action to stop scams wherever they appear. We have donated £3m to citizens advice to deliver a new UK scam action programme, and we have created a new scam ads reporting tool on facebook in the UK, supported by a dedicated internal operations team.

‘if people see something on facebook they think is a scam, we urge them to report it by clicking on the top right of any ad they see.’

A microsoft spokesperson explained that ‘the issue of “ad cloaking” is a challenge across the online advertising industry’ and that microsoft is ‘working…to address the techniques scammers use and detect, block and remove advertisements more effectively.

In the meantime, we urge customers to remain vigilant and only engage with brands they trust and recognise.’

A spokesperson for verizon media, the parent company of AOL and yahoo, told us: ‘deceptive and misleading ads are not acceptable, and we expect our partners to comply with all laws, regulations and our policies.

‘we will take action to block ads in violation of our policies, as well as bad actors who work to circumvent our human and automated controls.

‘we have a new, simplified adfeedback reporting tool for our users to identify anything they believe to be “misleading or a scam” through a simple thumbs up, thumbs-down icon on ads served through our platforms that is rolling out now. Our teams will remove any ads identified and confirmed as such.’

- The full investigation appeared in the december issue of which? Money magazine. You can try which? Money today for just £1 to have our impartial, jargon-free insight delivered to your door every month.

Bitcoin trading world

Your guide to the world of an open financial system. Get started with the easiest and most secure platform to buy and trade cryptocurrency.

Cheaper GBP deposits HOT

50% off for GBP deposits with the UK-issued cards

Deposit now

Margin trading

Trade with leverage as high as 100x

Trade now

CEX.IO staking

Earn by simply holding coins on CEX.IO

Learn more

Buy crypto with a card

Own crypto in minutes using your card

Buy now

Among the numerous websites providing bitcoin exchange services, the positive reputation of CEX.IO makes it worth the trust of the users all over the world. With the customer base of over 3,000,000, the platform can be recognized as the one that can be relied on. Starting your bitcoin trading on a platform with substantial history, you will benefit from a deep understanding of the market and customersвђ™ needs. We are constantly working on enhancing the security, ensuring the high level of customer support, and providing our users with new opportunities for trading on the bitcoin market. CEX.IO is regularly considering the addition of new coins, which was not so long the case with dash, zcash, and bitcoin cash. Still, every cryptocurrency has to pass a thorough check to be listed. Our due diligence and concerns about the quality of the service yield results. Now, we are moving forward to achieve the status of the best cryptocurrency exchange.

Best cryptocurrency exchange: what does it mean for us?

For you to be able to recognize a reliable online exchange and sort out those that appear to be too weak, we list several features, paying attention to which would help you to make the right choice. 1. Service safety and security. It is critical to ensure that your data will not be leaked to any other parties. Thus, the availability of certificates, like the PCI DSS, serves as the proof of serviceвђ™s safety. Besides, the regulation of exchanges is also important. For example, CEX.IO.

- Is officially registered in the UK;

- Has a money services business status in fincen;

- Complies with the legal requirements of the countries where it functions.

So, let's see, what we have: when dealing with the approach of the crypto trading world, the absolute most important thing that you have to take care of establishing the perfect foundation that will help you kick-start your trading journey in the right direction. This explains the attention that you have to put on the subject of finding the best way […] at bitcoin trading world

Contents

- Top forex bonus list

- 5 ways to approach the bitcoin trading process

- Related

- 5 easy steps for bitcoin trading for profit and beginners

- Why trade bitcoin?

- Find an exchange

- How to trade bitcoin

- Trading risks

- Bitcoin trading tools & resources

- Bitcoin trading - 800 pct SURGE as trades near sunday record of $34,800

- Bitcoin and crypto trading tips from poker world champion annie duke

- Bitcoin trading - 800 pct SURGE as trades near sunday record of $34,800

- Bitcoin trading for short-term profit

- 3 keys to bitcoin trading

- The boom/bust market cycle

- Avoid emotional trading

- Why most investor accounts lose money

- Pump and dump schemes

- Technical analysis — an easy way to start

- Fundamental analysis

- Continue learning

- Bitcoin trading FAQ

- Bitcoin’s wild weekends turn efficient market theory inside out

- IT department rejects requests for further extension of tax return filing due date

- California virus deaths top 30,000 after deadliest weekend

- Guterres to run for second term as UN chief: official

- Saudi arabia aims to raise over $5 billion in bond-market return

- Beware this ‘celebrity’ bitcoin scam

- Losses of up to £200,000 are being reported by victims of a sophisticated global investment fraud

- Share this page

- Criminals are exploiting trusted global websites to post fake celebrity endorsements for...

- Celebrity ‘endorsements’ used to ensnare investors

- How the scam unfolds

- The buy-in

- The scale of the problem

- What is bitcoin?

- How to stay safe

- The websites respond

- Bitcoin trading world

- Cheaper GBP deposits HOT

- Margin trading

- CEX.IO staking

- Buy crypto with a card

- Best cryptocurrency exchange: what does it mean for us?

Comments

Post a Comment