Online trading free money

Online trading free money

‘knowledge is power’ (francis bacon) there’s no charge for this.

Online trading free money

Get trading opportunities to your inbox

Top forex bonus list

Online trading

The internet has made investing significantly more accessible to private investors. Before online trading platforms, investors would have to place an order with their broker by telephone. Now, the global financial markets are accessible to anyone with access to a computer, and investors are able to input trading orders directly via the internet.

Online trading gives both beginners and advanced traders the opportunity to trade spread bets, cfds and FX on global financial assets. One should never associate online trading with gambling. Traders should avoid making spontaneous or ill thought out decisions, as unplanned and poorly researched online trading can be disastrous. On the other hand, as with any other form of trading, losses are an inevitable part of online trading and traders should be comfortable with this. In order to succeed, every trader should aim to manage potential loss and risk.

Online trading provides the opportunity to make money online (of course, losses are also possible) and to keep a constant vigil on how your investments are performing. Because the internet is always available, in libraries, at work, in internet cafés and of course through WIFI on your personal laptop, it is always possible to monitor and analyse online trading markets, open and fund an account or to keep up to date with performed deals.

Online trading platforms

Our online trading platform will provide you with the means to trade cfds and spread bets on a wide range of assets including indices, currencies, commodities and shares. The online trading platform will give you access to live stock prices, along with the ability to immediately buy and sell assets when you see an opportunity.

Investors using online trading platforms can access the markets at any time; many markets all over the world are in service 24 hours a day. Investors can fund their account online and keep up to date with the market. Online trading also gives investors more opportunity to monitor performance (i.E. To analyse their own trading mistakes) in order to improve on future trading. Using accendo markets‘ online trading platform gives you all of this, plus the benefit of our daily reports, research and trading opportunities. You will also have a professional trader available to answer your questions, help you search the market for trading opportunities, and guide you through the procedure involved in setting up and operating your online account.

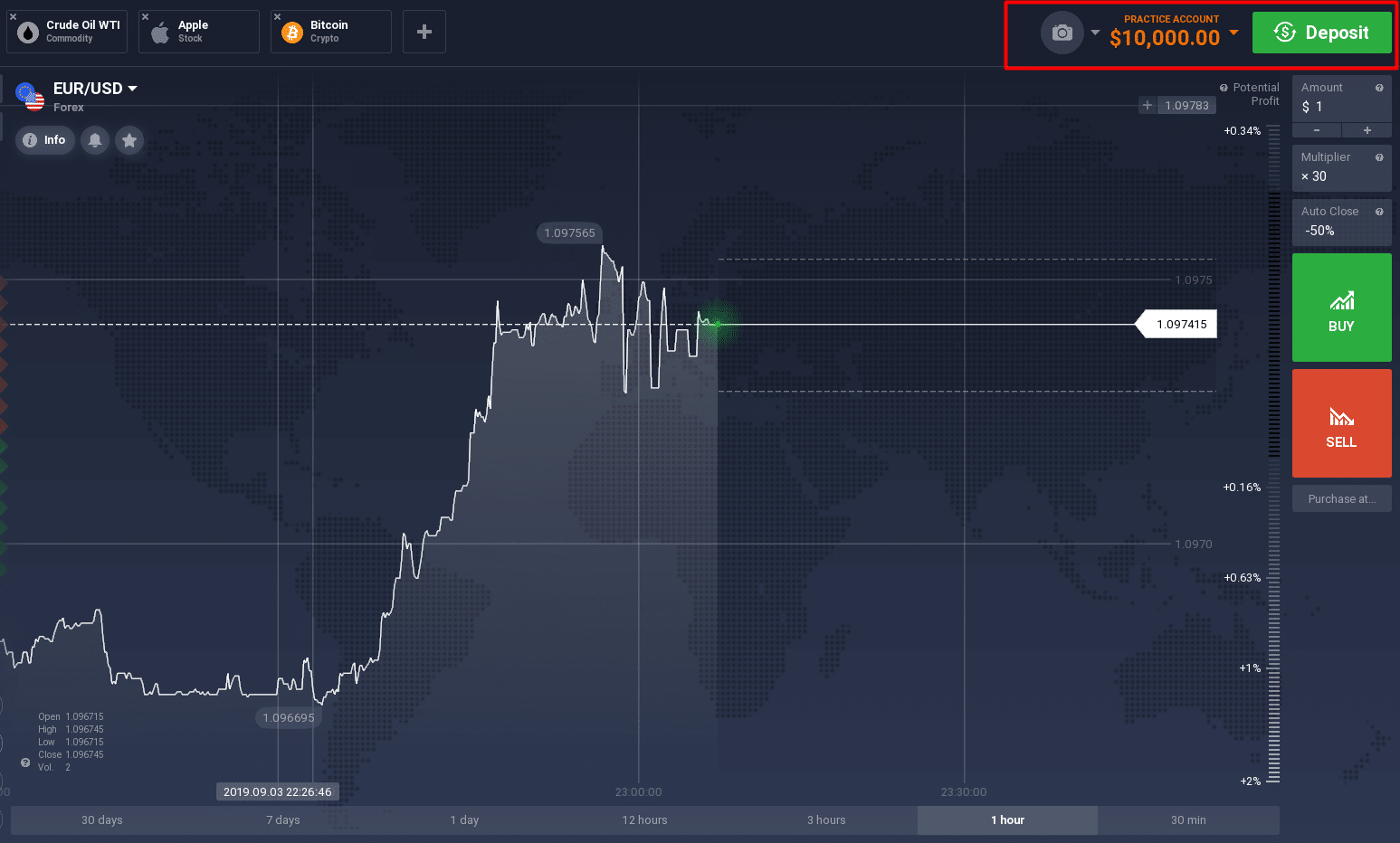

We are pleased to offer potential clients a free demonstration online trading platform, including:

- £10,000 demo money to trade the financial markets

- Live price quotes for shares, commodities, indices and forex

- Trading charts and tools

- Live news feeds

This demonstration is completely free and without obligation, so your credit/debit card details are not required.

However, we hope that when you have experienced our online trading platform first hand, you will want to join our list of online trading clients. You can open a live online trading account with all the facilities you enjoyed in the demo, plus access to the live online trading platform to trade with real money.

If after the demo expires you decide not to trade with accendo markets, you will owe nothing.

‘knowledge is power’ (francis bacon)

Choosing which stock to invest in can be overwhelming for a new trader, and always challenging for the established investor. Our professional traders are here to support and educate you in the process involved to research stocks and shares when online trading, and to help you identify your own trading opportunities. Make use of accendo markets’ research staff and resources, they are here to help you. Whilst we can help you with your trading strategy (i.E. You tell us what to look for), we do not provide advice. If necessary, please take advice from an independent financial adviser.

Knowledge is the main key to successful online trading for a living, and researching a potential investment thoroughly will enable you to make an educated decision as to whether the company you are investing in has a good future. Investors should research news releases and industrial publications. Also look at the company’s financial reports and applicable charts before using our online trading platform.

And remember: ‘money can’t buy you friends, but you get a better class of enemy’ (spike milligan)

As a client of accendo markets, you’ll have access to your own online trading platform. There’s no need to download software; simply use the username and password provided and login via the accendo markets website.

Your online trading platform will give you access to global financial markets, including commodities, currencies, shares and indices. You can trade at the touch of a button on your platform, or call your trader to place the order for you at no extra cost.

Your trader will be on hand to assist you with your online trading platform and trading strategy, as well as provide you with the latest market talk from the trading floor.

About accendo markets

Accendo markets is an award winning derivatives brokerage and provider of online trading services. As experienced and professional traders, we offer the best in online trading but also the advantage of a dedicated professional trader who is available for client questions, and who will also act as an account manager and trading tutor if required.

Free trading demo account review

Are you looking for a free and unlimited trading demo account? – then this page is for you. In more than 7 years of experience in online trading, we have tested many providers and present you in the lower table in our top 3. Additionally, you will learn on this page why a demo account with virtual credit is so important for beginners and advanced traders.

| Broker: | review: | spreads: | advantages: | open account: |

|---|---|---|---|---|

1. IQ option  | ➜ read the review | starting 1.0 pips | + FX & options + best platform + start with $10 |

Criteria for a good trading demo account:

Not every trading demo account is optimal for the private trader. That’s why there are different criteria that make a good trader. All in all, however, it can be said that nowadays almost every online broker offers a free demo account. Sometimes, however, there are runtime restrictions or other functions that are limited.

The demo account is intended to simulate real money trading. Therefore, it is essential to choose a reputable provider. With brokers with an official regulation and financial license, there are no differences in the demo and real money trading from our experience.

- Free demo account

- Unlimited demo account

- There is no difference between the demo account and real money trading

- The account can be recharged with virtual money as desired

- All functions are available

Why is a demo account so important for beginners and advanced users?

A trading demo account is an account filled with virtual credit (play money). It simulates real money trading. Traders can therefore trade real market situations without risk. The account is particularly suitable for beginners who want to start trading. The first experiences can be collected in the demo account.

In general, it is about getting to know the trading platform of the broker better. In our experience, most beginners find it very complex to trade on the financial markets at first. After a few explanations and tests, however, one realizes that it is not so difficult. In addition to the trading platform, the broker can also test the trading conditions.

The spread and trading commission in the demo account is the same as in the real money account. New markets should also first be tested in virtual mode, especially in the short-term area (day trading). Beginners and advanced traders can benefit from this. In addition, trading strategies can be tried out or developed. In summary, the rule is that you should trade in the demo account until you are profitable and make progress.

Facts about the demo account:

- Trading in the demo account is risk-free and simulates real money trading

- Test the trading platforms sufficiently

- Learn online trading and control order execution

- Test the broker’s fees

- Test and develop new trading strategies

Free and unlimited demo account

In general, a demo account is always free of charge. From our experience, 99% of online brokers offer this service. Some few providers require a minimum deposit. From such offerers is urgently to be advised against, because these are often unserious. In addition, the account should have an unlimited duration.

Some providers have fixed expiration times for the test account. By a message to the support, this problem can be solved however and the running time was extended from my experiences up to now always. In summary, beginners and advanced traders have the opportunity to test open trading platforms and brokers. A demo account like the real money account should always be ready to trade.

IQ option trading demo account

No difference between real money and virtual credit

With good brokers there is no difference between demo and real money trading. The price movements and executions are the same. Gladly, the trader can also check this himself. With regulated providers you do not have to worry. Therefore, be sure to obtain an official license from a financial supervisory authority.

The top recommended brokers all have an official license and are even regulated several times. Also, the trading fees and/or the spread has no difference in the demo account to the real money trade. With these accounts, you can simulate real money trading 1 to 1.

- Choose a reputable provider for your trading demo account as well

- You trade in both accounts under the same conditions

Account recharge is quite simple

With the demo account, there is the possibility to recharge the credit as desired. Since it is a test account, the credit can shrink quickly. But this is no problem at all. Because over the web page of the broker one can recharge the account very simply in few clicks. If you have any questions you can contact the support.

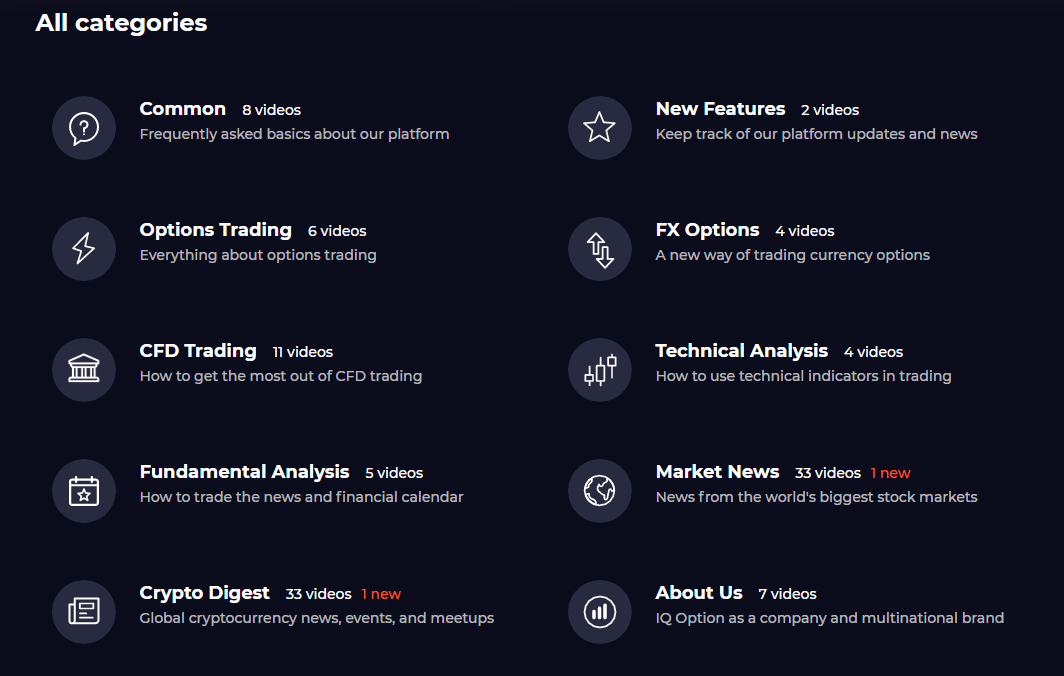

Further training for traders

Especially many beginners trade in the demo account and this is also absolutely necessary for a newcomer. The brokers offer concrete training material. The offer ranges from trade tutorials to free-market analyses and webinars. The demo account is the best way to expand your knowledge.

In addition, you can gain personal experience in various market situations. Professionals generally talk about the fact that it takes several thousand hours of screening time to act successfully. Read also our 10 trading tips.

Education center (videos and more)

How long should I practice in a demo account?

From our experience, one should practice in the demo account until one has made demonstrably the first profits over a longer period of time. From our experience, a period of one month is suitable here. If you make a good profit week after week, you can slowly dare to trade real money.

It is important that you keep a statistic about your trades. The trading platform, however, already shows this very transparently. Alternatively, further tools can be added. It is best not to rush into anything. Trading a week longer in a demo account is better than losing real money because you don’t feel safe enough.

Conclusion: the demo account is the best way to learn online trading

The trading demo account is suitable for any trader and should be used before trading real money. It has many advantages which we have described to you on this page.

In addition, the creation of such an account is done in a few minutes. Online brokers meanwhile offer very easy access to the trading platform. Should he feel sure that a trader is safe enough for real money trading, he can start it directly.

In summary, the demo account is one of the most important tools of a trader, because with this account you can try many things about real market situations for free and without risk.

Good luck with your trading.

A demo account is necessary for each type of trader. You can try to trade the markets without risk.

Forex trading without deposit | no deposit bonus explained

It’s no surprise that one regular lot is equal to 100,000 currency units – forex trading is definitely an expensive endeavor. However, there are still some ways in which you can start trading forex while maintaining some sort of profitability without spending hundreds of thousands of dollars.

No deposit bonus in a glance

In forex trading you can, in fact, start trading with no money of your own or even making a deposit. With free no deposit bonus offered by the top forex brokers, you can start forex trading without deposit with a good boost.

There is no sense in hiding the fact that FX trading is risky, especially if you are trading without proper knowledge and at least minimal experience. In an attempt to prevail over the risk of losing your money and to stay safe, it is undoubtedly better to start trading with a free forex account or no deposit bonus offered by various FX brokers. Especially if such deals are not so rare at this time and even best forex brokers sometimes offer such deals.

It is always better to preview all conditions that offer you an option to trade without money of your own. So, be sure to start forex trading without a deposit now and get yourself a good and reliable deal!

But let’s say that although you’ve learned how to start deposit free forex trading, it’s still too risky for you. Thankfully, there is an alternative. One way to start trading with a broker is by opening a free forex demo account for beginners. A demo account will allow you to try your hand at trading on the real market without ever touching real money. One of the best brokers to try a free demo account with would be FXTM. If you don’t want to be working with FXTM and want access to a reliable forex broker that offers its services around the globe, alpari offers a similar service, including forex trading demo accounts. If you are a US citizen that wants to trade with local brokers, then you should go for forex.Com, who offer their services within the US and are known to be one of the best brokers in the world.

Transparent pricing and fast, reliable trade executions on over 80 currencies

Start trading with the largest forex broker in the US

How to start forex trading without deposit: tips & recommendations

As a matter of fact, a lot of brokers worldwide try to offer their clients those no deposit deals, and we’ve even seen some trading apps without deposit popping up here and there. Do not perceive this as an act of generosity though, those bonuses serve as a sort of protection for them also. But still, this is good for you if you want to start forex trading without a deposit.

Here are some of the main considerations that can help you spot a decent no deposit bonus:

- If you somehow dislike conditions and terms offered by the broker – simply skip the promotion. Let’s investigate the ways that may help you find the best bonus in FX. First of all, bonuses must be easy to understand and transparent in general conditions. If you see non-explicit information presented, avoid the promotion or ask the broker for clarification.

- If you wish to take part in the particular promotion and start forex trading without investment, then do not overlook terms and conditions. Even the smallest detail must be in your sight. A free bonus is actually not always 100% free. Some brokers may ask you to deposit some money in order to collect your profits. Indeed, such promotions are scams.

- Be attentive, because some forex brokers can demonstrate a good opportunity with their no deposit bonus, however it may ask to complete the trading volume requirement. Stay away from the bonus that asks to complete more than 1 lot for $10 to further unlock the profits and balance.

- Bonuses can vary in terms of geographical location requirements. Therefore, ensure that FX bonus accounts of the broker are given in your country as well if you desire to start forex trading without investment. Furthermore, there can be account restrictions. This means that no deposit bonuses may not always be available for every account at a particular broker. Thus, check whether you applied for a correct account.

- In addition, make sure what instruments can be traded to withdraw your profit before you begin trading as sometimes FX bonus accounts are not available for some of them. As for the withdrawal, some forex bonus brokers limit the maximum profit available to withdraw from the account. So, do not miss this field before you start trading on your no deposit FX bonus account.

- Bonuses are frequently represented only in 1 currency equivalent. However, there are many no deposit bonuses that evaluate a similar amount in your local currency, so doing your research in order to figure out how to join forex trading without making any deposits is a good way for ensuring success in the long run.

Not ready for live trading? Try IQ option demo account!

Practice your trading skills with free $10,000 practice account!

How to start forex trading without a deposit?

How to start forex trading without a deposit?

As one of the cases, no deposit bonus may come with SMS verification. It is recommended to make sure that you have the right phone number prior to start applying for the bonus.

One of the last tips that can help you find a trustworthy no deposit bonus, or at least help you get through a scammer, is to save the terms and conditions document as a .Pdf file. Do this even if you deal with the best no deposit forex bonus account. You can use the help of your account manager and ask him to confirm all the statements of the bonus promotion in which you participate.

Start forex trading without deposit: introduction to best no deposit bonuses

Although there are very good no deposit bonuses offered by industry leaders and most proficient brokers, you should understand one fact: FX bonuses without a deposit are most frequently offered by bad brokers. That is the very reason why you should be very careful not to get entangled with a scammer.

All this leads to us stressing how important it is to be attentive at all times, so be attentive to details when researching how to start trading with no deposit bonuses. Fortunately, we have examples of the best brokers/investment firms.

Start forex trading without investment: XM forex broker

To begin with, XM is recognized by the united kingdom-based organization – investors in people for its powerful efforts in developing individuals to realize their entire potential and achieve both individual and corporate goals. We should also admit that this organization provides a huge amount of proven tools and resources specially designed to complement its unique framework with an aim to boost performance and indeed maximize sustainability. XM achieves this standard by showing that it is a driving force in the online trading sector and is committed to the provision of services and products of the best quality. How to start forex trading without money? If you are interested, you can claim the XM 30 USD no deposit bonus!

Get your 30 USD no deposit bonus with XM, and start trading today

Sign up with top tier broker and get the best no deposit deal on the market

*clients registered under the EU regulated entity of the group are not eligible for the bonus

No deposit bonus as an alternative – is it worth it?

So, now that you know what no deposit bonuses are and how they work, one question remains active: is it actually worth it to sign up for one yourself? Will you get any significant benefit from it?

The answer to that question is subjective; some traders can definitely find use in this type of promotion by amassing a small account balance and then turning it into a full-blown trading career. But in order to do so, you need to be very careful not to catch a scammer instead of a legitimate promotion issuer.

As for other traders, they often prefer spending their own money, which gives them more incentive to be more careful in the market – after all, it’s their own money they’re risking.

So, suffice to say no deposit bonuses have their time and place; one just has to seize that exact moment.

Free stock trading courses online

Learn stock trading with the free stock trading tutorials and online courses.

Subjects

Certification

Level

Ratings

Duration

Stock trading: intelligent investing in stocks on the stock market

Start making money by investing in the stock market! Learn the intelligent ways of investing in stock trading with this online course. Get started today!

Strongest reversal candlestick patterns - forex trading / stock trading

This is a mastery course for both the beginner and advanced - FOREX and stock market traders, who wants to increase their potentiality by analyzing the reversal candlestick patterns in price action chart to earn consistent profit from their trades.

Stock trading with candlestick patterns | technical analysis

Learn how to use over 20+ candlestick patterns to perform technical analysis, and to predict the future price movement of stocks.

Stock trading & investing | beginners masterclass

This is your guide to the world of technical stock trading, as you learn how to strategically trade stocks (and other assets) using technical analysis & candlestick charts!

Investment and technical analysis methods on stock markets

In this online course, you will learn to become a better investor, stock picker, portfolio manager, analyst and many more. Enroll now to learn method on stock market

Stock trading strategies : technical analysis masterclass 2

31 analysed stock trading strategies for day / swing trading options trading & forex by technical analysis + ASSIGNMENTS

Trading in a futures market - revised

This course covers futures trading. This course explains in simple terms trading concepts such as contango, backwardation and how to analyse future curves.

Stocks and short selling revised course - an introduction

Learn more about how stocks and shares are valued and how to borrow stocks that you do not own and buy it back at a later time, ideally at a lower price.

Learn how to do online trading: online trading for beginners

Wish to know how to do online trading? Follow this online trading for beginners course to learn online trading concepts & how to do online trading.

Free financial trading tutorial - introduzione al trading online

Le basi dell'analisi tecnica nel trading online - free course

Details about free stock trading certification and courses

Want to learn stock trading ? This is the list of free stock trading courses available online. From this list, you can take any of the stock trading course to learn stock trading in details and become master of stock trading.

Learn stock trading from the free stock trading courses and free stock trading certifications online. Select free courses for stock trading based on your skill level either beginner or expert. These are the free stock trading certification and courses to learn stock trading step by step.

Collection of free stock trading courses

These free stock trading courses are collected from moocs and online education providers such as udemy, coursera, edx, skillshare, udacity, bitdegree, eduonix, quickstart, youtube and more. Find the free stock trading tutorials courses and get free training and practical knowledge of stock trading.

Get started with stock trading for free and learn fast from the scratch as a beginner. Find free stock trading certifications for beginners that may include projects, practice exercises, quizzes and tests, video lectures, examples, certificate and advanced your stock trading level. Some courses provide free certificate on course completion.

Stock trading courses are categorized in the free, discount offers, free trials based on their availability on their original platforms like udemy, coursera, edx, udacity, skillshare, eduonix, quickstart, youtube and others moocs providers. The stock trading courses list are updated at regular interval to maintain latest status.

After collecting courses and certification from different moocs and education providers, we filter them based on its pricing, subject type, certification and categorize them in the relevant subject or programming language or framework so you do not have to waste time in finding the right course and start learning instead.

Suggest more stock trading courses or certifications ?

Do you think any stock trading certification or stock trading course need to include on this list? Please submit new stock trading certification and share your stock trading course with other community members now.

Online trading journal & money management

Tradebench is an online trading journal for you to plan, journal and learn from your trades.

You’ll get a structured approach to earn more money from your trading.

Become a more profitable trader. Cost free.

Join over 40,000 other traders and see what a difference tradebench will make in your trading!

* in return for free personal usage you accept to receive & open 1 sponsored e-mail per month as well as one of the following two: A) add a link to tradebench.Com somewhere relevant or B) support us with a donation. More info here (includes commercial use info). Note: feel free to try our tools a couple of days before fulfilling A or B. Our general term & conditions and privacy policy also apply and can be found here.

Join these traders and 40,000 others!

“thank you so much for your wonderful trading tools. I am amazed that you provide them for free and have never seen such a comprehensive trading journal.”

– hamid esnaashari

“just wanted to send you a thank you note. I am a new trader but very organized and detailed. Your platform is like heaven sent. Thank you very much.”

– julio richardson

I was looking for a proper trading journal for some time and finally found tradebench. It has great functionality, including import & export for excel. I can create trade plans to ensure I only enter trades that suit my personal strategy, avoiding emotional trades. If you’re looking for a trade journal, you should give tradebench a try.”

– mathias burmeister

What you get…

✔️ trade planning

✔️ position sizing

✔️ labels & checklists

✔️ open trades dashboard

✔️ reports, review & learn

✔️ compare potential trades

✔️ customizable parameters

✔️ risk & money management

✔️ worldwide exchanges

✔️ almost all trading vehicles

Try it hands on – cost free!

Sign up for immediate access

Trading journal, trade planning, risk & money management

Tradebench is a cost free online trading journal, trade planning, position sizing and risk management software for private stock, futures, CFD and forex traders in the financial markets.

Our number one goal is to make you a more profitable trader. This is achieved by offering a structured approach to your trade planning and position sizing/risk management as well as an easy-to-use way of journaling your trades making reviewing and learning from previous trades an integral part of your trading routine.

Learn more about the features or click the button below to do a quick sign up for immediate access. It’s cost free.

Online trading for beginners

You can trade online and make money from the comfort of your home these days. What is more, you do not need much of an experience to do this successfully. As a result of this, both beginners and experts can use this method to make a lot of money. While it is possible to make a lot of money via online trading of beginners, you need to understand that you will not make millions from it at the start, making millions form such trading will take some time to come and it will be after series of ups and downs.

Online trading for beginners brokers

The dream of making millions under a few days of trading will never become a reality. As a reasonable trader, you should know that profiting from trading is a gradual process and will take some time from materializing. So, every newbie needs to start having a different opinion about trading lest he ends up badly.

Online trading should not be seen as a magic(online trading for beginners)

Those who see the online kind of trading as magic or a get-rich-quick scheme will end up being disappointed. If you have that kind of mentality, you will only get your fingers burnt. Instead, you should see online trading as a business and not as anything else. So, it is in your best interest to start treating trading as a business so that you can make a regular income from it.

The trend is your friend

You should always follow the trend when you are trading online as it will help you to make the right trading decisions a all times. This is one rule that every trader needs to bear in mind. Following the trend will help to reduce the occurrence of losses. If the trend shows that the particular asset you are concerned with is rising in value, then you should only consider taking a buying position. If the trend shows otherwise, then you should only consider selling a particular asset. When you follow the trend, the number of times you record losses will reduce. When the market is ranging or spiky, on the other hand, it is advisable to hold back from trading until the market makes up its mind about the particular direction to follow. Trading in a ranging market may cause you to record more losses.

Choose traders wisely

Trading online can be profitable and it can also be risky. So, you need to choose tread carefully so that you will not end up with more losses than profits. First of all, you need to choose the broker very carefully. There are so many brokers out there today claiming to be the best, but, unfortunately, not all of them can be trusted to deliver on their promises. This is why you need to choose carefully so that you will not end up with an unreliable broker. You should read up reviews about the online broker to find out if the broker is reliable or not. You should also avoid registering with a broker that is not regulated. Only regulated brokers can be trusted to protect the interests and funds of their clients. Your fund may go missing if you register with an unregulated broker.

Keep on learning

Forex trading online is a very risky business and you need to also bear this at the back of your mind. One of the factors responsible for the risky situation is its dynamic nature. Forex trading is dynamic and this means that market is consistently changing. A forex trading strategy that worked yesterday may fail to work today because of the dynamic nature of the market. This means that the forex trader will need to consistently adjust and modify his trading strategy so that it can be useful in the current market situation. If you are to successfully adjust your trading strategy to meet up with the current condition of the market, then you need to keep on learning so that you will not get it wrong. Learning is a constant thing for everyone that wants to trade online. The day you stop learning is the day you start failing. If you do not want to fail, then you must not stop learning. There is always something new to learn in forex trading and the earlier you get down to it the better for you.

You need more than just the basic knowledge of trading of you to be able to make anything out of online trading for beginners. You need to get additional knowledge and make learning a daily engagement. You can look for sources of information for online trading for beginners that can help you to better understand how to go about trading online.

Put your risks under control

You should not trade forex with money you cannot afford to lose. It is not wise to borrow money or take a loan for trading online. This is because you can end up with a huge loss that will put you in big debt. So, only trade forex with money that will not put you in an emotional problem when you lose. Also, you should never risk more than 1 or 2% of your money when trading forex online. You should calculate your risk based on how much money you have in your trading account and the calculation should have been done long before you start trading and make sure that your plans are made well before trading begins. Always remember that you can win or lose during forex trading online. So, you must be prepared for eventualities.

Be ready to spare time

Forex trading will take time before you can understand how it works. Determining when to place trades can also take some time. So, you must be ready to spare the time before you can successfully trade forex. Online trading is not something you can venture into if you do not have adequate time for market analysis lest you end up making mistakes that can cost you. This is even more important if you are into day trading. It may cause you to give up most of your day on trading analysis. It is not safe to start trading online if you do not have adequate time to spare on market analysis. Trading opportunities can come up at any time of the day or night. So, the trader needs to always be on the lookout lest he misses out.

Be ready to start small in online trading for beginners

One of the points online trading for beginners instructions should emphasize is the need to start small. Do not forget that trading online should be treated as a business and you should be ready to start your business small and look towards growing with time. This is exactly the case when it comes to online trading. If you are a newbie with limited knowledge about trading, then starting small is always in your best interest. You can now add more funds and go in big after you have built a lot of knowledge about trading. Even at that, you must not risk more than what you can afford to lose since the best of forex trading online strategies can turn out to be unprofitable at the end of the day. You should always bear in mind that there is no 100% profitable strategy in forex trading.

Want to trade commission-free? Here are best online brokers for commission free trading in 2021

Modified date: december 28, 2020

The fact that you can now trade stocks without paying commissions removes one of the barriers to stock trading for those without a ton of money to invest.

Traditionally, you had to pay anywhere from $4.95 and up for each stock trade you make. Firms relied on these fees as a significant part of their revenue. Needless to say, I was very surprised when a few major platforms announced, all within just a few days, that they would no longer charge fees to trade stocks on their platform.

Now, you have a large number of options to trade stocks and other securities commission-free. Even so, each trading platform has different benefits and drawbacks. To help you find the best commission-free trading platform for you, I put together this list. Here’s what you need to know.

Best commission-free trading platforms overview

Robinhood

While robinhood is well known for starting the commission-free trade movement, they also want you to learn about investing, as well. Their website has an in-depth learn section to help you learn about investing basics, the markets, and trading lingo. These resources can help you figure out how to get started investing. They offer tools to help you manage your portfolio, too.

While robinhood’s main service is free, you can upgrade to robinhood gold starting at $5 per month. This gives you the ability to trade on margin, make larger instant deposits, and the ability to access professional research reports. This is more than the average investor likely needs, but it’s nice to have as an option if you’d like to take advantage of these services.

Advertiser disclosure – this advertisement contains information and materials provided by robinhood financial LLC and its affiliates (“robinhood”) and moneyunder30, a third party not affiliated with robinhood. All investments involve risk and the past performance of a security, or financial product does not guarantee future results or returns. Securities offered through robinhood financial LLC and robinhood securities LLC, which are members of FINRA and SIPC. Moneyunder30 is not a member of FINRA or SIPC.”

Public

The idea behind the app is you can buy slices of stocks and etfs rather than having to pay the full share price. At the same time, you can connect with the investing community within the app. Public allows you to share your own insights and follow other investors that do the same. You can even start group chats.

The app also includes a feature called themes. This allows you to discover new companies that share unique themes such as female-led companies in the S&P 500. Public has built-in safeguards for risky stocks and they don’t allow day trading, margin loans or complex investment instruments. You can even earn free stock by referring your friends to public.

M1 finance

You can invest in stocks and etfs. M1 finance even allows you to purchase fractional shares which can be great if you’re just getting started and don’t have a lot of money to invest.

Your first deposit will be invested based on the portfolio percentages you set up. Future investments will be used to make purchases to bring your total balances back in line with that portfolio.

M1 finance doesn’t charge any trading commissions or management fees, but underlying investments may charge fees.

If you want access to two daily trading windows, a lower rate on the offered flexible line of credit and checking accounts that pay APY and cash back, you’ll have to pay a $125 annual fee to upgrade to M1 plus.

E*TRADE

E*TRADE focuses their business on active traders rather than passive investors that prefer index funds.

They have an easy-to-use platform and tools, a dedicated trader service team, as well as a vast database of educational resources.

Acorns

The acorns app gives you a unique way to invest that most other trading platforms don’t allow. Acorns allows you to start investing through micro-investing.

Essentially, acorns rounds up your everyday purchases to the nearest dollar. Then, they take that change and invest it when it adds up to at least $5 from your linked accounts.

Acorns does charge a monthly fee that ranges from $1 to $3 depending on the services you want access to.

TD ameritrade

TD ameritrade was founded in 1975 and was rated as the best online broker for 2018 in kiplinger’s personal finance best online brokers review. Currently, TD ameritrade has reached a definitive agreement to be acquired by charles schwab.

TD ameritrade offers commission-free trades on most US exchange-listed stocks and etfs. There is a $0.65 fee per contract for options trades.

TD ameritrade offers a robust trading platform, free research and good customer support to back up their service. I’ll be interested to see what changes after TD ameritrade gets acquired.

Vanguard

Vanguard charges for stock trades depending on the amoun of assets you hold with the company. Those with over $1,000,000 in assets do get some free trades, but those with fewer assets at vanguard get charged anywhere from $2 to $20 per trade for online trades.

Vanguard offers commission-free ETF trades for over 1,800 etfs as long as you trade online. There is a fee if you trade etfs over the phone.

Similarly, all vanguard mutual funds have no transaction fees and over 3,000 non-vanguard mutual funds can be traded for free online. Fees do apply for phone purchases and certain other transactions.

Summary of the best commission-free trading platforms

How I came up with this list

I examined the market and selected a variety of commission-free trading platforms that would appeal to different audiences.

I looked at the firm’s history, its unique features, the minimum account opening requirements, the types of investments available to account holders to invest in, as well as any other costs associated with the platforms.

What may be the best trading platform for one person may not be a good fit for someone else, so I focused on finding a variety of platform options based on differing needs.

How to choose the best commission-free trading platform for you

Ultimately, choosing the best commission-free trading platform will come down to your preferences. That said, there are a few things you should look for before selecting the best platform for you.

Figure out how much you can invest

First, figure out how much money you have available to start investing. Next, decide what you want to invest that money in.

Based on these two answers, you can start narrowing down your options. Eliminate options that don’t allow you to start investing in your chosen investment with the amount of money you have available.

Since some platforms have no or extremely low account opening minimums, you should be able to find an option for you.

Pick the right account type for you

Once you’ve narrowed down your options, make sure you can open the account type you want to invest in. For most people, this is an IRA, roth IRA, or traditional taxable brokerage account. These account types are fairly common at most platforms.

However, those that need specialized accounts such as SEP iras, solo 401(k)s or others may have limited options for the best platform for them.

Make sure to watch out for any other fees the platforms may charge. If they have a monthly fee or additional non-trading fees that eat away at your returns, they may not be the best fit for you for the long-term.

Once your balance has grown, you may want to consider moving to a different platform if it better meets your needs.

Should you invest with a commission-free trading platform?

The investing industry is quickly moving to a mostly commission-free trading environment. This is good for consumers because it cuts investing costs and makes investing more accessible to the general public.

Even so, trading commission-free can have some downsides. Trading commissions provided a barrier to discourage frequent trading. Without this barrier, it may be tempting to trade stocks more often.

The more you trade, the more chances you have to make mistakes. If no commissions on trades make you tempted to trade more often, it may not be a good fit for you.

Additionally, these platforms that used to make money on trade fees still have to turn a profit. While you aren’t paying fees on trades anymore, watch out for other fees or costs that could end up costing you more over the long run.

These may not appear for all types of investments, but it’s always smart to watch out for increasing costs.

If you’re a disciplined investor, commission-free trades could save you a few bucks here and there. If there are no additional costs elsewhere, you might as well take advantage of the cost savings.

Are there disadvantages to free stock trades?

While free stock trades sound great, they may cause issues for some people. In the past, the stock trade fee made many investors carefully consider their trades. With no stock trade fees, you can trade as much or as little as you’d like.

What should I look out for at commission-free brokerages?

Whenever you get something for free, you should carefully consider why you’re getting it for free. Chances are, there are fees (however small) for some things you may eventually have to do.

I’ve always heard the saying there is no such thing as a free lunch and this includes commission-free trading platforms.

Summary

Commission-free trading platforms can be a great option for active traders to save money on their trading commissions. If you’re currently paying for stock, ETF, or mutual fund trades, consider switching to one of our best commission-free trading platforms listed above.

Just remember, free trading doesn’t mean you should trade more often. While some active traders are successful, you may be better off sticking with long term index investing. Make sure to consider all of your investment options and consult an investment professional if you need help deciding what you should invest in.

Online trading free money

Forex course

Learn how to trade forex with professional traders – proven techniques and daily analysis of major currency pairs. Try it risk free

Free info

Get the best in forex education via email – video tutorials, best strategies & PDF guides and best trade set ups and analysis

About us

Learn to trade FX with us and benefit from our 27 years of trading experience and learn more about our philosophy of trading

Learn more about mentoring

Want to learn how to trade forex with a personal mentor? Get intensive 1 month training to help you trade like a professional trader

FX trading course

Free FX education

Follow us on youtube

The real secret of forex profits

If you want to know the real secret of successful forex trading you can discover it by learning a simple fact and its significance which most traders dont think about which really gives you the way to make money trading forex.

The tutorial wille explain the significance of the fact and give you a simple forex trading strategy which will help you win at forex trading oneline, as well as how to get the psychology of a professional trader.

Anyone can learn to trade currencies for profit – it's a specifically learned skill, and if want to succeed you can all you need is the right education and FX training. After checking out the education in the tutorial, check out our site for all the best currency trading techniques that work which can lead you to long term profits trading global forex markets online.

How online trading works

Legend has it that joseph kennedy sold all the stock he owned the day before "black thursday," the start of the catastrophic 1929 stock market crash. Many investors suffered enormous losses in the crash, which became one of the hallmarks of the great depression.

What made kennedy sell? According to the story, he got a stock tip from a shoeshine boy. In the 1920s, the stock market was the realm of the rich and powerful. Kennedy thought that if a shoeshine boy could own stock, something must have gone terribly wrong.

Now, plenty of "common" people own stock. Online trading has given anyone who has a computer, enough money to open an account and a reasonably good financial history the ability to invest in the market. You don't have to have a personal broker or a disposable fortune to do it, and most analysts agree that average people trading stock is no longer a sign of impending doom.

the market has become more accessible, but that doesn't mean you should take online trading lightly. In this article, we'll look at the different types of online trading accounts, as well as how to choose an online brokerage, make trades and protect yourself from fraud.

Review of stocks & markets

Review of stocks & markets

Before we look at the world of online trading, let's take a quick look at the basics of the stock market. If you've already read how stocks and the stock market work, you can go on to the next section.

A share of stock is basically a tiny piece of a corporation. Shareholders -- people who buy stock -- are investing in the future of a company for as long as they own their shares. The price of a share varies according to economic conditions, the performance of the company and investors' attitudes. The first time a company offers its stock for public sale is called an initial public offering (IPO), also known as "going public."

When a business makes a profit, it can share that money with its stockholders by issuing a dividend. A business can also save its profit or re-invest it by making improvements to the business or hiring new people. Stocks that issue frequent dividends are income stocks. Stocks in companies that re-invest their profits are growth stocks.

Brokers buy and sell stocks through an exchange, charging a commission to do so. A broker is simply a person who is licensed to trade stocks through the exchange. A broker can be on the trading floor or can make trades by phone or electronically.

An exchange is like a warehouse in which people buy and sell stocks. A person or computer must match each buy order to a sell order, and vice versa. Some exchanges work like auctions on an actual trading floor, and others match buyers to sellers electronically. Some examples of major stock exchanges are:

- The new york stock exchange, which trades stocks auction-style on a trading floor

- The NASDAQ, an electronic stock exchange

- The tokyo stock exchange, a japanese stock exchange

Worldwide stock exchanges has a list of major exchanges. Over-the-counter (OTC) stocks are not listed on a major exchange, and you can look up information on them at the OTC bulletin board or pinksheets.

When you buy and sell stocks online, you're using an online broker that largely takes the place of a human broker. You still use real money, but instead of talking to someone about investments, you decide which stocks to buy and sell, and you request your trades yourself. Some online brokerages offer advice from live brokers and broker-assisted trades as part of their service.

If you need a broker to help you with your trades, you'll need to choose a firm that offers that service. We'll look at other qualities to look for in an online brokerage next.

So, let's see, what we have: online trading - cfds and spreads. Your online trading demo with £10,000 fictional funds. Online trading provides the opportunity to earn money online and to keep a constant vigil on how your investments are performing. Statistically, the most profitable online trading strategy is... At online trading free money

Contents

- Online trading free money

- Top forex bonus list

- Online trading

- Free trading demo account review

- Criteria for a good trading demo account:

- Why is a demo account so important for beginners and advanced users?

- Free and unlimited demo account

- No difference between real money and virtual credit

- Account recharge is quite simple

- Further training for traders

- How long should I practice in a demo account?

- Conclusion: the demo account is the best way to learn online trading

- Forex trading without deposit | no deposit bonus explained

- No deposit bonus in a glance

- How to start forex trading without deposit: tips & recommendations

- Start forex trading without deposit: introduction to best no deposit bonuses

- No deposit bonus as an alternative – is it worth it?

- Free stock trading courses online

- Stock trading: intelligent investing in stocks on the stock market

- Strongest reversal candlestick patterns - forex trading / stock trading

- Stock trading with candlestick patterns | technical analysis

- Stock trading & investing | beginners masterclass

- Investment and technical analysis methods on stock markets

- Stock trading strategies : technical analysis masterclass 2

- Trading in a futures market - revised

- Stocks and short selling revised course - an introduction

- Learn how to do online trading: online trading for beginners

- Free financial trading tutorial - introduzione al trading online

- Details about free stock trading certification and courses

- Collection of free stock trading courses

- Suggest more stock trading courses or certifications ?

- Online trading journal & money management

- Join these traders and 40,000 others!

- Trading journal, trade planning, risk & money management

- Online trading for beginners

- Online trading for beginners brokers

- Online trading should not be seen as a magic(online trading for beginners)

- The trend is your friend

- Choose traders wisely

- Keep on learning

- Put your risks under control

- Be ready to spare time

- Be ready to start small in online trading for beginners

- Want to trade commission-free? Here are best online brokers for commission free trading in 2021

- Best commission-free trading platforms overview

- Robinhood

- Public

- M1 finance

- E*TRADE

- Acorns

- TD ameritrade

- Vanguard

- Summary of the best commission-free trading platforms

- How I came up with this list

- How to choose the best commission-free trading platform for you

- Should you invest with a commission-free trading platform?

- Are there disadvantages to free stock trades?

- What should I look out for at commission-free brokerages?

- Summary

- Online trading free money

- Forex course

- Free info

- About us

- Learn more about mentoring

- FX trading course

- Free FX education

- Follow us on youtube

- How online trading works

Comments

Post a Comment