15 Must-Read Bitcoin; Crypto Trading Tips (Updated 2020), crypto coin trading.

Crypto coin trading

Here are some practical tips you can implement right away: additionally, it’s best not to complicate your analysis by listening to other traders’ success stories.

Top forex bonus list

Competing with others can only lead to unhealthy FOMO trades. Your skills will only improve if you concentrate on yourself, rather than buying coins because one of your friends suggested it.

15 must-read bitcoin & crypto trading tips (updated 2020)

Last updated aug 9, 2020 @ 15:14

Safety rules are written in blood. That statement is familiar to every soldier serving his or her country. Although we are not talking about a risk to human life, losing one’s expensive bitcoins by making trading mistakes is definitely not fun.

So how can one avoid such mistakes and stay in the green? First, it is essential to note that trading requires your attention and 100% focus. Secondly, trading is not for everyone. The following tips are easy to internalize because these tips were “written in blood” (my blood). However, it’s difficult to apply them in real time. After all, humans are not rational.

New trading tips for 2019

Have a reason for every trade

Enter a trading position only when you know why you’re entering it, and have a clear strategy in mind.

Not all traders are profitable since this is a zero-sum game (for everyone who benefits, someone else loses on the other side). Large whales drive the altcoin market – yes, the same ones responsible for placing huge blocks of hundreds of bitcoins on the order book.

The whales are just waiting patiently for innocent little fish like us until we make trading mistakes. Even if you aspire to trade daily, sometimes it is better to do nothing instead of jumping into the rushing water and exposing yourself to substantial losses. There are days when you only keep your profits by not trading at all.

Clear stops, clear targets: have a plan

For each position, we must set a precise target level at which to take profit and, more importantly, a stop-loss level for cutting losses. Setting a stop-loss involves selecting the maximum amount of losses we can afford before the position gets closed.

Several factors must be considered in order to correctly choose a stop loss level. Most traders fail when they fall in love with their position or the coin itself.

They may say, “it will turn around and I will get out of this trade with a minimal loss, I’m sure.” they’re letting their egos take control of them, and compared to the traditional stock market where 2-3% is considered extreme volatility, crypto trades are a lot riskier: it’s not unusual to find a coin dumping by 80% just in a few hours, and nobody wants to be the one who is left holding it.

FOMO: be aware

Meet FOMO, or fear of missing out. Indeed, it isn’t fun to see such situations from the outside – when a specific coin is being pumped up like crazy with huge two-digit gains in just minutes.

That bold green candle yells at you, “you are the only one not holding me.” at exactly this point you will notice lame people flooding reddit and telegram trading groups and the exchanges’ trollboxes to talk about the ongoing pump.

A classic pump and dump. Source: steemit

What do we do then? It’s very simple: keep moving forward. True, it’s possible that many people ahead of us may have caught the rise and that the market could continue in one direction, but bare in mind that the whales (as mentioned above) are just waiting for small buyers on the way up to sell them the coins they bought for lower prices. The price has become high, and it’s clear that the current lucky holders only consist of those little fish. Needless to say, the next step is usually the bright red candle which sells through the whole order book.

Risk management: it’s not just for crypto

Pigs get fat; hogs get slaughtered. This statement tells the story of profits from our perspective. To be a profitable trader, you never look for the edge of the movement. You look for the small gains that will accumulate into a big one.

Manage risk wisely across your portfolio. For example, you should never invest more than a small percentage of your portfolio in a non-liquid (very high risk) market. To those positions we will assign greater tolerance; the stop and target levels will be chosen far from the buying level.

Cryptocurrencies are traded against bitcoin

The underlying asset creates volatile market conditions: most altcoins are mostly traded against bitcoin, rather than fiat.

Bitcoin is a volatile asset compared to almost any fiat currency, and this fact should be taken into consideration, especially when the price of bitcoin is moving sharply.

In past years, it was common for bitcoin and altcoins to exhibit an inverse correlation, i.E., when bitcoin rose, altcoins prices would fall against bitcoin, and vice versa. However, since 2018 the correlation has been unclear.

Regardless, when bitcoin is volatile, trading conditions are kind of foggy. During periods of fog, we can’t see far ahead, so it is better to have close targets and stop-losses set – or to not trade at all.

Must-have tips for trading altcoins

Most altcoins lose value over time. They may bleed in value slowly or rapidly, but the fact that the list of the largest 20 altcoins by market cap has changed so much over the past few years tells us a lot.

Take this into account when holding large amounts of altcoins for the medium and the longer term, and, of course, choose them wisely.

If you are considering holding altcoins for the longer term or building a long-term crypto portfolio, keep in mind that the projects or altcoins that have higher daily trading volumes and significant community backing are probably here to stay.

You should follow the coin’s chart and identify low and stable periods. Such periods are likely to be consolidation or accumulation periods on the part of whales, and when the right time comes, accompanied by positive project announcements, the pump will start, and the whales will sell for profit.

Icos, ieos and token sales

A word about public icos (or ieos, as they are now known in 2019): these are crypto token sales. Many new projects choose to hold a crowd-sale where they offer investors an early opportunity to buy a share of the project’s tokens at what is meant to be a reasonable price.

The motivation for investors is that the token will get listed on the secondary market, i.E. The crypto exchanges, and will yield a nice profit for early investors. In recent years, there have been many successful token sales: rois of 10x were not uncommon.

One example was augur’s ICO, which yielded investors a phenomenal 15x return on investment. Okay, but what’s the catch? Not all such projects reward their investors. Many sales proved to be complete scams. Not only were they not being traded at all, but some projects disappeared with the money, never to be heard from again.

So how do you know whether you should invest in a given token sale? We recently wrote about this, and a key factor is the amount of money the project aims to raise. A project which raises too little will probably not be able to develop a working product, while a project which raises a huge amount won’t have enough investors left out there to buy the tokens on the secondary market. Most important of all is risk management. Never put all your eggs in one basket and invest too much of your portfolio in one IEO or ICO. They are considered high risk.

Start today, right now

Here are some practical tips you can implement right away:

- Fees, fees, fees: making multiple trades means paying more fees. It’s always advisable and cheaper to post a new order to the order book as a market maker, and not to buy from the order book (taker).

- No pressure: don’t start trading unless you have the optimal conditions for making the right decisions, and always know when and how to get out of the trade (have a trading plan). Pressure always hurts your trading game. Never rush! Wait for the next opportunity; you will get there.

- Setting targets and placing sell orders: always set your targets by placing sell orders. You don’t know when a whale will pump up your coin to clean up the supply on the order book (and pay a reduced fee on the “maker” side, remember?).

Augur sell-off. Down 75% in one second, then back up

- A successful strategy involves placing low buy orders. The above chart is taken from the poloniex exchange in december 2016: a crazy flash crash took place, and augur’s price declined by 75%. After a short while, the market recovered completely. Anyone who had set low buy orders could easily double or triple his or her investment. Placing low buy orders requires special care; don’t wake up when you’re far away from the market to find that your buy order has executed and now the price is even lower.

- Buy the rumor, sell the news. When major news outlets publish news, it’s usually the right time to say goodbye to the coin involved.

- You have made a profitable trade, but as always, the moment you sold, the coin runs up again. First, meet murphy’s law. Second, read over what was written here previously and never enter a position under pressure or chase the FOMO. As long as there is profit, you are okay. Go on to your next trade and don’t find yourself losing it.

- Leave your ego aside. The goal here is not to be right with your trades, but to gain profit. Do not waste resources (time and money) trying to prove you should’ve been entering this or that position. Remember, no trader doesn’t sometimes lose. The equation is simple – the number of winning trades should be higher than losing trades.

- Bear markets are sometimes the best times to make profits: if you haven’t heard about it, learn how you can short bitcoin and other cryptocurrencies.

New bitcoin & altcoin trading tips for 2019

Ignore financial news and other traders

Don’t waste your time reading the news. The vast majority of the published analysis and news posts you will find in the traditional press is biased or promoted by a particular company or group. Better to invest your time in learning the long-term trends by reading financial pieces, not everyday news. You won’t find your next investment opportunity by reading the news. The opposite is true: if it appears in the news, then others must know about it, so it probably has no value. Buy the rumor, sell the news, remember?

Additionally, it’s best not to complicate your analysis by listening to other traders’ success stories. Competing with others can only lead to unhealthy FOMO trades. Your skills will only improve if you concentrate on yourself, rather than buying coins because one of your friends suggested it.

Have a long-term end goal

In the end, remember that you are trading for a reason while investing funds that you could completely lose. Examples of goals could be quitting your job, buying a house, or retiring.

Thus, set your short and long-term goals and trade accordingly, i.E., do not risk funds you will need in the short term. Your overall goal should be aligned with all of your trading positions as well as your risk management.

Identify crypto scams in seconds

Altcoins are very tempting, but remember that the cryptocurrency world received an enormous amount of attention, which brought many scammers into the field. The idea that “you are responsible for your funds, not the bank” is indeed revolutionary, but it can also lead inexperienced newbies to send their funds away, thinking about a “high ROI” or investing in an ICO or IEO that will “change the world.” unlike traditional finance, cryptocurrency has no insurance. Once you send your funds, they are no longer yours.

Learn how to identify crypto scams. Unfortunately, there are plenty of them around. Many entrepreneurs want your funds; not all of them want them for the right reasons. Don’t waste time; think about why you should not be investing instead of contributing your valuable cryptocurrency.

What you need to know about your long-term portfolio

In the long term, only a few cryptocurrencies will survive. Looking at the top 20 coins ranked by market cap, you can easily see that beyond first place, which of course belongs to bitcoin, most of the rest change from year to year. Since many won’t survive, you need to think wisely about which altcoins to include in your long-term crypto portfolio and what percentage portion of your portfolio each of those altcoins will comprise. You can’t time the market; another crypto bubble could develop at any time.

The profit is temporary until you meet the fiat

The fiat value of your crypto portfolio is key. As long as the everyday world’s money is fiat (dollars, euros and such), you should measure your total portfolio’s value in terms of fiat currency.

Remember, until the fiat reaches your bank account, you have not cashed out. Cryptocurrency has no insurance, and if you are not following security rules, you can quickly lose your funds despite being a successful crypto trader. Many investors saw their fiat holdings disappear despite holding them on exchanges after selling their crypto. The most famous example of this was the mt. Gox collapse in 2014. However, quadriga CX’s recent incident reminds us that when it comes to exchanges, things happen.

Create a group with your trading buddies

There is a lot of information associated with the crypto world, and things move very quickly. In order to stay up to date, find a reliable group of friends with whom to share trading ideas as well as fundamental and technical data. Whether on telegram or whatsapp, chart groups contain members who are worth listening to – and others who should be ignored.

Enjoyed these tips? There’s more

We will appreciate your share! We’ve also published more trading tips and a guide to common trading mistakes, which you can read here.

SPECIAL OFFER (sponsored) binance futures 50 USDT FREE voucher: use this link to register & get 10% off fees and 50 USDT when trading 500 USDT (limited offer).

Primexbt special offer: use this link to register & enter CRYPTOPOTATO35 code to get 35% free bonus on any deposit up to 1 BTC.

About the author

Yuval gov view more posts by this author

Yuval gov has over 15 years of trading experience in the stock exchange, graduated from TAU - economics and management. Fell in love with the crypto space. Does crossfit to get away from FOMO. Contact yuval: linkedin

Martin lewis: spread the word – don’t believe scam bitcoin code or bitcoin trading ads

I don’t do adverts. If you ever see one with my face or name on it, it is without my permission, and usually a scam. Admittedly some are supposedly legit firms bending the rules to imply a link (though do you really trust firms that’d do that anyway?).

The latest facebook ad plague with me in is the ‘bitcoin code’ or ‘bitcoin trader’ scam, which lies saying I suggest investing in it. In fact they’re not even about bitcoin (see my real view on bitcoin), but about binary trading, something no one should touch with a bargepole.

The ad looks like this…

Sadly we’ve already heard of people who’ve lost over £20,000 saying: “I only pursued it because I thought it was recommended by martin.” the thought of that makes me feel physically sick. I’ve spent my career trying to campaign for financial justice and now these b*****ds leach off that trust to rob vulnerable people.

Please help by doing two things (thanks in advance)…

- Spread the word. An easy way is to share this facebook post or retweet this twitter post or link to this blog.

- Report the scam. If one pops into your timeline, report it to facebook (or elsewhere) and post in the comments that “this is a fake ad, martin lewis warns against this, do not trust it.”

And yes, it’s been reported to facebook many times. Yet its systems are abysmal – instead of using image recognition to proactively block, it takes scammers’ money and relies on people reporting them.

Cryptocurrency trading

Find out how to get started trading cryptocurrency in this step-by-step guide.

Etoro cryptocurrency trading

- Buy bitcoin and 15 other cryptocurrencies

- Copy top-performing traders

- Disclaimer: virtual currencies are highly volatile. Your capital is at risk

- BC bitcoin

- CEX.IO

- Coinjar

- Etoro

- EXMO

- Gemini

- Kraken

- Paybis

- Revolut

- A-Z list of exchanges

- Trezor

- Ledger nano S

- Keepkey

- Jaxx

- Mycelium

- Electrum

- Exodus

- Copay

- Edge

- A-Z list of wallets

- Bitcoin (BTC)

- Ethereum (ETH)

- Ripple (XRP)

- Bitcoin cash (BCH)

- EOS (EOS)

- Litecoin (LTC)

- Cardano (ADA)

- IOTA (MIOTA)

- Stellar (XLM)

- TRON (TRX)

- NEO (NEO)

- A-Z list of altcoins

There are lots of different ways of making a profit (or losing money) from cryptocurrency. Trading is one of the most popular.

This guide explains where to begin, including how to choose a trading style, how to devise a trading plan, what to look for in a trading platform and things to consider.

What's in this guide?

How to trade cryptocurrency

There are five steps to getting started:

- Do your research and work out whether cryptocurrency trading is right for you.

- Decide whether you want to do long term or short term trading.

- Choose the trading method that’s right for you.

- Learn how to place trades and read charts.

- Choose an exchange and start trading.

This guide walks you through each of these steps.

The different types of cryptocurrency trading

The first step is to decide between long term or short term cryptocurrency trading. Both are very different.

Long-term trading

Long-term traders buy and hold cryptocurrencies over a long period of weeks, months or even years, with the intention of selling at a profit or using it later.

If you believe the value of a cryptocurrency will grow in the long run, and don’t want the stress of actively trading, then this might be your style, and a good first step may be learning how to safely buy and hold cryptocurrency.

Short-term trading

Short-term trading is about taking advantage of short term cryptocurrency price swings by creating and executing a trading strategy.

It’s more active, stressful and risky than long-term trading, but it also offers faster and larger potential returns for those who do it right, and lets you profit from cryptocurrency prices dropping as well as rising.

If this is what you’re looking for, you can either read on for a beginner’s guide or compare cryptocurrency trading platforms to get started.

Trading means accumulating more crypto or fiat currency through repeatedly buying low and selling high.

If you do it right, your funds grow. If you do it wrong, your funds shrink over time, as bad trades and changing markets eat away at your holdings.

The value of your cryptocurrency will rise and fall, but there’s no risk of immediately losing all your money to a bad trade.

- Good for: beginners, accumulating cryptocurrency, avoiding excessive risks, keeping things simple.

- Not so good for: high-risk high-reward strategies, profiting from markets dropping.

Cryptocurrency trading for beginners

Before you can start trading, you need to be sure cryptocurrency trading is right for your circumstances, and that you understand the risks associated with it. You’ll also need to know what all the buttons do.

Fortunately, most cryptocurrency exchanges have similar-looking market pages, and you can safely ignore a lot of the information on the page.

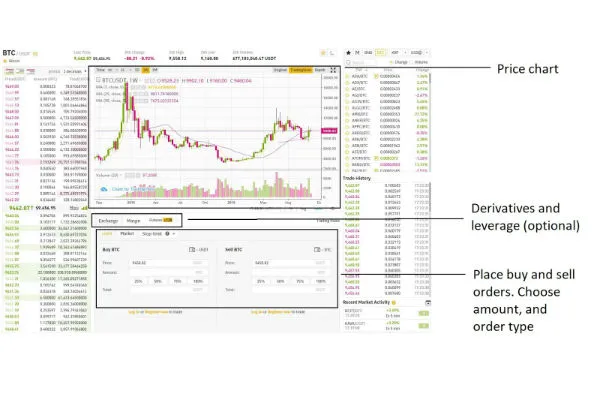

Here’s an example from the binance cryptocurrency trading platform, showing the bitcoin/USDT market with the important parts annotated.

Warning: binance offers cryptocurrency derivatives which the regulator banned from sale to UK consumers in january 2021.

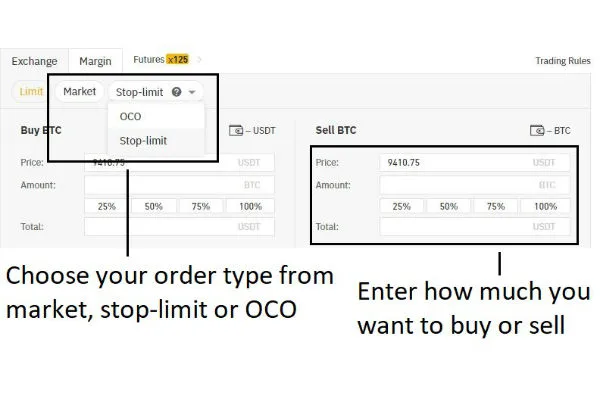

The red and green box at the top is the price chart. At the bottom is where you place your buy and sell orders. There are two things to pay attention to here: your order type and the amount you want to buy or sell.

In this case, binance offers three basic order types: market, stop-limit and OCO.

- Market: place a buy or sell order at the current market price, to execute immediately.

- Stop-limit: once you select this, you will be prompted to choose a separate stop price, and limit price. Once the asset (bitcoin in this case) reaches the stop price, it will sell for at least the limit price, if possible.

- OCO: “one cancels the other.” this is two stop-limit orders combined, where one cancels the other if it’s triggered.

Market and stop-limit are the basic order types you’ll find on almost all exchanges, while OCO is a bit less common. Different exchanges will sometimes have different order types, and slightly different rules about how they can be placed.

How to make a trading plan

The difference between gambling and trading is having a plan. Creating a plan is a three step process:

1. Look for patterns

The basic principle of reading charts and creating trading plans is to look for patterns in previous price movements, and then using those to try to predict future movements.

Some patterns emerge frequently enough across multiple markets that they’re given their own names, such as resistance and support. But others are much more obscure, and are never given names of their own.

For example, if you think bitcoin goes up when ethereum goes down, or that bitcoin rises when the US dollar falls relative to the chinese renmibi, or anything else you can think of, that could be a pattern you can trade on.

2. Make a plan and stick to it

The two basic components of a trading plan are:

- A place where you take profits

- A place where you cut your losses

For example, someone’s basic plan might be to sell 33% of their bitcoin for every $1,000 the price goes up (taking profits), or to immediately sell all their bitcoin if prices drop below the current support line (cutting losses). To lay out this plan, they could set up a series of stop-limit orders.

This is not necessarily a good plan, but it would ensure that the amount they gain or lose is within sensible boundaries no matter what the market does.

As traders get more experienced, they can create increasingly sophisticated trading plans that tie together more market indicators, and allow for much more nuanced trading strategies.

Experienced traders typically use cryptocurrency trading bots to execute their strategies, because they tirelessly follow complex trading plans faster and more reliably than a human ever could.

3. Experiment

It’s good to test trading theories before throwing real money at them. Paper trading or backtesting can be useful here. Both features are often found on trading platforms.

Paper trading is a way of using fake money on the real markets, so you can test a trading strategy in real, current conditions. Backtesting is when you put a trading strategy through historical market movements to see how it would have performed.

If you’re a beginner trying to get your head around the basics of reading charts and spotting patterns, you may want to read the step-by-step guide to cryptocurrency technical analysis for a sense of how to start spotting patterns.

What to watch out for

Cryptocurrency trading incurs many of the risks of trading on any other market, as well as some unique challenges.

- Volatility. Cryptocurrency is volatile. This is one of the things that makes it attractive to traders, but it also makes it very risky. Double-digit intra-day price swings are common, and drastic shifts can happen in just minutes.

- Unregulated, manipulated markets. The cryptocurrency markets are largely unregulated compared to more traditional markets. It’s an open secret that wash trading and market manipulation are common. They’re also a lot less liquid than many other markets, which can contribute to the volatility and make it easier for well-moneyed “whales” to manipulate prices, force liquidations and similar. Exchanges themselves are sometimes accused of manipulating their own markets against their own customers.

- Inaccurate patterns. Markets will often follow patterns, but often they won’t. This is a risk when trading anything, but the unique characteristics of the cryptocurrency market means it’s a particular challenge there.

- Being over-exposed. Don’t bet more than you can afford to lose. Limit your exposure and consider setting up “take profit” and “stop loss” orders to limit your exposure in the event of drastic swings.

- Using excessive leverage. Many cryptocurrency exchanges will offer up to 100x leverage, dramatically magnifying the potential risks. The volatility of cryptocurrency, combined with high leverage trading, can see positions be liquidated extremely quickly.

- Not knowing when to fold. Whether you’re up or down, it’s important to know when to close a position and either take profits, or cut your losses.

Compare cryptocurrency trading platforms

When choosing a cryptocurrency trading platform, consider factors such as whether it offers derivatives or leverage, what kind of order types it allows, and how easily it can integrate with cryptocurrency trading bots.

Where to trade cryptocurrency in the UK

Warning: your capital is at risk. The value of investments can fall as well as rise, and you may get back less than you invested. Past performance is no guarantee of future results. This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering. It is not a recommendation to trade

All of the following platforms are available in the UK and offer cryptocurrency trading.

Crypto trading bot in 2021 | best 12 bitcoin trading bots

Nowadays, lots of teams provide paid and free crypto trading bots for bitcoin and other cryptocurrency. It’s a hassle for a crypto trader like you and me to choose between these services

When should you use a crypto trading bot?

Many functions that a well-executed bot can conduct for you are rebalancing, portfolio management, data collection, smart order routing, etc.

What exactly can you improve with trading bots? Let’s take a look.

#1 repetitive tasks

Repetitive tasks consume a lot of time and effort. A crypto trading bot will allow you to virtually “copy and paste” specific tasks to conduct trades with ease. One of the best ways where bots can help with repetition is in periodic rebalances. If you want to conduct hourly rebalances, then you’ll need to, as the name suggests, rebalance your portfolio every hour. So, you have two options:

- Set the alarm every hour to rebalance the portfolio and lose your sanity in the process.

- Create a trading bot and program it to rebalance your portfolio every hour till the end of time.

#2 timing

Timing and achieving a high degree of accuracy in your trading is essential for trading. Every single trade that you make can have an enormous impact on your potential earning. Let’s take an example. Suppose the price of bitcoin is going down, and you want to sell your position the moment BTC hits the $8,750 support line. If you were to do this manually, you’d have to patiently and carefully observe the price chart, and even then, you may not pull the trigger at the right time. The bot can be easily programmed to monitor the market and execute a trade at the correct times.

#3 complications can be simplified

Consider the example of “smart order routing.”

- The idea is to route trades through numerous trading pairs.

- Every single trading pair needs to be carefully determined as per its timing, asset quantity, and trading price.

- This entire route needs to be finished within a specific time-limit before the market conditions change.

It seems pretty easy-to-understand, right? However, the execution of this trade could be nearly impossible. This is just one of the many examples of the several complexities that should be factored in while training. Some strategies could be almost impossible to implement.

Trading bots could be used to automate these complicated and seemingly impossible strategies with ease.

Crypto trading bot discounts and coupon codes ��

If you are looking for a free trading bot , try poinex , they only charge trading fee, not month on month fixed pricing.

Try altrady and get 40% discount (annual plan) and 10% (monthly plan) using coupon code COINMONKS

Try botcrypto , A simple yet powerful trading bot

Get 25$ credit which you can use for fees when you join mudrex

Try coinrule and get 7 days of free trial and 25% for 3 months using this link .

The best crypto trading bot in 2021

#1 quadency — A smarter way to trade and manage your crypto

The best part of quadency is the backtesting feature, with which you can do it based on data and numbers instead of shooting it in the dark. It’s also the most important feature for a crypto trading bot; it’s always nice to know the performance upon history data before using your money with the crypto trading bot.

Crypto trading signals – how they work

Want to get crypto trading signals on a regular basis? When you buy the “right” coins, you unlock the door to outstanding returns and that’s exactly where these crypto signals come into play – to help you recognize which cryptocurrencies have the greatest potential.

If this is your first time on our website, our team at trading strategy guides welcomes you. Make sure you hit the subscribe button, so you get your daily trade calls directly into your inbox. It is important to have a plan when you are trading the markets and, we make sure we cover every market with these live trade set up ideas.

The crypto trading signals can be based on multiple factors such as technical analysis, latest news and rumors, and market situation. If you wish, you can also opt for crypto trading signals provided by professional and experienced traders.

You can only benefit from these crypto signals if they are trustworthy and have a proven track record. Otherwise, it’s best to just do your own crypto trading charts analysis as in the end, it will probably yield better results.

Crypto coin trading requires some level of experience, which everyone lacks when they get started in this new business. Getting free crypto signals when you’re just getting your feet wet can be a good way to learn crypto coin trading.

Crypto trading signals - definition

Crypto trading signals are trading ideas or trade suggestions to buy or sell a particular coin at a certain price and time. These crypto trade signals are generated either manually by a professional trader, or by trading algorithms and bots that send the trade signals automatically.

Usually, the trade signals have also attached a take profit and a protective stop loss. Basically, your back is covered from all sides.

Nowadays, there are many crypto trading platforms that allow copy trading. If you really believe in your trading abilities you can use these crypto trading platforms to share with others your trades and earn an extra profit.

There are free crypto trade signals, but if you want something more reliable you need to pay a subscription fee to a crypto signal service provider. There are monthly subscription plans, quarterly subscription plans, and even annual subscription plans.

That crypto signal provider will send you the trade signal directly to your email, smartphone and through any other fastest means of communication.

The cryptocurrency trading signals are transmitted in a timely manner so you can take advantage of them.

Below is an example of a cryptocurrency trade signal:

We are going to explain to you what all the parts of the signal mean…

In layman terms, the above trade signal indicates to BUY bitcoin, at $7,450, using a take profit level of $8,200 and a stop-loss order at $7,000.

Without further ado, these are the five elements of a good cryptocurrency signal.

Crypto trading signal: action – buy/sell

The first element of a typical trade signal would indicate the action you need to take. If you’re trading cryptocurrencies, there are only two types of action you can take, either to buy or to sell.

Obviously, if there was a SELL shown instead of a BUY, you would have to hit the sell button. Click here to learn more about how to purchase cryptocurrency.

Crypto trading signal #2: what coin to buy/sell

The second element of a crypto trade signal would indicate what coin you need to buy (or sell). In other words, we need a particular instrument to buy or to sell.

In our example above, the trade signal was issued for bitcoin. Of course, that trade signals can be issued for ethereum, litecoin, ripple or any altcoins that the crypto signal service provider finds right to send.

There is nothing much to add here.

So far, we have learned that we have a buy signal for bitcoin.

Let’s now see the next element of a typical bitcoin trade signal.

Crypto trading signal #3: the price

All signals suppliers will give you the price at which you have to buy or sell a cryptocurrency. The crypto price can either be the current market price or a price that it’s above/below the current market price.

Now, if the cryptocurrency signal provider sends you a coin that needs to be bought or sold at the moment of signal’s issuing, then you need to act fast if you want to get the same price. In most instances, when you’re given a crypto signal with a current market price value you’ll get a slightly different price.

You might be using a different cryptocurrency exchange that has slightly different prices, or due to the short-term high volatility, the market might be moving too fast to catch the same price. An automated solution like the arbitraging trading software would resolve this issue.

You can still take advantage of this type of crypto signal if the market didn’t move that much, so a good portion of your potential profit to vanish away.

Crypto trading signal #4: take profit and stop loss orders

All signals should come with a take profit and stop loss order that offers you a decent risk to reward ratio. By using take profits and stop-loss orders you’re going to be able to leave the trade work for you without monitoring it all the time.

You’ll not need to guess where to close the trade. That’s a hard thing to do because this trending idea was not yours in the first place. And you don’t know what are the reasons behind the trade unless they are specified in advance.

Using a predetermined SL is a great way to minimize losses related to unfavorable changes in the crypto price.

Feature #5: additional information

Additional analysis and supporting crypto trading charts can be added by your favorite cryptocurrency trade signal provider. This additional information can come in various forms.

For example, the crypto signal provider can give you ways to trail your SL. Or to incorporate the time element and inform you to close the trade by a certain hour. Additionally, you can also receive a full analysis of the reasons that went into that specific trading idea.

The cryptocurrency trade signal can even contain some risk management as well.

Crypto trading charts

There are really two types of cryptocurrency traders. The first type of crypto traders is the one who wants to put in the necessary time and effort to learn by themselves the art of trading. The second kind of crypto traders is those who want to make money from the cryptocurrency market without too much effort.

If you find yourself in the second category, then you should try to use some of the best crypto signals to achieve your goals. Learning to cryptocurrency trading is not an easy task and something that you can do overnight, and that’s where a crypto signal provider comes to the rescue. Don't forget to check out the guide on cryptocurrency day trading.

However, if you find yourself in the first camp, you should try using crypto trading charts to analyze the crypto market. This will help you find the best trading signals for yourself.

When you follow a crypto signal service, you basically shift the responsibility onto someone else. In this situation, it’s very easy to blame someone else when the crypto strategy doesn’t work.

To trade the cryptocurrency market successfully, you need to take some responsibility. You need to understand the reasons behind the trade signal. By using your own crypto trading charts analysis you can gain more trust in the trade you take and you’ll be able to better manage your market exposure.

Conclusion – crypto coin trading signals

If you want to be an independent crypto trader and find real success, you need to learn the art of crypto trading and not rely on others. However, if you think that crypto trading signals can help you grow your crypto trading account into something very substantial, you can use some of the crypto trading platforms that allow copy crypto trading.

Should you subscribe to crypto trading signals?

It’s up to everyone to do his own research and decide for yourself if this is a good or a bad idea. However, you have to keep in mind that reliable cryptocurrency trading signals are very hard to find.

If you want to leave the whole decision-making process in the hands of a professional and if you don’t have enough time or experience to analyze the crypto market and come with your own trading ideas, relying on others can be a good idea.

Thank you for reading! You may also enjoy this guide on how to make money with cryptocurrency.

Feel free to leave any comments below, we do read them all and will respond.

Also, please give this strategy a 5 star if you enjoyed it!

Please share this trading strategy below and keep it for your own personal use! Thanks, traders!

Crypto trading bot in 2021 | best 12 bitcoin trading bots

Nowadays, lots of teams provide paid and free crypto trading bots for bitcoin and other cryptocurrency. It’s a hassle for a crypto trader like you and me to choose between these services

When should you use a crypto trading bot?

Many functions that a well-executed bot can conduct for you are rebalancing, portfolio management, data collection, smart order routing, etc.

What exactly can you improve with trading bots? Let’s take a look.

#1 repetitive tasks

Repetitive tasks consume a lot of time and effort. A crypto trading bot will allow you to virtually “copy and paste” specific tasks to conduct trades with ease. One of the best ways where bots can help with repetition is in periodic rebalances. If you want to conduct hourly rebalances, then you’ll need to, as the name suggests, rebalance your portfolio every hour. So, you have two options:

- Set the alarm every hour to rebalance the portfolio and lose your sanity in the process.

- Create a trading bot and program it to rebalance your portfolio every hour till the end of time.

#2 timing

Timing and achieving a high degree of accuracy in your trading is essential for trading. Every single trade that you make can have an enormous impact on your potential earning. Let’s take an example. Suppose the price of bitcoin is going down, and you want to sell your position the moment BTC hits the $8,750 support line. If you were to do this manually, you’d have to patiently and carefully observe the price chart, and even then, you may not pull the trigger at the right time. The bot can be easily programmed to monitor the market and execute a trade at the correct times.

#3 complications can be simplified

Consider the example of “smart order routing.”

- The idea is to route trades through numerous trading pairs.

- Every single trading pair needs to be carefully determined as per its timing, asset quantity, and trading price.

- This entire route needs to be finished within a specific time-limit before the market conditions change.

It seems pretty easy-to-understand, right? However, the execution of this trade could be nearly impossible. This is just one of the many examples of the several complexities that should be factored in while training. Some strategies could be almost impossible to implement.

Trading bots could be used to automate these complicated and seemingly impossible strategies with ease.

Crypto trading bot discounts and coupon codes ��

If you are looking for a free trading bot , try poinex , they only charge trading fee, not month on month fixed pricing.

Try altrady and get 40% discount (annual plan) and 10% (monthly plan) using coupon code COINMONKS

Try botcrypto , A simple yet powerful trading bot

Get 25$ credit which you can use for fees when you join mudrex

Try coinrule and get 7 days of free trial and 25% for 3 months using this link .

The best crypto trading bot in 2021

#1 quadency — A smarter way to trade and manage your crypto

The best part of quadency is the backtesting feature, with which you can do it based on data and numbers instead of shooting it in the dark. It’s also the most important feature for a crypto trading bot; it’s always nice to know the performance upon history data before using your money with the crypto trading bot.

Crypto coin trading

As an investor, you’re always looking for opportunities. And as a firm we are, too. That’s why TD ameritrade holding corporation has invested in erisx—an innovative company that offers traders access to cryptocurrency spot contracts, as well as futures contracts, on a single exchange.

Interested in cryptocurrency trading at TD ameritrade?

Email crypto@tdameritrade.Com for updates on when it'll be available.

What role will TD ameritrade play in erisx?

TD ameritrade is working with erisx. This strategic investment is yet another way to demonstrate our ongoing commitment to innovation—and bring our clients a best-in-class investing and trading experience.

When can I start trading these cryptocurrency products on erisx at TD ameritrade?

Email us so that we can keep you up to date on all of the latest info.

In the meantime, qualified clients can currently trade bitcoin futures at TD ameritrade.

Can I hold spot cryptocurrencies at TD ameritrade?

Be sure to email us so that we can keep you informed.

Erisx is a CFTC-regulated derivatives exchange and clearing organization that offers digital asset futures and spot contracts on one platform. By integrating digital asset products and technology into reliable, compliant, and robust capital markets workflows, erisx helps to make digital currency trading even more accessible to investors and traders, like you.

Learn more

If you want more information on erisx cryptocurrency trading products at TD ameritrade, here are some helpful resources.

Check the background of TD ameritrade on FINRA's brokercheck

Where smart investors get smarter SM

Call us 800-454-9272

#1 overall broker

Certain aspects of this offering are subject to regulatory approval. Erisx, eris exchange, and the erisx and eris exchange logos are trademarks of the eris exchange group of companies.

Futures trading services provided by TD ameritrade futures & forex LLC. Trading privileges subject to review and approval. Not all clients will quality.

Futures and futures options trading is speculative, and is not suitable for all investors. Please read the risk disclosure for futures and options prior to trading futures products.

Futures accounts are not protected by the securities investor protection corporation (SIPC).

Third-party firms mentioned above are separate from and not affiliated with TD ameritrade, which is not responsible for their services or policies.

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in australia, canada, hong kong, japan, saudi arabia, singapore, UK, and the countries of the european union.

TD ameritrade, inc., member FINRA/SIPC, a subsidiary of the charles schwab corporation. TD ameritrade is a trademark jointly owned by TD ameritrade IP company, inc. And the toronto-dominion bank. ©2021 charles schwab & co. Inc. All rights reserved.

Crypto coin trading

Your guide to the world of an open financial system. Get started with the easiest and most secure platform to buy and trade cryptocurrency.

Cheaper GBP deposits HOT

50% off for GBP deposits with the UK-issued cards

Deposit now

Margin trading

Trade with leverage as high as 100x

Trade now

CEX.IO staking

Earn by simply holding coins on CEX.IO

Learn more

Buy crypto with a card

Own crypto in minutes using your card

Buy now

Among the numerous websites providing bitcoin exchange services, the positive reputation of CEX.IO makes it worth the trust of the users all over the world. With the customer base of over 3,000,000, the platform can be recognized as the one that can be relied on. Starting your bitcoin trading on a platform with substantial history, you will benefit from a deep understanding of the market and customersвђ™ needs. We are constantly working on enhancing the security, ensuring the high level of customer support, and providing our users with new opportunities for trading on the bitcoin market. CEX.IO is regularly considering the addition of new coins, which was not so long the case with dash, zcash, and bitcoin cash. Still, every cryptocurrency has to pass a thorough check to be listed. Our due diligence and concerns about the quality of the service yield results. Now, we are moving forward to achieve the status of the best cryptocurrency exchange.

Best cryptocurrency exchange: what does it mean for us?

For you to be able to recognize a reliable online exchange and sort out those that appear to be too weak, we list several features, paying attention to which would help you to make the right choice. 1. Service safety and security. It is critical to ensure that your data will not be leaked to any other parties. Thus, the availability of certificates, like the PCI DSS, serves as the proof of serviceвђ™s safety. Besides, the regulation of exchanges is also important. For example, CEX.IO.

- Is officially registered in the UK;

- Has a money services business status in fincen;

- Complies with the legal requirements of the countries where it functions.

12 best cryptocurrency trading strategies | ultimate bitcoin & altcoin trading strategies

The cryptocurrency craze has become the talk of this year. More and more people are finding the blockchain technology exciting and profitable. As the technology is new, even the traders or investors are apparently new to this space. In order to assist the enthusiasts in this burgeoning crypto industry, we have created an easy-to-understand cryptocurrency strategy guide, which helps traders from committing any trading mistakes.

First, we shall discuss the daily cryptocurrency trading tips, and then we can discuss the common mistakes by the investors.

So, what are the ultimate crypto trading strategies for beginners & pros?

Learn as much as possible

Google can help power all sorts of knowledge regarding cryptocurrencies and blockchain-related applications. So, learn more about these topics. First of all, learn about all the crypto jargons like HODL and dynamics like “pump and dump”. Youtube has several blockchain and cryptocurrency-related material, which you can go through to build on your crypto knowledge. This is the foremost and one of the best crypto strategies to trade cryptocurrencies.

Follow crypto leaders and crypto news

Follow the tweets by the important people in the crypto world. Pay special attention to the crypto markets news. Positive news has a huge impact on the demand for a cryptocurrency. It also means to avoid the negative press which acts as FUD which is short for fear, uncertainty, and doubt. You can follow the latest crypto market news and insights as well.

Analyse about the coin you’re planning to invest

Ask yourself these four questions before finally giving into:

- Which market is the coin disrupting, for eg virtual payments, cloud storage, etc?

- What is the technology behind the currency? Is it easy to use, accessible and scalable)

- Research about the minds behind the creation of the coin, know its market potential, read about it more and more from sources like coinmarketcap.

- Last, but not the least what is the acceptance ratio of that coin. What is it that distinguishes this coin from its peers, i.E, what is the USP?

Advice: beware of the FOMO factor. Do not invest because you feel like you are missing on the opportunity. This is the top cryptocurrency trading strategy.

Install a price ticker

A price ticker will alert you whenever the price fluctuates. So, it's better to install on your phone. Depending on the price, you can make wise investment decisions. Actually, it is not the price which should be the sole factor to watch out before investing. You should always observe the market capitalization as that is an eminent factor. This is one of the common day to day altcoin trading strategy (crypto trading strategy). One of the best crypto to day trade is EOS.

Trading bots

If you are not able to understand the difficult technology behind blockchain technology, you should start using a trading bot with API enabled will help do the trading for you. This is one of the best cryptocurrency trading system for amateur traders.

HODL in the crypto world means holding onto your cryptocurrencies when things are not going as planned. HODL is not a typo after it appeared in the bitcoin talk forum by a member named gamkyubi in 2013 under the thread “I am hodling”. (crypto trading tips 2019)

Let’s talk about the mistakes which can lead to a great loss:

Crypto trading mistakes

Chasing pump and dump schemes

Pump and dump is a scheme that boosts the price through recommendations based on false, misleading or greatly exaggerated statements. So, it's better to not fall in these traps.

Not diversifying your portfolio to protect your investment

The most effective strategy for minimizing risk is diversification. A well-diversified portfolio consists of different types of securities from diverse industries, with varying degrees of risk. While diversification can’t guarantee against a loss, it is the most important component to helping you reach your long-range financial goals, while minimizing your risk.

Never let FOMO ( fear of missing out ) control your emotions. Try to feel and think logically to shatter the dreams of high returns. When you notice the market going up, try to avoid feeling like investing in the hopes of it going higher.

Not protecting your accounts with 2-factor authentication

Two-factor authentication, or 2FA, adds an extra layer of security to your account.

When logging into your account, in addition to your email and password you'll enter a code generated by an authentication app on your smartphone. This secures the account.

Falling for phishing scams and email account scams or airdrop scams

Falling for an email scam is something that can happen to anyone. It’s a frightening concept and one that frequently results in undiluted panic. Also known as a phishing scam, it involves using email and fraudulent websites to steal sensitive information such as passwords, credit card numbers, account data, addresses, and more.

With the increasing popularity of cryptocurrency airdrops, it is no surprise that there are also many scams out there.

Losing your private keys

This may be the greatest mistake in the crypto community to date. If you’re unfamiliar with what your “private keys” are, or what types of wallets you should be using, check out this article: https://coinswitch.Co/news/top-10-multi-cryptocurrency-wallets

Losing private keys will waste all your money as you can’t do anything if you have forgotten the password. These are the cryptocurrencies tricks which should help you become an informed investor. It will save you from making whimsical decisions. At the same time, never ever dare to commit any of the crypto mistakes mentioned above, especially the last point.

Frequently asked questions (FAQ)

1. How do you trade in cryptocurrency?

You can trade in more than 300 cryptocurrencies here.

2. How to pick crypto for day trading?

You have to do a lot of research and analysis before picking or investing ant cryptocurrencies.

3. Can you make money in bitcoin trading?

Yes, you can, some of the investors turned into millionaires after making wise trading decisions.

4. Which coin is best for day trading?

There are more than one. You can go here to find out in a detailed manner.

Interested in buying cryptos? You can exchange more than 300 cryptocurrencies at best rates from coinswitch instantly.

So, let's see, what we have: how to trade bitcoin and altcoins - the complete guide for beginners and experienced traders. Trading cryptocurrencies is different from traditional stocks: FOMO, risk management, diversification, and more. At crypto coin trading

Contents

- Top forex bonus list

- 15 must-read bitcoin & crypto trading tips (updated 2020)

- New trading tips for 2019

- Have a reason for every trade

- Clear stops, clear targets: have a plan

- FOMO: be aware

- Risk management: it’s not just for crypto

- Cryptocurrencies are traded against bitcoin

- Must-have tips for trading altcoins

- Icos, ieos and token sales

- Start today, right now

- New bitcoin & altcoin trading tips for 2019

- Ignore financial news and other traders

- Have a long-term end goal

- Identify crypto scams in seconds

- What you need to know about your long-term portfolio

- The profit is temporary until you meet the fiat

- Create a group with your trading buddies

- Enjoyed these tips? There’s more

- Martin lewis: spread the word – don’t believe scam bitcoin code or bitcoin trading ads

- Cryptocurrency trading

- Find out how to get started trading cryptocurrency in this step-by-step guide.

- What's in this guide?

- How to trade cryptocurrency

- The different types of cryptocurrency trading

- Cryptocurrency trading for beginners

- How to make a trading plan

- What to watch out for

- Compare cryptocurrency trading platforms

- Where to trade cryptocurrency in the UK

- Crypto trading bot in 2021 | best 12 bitcoin trading bots

- Nowadays, lots of teams provide paid and free crypto trading bots for bitcoin and other...

- When should you use a crypto trading bot?

- #1 repetitive tasks

- #2 timing

- #3 complications can be simplified

- Crypto trading bot discounts and coupon codes ��

- The best crypto trading bot in 2021

- #1 quadency — A smarter way to trade and manage your crypto

- Crypto trading signals – how they work

- Crypto trading signals - definition

- Crypto trading signal: action – buy/sell

- Crypto trading signal #2: what coin to buy/sell

- Crypto trading signal #3: the price

- Crypto trading signal #4: take profit and stop loss orders

- Feature #5: additional information

- Crypto trading charts

- Conclusion – crypto coin trading signals

- Crypto trading bot in 2021 | best 12 bitcoin trading bots

- Nowadays, lots of teams provide paid and free crypto trading bots for bitcoin and other...

- When should you use a crypto trading bot?

- #1 repetitive tasks

- #2 timing

- #3 complications can be simplified

- Crypto trading bot discounts and coupon codes ��

- The best crypto trading bot in 2021

- #1 quadency — A smarter way to trade and manage your crypto

- Crypto coin trading

- What role will TD ameritrade play in erisx?

- When can I start trading these cryptocurrency products on erisx at TD ameritrade?

- Crypto coin trading

- Cheaper GBP deposits HOT

- Margin trading

- CEX.IO staking

- Buy crypto with a card

- Best cryptocurrency exchange: what does it mean for us?

- 12 best cryptocurrency trading strategies | ultimate bitcoin & altcoin trading strategies

- So, what are the ultimate crypto trading strategies for beginners & pros?

- Learn as much as possible

- Follow crypto leaders and crypto news

- Analyse about the coin you’re planning to invest

- Install a price ticker

- Trading bots

- Crypto trading mistakes

- Chasing pump and dump schemes

- Not diversifying your portfolio to protect your investment

- Not protecting your accounts with 2-factor authentication

- Falling for phishing scams and email account scams or airdrop scams

- Losing your private keys

- Frequently asked questions (FAQ)

- 1. How do you trade in cryptocurrency?

- 2. How to pick crypto for day trading?

- 3. Can you make money in bitcoin trading?

- 4. Which coin is best for day trading?

Comments

Post a Comment