Understanding Cryptocurrency Trading Fees, crypto currency transfer fees.

Crypto currency transfer fees

A trading fee, or brokerage fee, is the amount of money charged by an exchange, broker, or OTC desk for the services that they provide you with – for example, executing your trades and providing you with a platform where your trades can be completed.

Top forex bonus list

If it weren’t for an exchange or a broker, traders would find it difficult to buy or sell cryptocurrency. Even if an individual is willing to sell their crypto and an individual is looking to buy crypto, without a marketplace like an exchange, broker, or OTC desk, the buyer and seller may never be able to connect and execute the trade. Therefore, exchanges and brokers serve as the middlemen who facilitate these transactions between buyers and sellers. However, they charge a fee for the service that they provide.

Understanding cryptocurrency trading fees

Trading fees can be a little hard to navigate. Let’s clear up the confusion.

Paying a trading or brokerage fee is unavoidable when you buy and sell cryptocurrency through a brokerage, exchange, or over-the-counter service (OTC desk). But have you ever wondered why exchanges, brokers, and OTC services charge a fee, how trading fees affect your net return, or, if you are new to trading, what a trading fee is?

To give traders a better understanding of trading fees and to give them the knowledge they need to make optimal decisions when it comes to picking a crypto brokerage, exchange, or over-the-counter service, let’s took a closer look at trading fees, why they are charged, how trading fees affect a trader’s net return, and how to reduce trading expenses.

What are trading fees?

A trading fee, or brokerage fee, is the amount of money charged by an exchange, broker, or OTC desk for the services that they provide you with – for example, executing your trades and providing you with a platform where your trades can be completed.

On nearly all exchanges, a fee, which is usually a percentage of the total transaction amount, a flat rate, or a combination of the two, is charged every time you buy or a sell an asset.

Why A re T rading F ees C harged ?

If it weren’t for an exchange or a broker, traders would find it difficult to buy or sell cryptocurrency. Even if an individual is willing to sell their crypto and an individual is looking to buy crypto, without a marketplace like an exchange, broker, or OTC desk, the buyer and seller may never be able to connect and execute the trade. Therefore, exchanges and brokers serve as the middlemen who facilitate these transactions between buyers and sellers. However, they charge a fee for the service that they provide.

In other words, trading/broker fees are service charges that go to the exchange or brokerage because they make it possible for traders to buy and sell cryptocurrency with ease. But, unfortunately, these same fees that allow you to easily buy and sell cryptocurrency also take away from your total trading profits.

How D o T rading F ees A ffect Y our N et R eturn?

Trading fees take away from your net return, the amount of money you receive after all your costs have been paid. Each time you buy cryptocurrency, a fee is taken from the initial amount of money you are looking to invest. And each time you sell cryptocurrency, a fee is taken out of the revenue you will be receiving from the trade. As a result, your net returns are decreased by the trading fee that is charged. Paying a trading fee is inevitable when you are buying and selling crypto through a brokerage, exchange, or OTC desk; however, there are ways to be proactive when it comes to reducing the trading fees that you have to pay.

How C an Y ou R educe Y our T rading F ees?

You can shop around to see which cryptocurrency exchanges have the lowest trading fees to reduce your trading fee expenses and increase the net return you receive on your trades.

For instance, cryptocurrency exchange bittrex charges 0.25% on every trade, but cryptocurrency exchange binance only charges 0.1% on the total amount per trade. These platforms are often better suited for highly experienced traders, so, oftentimes, easy-to-use brokerage platforms are the preferred method of trading.

When it comes to cryptocurrency brokerages, coinbase charges 1.49% per trade as well as a flat fee that ranges from $.99 to $2.99 (depending on how much you are transacting). On the other hand, cryptocurrency broker amplify only charges 1% per trade. In addition, when yo u pay your trading fees with the token native to their platform – the AMPX token – you receive 50% off on your trading fees. This means that the 1% fee that their brokerage charges will be reduced to only .50% per trade. An offering like this can save you significant amounts of money, especially if you buy and sell cryptocurrency frequently or in large amounts.

And when it comes to OTC desks, the OTC desk local bitcoins charges users who sell their cryptocurrency on the platform a 1% f ee on each completed transaction . Buyers on the local bitcoins platform do not explicitly pay a fee. However, sellers charge a premium that factors in the 1% fee they must pay; this premium implicitly includes the 1% fee. Compare that to the O TC desk, changelly, which charges their buyers a fixed fee of 0.5% .

As you can see, the trading fees, brokerage fees, and fees charged by OTC desks vary from business to business. That being said, it is best to shop around and leverage the internal mechanisms that some of these services offer so you can receive the lowest trading fees available.

Final thoughts

To optimize your net return from trading, you must be aware of trading fees. Make sure you shop around for a cryptocurrency broker, exchange, or OTC desk that works best for you and has relatively low fees. If you trade cryptocurrency frequently or in large amounts, you will find it advantageous to use one of the platforms with an internal token. Otherwise, you will be paying trading fees frequently. Depending on how often you trade and the size of your trades, this can add up to a significant amount of money, or can be rather expensive.

How to trade cryptocurrency without paying fees

How to buy and sell cryptocurrency without paying fees (or with paying minimal fees)

We explain how to trade cryptocurrency without paying fees (i.E., how to go from USD to cryptocurrency and back again without paying fees). [1] [2]

The page originally focused on using coinbase pro to avoid fees, this method was great as you could deposit dollars for free, then move your dollars to coinbase pro and place limit orders there for free. However, starting march 22nd 2019 coinbase pro ended free limit orders and then over the course of 2019 gradually replaced them with rather steep fees starting at 0.5% a trade (with discounts for volume).

Given the change to coinbase pro, there are no longer any major exchanges which allow trading without fees, however there are a few major exchanges that have reasonably low 0.1% fees including kucoin and binance that can be made even lower by using the tokens of these exchanges (when you use their tokens to pay your fees you get a discount on your trading fees).

Meanwhile, while there are some smaller exchanges that try to incentivize users with zero fees, but those are few and far between and generally zero fees are only promotional … and on often exchanges that don’t have the trust or liquidity of larger exchanges.

So here in may 2020, trading crypto without fees isn’t really a thing for the most part anymore.

Back in early 2019 cobinhood was an option for zero fee trading, but putting aside the fact cobinhood is no longer operational (see notes below), even at the time you had to get crypto into cobinhood to trade (which meant paying some fees to get your crypto and transfer it there).

So really, the good old zero fee coinbase pro days are gone, and there is no longer any way that we know of to trade crypto without paying fees!

Thus, this page is now going to be about “how to trade crypto at low fees / minimal fees.”

TIP: other exchanges aside from the ones noted here allow you to trade without fees or with low fees. This page just provides some examples. To do your own research google “fee schedule” + “the name of the exchange.” for example, see kraken’s fee schedule. [3]

UPDATE JANUARY 2020 (IMPORTANT UPDATE ON COBINHOOD): cobinhood was offering zero fee trading, they however announced they are temporarily shutting down. According to the announcement they are shutting down from jan 10 2020 to feb 9 2020 and reopening on feb 10th. In the meantime there are still other low fee and conditional offers to take advantage of. For example you can lower fees by holding and using some exchange tokens (for example holding and using BNB to pay fees on binance) and you can take advantage of conditions offers like the zero dollar USD trading on bittrex for those who trade over $30,000 in volume.

UPDATE MARCH 2019: limit orders on coinbase pro (GDAX) are no longer free starting march 22nd 2019. See: coinbase pro market structure update. Note, free limit orders are still offered to those who do over $50 million in volume. Also, if you trade over $100k worth of crypto, your fees are reduced to 0.1%. So if you trade a lot, coinbase pro sill offers reduced fees.

To keep fees low, as a rule of thumb, use bank deposits and limit orders: in general things like using bank wires to fund a crypto account, buying with a credit card, and using market orders instead of limit orders can result in higher fees. Not all exchanges will charges “makers” and “takers” different fees, but some will so keep this in mind.

Coinbase pro used to be called GDAX: GDAX is now called coinbase pro. At one point in time this page was about trading for free on GDAX. Times have changed, now it is about trading for minimal fees on exchanges like binance, kucoin, and coinbase pro.

Why does this matter? Most (if not all) user-friendly ways to buy cryptocurrency involve paying rather hefty fees. For example, if you have a coinbase.Com account (the app and website, not the coinbase pro exchange), you probably have already realized that buying cryptocurrency via the basic interface means paying fees (at least 1.4% per buy and 1.4% when you sell). That means you have to not only make money on cryptocurrency but have to make an extra 3% at least to pay off coinbase before you see a profit. That isn’t ideal, so we tell you how to avoid that.

NOTE: fee schedules are always subject to change. Please check the current fee schedule.

IMPORTANT: with cobinhood down and coinbase pro raising their fees, your best bet to reduce fees is using exchanges like binance and kucoin. Keep that in mind when reading the how-tos below.

How to trade with no fees

To trade with no fees you have to use a lower volume exchange. Cobinhood is one example. You can trade with no fees at cobinhood, meaning your only cost would be moving funds back and forth from cobinhood. Some other smaller exchanges will use zero fee trades to get users in the door as well.

- Fund a coinbase account using a bank deposit. You can follow the directions below for how to sign up and deposit funds in coinbase. We are doing this method to avoid fees, there is no fee for using your bank account to fund your account with dollars.

- Transfer your dollars to coinbase pro.

- Buy dai, BTC, ETH, LTC, or another coin that trades on cobinhood using coinbase pro (it is cheaper than using coinbase directly).

- Transfer the coin you bought to cobinhood.

- Optional: buy some cobinhood to lower margin fees and withdrawal fees.

- Trade a cobinhood for free.

- Transfer back to a coin that trades on coinbase to trade back to dollars.

With this method you’ll pay for your initial trade via coinbase pro and for your fees for sending crypto between exchanges, but you will otherwise pay zero fees.

TIP: you can also do commission free trading on robinhood. Robinhood is a custodial service without crypto deposit or withdrawal options. It has a limited selection of cryptocurrencies and only operates in some states. However, with those drawbacks noted, robinhood is a solution for saving fees when trading crypto.

How to trade at minimal fees using binance and kucoin

Here is how to trade at minimal fees (this is not the only way, just one way that will work):

- Fund a coinbase account using a bank deposit and then convert your dollars into USDC or simply use your bank account to buy USDC on coinbase. You can follow the directions below for how to sign up and deposit funds in coinbase, and then you can swap your dollars for USDC or buy USDC directly. We are doing this method to avoid fees, there is no fee for using your bank account to fund your account with dollars or for using your bank account to buy the USDC stable coin directly.

- Transfer your USDC to binance or kucoin.

- Use USDC to buy binance’s BNB or kucoin’s KCS. Using these tokens to pay fees will allow you to get a discount on fees.

- Go into your account settings and toggle the switch that let’s you use the exchange’s token to pay discounted fees.

- Use limit orders and market orders, you’ll pay the 0.1% rate minus the discount for using BNB or KCS respectively to bring your fees below 0.1%.

- Transfer back to USDC and send back to coinbase to swap USDC back to dollars.

Thus the only fees you’ll pay are your discounted trading fee and the fee to send USDC.

NOTE: alternatively, if you are a high volume trader, you can move your dollars or USDC to coinbase pro and trade until you qualify for lower fees.

How to use coinbase/GDAX to buy/sell cryptocurrency without paying any fees

NOTE: given the changes to GDAX’s name and fee structure, it is important to note that the information below is somewhat dated. For one, GDAX is now coinbase pro… for two, the method below will result in 0.15% fees instead of “$0” fees unless you are a high volume trader. That said, this method will still work until march 22nd for no fees and will work to get you set up with a coinbase account whenever you use it. Once the new schedule is officially in place I’ll update this section.

The idea below is to set up both coinbase and GDAX, to fund your account in USD, and then use limit orders on GDAX to trade. After that, you can use a platform like shapeshift to change bitcoin, litecoin, or ethereum into other altcoins like ripple and dash.

This isn’t the only way to trade cryptocurrency without paying fees, but it may be the simplest and most user-friendly option (especially in WA and NY where choices of exchanges are limited due to state regulations).

To trade cryptocurrency without paying any fees:

- Sign up for coinbase (click that link for instructions and a link that will net us both $10 in bitcoin). NOTE: you’ll need to at least attach your bank account (so you can withdraw and deposit money and verify yourself). You’ll probably also want to upload your ID. Verifying your identity via an ID and bank account will expand your withdrawal limits and spending limits and such.

- Sign up for coinbase’s GDAX (click that link for instructions, coinbase and GDAX use the same login).

- Deposit money into coinbase or GDAX (use a bank wire and pay a small fee, but get access quickly and avoid limits, or make a deposit and wait about 4-8 days and pay no fee, but face a limit of somewhere around $200 – $5,000). NOTE: there is no difference as far as I know between depositing into coinbase or GDAX.

- If it is that you deposited into coinbase (and not GDAX), then transfer your funds from your coinbase USD wallet to your GDAX account by clicking “deposit” in GDAX (on the top left under “balance”). NOTE: go to “deposit,” the button right next to “withdraw,” select the “coinbase account” tab, change the “source” to your USD wallet, and hit “withdraw” funds. All withdrawals and deposits are instant and free (same is true for moving coins between accounts).

- Now buy and sell your coins in GDAX. To avoid all fees you must only buy with limit orders and “let the order sit on the books.” in other words, you can’t buy/sell too close to the current price (as that could trigger a fill or partial fill of the order immediately and result in a fee). In simple terms, if your order sells too quick you pay a “taker” fee. NOTE: GDAX is intimidating to get used to, but ultra simple to use. Just turn of margin trading, set limit orders, and double check numbers before you hit the “place an order” button. See our page on GDAX for more.

- Once you have USD from your coin trading on GDAX, “withdraw” your USD from GDAX and put them in your USD wallet in coinbase (do not withdraw coins from GDAX and sell them on coinbase unless you want to pay the 1.4% fee; you must sell them on GDAX). NOTE: go to “withdraw,” the button right next to “deposit,” select the “coinbase account” tab, change the “destination” to your USD wallet, and hit “withdraw” funds).

- Now from coinbase go to “accounts,” go to your USD wallet, and hit “withdraw” to withdraw to your bank account.

And that is it, GDAX was your exchange, coinbase was like your “home base,” and the grand result is that instead of paying a 3% total fee or more for every buy/sell combo, you have now traded cryptocurrency paying no fees at all. Pretty sweet!

Considering we just potentially saved you some money, consider sending some coins to one of our wallets below:

NOTE: we didn’t create the video below, but it pairs well with the page.

TIP: I do not mean to say that one should never use coinbase. I do personally (and when I do, I have no problem paying the fees for the ease of use and risk they are taking regarding market volatility in doing my trade for me). First off, coinbase has an app, and GDAX doesn’t, that means one you can manage on the go, and the other you can’t. With that said, I only do this when the situation calls for it (for example, if the price of BTC dips, I only have my phone on me, and my limit orders aren’t set to take advantage of the dip on GDAX). In other words, one could say that theoretically, the goal would be for 95% of your trading to be done on GDAX with limit orders, 2.5% on GDAX with market buys, and 2.5% on coinbase. That 5% should be situations where sitting at a desktop and being methodical isn’t an option.

TIP: market buys on GDAX cost about .3%, that is way better than 1.4%. Still, 0% is better. Unless you can’t get a limit order to fill, there is almost never a good time to do a market buy / sell. Further, if you do a market buy / sell, make sure there are enough buy/sell orders on the books (as if the market is too thin, it can result in slippage).

ADVICE: to get your feet wet, you may want to use only coinbase. Then when you get to GDAX, you may want to try a few market buys. Once you start buying for real though, do yourself a favor, focus on GDAX and limit orders (using coinbase, market buys, and stops only when necessary).

By continuing to use the site, you agree to the use of cookies. More information accept

The cookie settings on this website are set to "allow cookies" to give you the best browsing experience possible. If you continue to use this website without changing your cookie settings or you click "accept" below then you are consenting to this.

Crypto currency transfer fees

These terms apply from 1st january . To view our previous terms, clickhere

Subscription

Add money

| first revolut card | free (but a delivery fee applies) |

| replacement revolut cards | ВЈ5 or currency equivalent per replacement (but a delivery fee applies) |

| custom card (design your own card in the revolut app) | ВЈ5 (but a delivery fee applies) if you need to replace a custom card, the same fee applies |

| special edition card | price per card varies depending on the edition (a delivery fee applies) if you need to replace a special edition card and the card is still on offer, you will need to pay the same fee again |

| delivery charge for revolut cards | £4.99 or currency equivalent for standard delivery €19.99 or currency equivalent for express delivery the delivery charge may be more depending on where you are sending the card. |

| Virtual revolut cards | free |

Spend

| ATM withdrawals | free withdrawals up to ВЈ200 per rolling month, then a fee of 2% of all withdrawals above this. |

The following charges might apply when you send a payment. If they do, weвђ™ll let you know in the revolut app before you make the payment.

If more than one of the fees in this вђњsendвђќ section could apply to a payment, weвђ™ll waive the lower fees and only apply the highest one.

| Instant transfers to other revolut users | free |

| local payments in your base currency | free |

| cross-border payments within the SEPA region in EUR and SEK | free this means payments in euros or swedish krona to non-revolut accounts that are outside your country but inside the single euro payments area region |

| cross-border payments outside the SEPA region | your first is free, then ВЈ0.5 each this means any other payments not covered above to non-revolut accounts that are outside your country and not via SWIFT |

Payments sent via SWIFT

ВЈ3 if the payment is in US dollars or ВЈ5 if it is in another currency

This means any payment where you send a payment to a country which is not in the national currency of that country. We'll let you know in the revolut app if any charges apply, before you make the transfer.

Exchange

Whenever you make a currency (including cryptocurrency or precious metal) exchange in the revolut app, we'll use an exchange rate based on our market data, which is based on foreign-exchange market. There is more information about our exchange rate in our crypto terms, personal terms, precious metals terms and business terms.

For certain exchanges we add a percentage (a mark-up), which changes according to when and how frequently the currencies are traded. These are set out below.

All standard users can make a set amount of exchanges at this rate every month. The set amount depends on what your base currency is and is set out on our fees page. Standard users who exchange more than this amount start paying a fair usage fee (but premium and metal customers do not).

Everyone on revolut whose base currency is GBP can ВЈ1,000 of exchanges at this rate each month. Standard customers who exchange more than this will begin paying a fair usage fee of 0.5% on any additional amount. A standard customer is anyone who is not a premium or metal customer. Premium and metal customers do not pay this fee.

This ВЈ1,000 is calculated across all types of exchanges, of all currencies (including cryptocurrencies) and precious metals, each monthly billing cycle (or, for standard users, each monthly anniversary of your sign up date). This means itвђ™s calculated as the total of all your exchanges in precious metals, cryptocurrencies and traditional currencies during cycle. For example, if you are a standard customer and exchange ВЈ600 into EUR in the last week of one month, and then exchange ВЈ600 into bitcoin in the first week of the next month, you will have exchanged ВЈ600 during the rolling month. This means you will be charged a fair usage fee of 0.5% on the additional ВЈ200.

We charge a fee of 1.0% for money currency and precious metal exchanges on weekends and bank holidays (in london) because exchange markets are generally closed and less currency and precious metals are traded during these times. You can avoid these fees by making your exchange on weekdays. We may charge this fee if these or other exchange markets are closed at other times too.

We also charge a fee of 1% for exchanges in money currencies that are traded less and so are not always easily available. These currencies are set out below.

We charge a fee for cryptocurrency exchanges. This fee is 2.5% for standard users (and 1.5% for premium and metal users). We donвђ™t charge you any other fees for this service.

The exchange rate for precious metals also does not include our fee for our precious metal services. This fee is 1.5% for standard and plus users (and 0.25% for premium and metal users) and is shown separately in the app when you make an exchange. We donвђ™t charge you any other fees for this service.

Weekday exchange fees

If you are a standard customer and make an exchange on a weekday, these are the fees that will apply to your exchange.

Remember, if you exchange more than ВЈ1,000 during the month (in foreign exchange, cryptocurrency or precious metals), a fair usage fee of 0.5% will begin to apply in addition to the fees below. You can avoid this fair usage fee by signing up to a metal or premium plan and receiving unlimited exchange.

| Standard money currencies: | |

|---|---|

| USD, GBP, EUR, AUD, CAD, NZD, CHF, JPY, SEK, HKD, NOK, SGD, DKK, PLN, CZK (or any other currency not listed as a вђњless traded money currencyвђќ below) | no fee |

| less traded money currencies: | |

|---|---|

| THB and UAH | 1.0% |

| cryptocurrencies | 2.5% |

| precious metals | 1.5% |

Weekend exchange fees for standard users

If you are a standard customer and make an exchange on a weekend, these are the fees that will apply to your exchange. You can avoid some of these fees by making an exchange on a weekday.

Remember, if you exchange more than ВЈ1,000 during the month, a fair usage fee of 0.5% will begin to apply in addition to the fees below. You can avoid this fair usage fee by signing up to a metal or premium plan and receiving unlimited exchange.

| Standard money currencies: | |

|---|---|

| USD, GBP, EUR, AUD, CAD, NZD, CHF, JPY, SEK, HKD, NOK, SGD, DKK, PLN, CZK (or any other currency not listed as a вђњless traded money currencyвђќ below) | 1.0% |

| less traded money currencies: | |

|---|---|

| THB and UAH | 2.0% |

| cryptocurrencies | 2.5% |

| precious metals | 2.25% |

The highest rate relevant to your conversion will apply. For example, for a conversion between USD and THB on a week day, we will apply the mark-up that applies to THB (1%), not the mark-up for USD (0%).

To view this in the regulator's standardised format please click here.

A glossary of the terms used in this document is available free of charge.

Understanding cryptocurrency trading fees

Trading fees can be a little hard to navigate. Let’s clear up the confusion.

Paying a trading or brokerage fee is unavoidable when you buy and sell cryptocurrency through a brokerage, exchange, or over-the-counter service (OTC desk). But have you ever wondered why exchanges, brokers, and OTC services charge a fee, how trading fees affect your net return, or, if you are new to trading, what a trading fee is?

To give traders a better understanding of trading fees and to give them the knowledge they need to make optimal decisions when it comes to picking a crypto brokerage, exchange, or over-the-counter service, let’s took a closer look at trading fees, why they are charged, how trading fees affect a trader’s net return, and how to reduce trading expenses.

What are trading fees?

A trading fee, or brokerage fee, is the amount of money charged by an exchange, broker, or OTC desk for the services that they provide you with – for example, executing your trades and providing you with a platform where your trades can be completed.

On nearly all exchanges, a fee, which is usually a percentage of the total transaction amount, a flat rate, or a combination of the two, is charged every time you buy or a sell an asset.

Why A re T rading F ees C harged ?

If it weren’t for an exchange or a broker, traders would find it difficult to buy or sell cryptocurrency. Even if an individual is willing to sell their crypto and an individual is looking to buy crypto, without a marketplace like an exchange, broker, or OTC desk, the buyer and seller may never be able to connect and execute the trade. Therefore, exchanges and brokers serve as the middlemen who facilitate these transactions between buyers and sellers. However, they charge a fee for the service that they provide.

In other words, trading/broker fees are service charges that go to the exchange or brokerage because they make it possible for traders to buy and sell cryptocurrency with ease. But, unfortunately, these same fees that allow you to easily buy and sell cryptocurrency also take away from your total trading profits.

How D o T rading F ees A ffect Y our N et R eturn?

Trading fees take away from your net return, the amount of money you receive after all your costs have been paid. Each time you buy cryptocurrency, a fee is taken from the initial amount of money you are looking to invest. And each time you sell cryptocurrency, a fee is taken out of the revenue you will be receiving from the trade. As a result, your net returns are decreased by the trading fee that is charged. Paying a trading fee is inevitable when you are buying and selling crypto through a brokerage, exchange, or OTC desk; however, there are ways to be proactive when it comes to reducing the trading fees that you have to pay.

How C an Y ou R educe Y our T rading F ees?

You can shop around to see which cryptocurrency exchanges have the lowest trading fees to reduce your trading fee expenses and increase the net return you receive on your trades.

For instance, cryptocurrency exchange bittrex charges 0.25% on every trade, but cryptocurrency exchange binance only charges 0.1% on the total amount per trade. These platforms are often better suited for highly experienced traders, so, oftentimes, easy-to-use brokerage platforms are the preferred method of trading.

When it comes to cryptocurrency brokerages, coinbase charges 1.49% per trade as well as a flat fee that ranges from $.99 to $2.99 (depending on how much you are transacting). On the other hand, cryptocurrency broker amplify only charges 1% per trade. In addition, when yo u pay your trading fees with the token native to their platform – the AMPX token – you receive 50% off on your trading fees. This means that the 1% fee that their brokerage charges will be reduced to only .50% per trade. An offering like this can save you significant amounts of money, especially if you buy and sell cryptocurrency frequently or in large amounts.

And when it comes to OTC desks, the OTC desk local bitcoins charges users who sell their cryptocurrency on the platform a 1% f ee on each completed transaction . Buyers on the local bitcoins platform do not explicitly pay a fee. However, sellers charge a premium that factors in the 1% fee they must pay; this premium implicitly includes the 1% fee. Compare that to the O TC desk, changelly, which charges their buyers a fixed fee of 0.5% .

As you can see, the trading fees, brokerage fees, and fees charged by OTC desks vary from business to business. That being said, it is best to shop around and leverage the internal mechanisms that some of these services offer so you can receive the lowest trading fees available.

Final thoughts

To optimize your net return from trading, you must be aware of trading fees. Make sure you shop around for a cryptocurrency broker, exchange, or OTC desk that works best for you and has relatively low fees. If you trade cryptocurrency frequently or in large amounts, you will find it advantageous to use one of the platforms with an internal token. Otherwise, you will be paying trading fees frequently. Depending on how often you trade and the size of your trades, this can add up to a significant amount of money, or can be rather expensive.

How to send and receive cryptocurrency

How to transfer cryptocurrency from one wallet to another (i.E. How to send/receive or withdraw/deposit bitcoin, ethereum, and other cryptos)

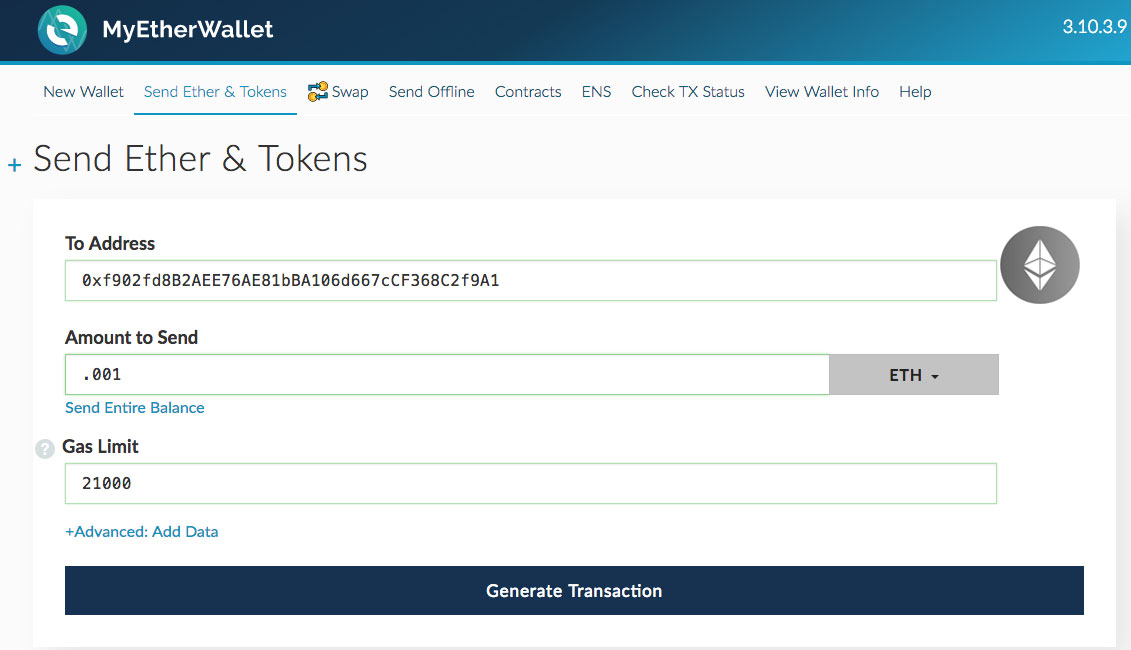

To send or receive cryptocurrency, first you need a cryptocurrency wallet, then you need to put in the public address of the recipient to send (or give your public address and have someone else put it in to receive).

Often this can be as easy as scanning the QR code related to the receiving address and typing in the amount you want to send, but in cases where you don’t have a QR code then copy and pasting the public address is the next best bet.

From there you just choose the amount you want to send, follow any other wallet-specific instructions (for example adding funds for fees if necessary), and then hit send (or your wallet’s equivalent).

Once that is done the transaction just needs to settle on the blockchain (how long that takes can differ between blockchains and depend on how much you paid in fees).

If you are anxious, you can always check the status of the transaction on the blockchain by using the block explorer of the coin you sent.

Below I’ll walk through the process in a bit more detail to make sure you fully understand each step.

TIP: the above process is sued to send/receive crypto, withdraw/deposit crypto, and buy things with crypto… it is how crypto transactions work regardless of what their purpose is ��

Sending and receiving cryptocurrencies

This process of sending and receiving cryptocurrencies like bitcoin, litecoin, ether, etc. Can differ slightly between wallets (as each coin has its own set of wallet options in which that cryptocurrency can be stored), but in general:

- Log into a wallet you have funds in.

- Go to the send/receive screen (by clicking the tab or button that says this or shows the proper icon).

- Choose whether you want to send or receive cryptocurrency. TIP: in general you must only send and receive like-coins. Meaning, you can only send/receive bitcoin-to-bitcoin, litecoin-to-litecoin, etc. (you can’t, for example, send bitcoin to an ethereum wallet or even bitcoin to a bitcoin cash wallet).

- For sending: enter the public wallet address of the recipient and choose the amount to send (make sure to account for transaction fees; you’ll need enough coins in your wallet to pay the fee). After you confirm the numbers, triple checking them to avoid silly mistakes then hit “send transaction” (or the equivalent) and verify the transaction one last time (confirming your public address and their public address is correct). TIP: you can write a note with your transaction to let the recipient know what transaction is for. TIP: using a QR code to copy an address helps avoid potential mistakes.

- For receiving: you don’t have to do anything except share your public wallet address with the sender. If you are in person, you can do this by letting them scan a QR code (if your wallet offers that).

If you are still uncertain, just look up the FAQ for the wallet you are using to verify you have the steps down. Check out the video below for more.

Tips and tricks for crypto transactions

Below are some more tips and tricks for crypto transactions.

Send a test amount to new addresses: before you send a lot of crypto, try sending a little bit as a test to make sure everything is working.

Using exchanges to send coins: for sending between exchanges you’ll want to use the withdraw and deposit buttons on the exchange next to the token you want to send. You must follow directions carefully, as sometimes you’ll need to follow specific directions. For example you might need to include a message, and sometimes you can only send whole numbers of coins. You may also need to use your authentication codes.

TIP: A wallet’s public address (or “public key”) looks like this: BTC wallet: 1bn9pjwsfwfwllebhagqe9ksusbct2jltm , ETH wallet: 0xf902fd8B2AEE76AE81bBA106d667cCF368C2f9A1 , LTC wallet: ldri8md4bu8icv3gkhv4nfvmoitv3axf6u … private keys look different. You should never share your private key, but as you can tell from our share above, sharing your public wallet address is not a problem. So again, do share the public address that looks like that (the worst that can happen is someone puts coins in it), but never share your private key or password (as that is like handing a stranger your wallet).

Crypto-to-crypto exchange: you can use a platform like shapeshift to turn one type of cryptocurrency into another. That can be helpful if you have bitcoin, but want to do a transaction in another coin.

Why didn’t my transaction go through? After you have sent some coins (AKA tokens AKA cryptocurrency), you’ll need to allow some time for the transaction to go through. It can be nearly instant, or it could take a few minutes, or if traffic is high, it could take hours. In most wallets, you can view pending transactions. Remember, the transaction will be added to the coin’s public blockchain (a digital ledger of transactions), so you’ll always be able to see an encrypted version of it. See etherescan.Io for an example of a website that let’s you view every public action on a blockchain.

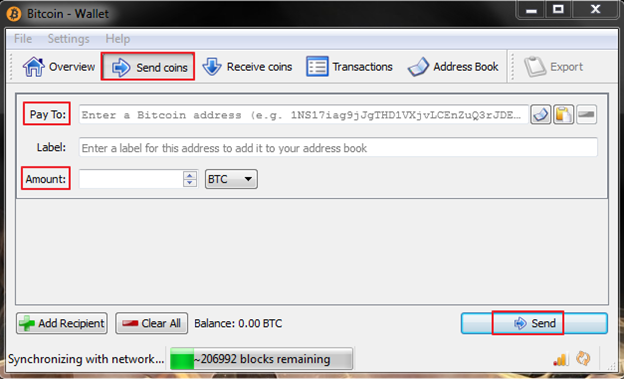

What it looks like in a bitcoin wallet.

By continuing to use the site, you agree to the use of cookies. More information accept

The cookie settings on this website are set to "allow cookies" to give you the best browsing experience possible. If you continue to use this website without changing your cookie settings or you click "accept" below then you are consenting to this.

The complete guide to coinbase fees (and how to avoid them)

Coinbase is one of the most widely used crypto exchanges around. It is the main go-to for people who like to invest in cryptocurrency since coinbase is one of the safest exchanges.

People love its user-friendly interface and convenience, but coinbase comes with some major fees you should be aware of. In fact, there's a fee for every transaction!

If you want to know how the process of coinbase fees works, including how to avoid them, continue reading this article. We've got some tips and information you're going to need. And, please, if you don't already have an account, use my link below to sign up:

A breakdown of coinbase fees

When you look over the coinbase user agreement, you might find that the fees are a bit confusing. Plus you have imposed limits and other regulations hidden in the small print.

In this section, we'll start with the fees.

There is a fee for every digital currency transaction you make on coinbase, whether you're buying or selling.

Buying fees

When you are buying BTC through coinbase, the amount of your fees is automatically deducted from the total amount of your order.

So, let's say, for example, you entered $100 into the app as the amount you are wishing to buy. For that transaction, you will be charged $2.99.

With that added fee, your full total for the transaction will end up being $100, but you will only get $97.01 worth of BTC.

Here is an example of a $100 BTC purchase while paying from a bank account:

Here is an example of a $1000 BTC purchase while paying from a bank account:

Here is an example of a $100 BTC purchase while paying from a debit card:

Selling fees

When you are selling on digital currency on coinbase, the fees you’re responsible for will be automatically deducted from the amount you initially entered. In this example, we’ll use $100 again.

If you key in $100 is the amount you’re selling, the fee is 1.49%. Since the fees are automatically deducted, the total amount you are selling the cryptocurrency for is going to be $98.51.

That is also the amount you will see applied for your payment method of choice. However, a full $100 of BTC is going to be removed from your account.

Where you’ll find your trading fees

Regardless of whether you’re buying or selling the digital currency BTC, you will always receive an automatic charge for any necessary fees. You will see a full write up of your transactions in digital and local currency in addition to the fees you’re being debited on the confirmation screen.

How much money does coinbase charge?

The fees charged by coinbase are pretty low. But they can add up, especially if you use the service often. You will see the buying and selling fees we described above.

There may also be fixed and variable fees depending on the amount of the transaction. And when your purchases are smaller, there is a flat fee charged.

Here are the flat fees for the smaller transactions:

- If you are buying or selling in the amount of $10.99 or less, the trading fee is $0.99

- If you are buying or selling between $11 and 26.49, the trading fee is $1.49

- If you are buying or selling from $26.50 to $51.99, the trading fee is $1.99

- If you are buying or selling from $52 to $78.05, the trading fee is $2.99

Now that we’ve covered the flat fees, here are the variables.

You can make a transaction of up to $200 within the coinbase system if you use either your bank account or USD wallet to buy or sell cryptocurrency.

However, if you are making a purchase or sale of $201 or more, the variable of 1.49% kicks in.

If you make a transaction of $78.06 or more, with a credit card or debit card and then transfer all your proceeds into your paypal account, you will have to pay a variable fee in the amount of 3.99%.

The possibility of bank fees

On top of the coinbase transaction fees, you may see some fees outside of your coinbase account – we’re talking fees from your own bank.

Some users are charged a 3% foreign transaction fee if a transaction is made via a credit card or debit card. The 3% is standard for international conversions, but it really depends on your bank.

The reason some people get these charges is that coinbase works with a company that’s based in london to process its credit card and debit card transactions.

Just so you can have a clear understanding of what to expect, you should speak with your bank to find out if those are fees you’ll ever need to worry about when buying digital currency.

Can you really avoid paying coinbase fees?

While coinbase’s fees are pretty reasonable in comparison to other brokers, it’s still nice to avoid paying them if you can. To start, you will need to start using coinbase pro. Read the article linked, if you’re unsure what’s the difference between coinbase and coinbase pro.

While its name implies that it is a version that should only be used for professional traders, don’t allow it to intimidate you. There are a few extra steps while using coinbase pro, but it isn’t much more difficult than the standard version you are already used to.

The main difference between the platforms is that the standard coinbase is a broker. In other words, it helps you get access to bitcoin and it charges you a fee for it.

Coinbase pro, on the other hand, is an exchange. This means you can freely buy and sell bitcoin on the open market.

One major bonus here is that if you already have a coinbase account you also have access to a coinbase pro account, you just may not have realized. You will simply log in using your same username and password.

And the fees are vastly different between the two.

Withdrawal fees

With coinbase, there isn’t a direct withdraw fee. However, there is a network fee at the time of withdrawing that varies depending on how busy the network is.

To avoid any withdraw related fees, you will need to remove your funds through coinbase pro.

Don’t worry, it’s pretty easy to do. Sign in to pro.Coinbase.Com and log in with your coinbase information.

Next, click on “portfolios” at the upper right area on the screen and then press “deposit.”

After that, pick the cryptocurrency or funds you want to move over to coinbase pro. Once you pick this, you will then have the option to move the funds over from coinbase.

Now, enter in the amount of funds you want to move from coinbase to coinbase pro, so then when you want to withdraw it, you won’t have to pay any fees.

Which cryptocurrencies have the lowest transaction fees?

Surprise! Investing in virtual currencies could mean paying up to three different types of fees.

Whether you're a fan of cryptocurrency or not, you have to recognize that it's the fastest growing asset class since 2017 began. Whereas the stock market delivered a well-above-average return in 2017 and has vacillated in 2018, the aggregate market cap of virtual currencies has soared from $17.7 billion at the beginning of 2017 to $297 billion as of march 27, according to coinmarketcap.Com. That's an increase in value of close to 1,600%, and it's a big reason retail investors have become enamored with this burgeoning asset class.

The 411 on cryptocurrency transaction fees

However, there's a lot about cryptocurrencies that the average american probably has no clue about. For instance, there's the fact that most virtual currencies have transaction fees attached. We're familiar with the idea of buying and selling stock and paying a brokerage firm for being the facilitator of that transaction, but similar (and additional) fees can be charged in the cryptocurrency market, depending on the token and exchange.

Image source: getty images.

Today, we'll take a brief look at the types of transaction fees you may encounter if you choose to invest in cryptocurrencies, and we'll examine which cryptocurrencies, among the largest by market cap, offer the lowest transaction fees.

In total, there are three transaction fees you could be hit with when dealing with cryptocurrencies:

Exchange fees: this first transaction fee is one we should be familiar with, as it describes the idea of paying a "commission" to complete a buy or sell order. Most cryptocurrency exchanges tend to use a fixed-fee format, but the actual cost of transaction fees can vary by platform. In essence, it's always smart to do some homework and find out which crypto exchanges offer the lowest transaction fees.

However, another model known as maker-taker exists within crypto exchanges that can cause transaction fees to fluctuate, as described by hype.Codes. The maker (seller of cryptocurrency)-taker (buyer of cryptocurrency) model charges a variable fee based on your amount of trading activity. If you're an active trader, or one who has transacted a high dollar amount over, say, a 30-day rolling period, you as the maker may qualify for a reduced transaction fee.

Image source: getty images.

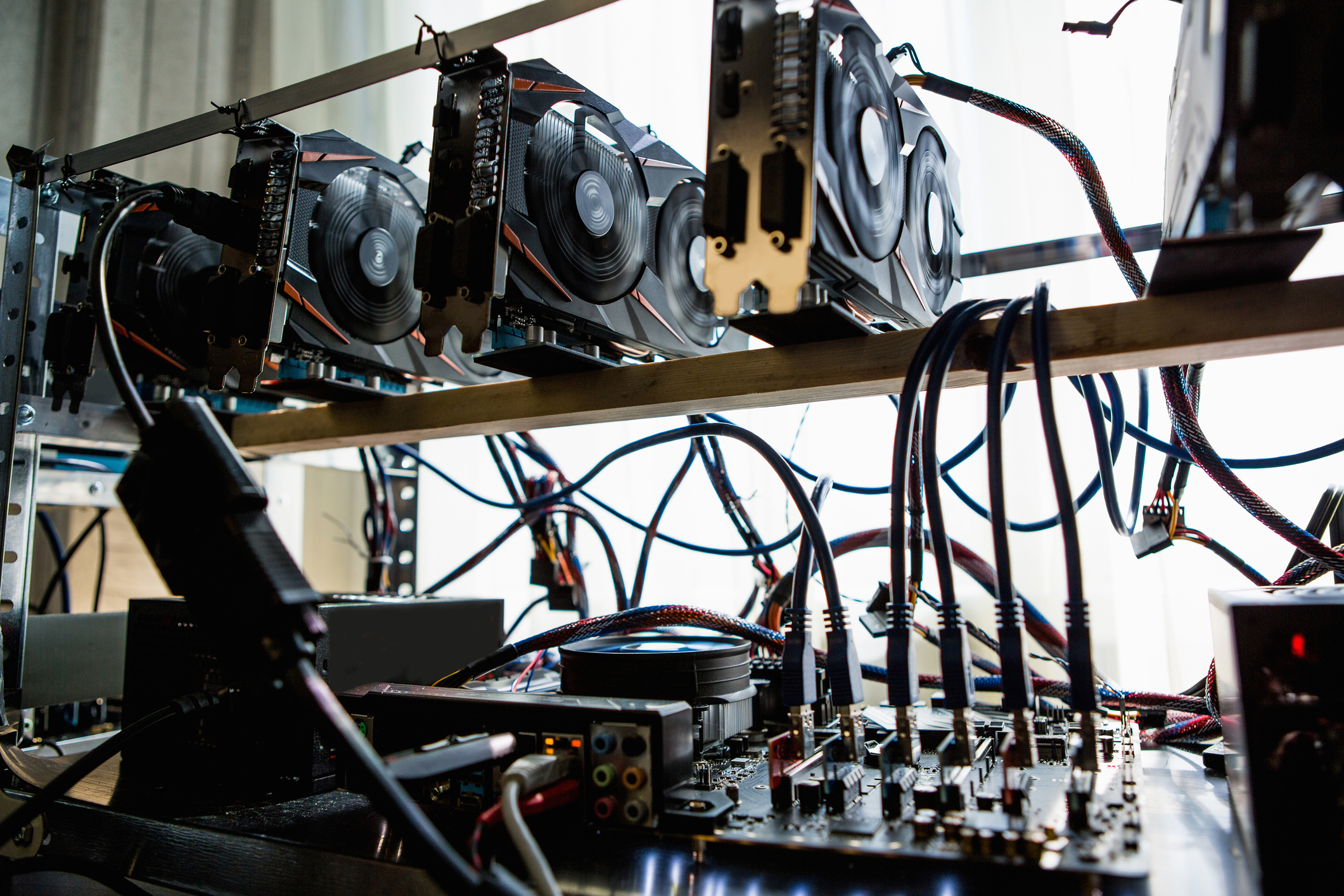

Network fees: next, you may be required to pay transaction fees in order to incentivize cryptocurrency miners. Miners are nothing more than persons with high-powered computers who are charged with verifying and validating transactions to be added to a blockchain. In short, they make sure that tokens weren't spent twice and that transactions are indeed true.

The validation of these transactions can vary by network, with miners setting their own price, and investors or crypto users choosing whether or not to accept it. Of course, the obvious should be stated: the lower transaction fee an investor or crypto user is willing to pay, the longer that transaction could take to be validated, as it'll be a low priority for miners.

Wallet fees: lastly, it's possible you'll pay fees to store your cryptocurrency in a digital wallet. The software used to develop wallets, as well as updates, isn't free, meaning you might owe a nominal amount to store your cryptocurrency.

Which cryptocurrencies sport the lowest average transaction fees?

But the big question probably on cryptocurrency enthusiasts' minds is this: which virtual currencies offer the lowest transaction fees, on average? According to data found at bitinfocharts.Com, this was the average transaction fee breakdown for march 26, 2018, presented in order of descending cost:

- Monero: $2.587

- Bitcoin: $1.184

- Dash: $0.363

- Ethereum: $0.347

- Litecoin: $0.198

- Bitcoin cash: $0.097

- EOS: $0.0105

- Ripple: $0.0037

- TRON: $0.0000901

First of all, yes, there's some arbitrariness to this data. Not all large cryptocurrencies are included in bitinfocharts.Com's data pull, and some virtual currencies over a $1 billion market cap were left off by yours truly to keep this list from growing to be a mile long. However, some very clear trends emerge.

Image source: getty images.

For example, you'll note that privacy coins monero and dash are among the most expensive in terms of transaction fees. Adding extra layers of anonymity to protect sender, receiver, and transaction-amount data from being traced isn't cheap.

You'll also note that some of the most popular networks have comparatively higher transaction costs. Examples include bitcoin at $1.184 and ethereum at $0.347. Miners on these networks understand how popular these virtual currencies are with businesses and consumers, so they have some degree of pricing power when setting their validation fee. If users don't choose to accept this fee, they could be in for a long wait.

By comparison, ripple and TRON have some of the lowest transaction fees around. Ripple's niche focus on financial institutions sort of narrows the XRP token's use as a mainstream currency. However, ripple's blockchain and ability to expedite on-demand liquidity for financial institutions for costs of just a fraction of a penny make it a popular choice for cryptocurrency investors. Not surprisingly, it's currently the third-largest virtual currency by market cap, and briefly surged to no. 2 in january.

Crypto transaction fees for beginners

And some personal preferences

Jon creasy

Jul 25, 2017 · 4 min read

Obligatory disclaimer: to modify a quote from tim ferris, “I am NOT a financial advisor, and none of this advice should be taken without speaking to a qualified professional first. Also, my results [are most likely] due to pure luck and zero skill.” but…this is working for me.

So, you’ve gotten your hands on your first crypto to k en. It was a good bit of work. You learned a lot. Maybe you had help from an awesome step-by-step guide, or maybe you figured it out for yourself. Either way, you’re a little richer (or a little poorer), and you want to get into the crypto game even deeper.

Not so fast! Before you become a seasoned crypto-investor, there is one thing you need to understand in and out: transaction fees.

Two of warren buffett’s most famous investing rules are: 1) never lose money, and 2) never forget rule number one. After a crytpo company uses up its hard-earned initial coin offering (ICO) millions, how do they continue to make money? The answer is simple: transaction fees.

These fees vary from token to token. Some are more expensive (as of the beginning of june, the average transaction fee for bitcoin is around $4!) and some are extremely cheap (DASH and litecoin transactions fees in june are averaging $0.11 and $0.14 respectively). The important thing to realize here however, is the real meaning of “transaction fee.”

Let’s say that you hold some siacoin (SC) on your favorite exchange (mine happens to be bittrex). You decide you want to convert this SC to digibyte (DGB), because you’ve seen it mentioned a lot on twitter. The steps to do this conversion could look something like this:

- Withdraw your SC from bittrex, and send it to shapeshift (pay a bittrex withdrawal fee)

- Convert SC to DGB through shapeshift (pay a siacoin miner fee, and a DGB miner fee)

- Send your DGB back to bittrex (depending on the token you’re depositing back to bittrex, you may have to pay another miner fee when the exchange creates a new address for your tokens)

That’s a lot of fees! Why does it work like this?

The short answer is: every company needs to make money. In an exchange like the one listed above, there are three companies involved, and each one wants a cut of your transaction.

On top of this, it’s worth noting that you probably bought your siacoin by converting bitcoin or ethereum on either an exchange or through shapeshift. If that’s the case, you payed at least two, possibly three more transaction fees beforehand (the fee to purchase ETH or BTC, and the miner fee to convert to SC).

All this may sound terribly depressing if you’re new to investing in cryptocurrency. How are you supposed to make any money with all these fees? My answer is pretty simple.

- Do I understand the tech/company?

- Would I use the tech/company myself?

- Do I see other people using this tech/company in 3 years?

- Do I have any type of advantage investing in this token?

5. Do I understand the fee structure of the exchange I’m using, and of the token I’m investing in?

Picking an exchange is just as important as doing your research before investing. While your options are limited, some charge higher fees than others. Some exchanges are more secure than others, and some exchanges are faster than others. You have to decide what you’re willing to pay in exchange for security, speed, and ease of use. Investing in solid companies (and the incredible ROI with which you’ll be rewarded) will make up for the fees.

In addition, some coins come with perks that others don’t. Singulardtv’s coin SNGLS, for instance, is planning to pay its token holders in ETH as a reward for being a part of the platform.

Decred, on the other hand, rewards token holders with “interest” who participate in their proof-of-stake system.

So what exchanges have I chosen to use? I’ll tell you.

- I use coinbase to purchase ETH or BTC with dollars to convert into other tokens. This is not the cheapest option, but they are secure, have good customer service, and you can complete a purchase instantly with a credit or debit card, instead of waiting on a wire transfer for 5–7 business days. You can sign up for coinbase using my referral link here.

- I use shapeshift to exchange my ETH or BTC for other tokens (like SC, DGB, etc). Shapeshift doesn’t charge a transaction fee to use their service, they don’t store any tokens or personal information, you don’t have to create an account to use them, and they respond to help tickets quickly. I’ve only ever had positive experiences using shapeshift.

- I use bittrex as my exchange of choice whenever 1) the token isn’t available on shapeshift, or 2) I can’t easily create a local wallet (or use myetherwallet) to store the token once I’ve purchased it. Comparatively, bittrex has decent fees, high security ( always use 2-factor authentication), and is run by a team that comes well recommended (zach lebeau, CEO of singulardtv, speaks very highly of the bittrex team).

There you have it! Now that you understand how to purchase crypto, and you understand a bit more about transaction fees, you’re a bit more prepared to play the game.

Always invest in solid companies, go above and beyond with the security of your tokens, and your ROI will outweigh the fees nearly every time.

P.S. Enjoyed this article? Click the �� to help other people find it.

If you’d like to start investing in cryptocurrency, the easiest way is with coinbase. Get $10 of free bitcoin when you use this link — it’s my referral link — and get started now!

Do more. Pay less.

These transactions are free:

- Paying a merchant directly from your skrill wallet

- Receiving money to your skrill account

- Sending money to an international bank account with skrill money transfer

Local payment methods

- Bank transfer

- Fast bank transfer

- Neteller

- Paysafecard

- Paysafecash

- Rapid transfer

- Trustly

Global payment methods

- Credit card AMEX

- Credit card diners

- Credit card JCB

- Credit card mastercard

- Credit card visa

Please note that if you use your credit card for gambling purposes your issuer may charge a ‘cash advance' fee. This fee is outside skrill’s control, and we receive no part of it.

Local payment methods

EUR 5.50 (EUR 5.50)

Global payment methods

Fee: EUR 5.50 (EUR 5.50)

Skrill money transfer

International transfer

No fee when you use skrill money transfer to send money to an international bank account.

Domestic transfer

Domestic fee per transaction.This fee will be charged when the transfer begins and ends in the same country.

Receive money

Skrill money transfer does not charge recipients any fee to receive

Skrill to skrill

Send money for customers registered after 8 april 2020

1.45%, min 0.50 EUR fee is applied if you have funded your wallet via card or bank account.

*if you haven't made any deposit to your skrill account, or have deposited via NETELLER, paysafecard or bitpay, a higher fee of 4.49%, min 0.50 EUR will apply.

Send money for customers registered between 18 march - 7 april including

1.45%, min 0.50 EUR fee is applied if you have funded your wallet via card or bank account.

**if you haven't made any deposit to your skrill account, or have deposited via NETELLER, paysafecard or bitpay, a higher one-time fee of 10%, min. EUR 100 will apply. All subsequent send money transactions will be charged with a 2.99% fee.

Send money for customers registered before 18 march 2020

The regular skrill fee for sending money is 1.45%, min EUR 0.50.

***if you haven’t made any deposit to your skrill account, or have deposited only via NETELLER, paysafecard or bitpay, a higher one-time fee of 20%, min. EUR 30 will apply.

Receive money

Receiving money is always free of charge

You will see the applicable fee before you complete your transaction.

Keep skrilling

Your skrill account is free for personal use as long as you log in or make a transaction at least every 12 months.

Otherwise a service fee of EUR 5.00 (or equivalent) will be deducted monthly from your account.

Currency conversion

For transactions involving currency conversion skrill adds a fee of 3.99% to our wholesale exchange rates. The exchange rates vary and will be applied immediately without notice to you.

If your skrill account is denominated in a currency other than euro, your cryptocurrency transactions will be subject to currency conversions. In this case, we will apply foreign exchange fee of 1.5%.

Prepaid card fees

Our fees are transparent, so you always know where you stand. Here are the fees we charge for using our skrill prepaid mastercard ® :

- 10 EUR card application

- 10 EUR annual fee

- 3.99 % FX fee

- 1.75 % ATM fee

- POS transactions are free

- Skrill virtual card application – first is free, any subsequent card is 2.5 EUR.

Simple and transparent fees

Crypto buy / crypto sell

Crypto P2P

Fee: 0.50 % per transaction

Important

Please note that the skrill cryptocurrency service is not regulated by the financial conduct authority.

Your use of the skrill cryptocurrency service is subject to the cryptocurrency terms of use.

You should also familiarise yourself with the cryptocurrency risk statement.

In accordance with the skrill account terms of use:

| provision of inaccurate or untruthful information and lack of cooperation fee (s. 4.5) | up to EUR 150 |

| chargeback fee (s. 8.3) | EUR 25 per chargeback |

| attempted cash upload fee (s. 8.12) | EUR 10 per upload |

| prohibited transactions fees (s. 11) | up to EUR 150 per instance |

| reversal of a wrong transaction fee (s. 12.7) | up to EUR 25 per reversal attempt |

Important notice

As of 22 february 2021 the following fees shall apply:

- Withdrawal fee from a skrill account to a NETELLER account – 3.49% per transaction

- International transfer send money fee for the use of skrill money transfer – up to 4.99% per transaction - applicable to international money transfers in the same send and receive currency only

- International transfer send money FX markup fee - up to 4.99% per transaction.

Official sponsor

For money movers and makers

Copyright © 2021 skrill limited. All rights reserved. Skrill ® is a registered trademark of skrill limited. Skrill limited is incorporated in england (company number 04260907) with its registered office at 25 canada square, london E14 5LQ. Authorised and regulated by the financial conduct authority under the electronic money regulations 2011 (FRN: 900001) for the issuance of electronic money and payment instruments. The skrill prepaid mastercard is issued by paysafe financial services limited pursuant to a licence from mastercard international. Paysafe financial services limited (FRN: 900015) is authorised by the financial conduct authority under the electronic money regulations 2011 for the issuance of electronic money and payment instruments. Mastercard ® is a registered trademark of mastercard international. Skrill limited has been temporarily registered under the money laundering, terrorist financing and transfer of funds (information on the payer) regulations 2017 as a cryptoasset business until 9 july 2021, pending the determination of its application by the financial conduct authority.

So, let's see, what we have: I am a women’s rights activist, running junkie, and eternal marketing student. I help companies market their brand to millennials and gen z. In my spare time, you’ll find playing with my golden retriever and reading the newest business books by my fire. At crypto currency transfer fees

Contents

- Top forex bonus list

- Understanding cryptocurrency trading fees

- Trading fees can be a little hard to navigate. Let’s clear up the confusion.

- What are trading fees?

- Why A re T rading F ees C harged ?

- How D o T rading F ees A ffect Y our N et R eturn?

- How C an Y ou R educe Y our T rading F ees?

- Final thoughts

- How to trade cryptocurrency without paying fees

- How to buy and sell cryptocurrency without paying fees (or with paying minimal fees)

- How to trade with no fees

- How to trade at minimal fees using binance and kucoin

- How to use coinbase/GDAX to buy/sell cryptocurrency without paying any fees

- Crypto currency transfer fees

- Subscription

- Add money

- Spend

- Exchange

- Understanding cryptocurrency trading fees

- Trading fees can be a little hard to navigate. Let’s clear up the confusion.

- What are trading fees?

- Why A re T rading F ees C harged ?

- How D o T rading F ees A ffect Y our N et R eturn?

- How C an Y ou R educe Y our T rading F ees?

- Final thoughts

- How to send and receive cryptocurrency

- How to transfer cryptocurrency from one wallet to another (i.E. How to send/receive or...

- Tips and tricks for crypto transactions

- The complete guide to coinbase fees (and how to avoid them)

- A breakdown of coinbase fees

- Buying fees

- Selling fees

- Where you’ll find your trading fees

- How much money does coinbase charge?

- The possibility of bank fees

- Can you really avoid paying coinbase fees?

- Which cryptocurrencies have the lowest transaction fees?

- Surprise! Investing in virtual currencies could mean paying up to three different types of fees.

- The 411 on cryptocurrency transaction fees

- Which cryptocurrencies sport the lowest average transaction fees?

- Crypto transaction fees for beginners

- And some personal preferences

- Do more. Pay less.

- Local payment methods

- Global payment methods

- Local payment methods

- Global payment methods

- Skrill money transfer

- Skrill to skrill

- Send money for customers registered after 8 april 2020

- Send money for customers registered between 18 march - 7 april including

- Send money for customers registered before 18 march 2020

- Receive money

- You will see the applicable fee before you complete your transaction.

- Keep skrilling

- Currency conversion

- Prepaid card fees

- In accordance with the skrill account terms of use:

- Important notice

Comments

Post a Comment